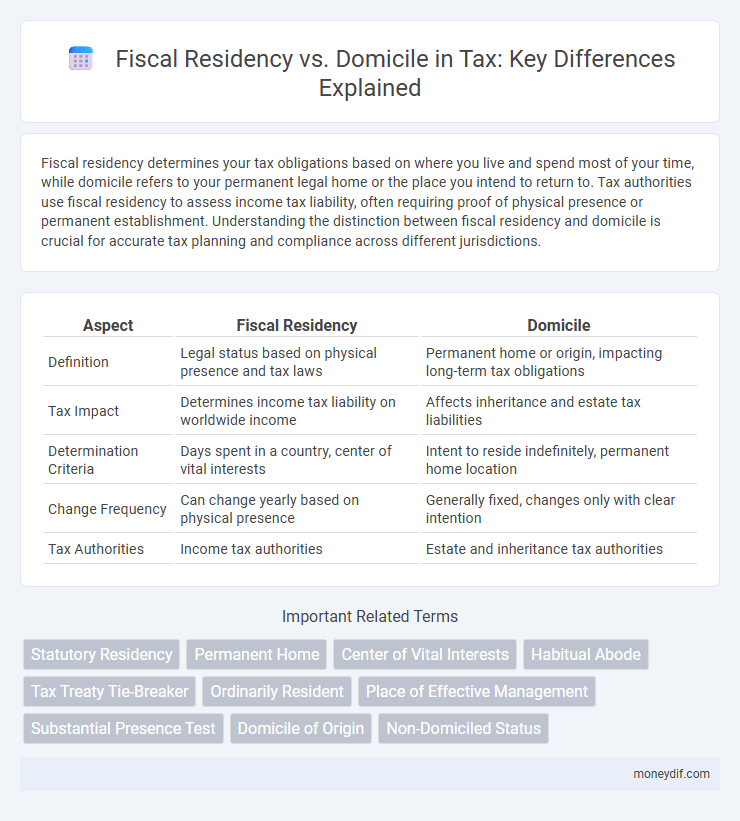

Fiscal residency determines your tax obligations based on where you live and spend most of your time, while domicile refers to your permanent legal home or the place you intend to return to. Tax authorities use fiscal residency to assess income tax liability, often requiring proof of physical presence or permanent establishment. Understanding the distinction between fiscal residency and domicile is crucial for accurate tax planning and compliance across different jurisdictions.

Table of Comparison

| Aspect | Fiscal Residency | Domicile |

|---|---|---|

| Definition | Legal status based on physical presence and tax laws | Permanent home or origin, impacting long-term tax obligations |

| Tax Impact | Determines income tax liability on worldwide income | Affects inheritance and estate tax liabilities |

| Determination Criteria | Days spent in a country, center of vital interests | Intent to reside indefinitely, permanent home location |

| Change Frequency | Can change yearly based on physical presence | Generally fixed, changes only with clear intention |

| Tax Authorities | Income tax authorities | Estate and inheritance tax authorities |

Understanding Fiscal Residency: Key Concepts

Fiscal residency determines an individual's tax obligations based on where they primarily live and work, influencing income tax liability across jurisdictions. It is assessed through criteria such as physical presence, permanent home, and economic interests, which tax authorities use to establish residency status for tax purposes. Understanding the distinction between fiscal residency and domicile is crucial, as domicile refers to the individual's permanent legal home, while fiscal residency impacts annual tax assessments and reporting requirements.

What Is Domicile and How Is It Determined?

Domicile refers to the country where an individual has a permanent home and intends to reside indefinitely, impacting tax obligations and legal matters. It is determined by factors such as physical presence, intent to remain, and the place of one's permanent home. Unlike fiscal residency, domicile remains constant unless explicitly changed through clear legal actions or intentions.

Fiscal Residency vs. Domicile: Core Differences

Fiscal residency determines the country where an individual is subject to tax based on physical presence, typically defined by the number of days spent within its borders. Domicile represents a broader, more permanent legal concept tied to an individual's fixed, permanent home and intentions regarding return. Tax obligations hinge primarily on fiscal residency, while domicile influences inheritance tax and long-term legal status.

Tax Implications of Fiscal Residency

Fiscal residency determines an individual's tax obligations, as most countries tax residents on their worldwide income, while non-residents are typically taxed only on income sourced within the country. Domicile, by contrast, affects inheritance tax and long-term tax considerations, but fiscal residency status primarily influences income tax liability, filing requirements, and access to tax treaties. Understanding fiscal residency criteria, such as the number of days spent in a country and permanent home availability, is essential for optimizing tax planning and compliance.

Legal Criteria for Establishing Domicile

Legal criteria for establishing domicile primarily depend on an individual's intention to reside permanently in a particular place combined with physical presence. Courts often consider factors such as ownership of property, location of family, the address used for official documents, and where the individual exercises civil rights. Unlike fiscal residency, which hinges on meeting specific time-based presence tests, domicile is centered on the subjective intent to make a location one's permanent home.

Changing Your Fiscal Residency: Steps and Risks

Changing your fiscal residency involves formally establishing tax residence in a new jurisdiction by meeting specific criteria such as physical presence, permanent home, and economic ties, while severing significant connections with the former country. The process requires notifying relevant tax authorities, updating legal documents, and complying with exit tax regulations to avoid dual taxation or penalties. Risks include potential audits, double taxation due to differing residency rules, and unintended long-term tax liabilities if the change is not properly executed or documented.

International Tax Treaties and Residency Rules

Fiscal residency determines an individual's tax obligations based on the country where they primarily live or work, while domicile refers to their permanent home or legal residence. International Tax Treaties often resolve conflicts between residency and domicile by establishing tie-breaker rules to prevent double taxation and clarify tax jurisdiction. Understanding these residency rules is crucial for accurately determining tax liabilities and benefits under cross-border tax agreements.

Dual Residency: Managing Conflicting Tax Obligations

Dual residency arises when an individual qualifies as a tax resident in two countries under their respective domestic laws, leading to conflicting tax obligations. To manage these conflicts, tax treaties and tie-breaker rules evaluate factors such as permanent home, center of vital interests, habitual abode, and nationality to determine a single fiscal residency. Proper application of these criteria prevents double taxation and ensures compliance with international tax regulations.

Common Mistakes in Determining Residency or Domicile

Common mistakes in determining fiscal residency versus domicile often arise from confusing physical presence with legal intent, leading to inaccurate tax obligations. Taxpayers frequently overlook the significance of domicile as a permanent home concept, mistakenly assuming residency rules alone dictate their tax status. Failure to consider factors like personal ties, habitual abode, and state of mind results in erroneous tax filings and potential penalties.

Expert Tips for Navigating Global Tax Residency

Understanding the distinction between fiscal residency and domicile is crucial for effective global tax planning, as fiscal residency typically determines where an individual is taxed on worldwide income, while domicile affects estate and inheritance tax liabilities. Experts recommend maintaining thorough documentation of physical presence, such as travel records and residential ties, to substantiate residency claims under varying international tax laws. Utilizing double taxation treaties and consulting specialized tax advisors can optimize tax obligations and prevent costly disputes across jurisdictions.

Important Terms

Statutory Residency

Statutory residency determines an individual's tax obligations based on physical presence and meets specific day-count tests set by the jurisdiction, distinguishing it from domicile, which is a more permanent home-based status influencing long-term tax liabilities. Fiscal residency involves tax residency status under tax law and focuses on where an individual is considered a resident for tax purposes, often using statutory residency rules, whereas domicile reflects a subjective intent to reside indefinitely in a particular location.

Permanent Home

Permanent home plays a critical role in determining fiscal residency and distinguishing it from domicile as it reflects the fixed place where an individual habitually resides and intends to maintain. While fiscal residency influences tax obligations based on physical presence and ties to a country, domicile represents a deeper, long-term legal permanent home connection, affecting estate and inheritance tax implications.

Center of Vital Interests

The Center of Vital Interests determines fiscal residency by identifying the location where an individual's personal, economic, and social ties are strongest, which may differ from their legal domicile. Tax authorities assess factors such as family location, property ownership, and business interests to establish where an individual's primary tax obligations arise.

Habitual Abode

Habitual abode refers to the place where a person normally lives and spends a substantial part of their time, often considered in determining fiscal residency for tax purposes. Unlike domicile, which is a more permanent legal concept indicating a person's fixed, permanent home, habitual abode emphasizes physical presence and regularity of stay in a particular location.

Tax Treaty Tie-Breaker

Tax Treaty Tie-Breaker rules determine an individual's fiscal residency when multiple jurisdictions claim tax rights based on residency or domicile, prioritizing criteria such as permanent home location, center of vital interests, habitual abode, and nationality. These provisions prevent double taxation by establishing a single country as the taxpayer's residence for treaty purposes, aligning tax obligations with the taxpayer's primary economic and personal connections.

Ordinarily Resident

Ordinarily Resident refers to an individual who resides in a country for a substantial period, typically establishing a habitual residence that influences tax obligations, distinguishing it from domicile, which is the person's permanent home or origin. Fiscal residency is determined by physical presence and intent to reside, while domicile is a broader legal concept affecting inheritance and long-term tax liabilities.

Place of Effective Management

Place of Effective Management (POEM) determines a company's fiscal residency based on where key management decisions are made, distinguishing it from domicile, which refers to the legal home of an individual or entity. Tax authorities prioritize POEM to establish jurisdiction for corporate taxation, ensuring that profits are taxed in the country where actual control and management activities occur.

Substantial Presence Test

The Substantial Presence Test determines U.S. tax residency based on the number of days an individual is physically present in the United States, distinguishing fiscal residency from domicile. Unlike domicile, which refers to a person's permanent home, the Substantial Presence Test quantifies fiscal residency through a formula counting days spent in the U.S. over a three-year period.

Domicile of Origin

Domicile of Origin refers to the legal residence established at birth, influencing fiscal residency rules by serving as a baseline for tax authorities when determining an individual's tax obligations. Unlike fiscal residency, which depends on physical presence and intent to reside, domicile of origin remains fixed unless formally changed through domicile of choice, affecting inheritance tax and cross-border taxation.

Non-Domiciled Status

Non-Domiciled Status allows individuals residing in a country to be taxed based on their fiscal residency rather than their domicile, often resulting in favorable tax treatment on foreign income and assets. This status is commonly utilized in jurisdictions like the UK, where domicile is a legal concept distinct from residency, impacting how global income and estate taxes are applied.

fiscal residency vs domicile Infographic

moneydif.com

moneydif.com