Input tax credit allows businesses to deduct the tax paid on purchases from their tax liability, reducing the overall tax payable. Tax rebate involves a refund or reduction in tax when certain conditions are met, typically aimed at encouraging specific behaviors or supporting particular sectors. Understanding the distinction between input tax credit and tax rebate helps optimize tax planning and improve cash flow management.

Table of Comparison

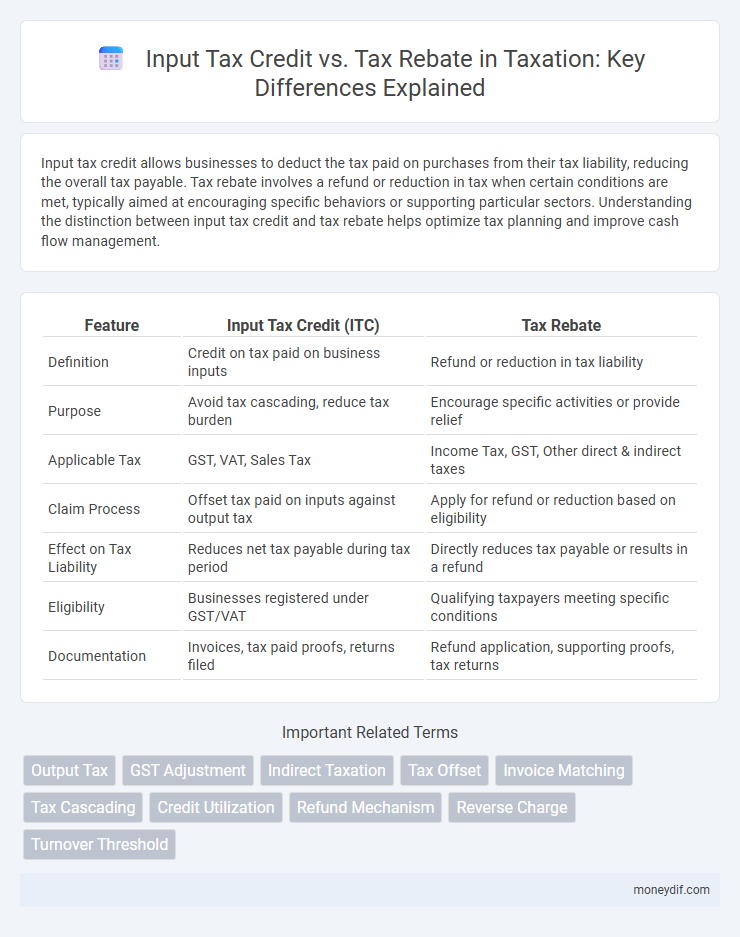

| Feature | Input Tax Credit (ITC) | Tax Rebate |

|---|---|---|

| Definition | Credit on tax paid on business inputs | Refund or reduction in tax liability |

| Purpose | Avoid tax cascading, reduce tax burden | Encourage specific activities or provide relief |

| Applicable Tax | GST, VAT, Sales Tax | Income Tax, GST, Other direct & indirect taxes |

| Claim Process | Offset tax paid on inputs against output tax | Apply for refund or reduction based on eligibility |

| Effect on Tax Liability | Reduces net tax payable during tax period | Directly reduces tax payable or results in a refund |

| Eligibility | Businesses registered under GST/VAT | Qualifying taxpayers meeting specific conditions |

| Documentation | Invoices, tax paid proofs, returns filed | Refund application, supporting proofs, tax returns |

Understanding Input Tax Credit

Input Tax Credit (ITC) allows businesses to reduce the tax payable on their output by claiming credit for the tax paid on inputs purchased during the production process, thereby avoiding the cascading effect of taxes. Eligible ITC can be claimed on goods and services used in the course of business, provided proper invoices and compliance are maintained under GST regulations. This mechanism differs from a tax rebate, which is a direct refund or reduction on the tax liability granted by the government, usually as an incentive or to promote specific sectors.

What is a Tax Rebate?

A tax rebate is a refund granted by the government when the taxpayer has paid more tax than they owe, effectively reducing their overall tax liability. Unlike input tax credit, which allows businesses to offset taxes paid on inputs against output tax liabilities, a tax rebate directly returns excess tax payments to the individual or entity. Tax rebates are often issued to encourage certain behaviors or provide relief in cases of overpayment or special circumstances.

Key Differences: Input Tax Credit vs Tax Rebate

Input tax credit allows businesses to reduce their tax liability by claiming credit for the GST or VAT paid on purchases related to their commercial activities, directly offsetting output tax payable. Tax rebate, however, is a refund or reduction granted by tax authorities on taxes already paid, often provided under specific conditions such as investments, exports, or certain sectors. The key difference lies in timing and application: input tax credit is utilized during tax calculation to minimize payable tax, while tax rebate is applied post-payment as a partial refund.

Eligibility Criteria for Input Tax Credit

Input Tax Credit (ITC) eligibility requires that the taxpayer must possess a valid tax invoice from a registered supplier and have received the goods or services. The claimant must use the goods or services for business purposes, ensuring that the input tax is not related to exempt supplies or personal use. Compliance with timely filing of GST returns and payment of tax is mandatory to claim ITC under prevailing tax laws.

Who Qualifies for a Tax Rebate?

Tax rebates typically qualify individuals or businesses that have paid taxes beyond their liability or meet specific government criteria such as income level, investments in renewable energy, or special economic zones. Eligibility often depends on filing accurate tax returns demonstrating overpayment or qualifying expenses under tax laws. Claiming a tax rebate requires adherence to documentation standards set by tax authorities to validate entitlement.

Claiming Input Tax Credit: Step-by-Step Process

Claiming Input Tax Credit (ITC) involves verifying purchase invoices to ensure they contain the supplier's GST details and GSTIN. Next, reconcile the purchase data with the supplier's tax returns to confirm that the tax has been paid and correctly reported. Finally, file the GST return accurately, ensuring the input tax credit claimed matches the eligible purchases to reduce the overall tax liability.

Tax Rebate Application Procedures

Tax rebate application procedures require submitting a detailed claim form along with proof of tax payments, such as invoices and receipts, to the relevant tax authority. Applicants must ensure compliance with eligibility criteria, including timely filing within the stipulated deadline and accurate documentation to support the rebate claim. Verification processes conducted by tax officials may involve audits to confirm the validity of the claim before the rebate is approved and disbursed.

Impact on Tax Liability: ITC vs Rebate

Input tax credit (ITC) directly reduces the tax liability by allowing businesses to deduct the tax paid on purchases from their output tax, effectively lowering the overall tax payable. Tax rebates, on the other hand, provide a refund or reduction in tax liability after assessment, often subject to specific conditions or limits. ITC offers immediate cash flow benefits by offsetting taxes during the filing period, whereas rebates typically offer relief post-payment, impacting the timing of tax liability reduction.

Common Mistakes in ITC and Rebate Claims

Confusing input tax credit (ITC) with tax rebate often leads to common mistakes such as claiming ITC on non-eligible purchases or missing out on timely rebate filings. Businesses frequently overlook proper documentation requirements, resulting in rejected claims for both ITC and tax rebates. Ensuring accurate classification of expenses and adherence to prescribed timelines significantly reduces errors and maximizes tax benefits.

Maximizing Tax Savings: Choosing Between ITC and Rebate

Maximizing tax savings requires a clear understanding of input tax credit (ITC) and tax rebates, as both offer different financial benefits under GST regulations. ITC allows businesses to deduct the tax paid on purchases from their output tax liability, effectively reducing the amount payable, whereas tax rebates provide direct reductions on tax due, often subject to specific conditions and eligibility criteria set by tax authorities. Evaluating the transaction type, eligibility conditions, and cash flow impact helps determine whether claiming ITC or opting for a tax rebate generates the most significant tax savings.

Important Terms

Output Tax

Output tax is the sales tax collected on goods and services sold, which businesses must remit to tax authorities, while input tax credit allows businesses to deduct the tax paid on purchases from their output tax liability. Tax rebate refers to a refund or deduction granted by the government, reducing the overall tax burden, typically after accounting for input tax credits.

GST Adjustment

GST adjustment involves reconciling input tax credit (ITC) against tax liabilities to ensure accurate tax compliance and avoid double taxation. Input tax credit allows businesses to deduct GST paid on purchases from their GST liability, while tax rebate refers to refunds granted on excess tax payments after adjustments.

Indirect Taxation

Input tax credit allows businesses to reduce the tax paid on inputs from their output tax liability, enhancing cash flow and reducing overall tax burden in indirect taxation systems like GST or VAT. Tax rebates, however, directly reduce the amount of tax payable by a fixed amount or percentage, often provided as incentives to encourage specific behaviors or support sectors, differing fundamentally from the offset mechanism of input tax credit.

Tax Offset

Tax offset allows businesses to reduce their overall tax liability by utilizing Input Tax Credits (ITC), which are credits for GST paid on business purchases, against their output tax payable on sales; unlike tax rebates, which provide refunds based on specific qualifying criteria or excess tax payments, ITC directly lowers taxable amounts before final tax calculation. Efficient management of ITC ensures compliance with GST regulations and maximizes cash flow advantages by minimizing direct tax outflows, whereas tax rebates serve as post-payment relief typically issued by tax authorities.

Invoice Matching

Invoice matching ensures the accuracy of input tax credit claims by verifying purchase invoices against goods receipts and tax filings, preventing discrepancies in tax rebate submissions. Proper alignment of invoiced amounts and corresponding tax data optimizes compliance and maximizes eligible input tax credits while minimizing risks of rebate denial.

Tax Cascading

Tax cascading occurs when a product is taxed multiple times at different stages of production, leading to a higher overall tax burden, which can be mitigated through input tax credit by allowing businesses to deduct the tax paid on inputs from their output tax liability. In contrast, tax rebate directly refunds the tax paid to the taxpayer, but does not prevent the compounding effect of tax-on-tax as effectively as the input tax credit mechanism.

Credit Utilization

Credit utilization directly impacts the efficiency of claiming Input Tax Credit (ITC) by offsetting tax liabilities, whereas tax rebates reduce the overall tax payable through government refunds. Optimizing credit utilization ensures maximum benefit from ITC claims, minimizing cash outflow and enhancing tax rebate applicability.

Refund Mechanism

The refund mechanism allows businesses to recover excess tax paid when input tax credit exceeds their output tax liability, effectively balancing cash flow in value-added tax systems. Tax rebate, however, is a direct reduction or return of tax based on specific criteria or incentives, often unrelated to the actual input tax credits claimed.

Reverse Charge

Reverse Charge mechanism shifts the liability to pay GST from the supplier to the recipient, enabling the recipient to claim Input Tax Credit (ITC) on the tax paid, which directly reduces their overall tax liability. In contrast, tax rebates are government refunds on taxes already paid, providing financial relief without affecting the ITC process.

Turnover Threshold

Turnover threshold determines eligibility for input tax credit, as businesses must exceed a specified annual turnover limit to claim ITC under GST regulations. Tax rebate schemes often rely on turnover thresholds to provide relief to small enterprises, ensuring rebates are targeted to businesses below a defined revenue level.

Input tax credit vs tax rebate Infographic

moneydif.com

moneydif.com