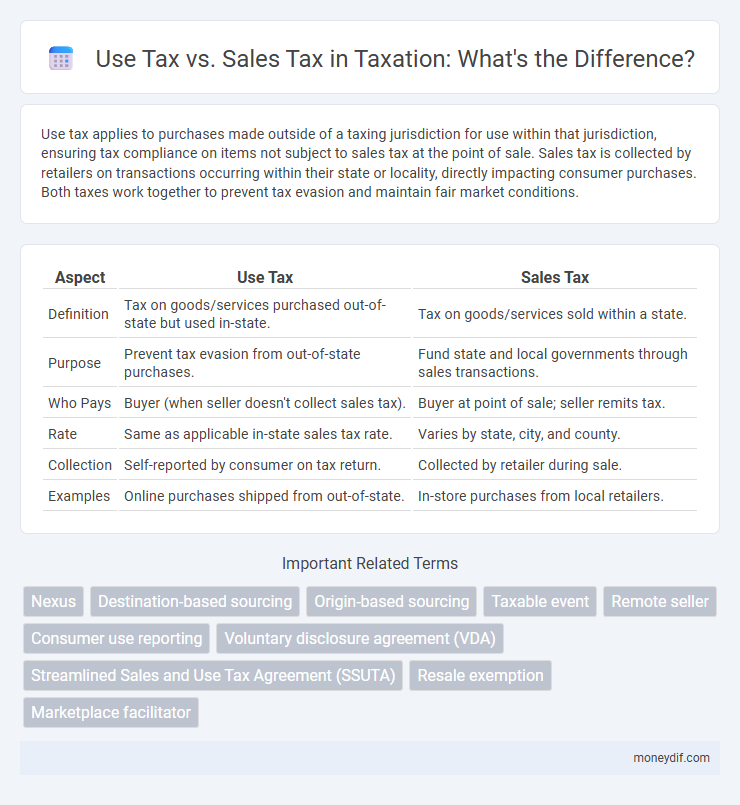

Use tax applies to purchases made outside of a taxing jurisdiction for use within that jurisdiction, ensuring tax compliance on items not subject to sales tax at the point of sale. Sales tax is collected by retailers on transactions occurring within their state or locality, directly impacting consumer purchases. Both taxes work together to prevent tax evasion and maintain fair market conditions.

Table of Comparison

| Aspect | Use Tax | Sales Tax |

|---|---|---|

| Definition | Tax on goods/services purchased out-of-state but used in-state. | Tax on goods/services sold within a state. |

| Purpose | Prevent tax evasion from out-of-state purchases. | Fund state and local governments through sales transactions. |

| Who Pays | Buyer (when seller doesn't collect sales tax). | Buyer at point of sale; seller remits tax. |

| Rate | Same as applicable in-state sales tax rate. | Varies by state, city, and county. |

| Collection | Self-reported by consumer on tax return. | Collected by retailer during sale. |

| Examples | Online purchases shipped from out-of-state. | In-store purchases from local retailers. |

Understanding the Basics: What Are Use Tax and Sales Tax?

Use tax and sales tax are both consumption taxes but apply in different scenarios: sales tax is collected by retailers at the point of sale, while use tax is paid by consumers on out-of-state purchases where sales tax was not collected. Use tax ensures that local tax obligations are met when goods or services are bought outside the purchaser's state but used within their home state. Understanding the distinction is essential for compliance, as both taxes fund state and local government services but are applied based on the location and nature of the transaction.

Key Differences Between Use Tax and Sales Tax

Sales tax is imposed on the purchase of goods and services at the point of sale and is collected by the retailer for the state. Use tax applies to goods purchased outside the state but used, stored, or consumed within the state when sales tax was not paid at the time of purchase. The key difference lies in the timing and responsibility: sales tax is collected by the seller during the transaction, whereas use tax is typically self-reported and paid directly by the consumer.

When Does Use Tax Apply?

Use tax applies when goods or services are purchased outside of a buyer's state but used, stored, or consumed within that state, and sales tax was not collected at the point of sale. This tax ensures that local tax rates are respected regardless of the location of the vendor, preventing tax avoidance through out-of-state purchases. Businesses and individuals must report and pay use tax on these taxable items to comply with state tax laws and avoid penalties.

Common Scenarios Triggering Sales Tax

Common scenarios triggering sales tax include in-store purchases, online retail transactions, and services provided by businesses in taxable categories. Use tax applies primarily when goods are purchased out-of-state or online without paying sales tax, but the items are used, stored, or consumed within the purchaser's state. Both taxes ensure states collect revenue on goods and services consumed within their jurisdiction.

How Are Sales Tax and Use Tax Calculated?

Sales tax is calculated as a percentage of the purchase price charged by the retailer at the point of sale, varying by state and locality rates. Use tax is imposed on the buyer for out-of-state purchases where no sales tax was collected, matching the local sales tax rate to ensure tax parity. Both taxes are based on the taxable value of goods or services acquired, with use tax filling gaps when sales tax is not collected.

Interstate Purchases: Navigating Use vs Sales Tax

Interstate purchases often trigger use tax obligations when sales tax is not collected at the point of sale, requiring consumers to report and remit tax directly to their home state. Sales tax applies to in-state transactions, whereas use tax covers out-of-state acquisitions, closing the gap to ensure tax compliance. Understanding state-specific use tax rates and reporting protocols is essential to avoid penalties on remote or online purchases.

Business Compliance: Managing Use and Sales Tax Obligations

Businesses must accurately distinguish between use tax and sales tax to ensure full compliance with state tax laws, as sales tax applies to transactions made at the point of sale while use tax covers out-of-state purchases not subject to sales tax. Effective compliance requires implementing rigorous tracking systems for both taxable purchases and sales to avoid penalties and potential audits. Leveraging automated tax software can streamline the calculation and reporting processes, minimizing errors and maintaining up-to-date adherence to varying state tax regulations.

Penalties for Non-Compliance with Use or Sales Tax Laws

Penalties for non-compliance with use tax or sales tax laws often include substantial fines, interest charges on unpaid amounts, and potential legal action by tax authorities. Businesses that fail to report or remit the correct amount of tax risk audits, increased scrutiny, and possible suspension of business licenses. Consistent failure to comply may lead to criminal charges, emphasizing the importance of accurate tax reporting and timely payment.

How to Report and Pay Use Tax

Use tax is reported and paid directly to the state tax agency, commonly through periodic tax returns or by filing a separate use tax form if purchases were made without sales tax. Businesses and individuals must track out-of-state purchases and calculate the correct use tax based on the local tax rate where the item is used or stored. Failure to report and pay use tax can result in penalties and interest, making accurate record-keeping essential for compliance.

Frequently Asked Questions About Use Tax and Sales Tax

Use tax applies to purchases made outside a retailer's jurisdiction where sales tax was not collected, ensuring tax compliance on goods brought into the state. Sales tax is a consumption tax imposed on the sale of goods and services within a state's borders, collected by the seller at the point of sale. Common questions about use tax include how to report it on income tax returns, the difference between use and sales tax rates, and requirements for out-of-state internet purchases.

Important Terms

Nexus

Nexus determines a business's obligation to collect use tax or sales tax based on its physical or economic presence within a state, impacting the application of each tax type. States enforce sales tax on in-state sales transactions, while use tax applies when goods purchased out-of-state are used or consumed within the state where nexus is established.

Destination-based sourcing

Destination-based sourcing applies the tax rate of the buyer's location, making use tax relevant when out-of-state sellers do not collect sales tax. This system ensures compliance by requiring purchasers to self-assess use tax on goods received from vendors who do not charge sales tax at the destination point.

Origin-based sourcing

Origin-based sourcing determines sales tax based on the seller's location, while use tax applies when goods are purchased outside the buyer's state but used within it, ensuring tax compliance on out-of-state purchases. This distinction affects businesses operating in multiple jurisdictions by requiring accurate tax collection and reporting according to seller or buyer locations.

Taxable event

A taxable event occurs when a transaction triggers a tax liability, such as the purchase or use of tangible personal property. Use tax applies to goods purchased out-of-state and used within a taxing jurisdiction without paying sales tax, ensuring tax equity, whereas sales tax is charged at the point of sale by the seller within the jurisdiction.

Remote seller

Remote sellers must navigate complex tax landscapes where use tax applies to out-of-state purchases not subject to sales tax, requiring accurate tracking and reporting to comply with various state regulations. Sales tax is typically collected at the point of sale by in-state retailers, while remote sellers often face obligations to collect and remit use tax to avoid tax avoidance and ensure revenue compliance.

Consumer use reporting

Consumer use reporting requires accurate documentation of purchases subject to use tax, which applies when sales tax was not collected at the point of sale. Proper compliance ensures businesses and individuals report and remit use tax to avoid penalties and reconcile differences with sales tax obligations.

Voluntary disclosure agreement (VDA)

Voluntary Disclosure Agreements (VDAs) allow businesses to report and pay previously unreported use tax, minimizing penalties and interest compared to traditional audits. Use tax applies to purchases made without sales tax collected, while sales tax is collected at the point of sale, making VDAs crucial for reconciling discrepancies between these tax liabilities.

Streamlined Sales and Use Tax Agreement (SSUTA)

The Streamlined Sales and Use Tax Agreement (SSUTA) standardizes sales tax collection and simplifies compliance across member states, ensuring consistent tax treatment for sales tax on purchased goods and use tax on items used rather than sold within a jurisdiction. By harmonizing definitions, rates, and administration procedures, SSUTA reduces the complexity businesses face when determining sales tax versus use tax obligations across multiple states.

Resale exemption

Resale exemption allows businesses to purchase goods without paying sales tax when those goods are intended for resale, shifting the tax liability to the final consumer under use tax. Use tax applies to items bought out-of-state or without sales tax, ensuring tax compliance and preventing tax evasion in use tax vs sales tax scenarios.

Marketplace facilitator

Marketplace facilitators are responsible for collecting and remitting sales tax on behalf of sellers, which simplifies compliance but may shift use tax obligations away from individual buyers. This distinction affects businesses and consumers differently, as sales tax is collected at the point of sale, while use tax applies to purchases made outside a taxing jurisdiction without sales tax collected.

Use tax vs Sales tax Infographic

moneydif.com

moneydif.com