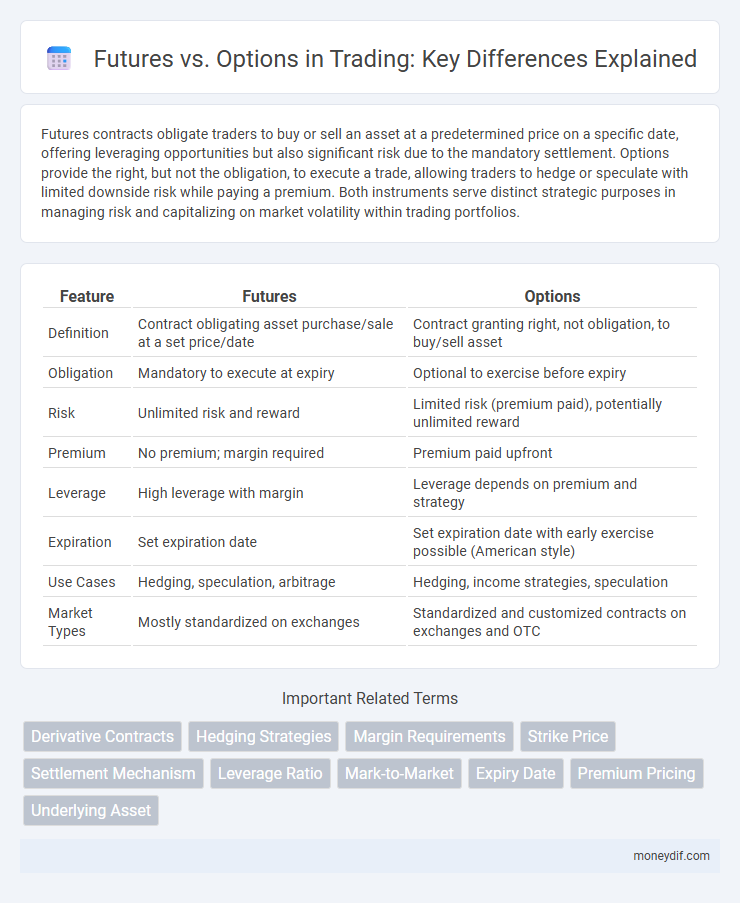

Futures contracts obligate traders to buy or sell an asset at a predetermined price on a specific date, offering leveraging opportunities but also significant risk due to the mandatory settlement. Options provide the right, but not the obligation, to execute a trade, allowing traders to hedge or speculate with limited downside risk while paying a premium. Both instruments serve distinct strategic purposes in managing risk and capitalizing on market volatility within trading portfolios.

Table of Comparison

| Feature | Futures | Options |

|---|---|---|

| Definition | Contract obligating asset purchase/sale at a set price/date | Contract granting right, not obligation, to buy/sell asset |

| Obligation | Mandatory to execute at expiry | Optional to exercise before expiry |

| Risk | Unlimited risk and reward | Limited risk (premium paid), potentially unlimited reward |

| Premium | No premium; margin required | Premium paid upfront |

| Leverage | High leverage with margin | Leverage depends on premium and strategy |

| Expiration | Set expiration date | Set expiration date with early exercise possible (American style) |

| Use Cases | Hedging, speculation, arbitrage | Hedging, income strategies, speculation |

| Market Types | Mostly standardized on exchanges | Standardized and customized contracts on exchanges and OTC |

Introduction to Futures and Options

Futures are standardized contracts obligating the buyer to purchase, or the seller to sell, an asset at a predetermined price and date, commonly used for commodities, indices, and currencies trading. Options provide the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price before or on a certain date, offering more flexibility and limited risk. Both instruments serve as essential tools for hedging risks and speculative strategies in financial markets.

Key Differences Between Futures and Options

Futures contracts obligate the buyer to purchase, and the seller to sell, an asset at a predetermined price on a specific date, resulting in a binding agreement with unlimited risk and reward potential. Options provide the buyer the right, but not the obligation, to buy or sell an asset at a set strike price before expiration, offering limited risk to the premium paid and asymmetric profit opportunities. The key differences include risk exposure, obligation, cost structure, and flexibility, with futures being more suited for hedging large, predictable exposures and options favored for strategic, leverage-driven positions.

How Futures Contracts Work

Futures contracts obligate traders to buy or sell an asset at a predetermined price on a specified future date, creating a binding agreement that standardizes the quantity and quality of the underlying asset. These contracts are traded on regulated exchanges, ensuring transparency, liquidity, and price discovery for commodities, currencies, and financial instruments. Margin requirements and daily settlement through mark-to-market mechanisms minimize counterparty risk and maintain market integrity in futures trading.

How Options Contracts Operate

Options contracts grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or on a specific expiration date. These contracts involve premiums paid upfront, allowing investors to limit risk while retaining profit potential based on market movements. Unlike futures, options offer asymmetric risk profiles, making them essential tools for hedging and speculative strategies in trading.

Pros and Cons of Futures Trading

Futures trading offers high leverage and standardized contracts, enabling traders to hedge risks or speculate with a clear understanding of potential gains and losses. The requirement for margin maintenance can amplify both profits and losses, leading to increased financial risk compared to other derivatives. Futures markets provide high liquidity and transparency but lack the flexibility of options contracts, which allow selective risk exposure through premium payments.

Pros and Cons of Options Trading

Options trading offers significant flexibility by allowing investors to hedge risk, speculate on market direction, and leverage positions with limited capital outlay. The primary advantage lies in the ability to control large asset positions with a relatively small premium, providing substantial profit potential while capping losses to the premium paid. However, the complexity of options strategies, time decay, and the risk of total premium loss if the option expires worthless present considerable challenges for inexperienced traders.

Risk Management in Futures vs Options

Futures contracts require a commitment to buy or sell an asset at a predetermined price, exposing traders to potentially unlimited risk if the market moves against their position. Options provide a risk management advantage by allowing traders to control the right, but not the obligation, to execute a trade, limiting losses to the premium paid. This fundamental difference makes options a more flexible tool for hedging and managing downside risk compared to the leveraged exposure inherent in futures trading.

Margin Requirements and Leverage Comparison

Futures contracts require traders to post an initial margin typically ranging from 5% to 15% of the contract's notional value, allowing for higher leverage compared to options. Options demand lower margin due to the premium paid upfront, but leverage varies based on the option's delta, time to expiration, and volatility. Traders seeking amplified exposure prefer futures for consistent margin and leverage, while options offer controlled risk with variable leverage linked to premium and underlying asset movements.

Ideal Strategies for Futures and Options Traders

Futures traders benefit from strategies like hedging and speculating on price movements due to the contract's obligation to buy or sell assets at a set price and date. Options traders leverage strategies such as covered calls, protective puts, and spreads to manage risk while capitalizing on market volatility with the flexibility to exercise or let the option expire. Understanding the differences in risk exposure, margin requirements, and payoff structures is crucial for selecting ideal strategies tailored to futures or options trading.

Choosing Between Futures and Options: Factors to Consider

Selecting between futures and options requires evaluating risk tolerance, capital availability, and market outlook. Futures contracts obligate the buyer to purchase assets at a set price by a specific date, offering high leverage but increased exposure to potential losses. Options provide the right, not the obligation, to buy or sell, allowing limited risk to the premium paid while enabling strategic flexibility in hedging or speculating.

Important Terms

Derivative Contracts

Derivative contracts such as futures and options are financial instruments that derive their value from underlying assets like stocks, commodities, or indices. Futures obligate the buyer to purchase and the seller to sell the asset at a predetermined price and date, offering high leverage and standardized terms, whereas options provide the right but not the obligation to buy (call) or sell (put) the asset, allowing for risk management with limited downside exposure.

Hedging Strategies

Hedging strategies using futures contracts involve locking in prices to mitigate the risk of adverse price movements, offering obligational commitments that ensure asset delivery or receipt at contract maturity. Options strategies provide asymmetric risk management by granting the right, but not the obligation, to buy or sell underlying assets, allowing investors to limit potential losses while retaining upside potential.

Margin Requirements

Margin requirements for futures contracts typically demand a fixed initial margin and maintenance margin due to their standardized obligations, whereas options require lower premiums upfront since buyers risk only the paid premium but sellers must meet margin calls reflecting potential unlimited losses. Futures margins are adjusted daily through mark-to-market processes, while options margins depend on factors like underlying asset volatility, time to expiration, and strike price proximity.

Strike Price

Strike price in options represents the predetermined price at which the underlying asset can be bought or sold, whereas futures contracts do not have a strike price but instead have a set price agreed upon at contract initiation. Options strike prices impact premium costs and exercise decisions, while futures prices fluctuate daily based on market conditions and margin requirements.

Settlement Mechanism

Settlement mechanism for futures involves daily marking to market and physical or cash delivery at contract expiration, ensuring real-time profit or loss realization. Options settlement depends on exercise style, with American options allowing early exercise and European options settled only at expiration, involving either physical delivery or cash settlement based on intrinsic value.

Leverage Ratio

The leverage ratio in futures contracts is typically higher compared to options, as futures require a margin that represents a fraction of the contract's total value, enabling greater exposure with less capital. Options offer built-in leverage through premium costs, but their leverage ratio varies based on strike price, volatility, and time to expiration, often resulting in lower direct leverage than futures.

Mark-to-Market

Mark-to-Market in futures involves daily settlement of gains and losses based on the closing market price, ensuring margin requirements are met and reducing credit risk; in contrast, options do not require daily settlements, with profits and losses realized only upon exercise or sale, reflecting different risk and liquidity profiles between these derivatives. Futures contracts are standardized with obligatory daily mark-to-market, while options provide asymmetric risk exposure and optional exercise, affecting how market participants manage and hedge positions.

Expiry Date

Expiry date in futures contracts marks the final trading day when the underlying asset must be delivered or settled, whereas in options, it signifies the deadline by which the option holder must exercise their right to buy or sell the underlying asset. The expiry date heavily impacts the time value and volatility of options premiums, while futures contracts typically require physical delivery or cash settlement upon expiry.

Premium Pricing

Premium pricing in futures contracts typically involves the difference between the spot price and the futures price, reflecting factors like storage costs and interest rates, whereas options pricing includes intrinsic and time value components driven by volatility, strike price, and time to expiration. Options premiums are often higher due to the added value of optionality, providing the right but not the obligation to buy or sell an underlying asset, unlike futures contracts which obligate the trade at maturity.

Underlying Asset

The underlying asset in futures contracts represents the specific commodity, currency, or financial instrument that must be delivered or settled at contract expiration, ensuring standardized, binding obligations. In options, the underlying asset is the security or commodity that gives the holder the right, but not the obligation, to buy or sell at a predetermined price before expiry, offering asymmetric risk exposure and strategic flexibility.

Futures vs Options Infographic

moneydif.com

moneydif.com