Ad valorem tax is calculated as a percentage of the assessed value of an item, often applied to property, sales, or imports, making it responsive to price fluctuations. Specific tax is a fixed amount charged per unit of a good or service, regardless of its price, commonly used on items like tobacco and fuel. Choosing between ad valorem and specific taxes depends on policy goals such as revenue stability, economic efficiency, and administrative simplicity.

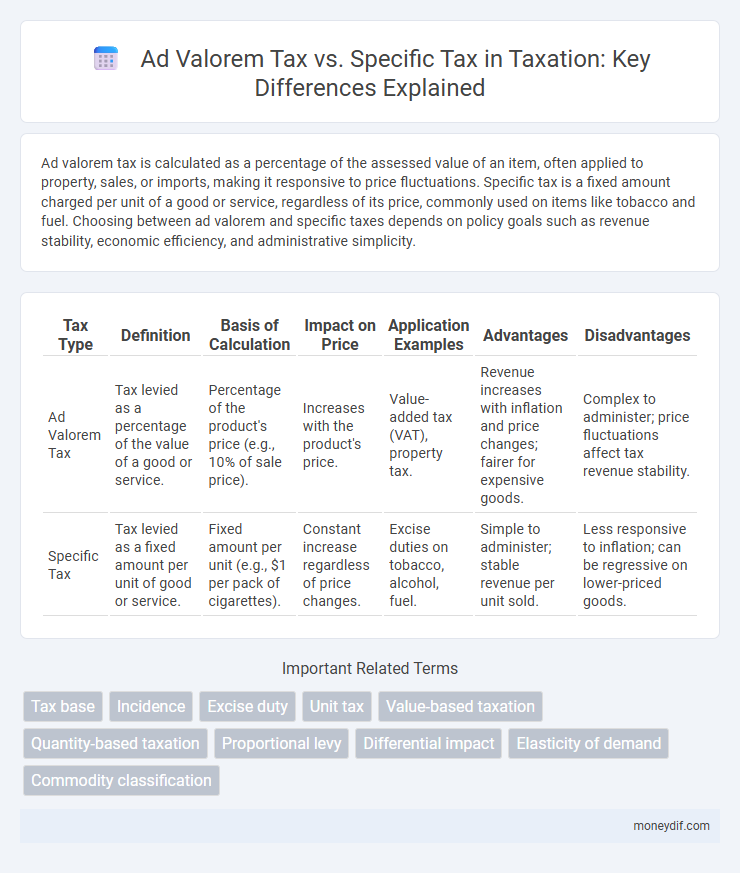

Table of Comparison

| Tax Type | Definition | Basis of Calculation | Impact on Price | Application Examples | Advantages | Disadvantages |

|---|---|---|---|---|---|---|

| Ad Valorem Tax | Tax levied as a percentage of the value of a good or service. | Percentage of the product's price (e.g., 10% of sale price). | Increases with the product's price. | Value-added tax (VAT), property tax. | Revenue increases with inflation and price changes; fairer for expensive goods. | Complex to administer; price fluctuations affect tax revenue stability. |

| Specific Tax | Tax levied as a fixed amount per unit of good or service. | Fixed amount per unit (e.g., $1 per pack of cigarettes). | Constant increase regardless of price changes. | Excise duties on tobacco, alcohol, fuel. | Simple to administer; stable revenue per unit sold. | Less responsive to inflation; can be regressive on lower-priced goods. |

Introduction to Ad Valorem Tax and Specific Tax

Ad valorem tax is a percentage-based tax imposed on the value of a good or property, calculated as a fixed proportion of its assessed worth. Specific tax, by contrast, is a fixed amount charged per unit of quantity, such as a set fee per item or volume. Both tax types are commonly applied in excise taxation but differ significantly in their impact on pricing and revenue predictability.

Definition of Ad Valorem Tax

Ad valorem tax is a levy based on the assessed value of an item, such as property or sales, calculated as a fixed percentage of its market price. This type of tax adjusts automatically with changes in value, ensuring higher-value goods or properties incur greater tax liabilities. Unlike specific tax, which applies a fixed amount per unit regardless of value, ad valorem tax aligns revenue generation with the economic worth of the taxed item.

Definition of Specific Tax

Specific tax is a fixed amount of tax levied on a product based on a measurable unit, such as weight, volume, or quantity, regardless of its price. Unlike ad valorem tax, which is calculated as a percentage of the product's value, specific tax remains constant per unit sold, providing predictable revenue for governments. This type of tax is commonly applied to goods like tobacco, alcohol, and fuel to control consumption and generate stable fiscal income.

Key Differences Between Ad Valorem and Specific Taxes

Ad valorem tax is calculated as a percentage of the assessed value of goods or property, making tax liability directly proportional to value fluctuations, while specific tax is levied as a fixed amount per unit, regardless of price changes. Ad valorem taxes provide government revenue that scales with market value, enhancing fairness in taxation, whereas specific taxes are simpler to administer and ensure consistent revenue generation. The choice between these taxes affects economic behavior, with ad valorem potentially discouraging high-value transactions and specific taxes impacting consumption volume.

Advantages of Ad Valorem Tax

Ad valorem tax offers the advantage of generating revenue proportional to the value of the taxed item, ensuring fairness and equity in taxation. It adjusts automatically with inflation and market fluctuations, maintaining revenue consistency for governments. This tax type incentivizes efficient resource allocation by linking tax liability directly to asset value or price.

Advantages of Specific Tax

Specific tax offers advantages such as simplicity and ease of administration since it is imposed as a fixed amount per unit of a good or service, making calculation straightforward. It provides more predictable revenue streams for governments regardless of price fluctuations, enhancing budget planning. Specific tax also minimizes price variability impacts on tax revenue, benefiting sectors with volatile market prices.

Disadvantages of Ad Valorem Tax

Ad valorem tax can be challenging for taxpayers due to its fluctuating nature, which depends on the assessed value of goods or property, often leading to unpredictability in tax liabilities. The assessment process can be complex and costly, creating opportunities for valuation disputes and potential inequities. Unlike specific taxes, ad valorem taxes may discourage investment in high-value assets because of their proportional cost impact.

Disadvantages of Specific Tax

Specific tax has disadvantages including inflexibility to inflation, which erodes its real value over time, reducing government revenue. It can create distortions by disproportionately impacting low-priced goods, leading to regressive effects on consumers. Specific tax also lacks responsiveness to changes in market prices, limiting its effectiveness in adjusting tax burdens accordingly.

Real-World Examples: Ad Valorem vs Specific Tax

Ad valorem tax is calculated as a percentage of an item's value, commonly applied to real estate and luxury goods, exemplified by property taxes where rates vary according to assessed market value. Specific tax imposes a fixed amount per unit, often seen in excise taxes on cigarettes or fuel, ensuring consistent revenue regardless of price fluctuations. Countries like the United States utilize ad valorem taxes for property while employing specific taxes on products like tobacco to control consumption and generate steady fiscal income.

Choosing the Right Tax Structure for Policy Purposes

Ad valorem tax, levied as a percentage of the item's value, allows for automatic adjustment with price fluctuations, enhancing revenue stability and fairness in wealth distribution. Specific tax imposes a fixed amount per unit, providing simplicity in administration and predictability in revenue collection, particularly effective for controlling consumption of harmful goods. Policymakers must evaluate economic objectives, administrative capacity, and market conditions to select the optimal tax structure that balances equity, efficiency, and enforcement feasibility.

Important Terms

Tax base

The tax base for ad valorem tax is calculated based on the assessed value of the property or goods, leading to variable revenue dependent on market fluctuations. Specific tax uses a fixed tax base defined by quantity or volume, providing consistent revenue regardless of the item's value changes.

Incidence

Incidence of ad valorem tax depends on the price elasticity of demand and supply, shifting the tax burden proportionally based on product value, whereas specific tax imposes a fixed amount per unit, causing varied incidence regardless of price fluctuations. Economic models show that ad valorem taxes tend to influence consumer prices more dynamically, while specific taxes create a predictable but sometimes disproportionate impact on producers and consumers.

Excise duty

Excise duty can be structured as either ad valorem tax, calculated as a percentage of the product's value, or specific tax, imposed as a fixed amount per unit or volume. Ad valorem excise duty adjusts automatically with price changes, enhancing revenue elasticity, while specific excise tax provides stable revenue per unit regardless of price fluctuations.

Unit tax

Unit tax imposes a fixed amount per unit of goods sold, contrasting with ad valorem tax which is calculated as a percentage of the product's value, affecting pricing strategies and consumer demand differently. Specific tax simplifies tax administration by applying a constant charge, while ad valorem tax adjusts with price fluctuations, influencing inflation and market competition.

Value-based taxation

Value-based taxation levies taxes as a percentage of the product's market value, making ad valorem tax responsive to price fluctuations and inflation, whereas specific tax imposes a fixed amount per unit regardless of the product's price. Ad valorem taxes generate variable revenue aligned with sales value, while specific taxes provide predictable revenue streams independent of market prices.

Quantity-based taxation

Quantity-based taxation imposes taxes based on the physical amount of goods, differing from ad valorem tax which charges a percentage of the item's value, while specific tax levies a fixed amount per unit. This distinction influences tax burden, revenue predictability, and market behavior, with specific taxes offering simplicity and ad valorem taxes adjusting with price fluctuations.

Proportional levy

Proportional levy imposes a tax rate that remains constant regardless of the base amount, similar to ad valorem tax which is calculated as a fixed percentage of the value of goods or services. In contrast, specific tax applies a fixed amount per unit or quantity, making proportional levies synonymous with ad valorem taxes in maintaining consistent relative tax burdens.

Differential impact

Differential impact arises as ad valorem tax, calculated as a percentage of the product's value, disproportionately affects higher-priced goods whereas specific tax, imposed as a fixed amount per unit, places a uniform burden across products regardless of price. This distinction influences consumer behavior and market prices differently, with ad valorem taxes generally leading to more pronounced price increases on premium items compared to specific taxes.

Elasticity of demand

Elasticity of demand measures consumer responsiveness to price changes, significantly impacting the incidence of ad valorem and specific taxes; with more elastic demand, consumers bear less tax burden as quantity demanded decreases sharply under both tax types. Ad valorem taxes, levied as a percentage of price, cause proportional price changes, while specific taxes impose a fixed monetary amount, affecting consumer behavior differently depending on demand elasticity.

Commodity classification

Commodity classification plays a crucial role in determining whether an ad valorem tax or a specific tax is applied, as ad valorem taxes are based on the product's value while specific taxes are fixed amounts per unit. Accurate classification ensures proper tax calculation, compliance with trade regulations, and prevents revenue loss by differentiating between high-value and standardized goods.

ad valorem tax vs specific tax Infographic

moneydif.com

moneydif.com