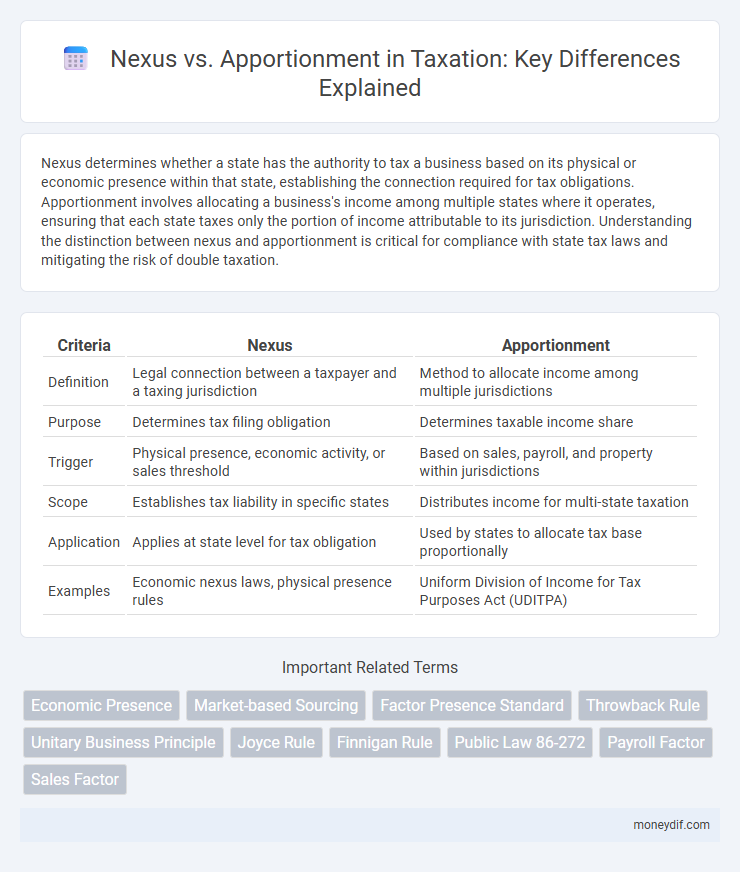

Nexus determines whether a state has the authority to tax a business based on its physical or economic presence within that state, establishing the connection required for tax obligations. Apportionment involves allocating a business's income among multiple states where it operates, ensuring that each state taxes only the portion of income attributable to its jurisdiction. Understanding the distinction between nexus and apportionment is critical for compliance with state tax laws and mitigating the risk of double taxation.

Table of Comparison

| Criteria | Nexus | Apportionment |

|---|---|---|

| Definition | Legal connection between a taxpayer and a taxing jurisdiction | Method to allocate income among multiple jurisdictions |

| Purpose | Determines tax filing obligation | Determines taxable income share |

| Trigger | Physical presence, economic activity, or sales threshold | Based on sales, payroll, and property within jurisdictions |

| Scope | Establishes tax liability in specific states | Distributes income for multi-state taxation |

| Application | Applies at state level for tax obligation | Used by states to allocate tax base proportionally |

| Examples | Economic nexus laws, physical presence rules | Uniform Division of Income for Tax Purposes Act (UDITPA) |

Understanding Tax Nexus: Definition and Importance

Tax nexus defines the connection between a business and a taxing authority, determining the obligation to collect or pay taxes in that jurisdiction. Understanding nexus is crucial for compliance, as it influences whether a company must remit sales tax, income tax, or other levies based on physical presence, economic activity, or transaction volume. Apportionment methods then allocate taxable income fairly across multiple jurisdictions where nexus exists, ensuring accurate tax liabilities.

What Is Apportionment in Taxation?

Apportionment in taxation refers to the method used by states to determine the portion of a multistate business's income subject to state tax, based on factors such as property, payroll, and sales within the state. This system allows states to fairly allocate income when a company operates in multiple jurisdictions, preventing double taxation. Unlike nexus, which establishes the connection required for tax obligation, apportionment calculates how much income is taxable within the specific state boundaries.

Key Differences Between Nexus and Apportionment

Nexus determines a business's legal obligation to collect and remit taxes in a specific state based on physical presence, economic activity, or sales thresholds, while apportionment allocates a multi-state business's income among states to accurately calculate taxable income in each jurisdiction. Nexus establishes tax liability by defining when a business has sufficient connection to a state, whereas apportionment uses formulas based on property, payroll, and sales to distribute income for tax purposes. Understanding the key differences between nexus and apportionment is essential for compliance with state tax laws and minimizing multi-state tax burdens.

Nexus: Establishing Tax Liability Across States

Nexus defines the connection that determines a state's authority to impose tax on a business, often based on physical presence, economic activity, or sales thresholds. Establishing nexus is essential for determining tax liability because it signals where a company must collect and remit taxes, impacting multi-state operations significantly. Understanding state-specific nexus laws ensures compliance and minimizes the risk of penalties or audits related to improper tax reporting.

Apportionment Methods: How States Divide Taxable Income

States use apportionment methods such as the three-factor formula, which considers property, payroll, and sales to allocate taxable income across jurisdictions. Many states are shifting towards sales-only apportionment, emphasizing the location of sales to determine tax liability more precisely. These methods ensure businesses with multistate operations are taxed fairly based on economic presence rather than just physical nexus.

Nexus Standards: Physical Presence vs Economic Presence

Nexus standards for tax purposes primarily differentiate between physical presence and economic presence to establish tax obligations. Physical presence requires a tangible location or property, employees, or sales representatives within a state, whereas economic presence bases nexus on the level of economic activity, such as sales revenue or customer interactions, even without a physical location. Courts and tax authorities increasingly adopt economic nexus standards, especially following the South Dakota v. Wayfair decision, expanding tax liability to remote sellers based on substantial economic connections.

Apportionment Formulas: Three-Factor vs Single Sales Factor

Apportionment formulas determine how state income tax is allocated for multistate businesses, with the Three-Factor formula using property, payroll, and sales to calculate tax liability, providing a balanced reflection of business activity. The Single Sales Factor formula assigns tax based solely on sales within the state, incentivizing businesses to locate property and payroll outside to reduce taxable income. Understanding the differences between these formulas is crucial for tax planning, as the choice affects state tax burden and nexus determination.

The Impact of Nexus and Apportionment on Multistate Businesses

Nexus determines a multistate business's tax obligation by establishing the connection between the business and the taxing state, directly influencing whether state income tax applies. Apportionment calculates the portion of income subject to tax based on the business's economic presence across states, using factors like sales, property, and payroll. Together, nexus rules and apportionment formulas critically affect tax liabilities, compliance requirements, and strategic decisions for companies operating in multiple jurisdictions.

State Compliance Challenges: Navigating Nexus and Apportionment

State tax compliance challenges intensify as businesses navigate nexus rules and apportionment formulas, which vary widely across jurisdictions. Nexus determines a state's authority to tax a business, often triggered by physical presence or economic activity, while apportionment allocates income among states based on factors like sales, property, and payroll. Accurate application of nexus standards combined with complex apportionment methods is critical for avoiding double taxation and ensuring adherence to diverse state tax regulations.

Future Trends: Evolving Nexus and Apportionment Regulations

Future trends in nexus and apportionment regulations indicate a shift towards more precise digital presence criteria and multi-factor apportionment formulas to capture taxable activities in the evolving economy. States increasingly adopt economic nexus thresholds based on sales revenue or transaction counts, while exploring destination-based sourcing methods for apportionment to ensure fair tax collection. Advances in data analytics and interstate cooperation are expected to drive consistent tax compliance frameworks, reducing disputes and adapting to remote and digital commerce growth.

Important Terms

Economic Presence

Economic presence establishes nexus by demonstrating sufficient business activity in a jurisdiction, while apportionment allocates taxable income based on that nexus.

Market-based Sourcing

Market-based sourcing determines state income tax liability by attributing revenue to the location where the customer receives the benefit, contrasting with apportionment methods that allocate income based on a formula of property, payroll, and sales factors. Nexus establishes a business's tax presence in a state, triggering market-based sourcing rules, thereby influencing how income is apportioned and taxed across different jurisdictions.

Factor Presence Standard

Factor Presence Standard determines tax nexus by evaluating the substantial physical or economic presence of a business within a state, contrasting with apportionment which allocates taxable income based on the proportion of business activities conducted in each jurisdiction.

Throwback Rule

The Throwback Rule mandates the inclusion of sales in a state's tax base when a seller lacks nexus there, contrasting with apportionment methods that allocate income based on multistate business factors.

Unitary Business Principle

The Unitary Business Principle requires states to treat all affiliated entities engaged in a unitary business as a single entity for tax purposes, establishing nexus beyond physical presence by connecting related activities. This principle contrasts with apportionment methods, which allocate income among states based on factors such as property, payroll, and sales to fairly distribute tax obligations within the established nexus framework.

Joyce Rule

Joyce Rule addresses the Supreme Court's approach in Nexus vs Apportionment cases by affirming that states must establish a substantial nexus to impose tax obligations on out-of-state businesses.

Finnigan Rule

The Finnigan Rule establishes that in Nexus versus apportionment analyses, state tax jurisdiction hinges on the existence of sufficient business contacts within the state rather than the proportional allocation of income.

Public Law 86-272

Public Law 86-272 restricts states from imposing income tax nexus based solely on solicitation of sales, distinguishing nexus from apportionment which determines tax liability allocation among states.

Payroll Factor

Payroll factor measures the proportion of total payroll paid to employees within a state, influencing Nexus determination and apportionment formulas for state income tax allocation.

Sales Factor

Sales factor is a key component of apportionment formulas used to allocate state tax nexus based on the proportion of sales made within a taxing jurisdiction.

Nexus vs apportionment Infographic

moneydif.com

moneydif.com