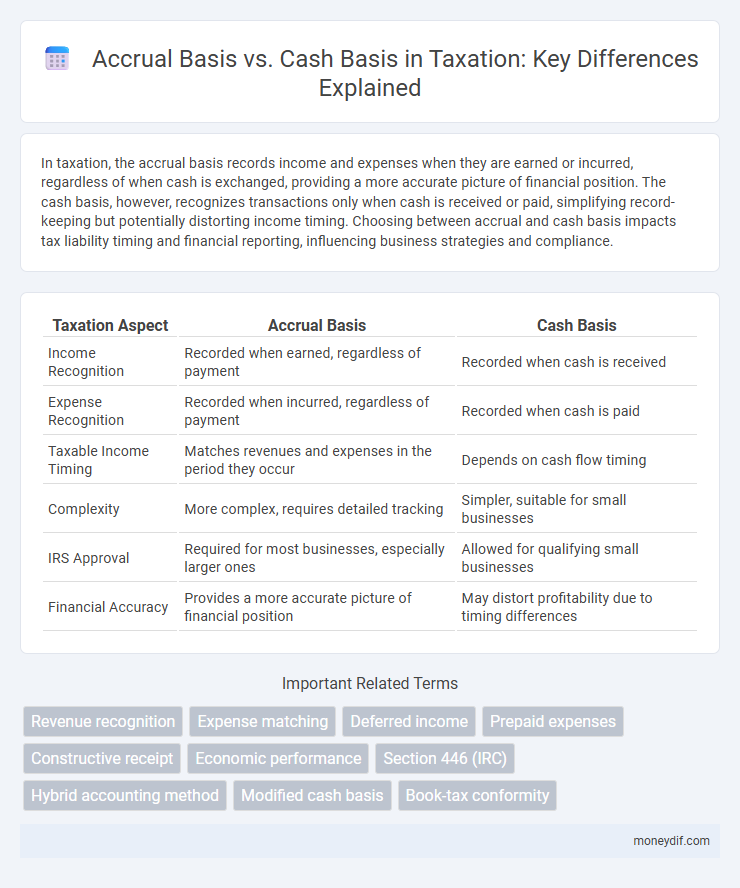

In taxation, the accrual basis records income and expenses when they are earned or incurred, regardless of when cash is exchanged, providing a more accurate picture of financial position. The cash basis, however, recognizes transactions only when cash is received or paid, simplifying record-keeping but potentially distorting income timing. Choosing between accrual and cash basis impacts tax liability timing and financial reporting, influencing business strategies and compliance.

Table of Comparison

| Taxation Aspect | Accrual Basis | Cash Basis |

|---|---|---|

| Income Recognition | Recorded when earned, regardless of payment | Recorded when cash is received |

| Expense Recognition | Recorded when incurred, regardless of payment | Recorded when cash is paid |

| Taxable Income Timing | Matches revenues and expenses in the period they occur | Depends on cash flow timing |

| Complexity | More complex, requires detailed tracking | Simpler, suitable for small businesses |

| IRS Approval | Required for most businesses, especially larger ones | Allowed for qualifying small businesses |

| Financial Accuracy | Provides a more accurate picture of financial position | May distort profitability due to timing differences |

Understanding Accrual and Cash Basis Accounting

Accrual basis accounting records income and expenses when they are earned or incurred, providing a more accurate financial picture by matching revenues with related costs. Cash basis accounting recognizes income and expenses only when cash is actually received or paid, often resulting in simpler bookkeeping but less precise financial tracking. The choice between accrual and cash basis affects tax liability timing and compliance with IRS rules, especially for businesses with inventory or exceeding specific revenue thresholds.

Key Differences Between Accrual and Cash Basis

The key differences between accrual and cash basis accounting for tax purposes include the timing of income and expense recognition, where accrual basis records revenues and expenses when earned or incurred regardless of cash flow, while cash basis recognizes them only when cash is exchanged. Accrual basis provides a more accurate financial picture by matching income with related expenses, whereas cash basis offers simplicity and immediate tax impact based on actual cash movements. Taxpayers must choose the appropriate method depending on IRS regulations, business size, and industry requirements, as this choice affects taxable income reporting and tax liability timing.

Tax Implications of Accrual Basis Accounting

Accrual basis accounting recognizes income and expenses when they are earned or incurred, regardless of cash flow, impacting taxable income reporting periods. This method often accelerates tax liabilities since revenue is taxed when earned, not received, and expenses are deducted when incurred, not paid. Businesses using accrual accounting may face more complex tax compliance but can benefit from matching income and expenses in the appropriate periods for accurate financial representation.

Tax Implications of Cash Basis Accounting

Cash basis accounting recognizes income and expenses only when cash changes hands, directly affecting taxable income timing and potentially deferring tax liability. This method simplifies tax reporting for small businesses but may result in uneven income recognition, impacting tax planning and cash flow management. IRS regulations limit cash basis accounting eligibility for certain corporations and businesses with inventory, emphasizing the importance of compliance for accurate tax reporting.

Eligibility for Accrual vs. Cash Basis in Taxation

Eligibility for accrual versus cash basis in taxation depends on the type and size of the taxpayer's business, with the Internal Revenue Service (IRS) generally requiring corporations and partnerships with inventory to use the accrual method. Small businesses with average annual gross receipts of $27 million or less for the prior three years may qualify to use the cash basis, offering simpler accounting and tax reporting. The choice between these methods affects income recognition timing, impacting tax liabilities and cash flow management.

Pros and Cons of Accrual Basis for Tax Reporting

Accrual basis accounting for tax reporting recognizes income and expenses when they are earned or incurred, providing a more accurate financial picture and matching revenues with related expenses. This method can improve business decision-making and compliance with generally accepted accounting principles (GAAP), but it may increase the complexity of tax filings and result in paying taxes on income not yet received. Small businesses may face cash flow challenges under accrual accounting due to taxable income exceeding actual cash on hand.

Pros and Cons of Cash Basis for Tax Reporting

Cash basis accounting simplifies tax reporting by recognizing income and expenses only when cash transactions occur, enhancing cash flow management and reducing administrative burden for small businesses. However, it may distort profitability by ignoring receivables and payables, potentially leading to tax liabilities that do not align with actual earnings. This method limits the ability to defer income or accelerate expenses, which can impact strategic tax planning and compliance with IRS guidelines for larger businesses.

Impact on Income Recognition and Tax Liability

Accrual basis accounting recognizes income when earned and expenses when incurred, directly impacting the timing and amount of taxable income reported, often leading to earlier tax liabilities. Cash basis accounting records income and expenses only when cash is actually received or paid, which can defer tax liabilities and affect the period in which income is recognized. This difference significantly influences tax planning strategies and cash flow management for businesses under various tax jurisdictions.

Choosing the Right Method for Your Business Taxes

Selecting between accrual basis and cash basis accounting significantly impacts your business taxes by determining when income and expenses are recognized. The accrual method records revenue and expenses when they are earned or incurred, aligning with GAAP and providing a clearer financial picture, especially for businesses with inventory or credit sales. In contrast, the cash basis method records transactions only when cash changes hands, offering simplicity and potential tax deferral benefits for small businesses with straightforward transactions.

Switching Between Accrual and Cash Basis: Tax Considerations

Switching between accrual and cash basis accounting can significantly impact taxable income due to differences in revenue and expense recognition timing under IRS rules. Businesses must file Form 3115, Application for Change in Accounting Method, to obtain IRS approval for the switch, which may trigger adjustments known as Section 481(a) adjustments to prevent income duplication or omission. Careful consideration of eligibility criteria, potential tax implications, and compliance requirements is essential to optimize tax outcomes and avoid penalties.

Important Terms

Revenue recognition

Revenue recognition under the accrual basis records income when earned regardless of cash receipt, aligning with GAAP and providing a more accurate financial position for taxation purposes. In contrast, the cash basis recognizes revenue only upon cash receipt, often simplifying tax reporting but potentially misrepresenting actual earnings during a fiscal year.

Expense matching

Expense matching under the accrual basis requires recognizing expenses when they are incurred, aligning costs with related revenues for accurate financial reporting and tax deductions. In contrast, the cash basis records expenses only when paid, potentially deferring deductions and impacting taxable income timing under tax regulations.

Deferred income

Deferred income represents revenue received but not yet earned under the accrual basis, requiring recognition as a liability until the service or product delivery occurs, whereas under the cash basis, income is recorded only when cash is received, impacting the timing of taxable income and tax liabilities. This distinction affects tax reporting and financial analysis, as accrual basis provides a more accurate matching of income and expenses in the period earned, while cash basis may defer taxable income recognition until payment is actually received.

Prepaid expenses

Prepaid expenses represent payments made for goods or services to be received in future periods, recognized as assets under the accrual basis of accounting but expensed over time, affecting taxable income timing. Under the cash basis, prepaid expenses are deducted only when cash is actually paid, potentially accelerating deductions compared to the accrual method in taxation contexts.

Constructive receipt

Constructive receipt occurs when income is credited to a taxpayer's account or made available without restriction, triggering tax liability under the cash basis method even if funds are not physically received. In contrast, accrual basis taxation recognizes income when earned regardless of actual receipt, emphasizing the timing of economic benefit rather than cash flow.

Economic performance

Economic performance under the accrual basis reflects income and expenses when earned or incurred, providing a more accurate representation of a business's financial health for taxation purposes. In contrast, the cash basis records transactions only when cash is exchanged, potentially distorting tax liabilities by deferring income recognition or expense deductions.

Section 446 (IRC)

Section 446 of the Internal Revenue Code governs the determination of taxable income by specifying the acceptable accounting methods, primarily distinguishing between the cash basis and accrual basis for tax purposes. Taxpayers using the accrual method must report income when all events have occurred to fix the right to receive it, whereas cash basis taxpayers report income when actually or constructively received, with the IRS retaining authority under Section 446(b) to adjust methods if they distort income.

Hybrid accounting method

The hybrid accounting method combines elements of both accrual basis and cash basis accounting, allowing businesses to report income when received and expenses when incurred, which can optimize tax liability management. This approach is often utilized to comply with IRS regulations while providing greater flexibility in matching revenues and expenses for more accurate financial reporting.

Modified cash basis

Modified cash basis accounting combines elements of cash basis and accrual basis by recording revenues and expenses when cash changes hands but also recognizing certain liabilities and receivables to better reflect financial position. This hybrid approach is often favored for tax purposes because it simplifies reporting compared to full accrual accounting while providing more accurate financial information than strict cash basis methods.

Book-tax conformity

Book-tax conformity refers to the alignment between financial accounting income reported on financial statements using the accrual basis and taxable income calculated for tax purposes, which may use either the accrual or cash basis. Differences between these methods impact deferred tax assets and liabilities, influencing corporate tax planning and compliance strategies.

accrual basis vs cash basis (taxation context) Infographic

moneydif.com

moneydif.com