Arbitrage exploits price discrepancies between different markets to secure risk-free profits, while scalping involves rapidly buying and selling assets within a single market to capture small price movements. Both strategies require precision and speed, but arbitrage relies on cross-market inefficiencies, whereas scalping depends on high-frequency trades and liquidity. Traders choose between these methods based on market conditions, risk tolerance, and available technology.

Table of Comparison

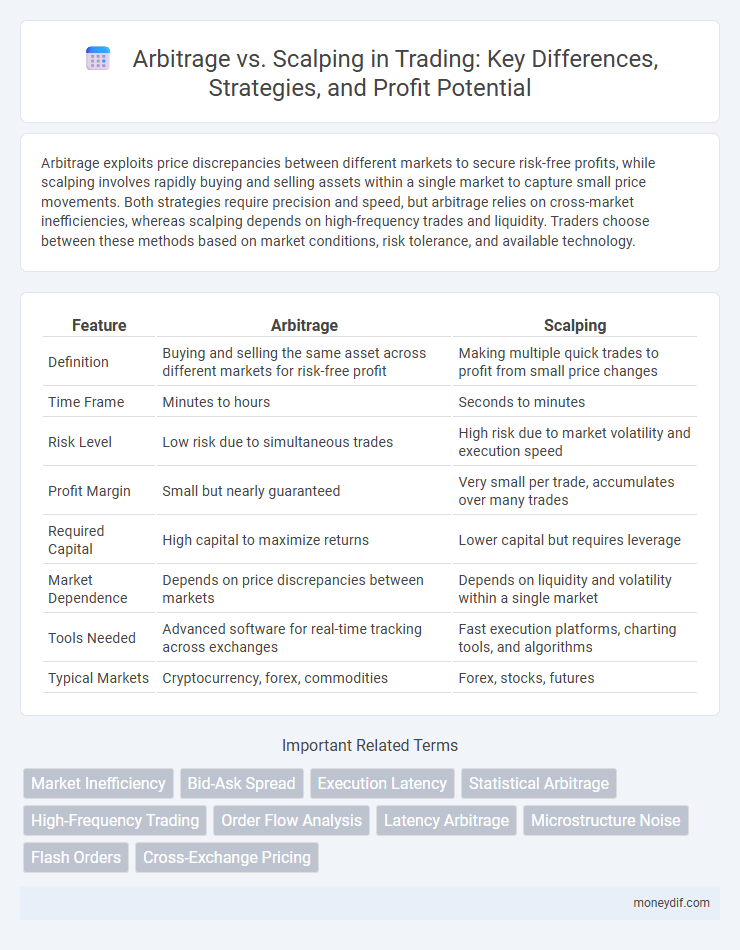

| Feature | Arbitrage | Scalping |

|---|---|---|

| Definition | Buying and selling the same asset across different markets for risk-free profit | Making multiple quick trades to profit from small price changes |

| Time Frame | Minutes to hours | Seconds to minutes |

| Risk Level | Low risk due to simultaneous trades | High risk due to market volatility and execution speed |

| Profit Margin | Small but nearly guaranteed | Very small per trade, accumulates over many trades |

| Required Capital | High capital to maximize returns | Lower capital but requires leverage |

| Market Dependence | Depends on price discrepancies between markets | Depends on liquidity and volatility within a single market |

| Tools Needed | Advanced software for real-time tracking across exchanges | Fast execution platforms, charting tools, and algorithms |

| Typical Markets | Cryptocurrency, forex, commodities | Forex, stocks, futures |

Understanding Arbitrage and Scalping: Core Concepts

Arbitrage involves exploiting price differences of the same asset across different markets to secure risk-free profits, relying heavily on speed and market inefficiencies. Scalping focuses on making numerous small trades within short timeframes, aiming to profit from minor price fluctuations and high liquidity. Both strategies demand advanced technology and precise timing but differ in risk exposure and market scope.

Key Differences Between Arbitrage and Scalping

Arbitrage exploits price discrepancies for the same asset across different markets, ensuring low risk and quick, guaranteed profits through simultaneous buy and sell orders. Scalping involves rapid, high-frequency trades within a single market, aiming to profit from small price movements and requires advanced technical analysis and swift execution. The key difference lies in arbitrage's focus on cross-market inefficiencies versus scalping's dependence on market volatility and timing precision.

Types of Arbitrage Strategies in Trading

Arbitrage strategies in trading include spatial arbitrage, where traders exploit price differences of the same asset across different markets, and triangular arbitrage, which capitalizes on discrepancies among three related currency pairs in forex markets. Statistical arbitrage relies on quantitative models to identify price inefficiencies based on historical data and correlations, often executed algorithmically. Risk arbitrage involves taking positions ahead of mergers or acquisitions, profiting from the price gap between current market values and expected deal prices.

Common Scalping Techniques for Day Traders

Common scalping techniques for day traders include quick, high-frequency trades executed within minutes or seconds to exploit small price movements. Popular methods involve using technical indicators like moving averages, Bollinger Bands, and the Relative Strength Index (RSI) to identify entry and exit points. Scalpers typically focus on highly liquid markets such as forex, stocks, and futures to ensure tight spreads and rapid order execution.

Risk Management in Arbitrage vs Scalping

Arbitrage reduces risk by exploiting price discrepancies across different markets, offering near risk-free profits with minimal exposure to market volatility. Scalping involves frequent trades within short time frames, demanding stringent risk management to control losses from rapid market fluctuations and high transaction costs. Effective risk management in scalping includes tight stop-loss orders and disciplined trade execution to protect capital against sudden price reversals.

Timeframes: Arbitrage vs Scalping Approaches

Arbitrage exploits price discrepancies across different markets or exchanges within seconds to minutes, capitalizing on nearly instantaneous trades to lock in risk-free profits. Scalping operates on very short timeframes, often seconds to a few minutes, involving rapid, high-frequency trades aimed at capturing small price movements within a single market. The key difference lies in arbitrage relying on cross-market inefficiencies, while scalping depends on quick order execution and market liquidity in a narrow timeframe.

Capital Requirements for Arbitrage and Scalping

Arbitrage trading demands significant capital allocation to exploit price discrepancies across markets efficiently, as profit margins per trade are typically small and require large volumes for meaningful returns. Scalping, however, operates effectively with lower capital due to its focus on frequent, small gains within short time frames, relying heavily on leverage and high trade volumes. Understanding these capital requirements is crucial for traders to optimize strategy selection and risk management in volatile trading environments.

Tools and Technologies for Effective Trading

Arbitrage trading relies heavily on advanced algorithms and real-time data feeds to identify and execute opportunities across multiple markets with minimal latency. Scalping demands ultra-fast order execution platforms, often employing direct market access (DMA) and high-frequency trading (HFT) systems to capture small price differentials within seconds. Both strategies benefit from robust risk management software, but arbitrage emphasizes cross-exchange connectivity, while scalping prioritizes speed and precision in order management tools.

Market Conditions Favoring Arbitrage or Scalping

Arbitrage thrives in highly efficient markets with minimal price discrepancies across assets or exchanges, enabling traders to exploit small but risk-free profits quickly. Scalping performs best in volatile markets with high liquidity and rapid price movements, allowing traders to capitalize on frequent, minor price changes within short timeframes. Understanding market conditions such as bid-ask spreads, volatility, and execution speed is crucial for selecting between arbitrage and scalping strategies.

Pros and Cons: Choosing Between Arbitrage and Scalping

Arbitrage exploits price discrepancies across different markets, offering low-risk profit potential but requiring significant capital and sophisticated technology to execute effectively. Scalping focuses on capturing small price movements within a single market, enabling frequent trades with minimal exposure but demanding intense concentration and rapid decision-making under volatile conditions. Traders must weigh arbitrage's stability and complexity against scalping's speed and stress to align with their risk tolerance and trading infrastructure.

Important Terms

Market Inefficiency

Market inefficiency occurs when asset prices deviate from their true value, creating opportunities for arbitrage, which exploits price differences across markets to secure risk-free profits. Scalping, in contrast, capitalizes on small, rapid price fluctuations within a single market, relying on high trade frequency rather than cross-market price discrepancies.

Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, serving as a critical factor in both arbitrage and scalping strategies. Arbitrage exploits price discrepancies across different markets to lock in risk-free profits, while scalping aims to capitalize on small price changes within the bid-ask spread through rapid, high-frequency trades.

Execution Latency

Execution latency critically impacts arbitrage and scalping strategies by determining the speed at which trades are executed to capitalize on price discrepancies. Lower latency enhances the likelihood of capturing fleeting arbitrage opportunities and achieving profitable scalping trades in high-frequency trading environments.

Statistical Arbitrage

Statistical arbitrage leverages quantitative models and historical data to exploit price inefficiencies between related securities, contrasting with scalping which focuses on rapid, small profits from short-term price movements. While arbitrage seeks low-risk, market-neutral opportunities across multiple assets, scalping depends on high-frequency trading and liquidity to capitalize on micro price fluctuations.

High-Frequency Trading

High-Frequency Trading (HFT) utilizes advanced algorithms to execute large volumes of trades at microsecond speeds, often capitalizing on minute price discrepancies through arbitrage opportunities across multiple markets. Unlike scalping, which targets small profits on individual trades by exploiting short-term price movements within a single market, HFT arbitrage strategies focus on simultaneous buy and sell orders to gain risk-free profits from price inefficiencies across different exchanges.

Order Flow Analysis

Order Flow Analysis leverages real-time market data to identify supply and demand imbalances, providing traders with precise entry and exit points crucial for both arbitrage and scalping strategies. While arbitrage exploits price discrepancies across different markets or instruments for low-risk profit, scalping focuses on capturing small price movements within a single market using rapid order execution informed by detailed order book insights.

Latency Arbitrage

Latency arbitrage exploits speed differences in price data feed between markets to execute trades before competitors, contrasting with scalping which focuses on capturing small price movements through rapid, frequent trades within a single market. While latency arbitrage leverages technological advantage for riskless profit across venues, scalping emphasizes trade frequency and quick exit strategies relying on market microstructure and liquidity.

Microstructure Noise

Microstructure noise refers to the random fluctuations in asset prices caused by the trading process, including bid-ask spreads, order execution delays, and discrete price changes, which complicate the detection of true price signals in high-frequency trading. In arbitrage, microstructure noise can obscure small price discrepancies across markets, while in scalping, it directly influences the profitability of rapid trades by affecting the accuracy of entry and exit points within very short time frames.

Flash Orders

Flash orders enable traders to access ultra-fast liquidity by temporarily displaying orders before they reach the broader market, which can be leveraged for arbitrage opportunities by exploiting price discrepancies across venues. In contrast, scalping focuses on profiting from small price movements within a single market, relying less on the speed advantage Flash orders provide.

Cross-Exchange Pricing

Cross-exchange pricing exploits price differences between multiple cryptocurrency exchanges to execute arbitrage, capturing risk-free profits from price discrepancies. Scalping, in contrast, focuses on rapid, small-margin trades within a single exchange, leveraging short-term market fluctuations rather than inter-exchange price variations.

Arbitrage vs Scalping Infographic

moneydif.com

moneydif.com