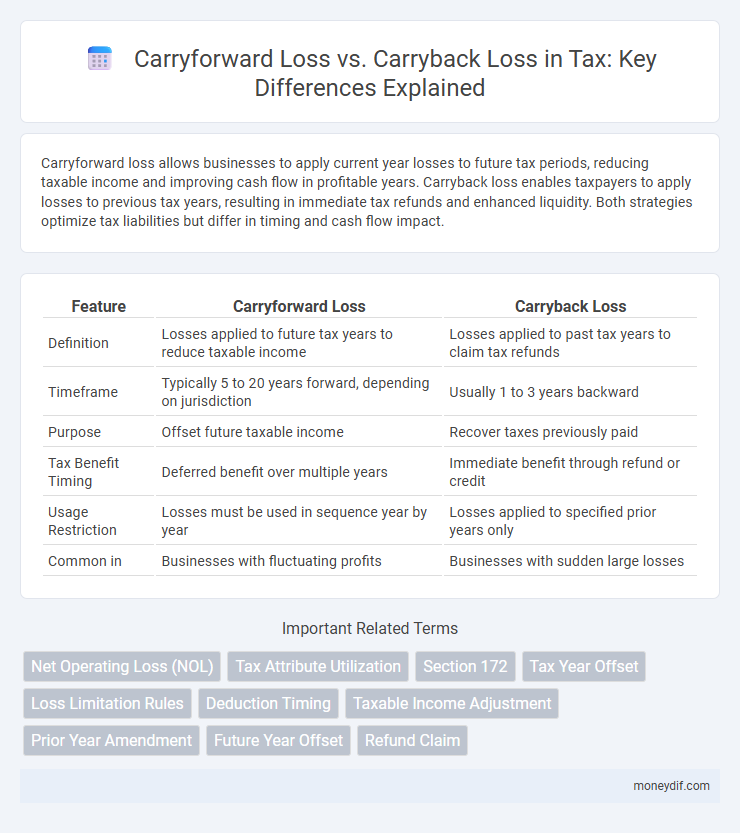

Carryforward loss allows businesses to apply current year losses to future tax periods, reducing taxable income and improving cash flow in profitable years. Carryback loss enables taxpayers to apply losses to previous tax years, resulting in immediate tax refunds and enhanced liquidity. Both strategies optimize tax liabilities but differ in timing and cash flow impact.

Table of Comparison

| Feature | Carryforward Loss | Carryback Loss |

|---|---|---|

| Definition | Losses applied to future tax years to reduce taxable income | Losses applied to past tax years to claim tax refunds |

| Timeframe | Typically 5 to 20 years forward, depending on jurisdiction | Usually 1 to 3 years backward |

| Purpose | Offset future taxable income | Recover taxes previously paid |

| Tax Benefit Timing | Deferred benefit over multiple years | Immediate benefit through refund or credit |

| Usage Restriction | Losses must be used in sequence year by year | Losses applied to specified prior years only |

| Common in | Businesses with fluctuating profits | Businesses with sudden large losses |

Understanding Loss Carryforward and Carryback

Loss carryforward allows taxpayers to apply current year losses to future tax years, reducing taxable income and lowering tax liability in profitable years. Loss carryback enables taxpayers to apply losses incurred in the current year to past tax years, potentially generating immediate tax refunds by offsetting previously reported income. Understanding the specific IRS rules and limitations for carryforward and carryback periods is essential for maximizing tax benefits and effective loss management.

Key Differences Between Carryforward and Carryback Losses

Carryforward loss allows taxpayers to apply current year losses to future tax years, reducing taxable income in those years, while carryback loss enables applying losses to previous tax years, resulting in immediate tax refunds. Carryforward periods typically extend up to 20 years under IRS rules, whereas carryback periods usually cover two years. These mechanisms differ in timing of tax relief and impact cash flow, with carrybacks offering faster financial recovery and carryforwards providing long-term tax planning benefits.

Eligibility Criteria for Loss Carryforward

Loss carryforward eligibility requires that the taxpayer's business or investment entity has incurred a net operating loss (NOL) in the current tax year that exceeds taxable income. The entity must have proper documentation and must file the appropriate tax forms within the specified deadlines to claim the carryforward benefit. Eligibility criteria often include limits on the type of losses, the nature of the taxpayer, and adherence to regulations set by tax authorities such as the IRS or equivalent agencies.

Eligibility Requirements for Loss Carryback

Loss carryback eligibility requires taxpayers to have incurred a net operating loss (NOL) in the current tax year and allows applying that loss to prior taxable years, generally up to two years back, depending on jurisdictional tax laws. Corporations and individuals must comply with specific filing deadlines, often amending previous tax returns to claim refunds from taxes paid in those prior years. Carryback provisions are subject to restrictions such as types of losses allowed, business structure, and state or federal tax code eligibility criteria.

Tax Benefits of Carryforward Losses

Carryforward losses allow businesses to offset future taxable income, reducing tax liability in profitable years and improving cash flow management. Unlike carryback losses, which apply to past tax periods, carryforward losses provide long-term tax relief by preserving the benefit of losses incurred during unprofitable years. This mechanism supports sustained financial planning by maximizing tax deductions over multiple fiscal periods.

Advantages of Carryback Losses for Immediate Relief

Carryback losses provide immediate tax relief by allowing businesses to apply current year losses to previous years' taxable income, resulting in quick tax refunds and improved cash flow. This mechanism accelerates recovery during financial downturns compared to carryforward losses, which defer benefits to future tax periods. Taxpayers gain enhanced liquidity and reduced financial strain through early reimbursement of overpaid taxes using carryback provisions.

Limitations and Restrictions on Loss Carryforward

Loss carryforward allows businesses to offset future taxable income with past losses, but it is subject to strict limitations such as expiration periods, often ranging from 5 to 20 years depending on jurisdiction. Restrictions include caps on the amount of loss that can be applied annually, ownership change limitations under Section 382 in the U.S., and industry-specific rules that may disallow certain types of losses. These constraints aim to prevent tax avoidance and ensure only legitimate economic losses are utilized over time.

Time Limits for Claiming Carryback Losses

Carryback losses must be claimed within a specific statutory period, typically three years from the end of the tax year in which the loss occurred, to offset prior taxable income. Failure to claim within this time frame results in forfeiture of the carryback benefit, forcing taxpayers to rely solely on carryforward options. Tax authorities enforce strict deadlines to ensure timely adjustments of previously filed returns and prevent prolonged uncertainty in taxable income assessments.

Documentation Needed for Loss Offset Claims

Accurate documentation for carryforward and carryback loss claims includes detailed financial statements, tax returns from previous years, and specific loss calculation worksheets. Taxpayers must maintain records of the original loss event, corresponding income in applicable years, and proof of timely filing to support offset eligibility. Proper documentation ensures compliance with IRS rules and facilitates smooth audits or dispute resolution.

Strategic Tax Planning: Choosing Between Carryforward and Carryback

Strategic tax planning requires evaluating carryforward loss, which enables offsetting future taxable income, against carryback loss, allowing immediate tax refunds by applying losses to previous profitable years. Businesses must analyze cash flow needs and tax rates over multiple periods to decide whether utilizing carrybacks provides quicker liquidity or carryforwards offer long-term tax relief. Sophisticated forecasting models incorporating projected taxable income and changes in tax legislation enhance decision-making between leveraging carryforward versus carryback tax loss benefits.

Important Terms

Net Operating Loss (NOL)

Net Operating Loss (NOL) allows businesses to offset taxable income by carrying forward losses to future tax years or carrying them back to prior years, optimizing tax liabilities according to current tax regulations.

Tax Attribute Utilization

Tax attribute utilization optimizes the recovery of carryforward losses by offsetting future taxable income, while carryback losses enable immediate tax refunds by applying losses to past tax years. Efficient management of these attributes enhances cash flow and reduces overall tax liability by strategically timing loss applications.

Section 172

Section 172 allows businesses to carry forward net operating losses indefinitely to offset future taxable income, while carryback of losses is generally disallowed except for specific relief provisions.

Tax Year Offset

Tax year offset allows businesses to apply carryback losses to previous tax years for immediate refunds or carryforward losses to future years to reduce taxable income.

Loss Limitation Rules

Loss Limitation Rules restrict the deductibility of carryforward losses to future taxable income while generally prohibiting the use of carryback losses to offset past taxable income, thereby controlling tax benefits over multiple periods.

Deduction Timing

Deduction timing affects tax liabilities by allowing carryforward losses to offset future taxable income, while carryback losses enable refunds from previously paid taxes in prior years.

Taxable Income Adjustment

Taxable income adjustment involves applying carryforward losses to offset future taxable profits while utilizing carryback losses allows for retroactive tax refunds against previous taxable income.

Prior Year Amendment

Prior Year Amendment adjusts tax returns to optimize the application of carryforward losses by extending unutilized losses to future profitable years, enhancing tax relief. Carryback losses differ by allowing taxpayers to apply current losses to previous profitable years, generating immediate refunds and improving cash flow.

Future Year Offset

Future Year Offset allows businesses to apply carryforward losses to reduce taxable income in future years, whereas carryback loss enables them to apply losses retroactively to offset past taxable income for immediate tax refunds.

Refund Claim

Businesses can offset taxable income by carrying forward losses to future years or utilizing carryback losses to reclaim taxes paid in prior years, optimizing refund claims and cash flow.

Carryforward loss vs carryback loss Infographic

moneydif.com

moneydif.com