Active income is earned through direct involvement in work or services, such as wages, salaries, and business profits, and is usually subject to standard income tax rates. Passive income, generated from investments like rental properties, dividends, and royalties, often benefits from favorable tax treatment or lower tax rates depending on jurisdiction. Understanding the tax implications of both income types helps optimize tax liabilities and maximize after-tax earnings.

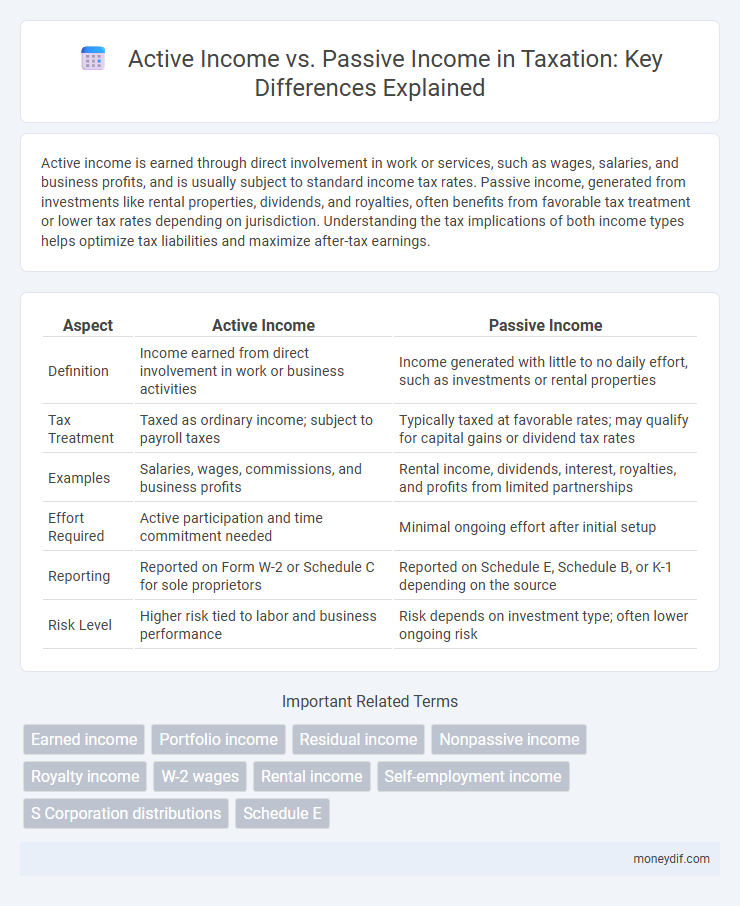

Table of Comparison

| Aspect | Active Income | Passive Income |

|---|---|---|

| Definition | Income earned from direct involvement in work or business activities | Income generated with little to no daily effort, such as investments or rental properties |

| Tax Treatment | Taxed as ordinary income; subject to payroll taxes | Typically taxed at favorable rates; may qualify for capital gains or dividend tax rates |

| Examples | Salaries, wages, commissions, and business profits | Rental income, dividends, interest, royalties, and profits from limited partnerships |

| Effort Required | Active participation and time commitment needed | Minimal ongoing effort after initial setup |

| Reporting | Reported on Form W-2 or Schedule C for sole proprietors | Reported on Schedule E, Schedule B, or K-1 depending on the source |

| Risk Level | Higher risk tied to labor and business performance | Risk depends on investment type; often lower ongoing risk |

Understanding Active Income and Passive Income

Active income is earned through direct involvement in work or business activities, such as salaries, wages, and commissions, and is typically subject to payroll taxes and ordinary income tax rates. Passive income derives from investments or rental activities where the taxpayer does not materially participate, including dividends, interest, and rental income, often benefiting from favorable tax treatment and potential deductions. Distinguishing between these income types is critical for accurate tax reporting, compliance, and optimization of tax liabilities.

Key Differences Between Active and Passive Income

Active income involves earnings derived from direct involvement in work or business activities, such as salaries, wages, or freelance payments, requiring continuous effort and time investment. Passive income originates from assets or investments like rental properties, dividends, or royalties, generating revenue with minimal ongoing participation. Tax treatment varies significantly, with active income typically subject to higher ordinary income tax rates, while passive income may benefit from preferential rates or specific deductions.

Common Sources of Active Income

Common sources of active income include wages, salaries, tips, commissions, and income earned from self-employment or running a business. This type of income requires continuous effort and direct involvement, making it fully taxable under ordinary income tax rates. Understanding active income sources is crucial for effective tax planning and maximizing potential deductions.

Popular Forms of Passive Income

Popular forms of passive income include rental income from real estate properties, dividends from stock investments, and earnings from online businesses or digital products. These income streams typically require an initial investment of capital or effort but generate revenue with minimal ongoing involvement. Understanding the tax implications for each type, such as rental income being subject to ordinary income tax rates and qualified dividends often taxed at lower capital gains rates, is crucial for effective financial planning.

Tax Treatment of Active Income

Active income, including wages, salaries, and business income, is subject to ordinary income tax rates and often payroll taxes such as Social Security and Medicare in the United States. This type of income is fully taxable in the year it is earned, and taxpayers may be eligible to deduct related business expenses if the income is derived from self-employment. Contrastingly, active income does not benefit from the lower tax rates typically applied to qualified dividends or long-term capital gains, resulting in a higher tax liability compared to many forms of passive income.

Tax Strategies for Passive Income

Tax strategies for passive income center on maximizing deductions and leveraging tax-advantaged accounts such as IRAs and 401(k)s. Real estate investors benefit from depreciation deductions and 1031 exchanges to defer taxable gains, while dividend income can qualify for lower capital gains tax rates. Properly structuring passive activities and utilizing losses against active income are critical methods to optimize overall tax liability.

Reporting Requirements for Different Income Types

Active income, such as wages, salaries, and business earnings, must be reported on Form 1040 with Schedule C or Schedule E if derived from self-employment or rental activities. Passive income, including dividends, interest, and rental income from passive investments, is reported on Schedule E or Schedule B, depending on the source. The IRS requires detailed documentation and accurate classification to apply appropriate tax rates and deductions, ensuring compliance and minimizing audit risks.

Maximizing Deductions for Both Income Streams

Maximizing deductions for active income involves leveraging business expenses, retirement contributions, and health savings accounts to lower taxable income effectively. Passive income tax strategies focus on deducting allowable expenses such as mortgage interest, property taxes, and depreciation for rental properties or investment-related costs. Utilizing tax credits and loss harvesting can further optimize tax liability across both active and passive income streams.

Pros and Cons: Active vs Passive Income

Active income, earned through direct labor like salaries or freelance work, offers consistent cash flow and potential for skill development but requires constant effort and time investment, resulting in limited scalability. Passive income, generated from investments such as dividends, rental properties, or royalties, provides financial freedom and wealth-building opportunities with minimal daily involvement but may involve higher initial capital and risks like market volatility. Balancing active and passive income streams can optimize tax benefits, diversify income sources, and enhance long-term financial stability.

Choosing the Right Income Strategy for Tax Efficiency

Active income, such as wages or business profits, is taxed at ordinary income tax rates, which can be higher depending on your tax bracket. Passive income, including rental earnings or dividends, often benefits from lower tax rates and specific deductions, making it more tax-efficient in certain scenarios. Choosing the right income strategy involves analyzing your current tax bracket, potential deductions, and long-term financial goals to optimize after-tax returns.

Important Terms

Earned income

Earned income refers to the money received from active participation in work or business activities, typically involving labor or services rendered, distinguishing it from passive income, which is generated with minimal effort through investments like rental properties or dividends. Active income requires continuous involvement, while passive income streams provide financial returns without direct daily management.

Portfolio income

Portfolio income derives from investments such as stocks, bonds, mutual funds, and dividends, distinguishing it from active income generated through direct labor or services. Unlike passive income, which often includes earnings from rental properties or business ventures with minimal involvement, portfolio income is specifically linked to financial asset ownership and market performance.

Residual income

Residual income generates continuous earnings from previous efforts, distinct from active income that requires ongoing work and passive income that may need minimal maintenance but is less effort-dependent. This form of income allows individuals to build wealth over time by leveraging investments, royalties, or business ventures that provide financial returns without daily involvement.

Nonpassive income

Nonpassive income includes earnings from business activities in which the individual materially participates, contrasting with passive income generated from investments or rental properties without active involvement. Understanding the distinction between active income, derived from direct work or services, and passive income is crucial for effective tax planning and maximizing financial growth.

Royalty income

Royalty income, classified as passive income, derives from ongoing earnings on intellectual property rights such as patents, copyrights, or trademarks, requiring minimal active involvement after the initial creation. Unlike active income generated through direct labor or services, royalty income provides continuous cash flow without regular work commitments.

W-2 wages

W-2 wages represent active income earned from employment where an employer withholds taxes and reports earnings to the IRS, distinguishing it from passive income generated through investments or rental properties. Active income such as W-2 wages is subject to payroll taxes, while passive income typically incurs different tax treatments, often excluding self-employment tax.

Rental income

Rental income typically qualifies as passive income because it is earned from property investments without active daily involvement, whereas active income requires direct effort through work or services rendered. Tax regulations often distinguish rental income from active income, affecting deductions and reporting requirements for landlords.

Self-employment income

Self-employment income is classified as active income because it requires direct involvement and effort in running the business or providing services. Unlike passive income, which generates earnings with minimal ongoing effort, self-employment income depends on continuous personal activity and time investment.

S Corporation distributions

S Corporation distributions are generally tax-free to the extent of the shareholder's basis and are tied to the corporation's earnings and profits, which consist primarily of active income earned through regular business operations. Passive income, such as rental income or royalties, can affect an S Corporation's qualification if it exceeds 25% of gross receipts, potentially leading to corporate status termination and altering the tax implications of distributions.

Schedule E

Schedule E is used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, and trusts, generally classified as passive income. Active income, such as wages or business profits, is reported separately on forms like Schedule C, distinguishing it from the passive income subject to different tax rules on Schedule E.

Active income vs Passive income Infographic

moneydif.com

moneydif.com