Liquidity risk occurs when traders cannot quickly buy or sell assets without causing significant price changes, potentially leading to losses during times of market stress. Market risk involves the possibility of losses due to unfavorable price movements driven by factors such as economic changes, interest rates, or geopolitical events. Understanding the differences between liquidity risk and market risk is essential for effective risk management and portfolio optimization in trading.

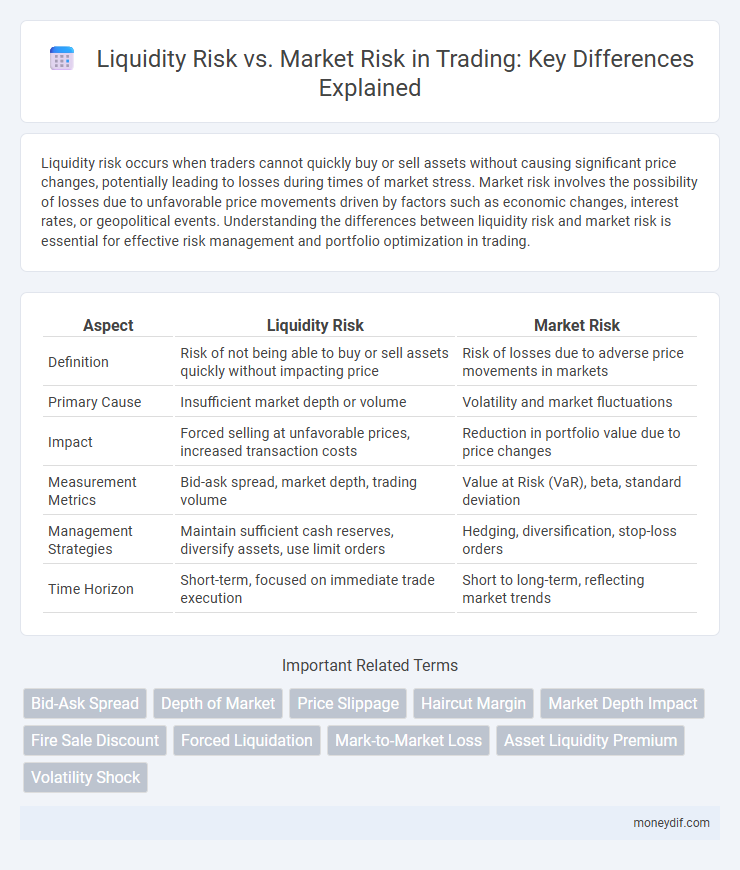

Table of Comparison

| Aspect | Liquidity Risk | Market Risk |

|---|---|---|

| Definition | Risk of not being able to buy or sell assets quickly without impacting price | Risk of losses due to adverse price movements in markets |

| Primary Cause | Insufficient market depth or volume | Volatility and market fluctuations |

| Impact | Forced selling at unfavorable prices, increased transaction costs | Reduction in portfolio value due to price changes |

| Measurement Metrics | Bid-ask spread, market depth, trading volume | Value at Risk (VaR), beta, standard deviation |

| Management Strategies | Maintain sufficient cash reserves, diversify assets, use limit orders | Hedging, diversification, stop-loss orders |

| Time Horizon | Short-term, focused on immediate trade execution | Short to long-term, reflecting market trends |

Defining Liquidity Risk in Trading

Liquidity risk in trading refers to the inability to buy or sell assets quickly without causing a significant impact on their price. This risk emerges when market participants face limited counterparty availability or insufficient market depth, leading to wider bid-ask spreads and potential losses. Understanding liquidity risk is essential for managing exposure during periods of market stress and ensuring efficient execution of large trades.

Understanding Market Risk Dynamics

Market risk involves potential losses due to adverse price movements in trading assets, directly impacting portfolio valuation and performance. Liquidity risk refers to the inability to execute trades without causing significant price disruption, often exacerbating market risk during volatile conditions. A deep understanding of market risk dynamics requires analyzing volatility patterns, bid-ask spreads, and order book depth to anticipate and mitigate potential losses effectively.

Key Differences: Liquidity Risk vs Market Risk

Liquidity risk refers to the potential inability to buy or sell assets quickly without causing significant price changes, impacting a trader's ability to execute orders effectively. Market risk involves the exposure to losses due to fluctuations in asset prices driven by market conditions, such as volatility, interest rates, and economic factors. While liquidity risk centers on transaction execution challenges, market risk pertains to changes in asset value, making risk management strategies essential to mitigate financial losses.

How Liquidity Risk Affects Asset Prices

Liquidity risk impacts asset prices by limiting the ease with which assets can be sold without causing significant price changes. When liquidity dries up, sellers may have to accept lower prices to execute trades quickly, leading to price discounts and increased volatility. This dynamic often widens bid-ask spreads and exacerbates market risk by amplifying price swings during periods of market stress.

Market Risk Drivers in Volatile Markets

Market risk drivers in volatile markets include rapid price fluctuations, unexpected macroeconomic events, and shifts in investor sentiment, which collectively increase the potential for substantial losses. High market volatility intensifies the sensitivity of asset prices to news and trading volumes, amplifying exposure to market risk. Traders must monitor volume spikes and volatility indices to anticipate and manage price risks effectively during turbulent periods.

Measuring Liquidity and Market Risks

Measuring liquidity risk involves assessing the ease with which assets can be converted to cash without significant price impact, often using metrics such as bid-ask spreads, market depth, and trading volume. Market risk measurement centers on quantifying potential losses due to market price fluctuations, employing tools like Value at Risk (VaR), stress testing, and scenario analysis. Both risk assessments rely on real-time data analytics and historical price volatility to inform trading strategies and risk management decisions.

Liquidity Crisis: Historical Examples

Liquidity crises, such as the 2008 Lehman Brothers collapse and the 1998 Long-Term Capital Management debacle, illustrate the devastating effects of liquidity risk when market participants cannot buy or sell assets without significant price impacts. These events underscore the importance of maintaining adequate cash reserves and stress-testing liquidity buffers to manage sudden market freezes. Effective liquidity risk management remains crucial in preventing systemic contagion during periods of extreme market volatility.

Mitigation Strategies for Liquidity Risk

Effective mitigation strategies for liquidity risk in trading involve maintaining adequate cash reserves and establishing access to diversified funding sources to ensure quick asset liquidation without significant price impact. Implementing real-time liquidity monitoring systems enhances traders' ability to anticipate and respond to market fluctuations. Stress testing under various market scenarios further prepares institutions to manage liquidity shortages during periods of market distress.

Managing Market Risk in Trading Portfolios

Managing market risk in trading portfolios involves continuously monitoring price volatility and asset correlations to predict potential losses and adjust positions accordingly. Employing risk metrics such as Value at Risk (VaR), stress testing, and scenario analysis helps identify vulnerabilities during market swings. Effective diversification across asset classes and timely execution of hedging strategies minimize exposure to adverse market movements while maintaining portfolio liquidity.

Balancing Liquidity and Market Risks in Trade Decisions

Balancing liquidity risk and market risk is critical in trading to ensure optimal trade execution and capital preservation. Traders must evaluate asset liquidity levels, bid-ask spreads, and market volatility to manage potential price slippage and order execution delays. Effective risk management involves diversifying portfolios and utilizing limit orders to mitigate adverse price movements while maintaining sufficient liquidity.

Important Terms

Bid-Ask Spread

The bid-ask spread represents the cost of liquidity risk, widening as market participants demand higher compensation for holding assets in less liquid markets. Market risk influences price volatility, while liquidity risk affects the ease and cost of trading, with wider spreads indicating increased uncertainty and reduced market depth.

Depth of Market

Depth of Market (DOM) reveals the volume of buy and sell orders at various price levels, directly impacting liquidity risk by indicating market participants' willingness to trade without significant price changes. Higher DOM reduces liquidity risk but may still expose traders to market risk from price volatility driven by macroeconomic factors or unexpected news events.

Price Slippage

Price slippage occurs when a trade executes at a different price than expected, often caused by low liquidity risk, where insufficient market depth leads to larger price impacts during order execution. Market risk, driven by volatile price fluctuations, can exacerbate slippage but primarily affects the overall asset value rather than the immediate execution price differences.

Haircut Margin

Haircut margin refers to the percentage reduction applied to the market value of collateral to mitigate credit exposure in financial transactions, playing a critical role in liquidity risk management by ensuring sufficient buffer against asset price volatility. Unlike market risk, which focuses on potential losses from market price fluctuations, haircut margin primarily addresses liquidity risk by preventing overvaluation of collateral and ensuring stable funding under stressed market conditions.

Market Depth Impact

Market depth significantly influences liquidity risk by determining the ability to execute large orders without substantial price changes, thereby mitigating potential losses from illiquid markets. Insufficient market depth intensifies market risk as price volatility increases when large trades cause sharp shifts in asset prices due to limited buy or sell orders.

Fire Sale Discount

A Fire Sale Discount occurs when assets are sold quickly at significantly reduced prices to address liquidity risk, reflecting the seller's urgent need for cash rather than market value. This discount often exceeds the impact of market risk, as forced liquidation under distressed conditions drives prices below fundamental levels.

Forced Liquidation

Forced liquidation occurs when an investor must sell assets rapidly, often at unfavorable prices, due to liquidity risk, which is the inability to meet short-term financial obligations without significant losses. This contrasts with market risk, where asset values fluctuate due to market conditions, but forced liquidation specifically exacerbates losses by limiting the time and price at which assets can be sold.

Mark-to-Market Loss

Mark-to-Market (MTM) loss occurs when the current market value of an asset declines below its recorded book value, directly impacting liquidity risk by forcing asset sales at unfavorable prices to meet cash flow needs. While market risk reflects the potential for asset price fluctuations, MTM loss specifically highlights the immediate liquidity challenges arising from these valuation changes, stressing the need for robust risk management strategies.

Asset Liquidity Premium

Asset liquidity premium quantifies the additional return investors demand for holding assets that cannot be quickly sold without significant price concessions, reflecting liquidity risk. This premium compensates for potential losses arising from delays or difficulties in converting assets to cash, distinguishing it from market risk which pertains to the overall price volatility of assets in the marketplace.

Volatility Shock

Volatility shock significantly amplifies liquidity risk by causing sudden drops in market depth and widening bid-ask spreads, which hinder the ability to execute trades without substantial price concessions. This shock also intensifies market risk as rapid and unpredictable price movements increase the potential for large losses in trading portfolios.

liquidity risk vs market risk Infographic

moneydif.com

moneydif.com