Zero-rated supply refers to goods or services that are taxable but charged at a 0% VAT rate, allowing businesses to reclaim input tax. Exempt supply, on the other hand, involves items that are outside the scope of VAT, meaning no VAT is charged and input tax cannot be reclaimed. Understanding the distinction is crucial for accurate tax reporting and compliance.

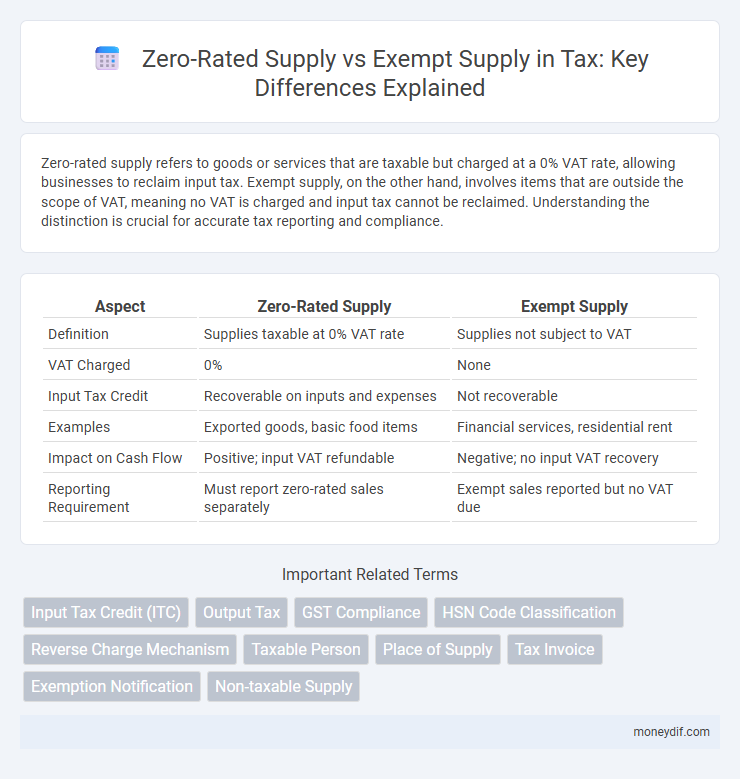

Table of Comparison

| Aspect | Zero-Rated Supply | Exempt Supply |

|---|---|---|

| Definition | Supplies taxable at 0% VAT rate | Supplies not subject to VAT |

| VAT Charged | 0% | None |

| Input Tax Credit | Recoverable on inputs and expenses | Not recoverable |

| Examples | Exported goods, basic food items | Financial services, residential rent |

| Impact on Cash Flow | Positive; input VAT refundable | Negative; no input VAT recovery |

| Reporting Requirement | Must report zero-rated sales separately | Exempt sales reported but no VAT due |

Definition of Zero-Rated Supply

Zero-rated supply refers to goods or services that are taxable but charged at a 0% rate, allowing businesses to claim input tax credits on related purchases. This contrasts with exempt supply, where no tax is charged or recoverable, and input tax credits cannot be claimed. Understanding zero-rated supplies is crucial for accurate tax compliance and maximizing input tax recovery under Value-Added Tax (VAT) systems.

Definition of Exempt Supply

Exempt supply refers to goods or services that are not subject to Value Added Tax (VAT), meaning no VAT is charged on the sale, and input tax on related purchases cannot be reclaimed. Common examples of exempt supplies include financial services, certain educational services, and healthcare services. Understanding exempt supply is crucial for accurate tax reporting and compliance, as it differs from zero-rated supply where VAT is charged at 0%, allowing input tax recovery.

Key Differences Between Zero-Rated and Exempt Supplies

Zero-rated supplies are taxable goods or services charged at a 0% VAT rate, allowing businesses to reclaim input VAT, whereas exempt supplies are not subject to VAT and businesses cannot reclaim input VAT on related purchases. Zero-rated supplies include items like basic food and exports, while exempt supplies often encompass financial services and education. Understanding these distinctions is crucial for accurate VAT reporting and compliance.

Tax Implications for Zero-Rated Supplies

Zero-rated supplies are taxable goods or services charged at a 0% VAT rate, allowing businesses to reclaim input tax on related purchases, which improves cash flow. In contrast, exempt supplies are not subject to VAT, and businesses cannot recover input tax on costs incurred, increasing the overall tax burden. The distinction impacts tax compliance and financial reporting, making accurate classification essential for optimal tax management.

Tax Implications for Exempt Supplies

Exempt supplies are transactions that do not attract Value-Added Tax (VAT), meaning businesses cannot claim input tax credits on purchases related to these supplies, which can increase overall costs. Unlike zero-rated supplies, which are taxable at 0% allowing input tax recovery, exempt supplies result in no VAT charge to customers but limit the ability to reclaim VAT, impacting cash flow and pricing strategies. Understanding the distinction is crucial for accurate tax reporting and compliance, especially in sectors like finance, healthcare, and education where exempt supplies are common.

Input Tax Credit Eligibility

Zero-rated supplies allow businesses to claim Input Tax Credit (ITC) on purchases related to these supplies, as the output goods or services are taxed at 0%. Exempt supplies, however, do not permit ITC claims because the goods or services are outside the scope of taxation, resulting in a non-recoverable input tax. Understanding the distinction is crucial for effective tax planning and compliance under VAT, GST, or Sales Tax regimes.

Examples of Zero-Rated Supplies

Zero-rated supplies include essential goods and services such as basic food items, exports, and certain medical supplies, which are taxed at a 0% VAT rate, allowing businesses to reclaim input tax. Exempt supplies, like financial services and residential property rental, do not charge VAT, but suppliers cannot reclaim input VAT, impacting cash flow. Understanding these distinctions helps businesses optimize tax planning and compliance strategies.

Examples of Exempt Supplies

Exempt supplies include financial services such as loans and insurance, residential rent, and certain educational services that do not attract Value Added Tax (VAT) despite being taxable activities. In contrast, zero-rated supplies like basic food items, exports, and healthcare products are taxable but charged at a VAT rate of 0%, allowing businesses to reclaim input tax. Understanding these distinctions helps businesses comply with tax regulations and optimize VAT recovery strategies.

Impact on Businesses and Consumers

Zero-rated supplies allow businesses to reclaim input VAT, improving cash flow and reducing overall tax costs, which often translates to lower prices for consumers. Exempt supplies do not require businesses to charge VAT, but they cannot reclaim input VAT, increasing costs that may be passed on to consumers through higher prices. The distinction affects business competitiveness and consumer spending power, influencing market dynamics and pricing strategies.

Compliance and Documentation Requirements

Zero-rated supplies require businesses to maintain detailed tax invoices and export documentation to claim input tax credits, ensuring compliance with GST regulations. Exempt supplies do not attract GST, but businesses cannot claim input tax credits, necessitating clear record-keeping to segregate exempt transactions accurately. Proper documentation is essential to avoid penalties and facilitate audits under both zero-rated and exempt supply categories.

Important Terms

Input Tax Credit (ITC)

Input Tax Credit (ITC) is fully available for zero-rated supplies, such as exports and supplies to SEZs, allowing businesses to claim credit on input taxes paid. In contrast, no ITC is allowed on exempt supplies, meaning businesses cannot recover GST on inputs used to make these supplies.

Output Tax

Output tax is charged on zero-rated supplies but not on exempt supplies, affecting VAT recovery and reporting obligations differently.

GST Compliance

Zero-rated supply under GST refers to goods or services taxable at 0%, allowing input tax credit claims, whereas exempt supply denotes goods or services not subject to GST, disallowing input tax credit claims. Distinguishing between zero-rated and exempt supplies is crucial for businesses to maintain accurate tax filings and optimize compliance strategies.

HSN Code Classification

HSN Code classification distinguishes zero-rated supplies, which are taxable but subject to a zero GST rate, from exempt supplies that are entirely outside the GST net and not taxable.

Reverse Charge Mechanism

Reverse Charge Mechanism applies to zero-rated supplies where tax liability shifts to the recipient, unlike exempt supplies which attract no tax and do not invoke reverse charge provisions.

Taxable Person

A taxable person engaged in zero-rated supply charges GST at 0% enabling input tax credit claims, whereas exempt supply involves no GST charge and disallows input tax credit recovery.

Place of Supply

Place of Supply determines tax jurisdiction by distinguishing zero-rated supplies, which are taxable at 0%, from exempt supplies that are entirely non-taxable.

Tax Invoice

A tax invoice for zero-rated supplies must include detailed information to claim full input tax credits, whereas exempt supplies do not require tax invoices since no output tax is charged.

Exemption Notification

Exemption Notification specifies goods and services exempt from GST, distinguishing zero-rated supplies taxed at 0% with input tax credit eligibility from exempt supplies that neither attract GST nor allow input tax credit.

Non-taxable Supply

Zero-rated supplies are taxable goods or services taxed at 0% allowing input tax credit claims, while exempt supplies are non-taxable and do not permit input tax credit recovery.

Zero-rated supply vs exempt supply Infographic

moneydif.com

moneydif.com