Transfer pricing involves setting prices for transactions between related entities to ensure fair taxation, preventing profit shifting and tax base erosion. Treaty shopping occurs when entities exploit tax treaties by routing income through jurisdictions with favorable tax treaties, aiming to reduce overall tax liability. Both practices pose challenges for tax authorities in maintaining equitable tax collection and combating tax avoidance.

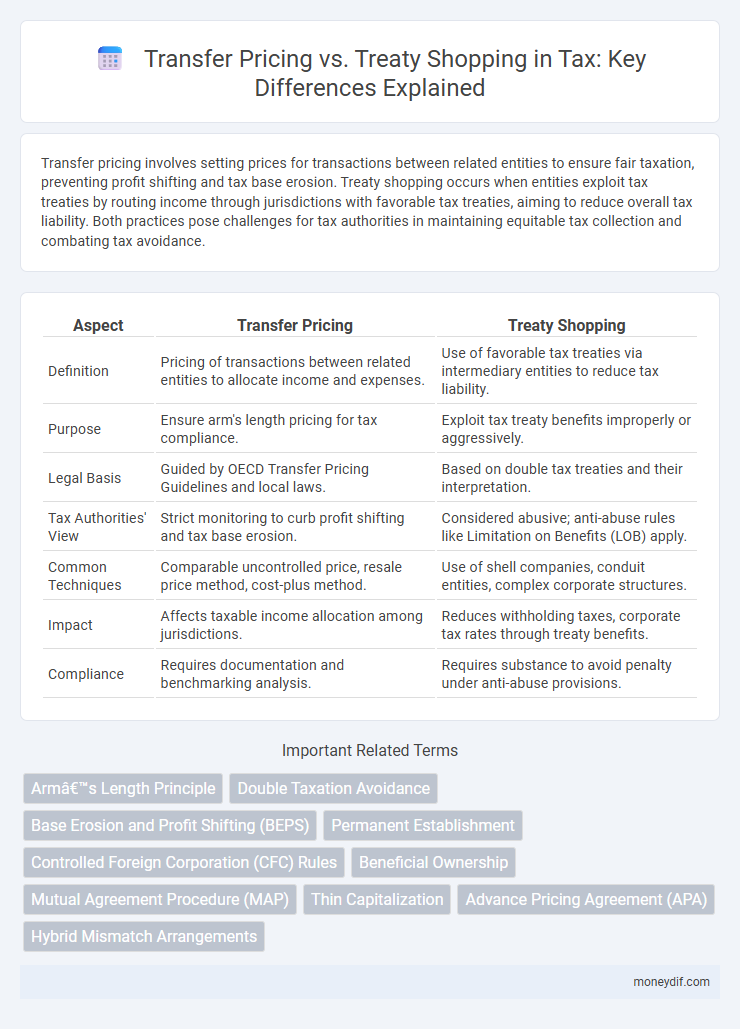

Table of Comparison

| Aspect | Transfer Pricing | Treaty Shopping |

|---|---|---|

| Definition | Pricing of transactions between related entities to allocate income and expenses. | Use of favorable tax treaties via intermediary entities to reduce tax liability. |

| Purpose | Ensure arm's length pricing for tax compliance. | Exploit tax treaty benefits improperly or aggressively. |

| Legal Basis | Guided by OECD Transfer Pricing Guidelines and local laws. | Based on double tax treaties and their interpretation. |

| Tax Authorities' View | Strict monitoring to curb profit shifting and tax base erosion. | Considered abusive; anti-abuse rules like Limitation on Benefits (LOB) apply. |

| Common Techniques | Comparable uncontrolled price, resale price method, cost-plus method. | Use of shell companies, conduit entities, complex corporate structures. |

| Impact | Affects taxable income allocation among jurisdictions. | Reduces withholding taxes, corporate tax rates through treaty benefits. |

| Compliance | Requires documentation and benchmarking analysis. | Requires substance to avoid penalty under anti-abuse provisions. |

Introduction to Transfer Pricing and Treaty Shopping

Transfer pricing involves setting prices for transactions between related entities within a multinational enterprise to ensure fair allocation of income and prevent tax evasion. Treaty shopping occurs when taxpayers exploit tax treaties between countries to reduce withholding taxes or gain treaty benefits not intended for them. Understanding the differences between transfer pricing regulations and treaty shopping strategies is essential for effective international tax compliance and minimizing tax risks.

Key Differences Between Transfer Pricing and Treaty Shopping

Transfer pricing involves setting prices for transactions between related entities to ensure fair taxation, while treaty shopping refers to exploiting tax treaties by routing transactions through third countries to gain tax benefits. Transfer pricing regulations aim to prevent profit shifting and ensure arm's length pricing, whereas treaty shopping often results in treaty abuse and reduced withholding tax liabilities. Enforcement of transfer pricing uses documentation and comparability analysis, whereas treaty shopping is addressed through anti-abuse rules in tax treaties and domestic law.

Understanding Transfer Pricing: Definition and Objectives

Transfer pricing refers to the rules and methods for pricing transactions between related entities within a multinational enterprise, ensuring that these prices reflect market conditions to prevent profit shifting and tax avoidance. Its primary objective is to allocate income and expenses fairly among jurisdictions to comply with tax laws and maintain arm's length pricing standards. Understanding transfer pricing is crucial for distinguishing legitimate pricing strategies from treaty shopping, which involves exploiting tax treaties to minimize tax liabilities improperly.

Treaty Shopping: Concept and Methods

Treaty shopping involves structuring investments or transactions through intermediary entities to exploit favorable tax treaty provisions and reduce withholding taxes or avoid double taxation. Common methods include establishing shell companies or entities in jurisdictions with extensive tax treaty networks that lack substantive economic activity, enabling taxpayers to benefit from treaty benefits without meeting genuine business purpose criteria. Tax authorities increasingly scrutinize treaty shopping arrangements using Principal Purpose Tests (PPT) and anti-abuse clauses to prevent treaty benefit misuse.

Legal Framework for Transfer Pricing Compliance

Transfer pricing compliance operates within a robust legal framework defined by OECD guidelines and local tax regulations to ensure transactions between related entities reflect arm's length principles. Treaty shopping, exploiting tax treaties to gain unfair benefits, is countered by anti-abuse provisions such as the Principal Purpose Test (PPT) embedded in many bilateral tax agreements. Effective enforcement of transfer pricing rules and anti-treaty shopping measures requires transparency, documentation, and mutual agreement procedures to prevent base erosion and profit shifting.

Anti-Treaty Shopping Measures in International Tax Treaties

Anti-treaty shopping measures in international tax treaties are designed to prevent entities from exploiting treaty benefits through artificial arrangements that lack economic substance. These measures commonly include the principal purpose test (PPT) and limitation on benefits (LOB) clauses to ensure treaty advantages are granted only to genuine residents with substantive economic activities. Transfer pricing regulations complement these rules by aligning profits with economic value creation, thereby countering profit shifting and treaty benefit abuse simultaneously.

Impact of OECD Guidelines on Transfer Pricing and Treaty Shopping

The OECD Guidelines on Transfer Pricing establish rigorous principles for determining arm's length pricing, significantly reducing opportunities for treaty shopping by promoting transparency and consistency in intercompany transactions. These guidelines enhance the ability of tax authorities to detect and challenge artificial arrangements designed to exploit tax treaties. As a result, multinational enterprises face increased compliance requirements, mitigating profit shifting and ensuring fair taxation alignment with economic substance.

Common Challenges in Transfer Pricing and Treaty Shopping Enforcement

Common challenges in transfer pricing enforcement include accurately determining arm's length prices and managing complex intercompany transactions across multiple jurisdictions. Treaty shopping enforcement struggles with identifying artificial arrangements designed to exploit tax treaties for undue benefits, often involving complex corporate structures and nominee entities. Both areas suffer from limited transparency, inconsistent international standards, and the high cost of compliance and audits, complicating effective tax administration and revenue protection.

Tax Planning Strategies: Transfer Pricing vs. Treaty Shopping

Effective tax planning strategies require a clear understanding of transfer pricing regulations and the risks of treaty shopping. Transfer pricing ensures compliance by setting arm's length prices for intercompany transactions, minimizing tax base erosion and profit shifting. Treaty shopping exploits tax treaties to obtain undue benefits, often triggering anti-abuse rules that can lead to penalties or loss of treaty benefits.

Future Trends and Global Initiatives Addressing Tax Avoidance

Future trends in transfer pricing emphasize enhanced transparency and stricter documentation requirements driven by global initiatives like the OECD's Base Erosion and Profit Shifting (BEPS) Action Plans. Treaty shopping is increasingly targeted through the implementation of Principal Purpose Tests (PPT) and anti-abuse rules embedded in bilateral tax treaties to deter artificial profit shifting. Multinational enterprises face growing scrutiny as jurisdictions adopt unified frameworks to curb tax avoidance and promote fair taxation across cross-border transactions.

Important Terms

Arm’s Length Principle

The Arm's Length Principle ensures that transfer pricing between related entities reflects market conditions, preventing treaty shopping and tax base erosion by aligning intra-group transactions with independent party standards.

Double Taxation Avoidance

Double Taxation Avoidance agreements mitigate transfer pricing disputes and prevent treaty shopping by establishing clear rules for allocating taxing rights and ensuring that transactions reflect arm's length standards.

Base Erosion and Profit Shifting (BEPS)

Base Erosion and Profit Shifting (BEPS) addresses aggressive tax avoidance strategies by multinational companies through transfer pricing manipulation and treaty shopping to shift profits to low-tax jurisdictions.

Permanent Establishment

Permanent Establishment regulations critically influence transfer pricing strategies and are key in preventing treaty shopping to ensure accurate allocation of taxable income.

Controlled Foreign Corporation (CFC) Rules

Controlled Foreign Corporation (CFC) rules prevent profit shifting through transfer pricing manipulation and curb treaty shopping by attributing foreign income to domestic taxpayers to ensure proper tax compliance.

Beneficial Ownership

Beneficial ownership plays a crucial role in transfer pricing analysis by establishing the true economic owner to prevent treaty shopping abuses and ensure appropriate tax allocation.

Mutual Agreement Procedure (MAP)

The Mutual Agreement Procedure (MAP) resolves transfer pricing disputes by enabling competent authorities to prevent treaty shopping abuses and ensure appropriate taxation based on economic substance.

Thin Capitalization

Thin capitalization rules limit excessive debt financing to prevent tax base erosion, mitigating risks of treaty shopping and abusive transfer pricing practices in multinational corporations.

Advance Pricing Agreement (APA)

Advance Pricing Agreements (APAs) mitigate transfer pricing risks by pre-approving pricing methods, reducing opportunities for treaty shopping and enhancing tax compliance across multinational transactions.

Hybrid Mismatch Arrangements

Hybrid Mismatch Arrangements exploit differences in tax treatment between jurisdictions, complicating transfer pricing compliance and enabling treaty shopping to minimize global tax liabilities.

Transfer pricing vs treaty shopping Infographic

moneydif.com

moneydif.com