Capital gains tax applies to profits from the sale of assets held longer than a year and is typically taxed at lower rates than ordinary income tax. Ordinary income tax rates apply to wages, salaries, and short-term asset sales, often resulting in higher tax liabilities. Understanding the distinction between these taxes can optimize tax strategy and minimize overall tax burden.

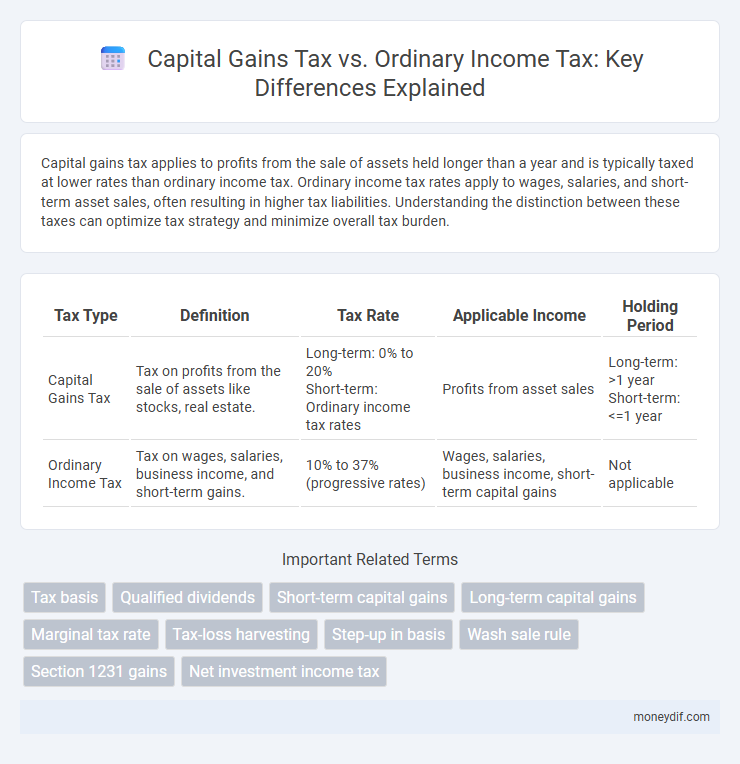

Table of Comparison

| Tax Type | Definition | Tax Rate | Applicable Income | Holding Period |

|---|---|---|---|---|

| Capital Gains Tax | Tax on profits from the sale of assets like stocks, real estate. | Long-term: 0% to 20% Short-term: Ordinary income tax rates |

Profits from asset sales | Long-term: >1 year Short-term: <=1 year |

| Ordinary Income Tax | Tax on wages, salaries, business income, and short-term gains. | 10% to 37% (progressive rates) | Wages, salaries, business income, short-term capital gains | Not applicable |

Understanding Capital Gains Tax

Capital gains tax is imposed on the profit from the sale of assets held longer than a year, typically taxed at lower rates than ordinary income, which applies to wages and salaries. Long-term capital gains rates range from 0% to 20% depending on taxable income and filing status, while ordinary income tax rates span from 10% to 37%. Understanding the distinctions helps optimize tax liability by strategically managing asset sales and timing income recognition.

What Is Ordinary Income Tax?

Ordinary income tax applies to wages, salaries, tips, and other earnings, taxed at progressive rates set by the IRS. This tax rate can range from 10% to 37%, depending on the taxpayer's income bracket for the year. Unlike capital gains tax, ordinary income tax rates are generally higher and apply to income earned regularly through employment or business activities.

Key Differences Between Capital Gains and Ordinary Income

Capital gains tax is applied to profits earned from the sale of assets held over a period, typically benefiting from lower tax rates compared to ordinary income tax, which is levied on wages, salaries, and business profits. Ordinary income tax rates are generally higher and structured progressively based on income brackets, while long-term capital gains tax rates are usually more favorable to encourage investment. The holding period is a critical factor: assets held for over a year qualify for long-term capital gains rates, whereas assets sold within a year are taxed as ordinary income.

Tax Rates: Capital Gains vs Ordinary Income

Capital gains tax rates are generally lower than ordinary income tax rates, with long-term capital gains typically taxed at 0%, 15%, or 20% depending on income brackets, whereas ordinary income tax rates range from 10% to 37%. Short-term capital gains are taxed as ordinary income, aligning their rates with standard federal income tax brackets. This distinction incentivizes longer investment holding periods by reducing tax liability on gains realized after more than one year.

Qualifying Assets for Capital Gains Tax

Qualifying assets for capital gains tax typically include stocks, bonds, real estate held for investment, and certain collectibles, which must be held for more than one year to benefit from lower tax rates. Ordinary income tax applies to wages, salaries, and non-qualifying short-term gains, which are taxed at higher marginal rates compared to long-term capital gains. Properly identifying and holding qualifying assets can significantly reduce tax liability by leveraging favorable capital gains tax treatment.

How Holding Periods Affect Your Tax

Holding periods determine whether capital gains are classified as short-term or long-term, significantly impacting tax rates; assets held for over one year qualify for long-term capital gains tax, which is typically lower than ordinary income tax rates. Short-term capital gains from assets sold within a year are taxed at ordinary income tax rates, resulting in higher tax liability for most taxpayers. Understanding these holding periods allows taxpayers to strategize asset sales to minimize tax burdens effectively.

Tax Implications for Investors and Wage Earners

Capital gains tax rates are generally lower than ordinary income tax rates, providing investors with a tax-efficient strategy for long-term asset appreciation, as gains on investments held over a year are taxed at reduced rates. Wage earners face ordinary income tax rates, which are typically higher and apply to salaries, bonuses, and short-term gains, resulting in a larger tax burden on regular income streams. Understanding the tax implications helps individuals optimize financial planning by distinguishing between income sources subject to capital gains tax versus ordinary income tax brackets.

Strategies to Minimize Tax Liability

Maximizing tax efficiency involves prioritizing long-term capital gains, which are taxed at significantly lower rates than ordinary income, often capped at 15% or 20% depending on income brackets. Utilizing tax-advantaged accounts like IRAs and 401(k)s can defer or eliminate capital gains tax, while harvesting losses strategically offsets gains, reducing taxable income. Implementing tax loss harvesting and holding investments for more than one year can substantially minimize overall tax liabilities by leveraging preferential capital gains rates.

Capital Gains and Ordinary Income: Real-Life Examples

Capital gains tax rates are typically lower than ordinary income tax rates, benefiting investors who hold assets long-term, such as stocks or real estate, where gains are realized upon sale. For example, a homeowner selling a primary residence may exclude up to $250,000 ($500,000 for married couples) of capital gains, whereas salary income is taxed at higher ordinary income rates ranging from 10% to 37%. Business owners earning ordinary income through wages or services pay higher tax rates compared to profits earned from qualified capital gains, underscoring strategic tax planning importance.

Recent Changes and Proposed Reforms in Tax Laws

Recent changes in tax laws have increased capital gains tax rates for high-income earners, aligning them more closely with ordinary income tax rates to reduce tax rate arbitrage. Proposed reforms include indexing capital gains for inflation to mitigate tax burdens on long-term investments and introducing stricter reporting requirements to curb tax avoidance. These adjustments aim to balance revenue generation while encouraging investment and economic growth.

Important Terms

Tax basis

The tax basis determines the capital gains tax owed by subtracting the asset's purchase price and improvements from the sale price, whereas ordinary income tax applies to wages and non-investment income.

Qualified dividends

Qualified dividends are taxed at the lower capital gains tax rates rather than the higher ordinary income tax rates, resulting in significant tax savings for investors.

Short-term capital gains

Short-term capital gains are taxed as ordinary income at your federal income tax rate, often resulting in a higher tax liability compared to the lower rates applied to long-term capital gains.

Long-term capital gains

Long-term capital gains are taxed at lower rates than ordinary income, providing significant tax advantages compared to the higher ordinary income tax rates applied to short-term gains and wages.

Marginal tax rate

Marginal tax rates on capital gains are typically lower than those on ordinary income, incentivizing investment by reducing the tax burden on profits from asset sales compared to wages and salaries.

Tax-loss harvesting

Tax-loss harvesting reduces capital gains tax liabilities by offsetting investment losses against gains, which often results in lower tax rates compared to higher ordinary income tax rates.

Step-up in basis

Step-up in basis increases the asset's cost basis to its market value at inheritance, minimizing capital gains tax liability compared to higher ordinary income tax rates on gains.

Wash sale rule

The wash sale rule disallows claiming a capital loss on securities sold at a loss and repurchased within 30 days, thereby impacting the timing of capital gains tax recognition versus ordinary income tax treatment.

Section 1231 gains

Section 1231 gains are taxed at favorable long-term capital gains rates rather than higher ordinary income tax rates when net Section 1231 gains exceed losses in a tax year.

Net investment income tax

Net investment income tax imposes a 3.8% surtax on capital gains, dividends, interest, and other investment income, which is separate from and in addition to ordinary income tax rates that apply to wages and salaries.

Capital gains tax vs ordinary income tax Infographic

moneydif.com

moneydif.com