General Anti-Avoidance Rule (GAAR) targets aggressive tax avoidance schemes by scrutinizing transactions that lack commercial substance and are primarily designed to obtain tax benefits. Specific Anti-Avoidance Rules (SAAR) focus on particular tax provisions, addressing predefined tax avoidance methods with detailed regulations in targeted areas. GAAR provides a broad, principle-based approach, while SAAR offers precise, rule-based deterrence against known avoidance strategies.

Table of Comparison

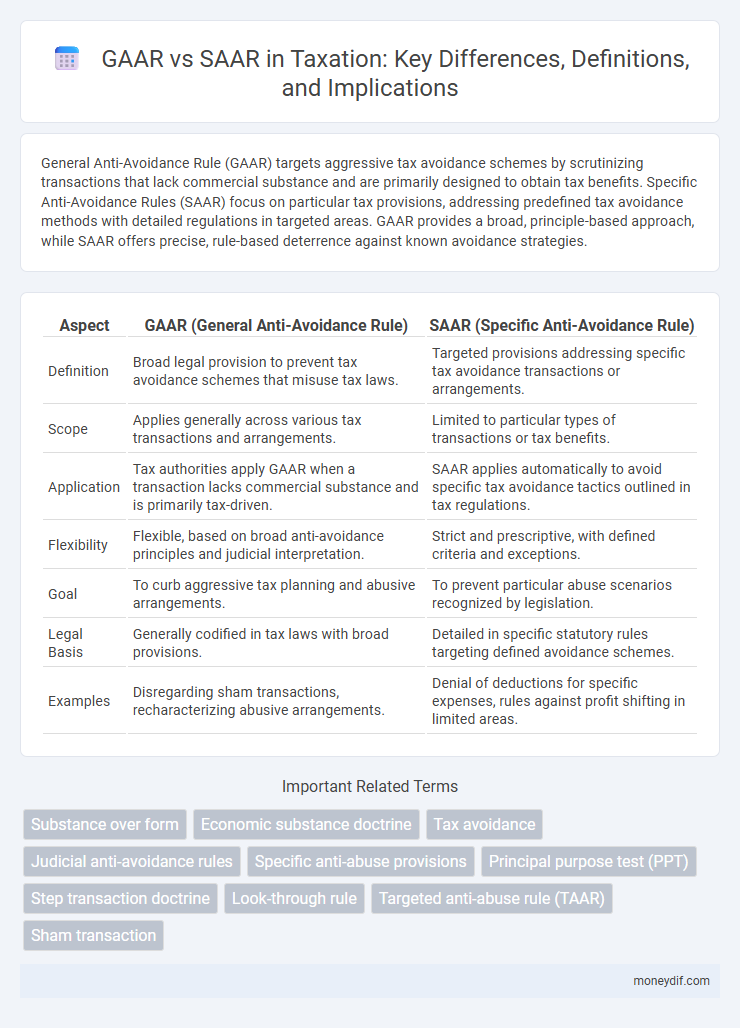

| Aspect | GAAR (General Anti-Avoidance Rule) | SAAR (Specific Anti-Avoidance Rule) |

|---|---|---|

| Definition | Broad legal provision to prevent tax avoidance schemes that misuse tax laws. | Targeted provisions addressing specific tax avoidance transactions or arrangements. |

| Scope | Applies generally across various tax transactions and arrangements. | Limited to particular types of transactions or tax benefits. |

| Application | Tax authorities apply GAAR when a transaction lacks commercial substance and is primarily tax-driven. | SAAR applies automatically to avoid specific tax avoidance tactics outlined in tax regulations. |

| Flexibility | Flexible, based on broad anti-avoidance principles and judicial interpretation. | Strict and prescriptive, with defined criteria and exceptions. |

| Goal | To curb aggressive tax planning and abusive arrangements. | To prevent particular abuse scenarios recognized by legislation. |

| Legal Basis | Generally codified in tax laws with broad provisions. | Detailed in specific statutory rules targeting defined avoidance schemes. |

| Examples | Disregarding sham transactions, recharacterizing abusive arrangements. | Denial of deductions for specific expenses, rules against profit shifting in limited areas. |

Introduction to GAAR and SAAR

GAAR (General Anti-Avoidance Rule) targets aggressive tax avoidance schemes by allowing tax authorities to deny tax benefits arising from transactions that lack commercial substance. SAAR (Specific Anti-Avoidance Rules) address particular tax avoidance strategies by applying tailored provisions to specific arrangements or transactions. Both GAAR and SAAR are key frameworks in combating tax evasion and ensuring compliance with the intended tax laws.

Defining GAAR: General Anti-Avoidance Rules

General Anti-Avoidance Rules (GAAR) are legal provisions designed to prevent tax avoidance schemes that comply with the letter of the law but violate its spirit, ensuring that tax benefits are not obtained through artificial or abusive arrangements. GAAR empowers tax authorities to scrutinize transactions and disregard arrangements primarily aimed at securing tax advantages without any substantial commercial purpose. This framework contrasts with Specific Anti-Avoidance Rules (SAAR), which target particular types of tax avoidance practices through detailed provisions.

Understanding SAAR: Specific Anti-Avoidance Rules

Specific Anti-Avoidance Rules (SAAR) target particular tax avoidance schemes by outlining clear legal provisions designed to prevent abuse of specific tax benefits. SAAR provides precise criteria and examples for identifying transactions that are aimed at circumventing tax laws, ensuring consistency in enforcement. These rules differ from General Anti-Avoidance Rules (GAAR) by focusing on narrowly defined avoidance practices rather than broad, discretionary powers.

Key Differences Between GAAR and SAAR

GAAR (General Anti-Avoidance Rule) targets broad and complex tax avoidance schemes, enabling tax authorities to deny tax benefits arising from transactions lacking commercial substance. SAAR (Specific Anti-Avoidance Rule) addresses narrowly defined tax avoidance practices related to particular provisions or transactions, providing targeted rules against specific types of tax evasion. GAAR uses a principles-based approach for assessing the substance over form, while SAAR relies on explicit statutory provisions to tackle predefined abusive arrangements.

Objectives and Scope of GAAR

The General Anti-Avoidance Rule (GAAR) aims to prevent tax avoidance by targeting arrangements lacking commercial substance and designed primarily to obtain tax benefits, ensuring transactions reflect economic reality. GAAR's scope covers a wide range of aggressive tax planning strategies, empowering tax authorities to disregard or recharacterize transactions that abuse tax laws. Unlike Specific Anti-Avoidance Rules (SAAR), which address particular types of tax avoidance, GAAR provides a broad framework to counteract new or unforeseen tax avoidance schemes.

Objectives and Scope of SAAR

SAAR (Specific Anti-Avoidance Rules) target precise tax avoidance schemes by defining clear objectives to prevent loophole exploitation in particular transactions or industries. Its scope is narrowly focused on predetermined arrangements identified as abusive, offering certainty and predictability for taxpayers and tax authorities. SAAR complements the broader GAAR (General Anti-Avoidance Rule) by providing detailed rules for cases where generalized provisions may not effectively deter specific tax avoidance practices.

Applicability: When GAAR and SAAR Are Triggered

GAAR (General Anti-Avoidance Rule) is triggered when tax arrangements lack commercial substance and are primarily aimed at obtaining tax benefits, targeting aggressive tax planning schemes. SAAR (Specific Anti-Avoidance Rule) applies to particular transactions explicitly identified by tax authorities, such as transfer pricing or dividend stripping, with clearly defined thresholds or triggers. GAAR takes a broader approach to combat tax avoidance across various scenarios, while SAAR focuses narrowly on specific abusive practices outlined in tax legislation.

Legal Framework Governing GAAR and SAAR

The legal framework governing GAAR (General Anti-Avoidance Rule) is primarily outlined in the Income Tax Act, designed to curb aggressive tax avoidance by disregarding arrangements lacking commercial substance and entered solely for tax benefits. SAAR (Specific Anti-Avoidance Rules) are codified provisions targeting particular types of tax avoidance transactions such as transfer pricing, thin capitalization, and international transactions, with detailed guidelines issued by tax authorities and incorporated under specific sections of tax law. Both frameworks empower tax authorities to counteract tax evasion, but GAAR provides a broad, principles-based approach while SAAR offers targeted, rule-based interventions.

Challenges in Implementing GAAR vs SAAR

Implementing GAAR (General Anti-Avoidance Rule) presents challenges including complex interpretation, extensive documentation requirements, and potential for increased litigation due to its broad scope. SAAR (Specific Anti-Avoidance Rules) face difficulties in scope limitation, frequent need for updates to address new schemes, and potential loopholes exploited by taxpayers. Both frameworks require robust administrative capacity and clear guidance to effectively deter tax avoidance without hindering legitimate transactions.

Case Studies: GAAR and SAAR in Practice

Case studies on GAAR and SAAR reveal distinct approaches in countering tax avoidance schemes, with GAAR targeting aggressive arrangements lacking commercial substance and SAAR focusing on specific anti-avoidance provisions within tax laws. Practical applications highlight GAAR's broader discretion in recharacterizing transactions, whereas SAAR enforces predefined rules against particular avoidance techniques. Judicial rulings demonstrate the effectiveness of GAAR in addressing novel schemes, while SAAR ensures consistency in handling well-established tax avoidance patterns.

Important Terms

Substance over form

Substance over form is a fundamental principle in tax law that prioritizes the economic reality of transactions over their legal form, playing a critical role in the application of General Anti-Avoidance Rules (GAAR) to counteract abusive tax avoidance schemes. Specific Anti-Avoidance Rules (SAAR) target particular transactions or arrangements, but GAAR provides a broader framework to address complex schemes where substance over form reveals the true intent behind the taxpayer's actions.

Economic substance doctrine

The Economic Substance Doctrine requires transactions to have a substantial purpose beyond tax benefits, influencing the application of General Anti-Avoidance Rules (GAAR) and Specific Anti-Avoidance Rules (SAAR) by providing a framework to challenge arrangements lacking economic reality. GAAR offers broad, principles-based authority to counteract tax avoidance schemes, while SAAR targets specific, identified transactions; both rely on the economic substance analysis to determine the legitimacy of tax positions.

Tax avoidance

Tax avoidance strategies often exploit legal loopholes, but the General Anti-Avoidance Rule (GAAR) empowers tax authorities to scrutinize and invalidate transactions lacking commercial substance aimed solely at tax benefits. In contrast, the Specific Anti-Avoidance Rules (SAAR) target particular schemes or arrangements explicitly defined by law, providing narrower but clearer guidelines on prohibited tax avoidance practices.

Judicial anti-avoidance rules

Judicial anti-avoidance rules primarily focus on dissecting transactions to identify abusive tax practices, with GAAR (General Anti-Avoidance Rules) providing a broad framework targeting impermissible tax benefits across multiple contexts, while SAAR (Specific Anti-Avoidance Rules) apply to narrowly defined scenarios or transactions such as transfer pricing or thin capitalization. Courts often interpret GAAR by examining the purpose and effect of transactions to prevent tax avoidance schemes, whereas SAAR enforces compliance with explicit provisions, ensuring targeted anti-avoidance measures are effectively implemented.

Specific anti-abuse provisions

Specific anti-abuse provisions under GAAR (General Anti-Avoidance Rule) target broad, abusive tax avoidance arrangements lacking commercial substance, while SAAR (Specific Anti-Avoidance Rules) focus on predefined, identified tax avoidance schemes with explicit transaction types. GAAR provides a flexible, principle-based framework to counteract aggressive tax planning, whereas SAAR offers detailed, rule-based measures addressing particular tax abuse tactics in legislation.

Principal purpose test (PPT)

The Principal Purpose Test (PPT) is a key anti-avoidance rule under the General Anti-Avoidance Rule (GAAR) framework designed to deny tax benefits when obtaining those benefits is one of the principal purposes of a transaction, contrasting with the Specific Anti-Avoidance Rule (SAAR) which targets narrowly defined avoidance schemes. GAAR's PPT provides a broader, principles-based approach to curb tax avoidance, whereas SAARs apply to particular arrangements predefined by tax legislations.

Step transaction doctrine

The Step Transaction Doctrine prevents tax avoidance by collapsing a series of formally separate steps into a single transaction to reflect the true intent, playing a crucial role in applying General Anti-Avoidance Rules (GAAR) versus Specific Anti-Avoidance Rules (SAAR). While GAAR provides broad authority to counteract tax benefits from abusive transactions, SAAR targets specific avoidance schemes, with the Step Transaction Doctrine often bridging interpretative gaps between these frameworks.

Look-through rule

The Look-through rule enables shareholders to directly access the income, deductions, and credits of a passthrough entity, influencing the application of General Anti-Avoidance Rules (GAAR) by providing transparency to prevent tax evasion. Specific Anti-Avoidance Rules (SAAR) target particular transactions, but the Look-through rule's transparency strengthens GAAR enforcement by revealing underlying economic realities.

Targeted anti-abuse rule (TAAR)

Targeted Anti-Abuse Rules (TAAR) provide specific measures focused on particular abusive tax practices, distinguishing themselves from General Anti-Avoidance Rules (GAAR) which address broad, generic tax avoidance schemes, and Specific Anti-Avoidance Rules (SAAR) that target clearly defined transactions or arrangements. TAARs enhance tax compliance by closing loopholes not effectively covered by GAAR or SAAR, ensuring more precise enforcement against identified abusive behaviors.

Sham transaction

Sham transactions are artificial arrangements lacking genuine economic substance, targeted under General Anti-Avoidance Rules (GAAR) to prevent tax avoidance by disregarding such transactions for tax purposes. Specific Anti-Avoidance Rules (SAAR) focus on identified types of tax avoidance schemes, but GAAR provides a broader authority to invalidate sham transactions that do not reflect legitimate business activities.

GAAR vs SAAR Infographic

moneydif.com

moneydif.com