A flash crash occurs when automated trading algorithms trigger a rapid and severe drop in market prices within minutes, creating sudden liquidity gaps. Fat finger errors involve human input mistakes, like entering incorrect trade orders, which can cause significant price distortions but are usually isolated incidents. Both phenomena highlight the importance of robust risk controls and real-time monitoring to maintain market stability.

Table of Comparison

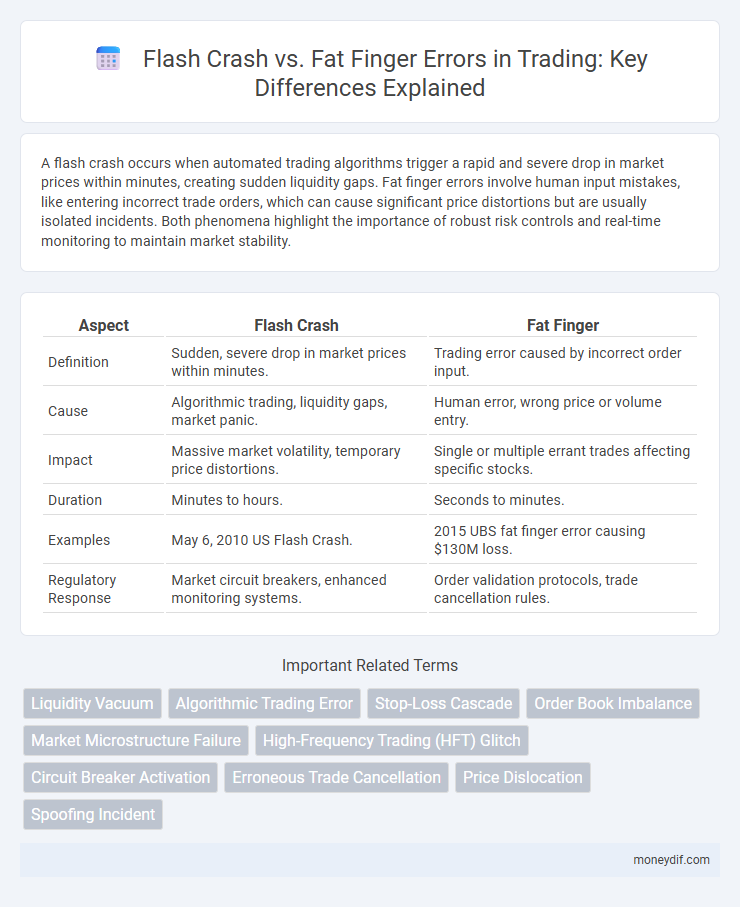

| Aspect | Flash Crash | Fat Finger |

|---|---|---|

| Definition | Sudden, severe drop in market prices within minutes. | Trading error caused by incorrect order input. |

| Cause | Algorithmic trading, liquidity gaps, market panic. | Human error, wrong price or volume entry. |

| Impact | Massive market volatility, temporary price distortions. | Single or multiple errant trades affecting specific stocks. |

| Duration | Minutes to hours. | Seconds to minutes. |

| Examples | May 6, 2010 US Flash Crash. | 2015 UBS fat finger error causing $130M loss. |

| Regulatory Response | Market circuit breakers, enhanced monitoring systems. | Order validation protocols, trade cancellation rules. |

Understanding Flash Crash and Fat Finger Errors

Flash crashes are sudden, severe market price declines caused by rapid, automated trading algorithms triggering mass sell-offs. Fat finger errors occur when human traders input incorrect trade information, like wrong price or volume, leading to unintended large trades that disrupt market stability. Both phenomena significantly impact market liquidity and emphasize the need for robust risk management and error prevention systems in high-frequency trading environments.

Key Differences Between Flash Crash and Fat Finger

Flash Crash refers to a sudden, severe drop in asset prices caused by high-frequency algorithmic trading and market liquidity shortages, often corrected within minutes. Fat Finger errors result from manual human input mistakes, such as entering incorrect order sizes or prices, leading to unintended large trades or price distortions. The primary difference lies in Flash Crash being driven by automated trading system malfunctions, while Fat Finger incidents stem from human errors in trade execution.

Historical Examples of Flash Crashes

The Flash Crash of May 6, 2010, stands as one of the most infamous historical examples, where the Dow Jones Industrial Average plummeted nearly 1,000 points within minutes before rapidly rebounding. Another significant event occurred on October 15, 2014, when the U.S. Treasury market experienced a sudden and severe drop, highlighting vulnerabilities in high-frequency trading systems. These incidents illustrate the impact of automated trading algorithms and market liquidity issues distinct from errors caused by a "fat finger," which typically results from manual input mistakes.

Notable Fat Finger Trading Incidents

Notable fat finger trading incidents include UBS's 2011 error where a misplaced zero caused a $2.3 billion loss and the 2015 order placed by a NYSE trader that disrupted the market for several minutes. These errors involve human mistakes such as entering incorrect order sizes or prices, leading to significant market distortions. Flash crashes differ by typically resulting from automated algorithmic trading causing rapid, extreme market movements in seconds.

Causes Behind Flash Crash Events

Flash crash events are primarily caused by a combination of high-frequency trading algorithms rapidly executing large volumes of orders, leading to abrupt market liquidity depletion and sharp price swings. These crashes often stem from algorithmic trading errors, market fragmentation, and the sudden withdrawal of market makers during periods of extreme volatility. Understanding these causes highlights the critical role of automated trading systems and the interconnectedness of global markets in triggering flash crashes.

Human Error in Fat Finger Trades

Fat finger trades result from human error, typically involving the accidental input of incorrect order sizes or prices, causing unintended market disruptions. Unlike flash crashes driven by complex algorithmic trading and rapid market fluctuations, fat finger errors stem from manual mistakes that can lead to significant but isolated price anomalies. These human errors highlight the critical need for robust verification systems to prevent costly trading blunders.

Impact on Market Liquidity and Stability

Flash Crash events cause sudden, severe price drops triggered by automated trading errors or market anomalies, leading to abrupt liquidity evaporation and heightened market instability. Fat Finger errors involve human input mistakes, often resulting in large erroneous trades that disrupt order books and temporarily distort price signals, impacting market confidence. Both phenomena undermine market liquidity and stability, but Flash Crashes generally pose systemic risks due to their rapid, algorithm-driven nature.

Regulatory Responses to Trading Anomalies

Regulatory responses to trading anomalies like flash crashes and fat finger errors emphasize enhanced market surveillance and faster circuit breakers to prevent systemic risks. Authorities such as the SEC and CFTC have implemented stringent reporting requirements and established kill switch mechanisms to halt errant trades quickly. These measures aim to increase market transparency, protect investors, and reduce volatility caused by sudden, erroneous transactions.

Preventing Flash Crash and Fat Finger Occurrences

Implementing real-time monitoring systems and automated trading halts helps prevent flash crashes by detecting abnormal price movements and suspending trading to restore market stability. Enforcing strict order validation protocols, including maximum order size limits and pre-trade risk controls, reduces the risk of fat finger errors that result from human input mistakes. Continuous trader education and robust algorithm testing further enhance the prevention of unintended market disruptions in high-frequency and algorithmic trading environments.

Flash Crash vs Fat Finger: Lessons for Traders

Flash crashes highlight the critical importance of automated systems and market liquidity in avoiding rapid, extreme price swings, while fat finger errors emphasize human error risks in order entry accuracy. Traders must implement robust risk management strategies, including real-time monitoring and circuit breakers, to mitigate the consequences of both technological glitches and manual input mistakes. Understanding these phenomena enhances decision-making under volatile conditions and safeguards portfolio stability.

Important Terms

Liquidity Vacuum

Liquidity vacuum triggers flash crashes by causing sudden market order imbalances, whereas fat finger errors result from large, accidental trades that disrupt price levels.

Algorithmic Trading Error

Algorithmic trading errors, including those involving fat finger mistakes, significantly contributed to the 2010 Flash Crash by triggering rapid, erroneous sell orders that overwhelmed market liquidity.

Stop-Loss Cascade

A Stop-Loss Cascade during a Flash Crash occurs when automated sell orders triggered by rapid price declines amplify market volatility, whereas a Fat Finger error involves a manual input mistake causing unintended large trades disrupting prices.

Order Book Imbalance

Order book imbalance, characterized by disproportionate buy and sell orders, often triggers flash crashes by amplifying market volatility, whereas fat finger errors typically result from erroneous large trades causing sudden price disruptions.

Market Microstructure Failure

Market microstructure failure during the Flash Crash primarily stemmed from rapid algorithmic trading spikes and liquidity evaporation, contrasting with the Fat Finger error characterized by human input mistakes causing isolated price distortions.

High-Frequency Trading (HFT) Glitch

High-Frequency Trading (HFT) glitches contributed to the 2010 Flash Crash by amplifying rapid algorithmic sell orders, while Fat Finger errors typically involve manual input mistakes causing isolated trading anomalies.

Circuit Breaker Activation

Circuit breaker activation during a flash crash rapidly halts trading to prevent market collapse, whereas fat finger errors trigger brief, unintended price fluctuations without systemic circuit breaker intervention.

Erroneous Trade Cancellation

Erroneous trade cancellations frequently occur during flash crashes due to algorithmic errors, whereas fat finger errors typically involve manual input mistakes causing isolated mispriced trades.

Price Dislocation

Price dislocation during a Flash Crash often results from rapid, automated selling pressure, whereas a Fat Finger error causes abrupt, significant price changes due to human input mistakes.

Spoofing Incident

The Spoofing Incident during the Flash Crash involved manipulative large sell orders falsely placed and rapidly canceled to create artificial market volatility, distinct from a Fat Finger error caused by unintentional human input.

Flash Crash vs Fat Finger Infographic

moneydif.com

moneydif.com