Hedging reduces risk by offsetting potential losses in trading positions, providing a safety net against market volatility. Leveraging amplifies potential returns by using borrowed capital but also increases exposure to losses and requires careful risk management. Understanding the balance between hedging and leveraging helps traders optimize their strategies for both protection and growth.

Table of Comparison

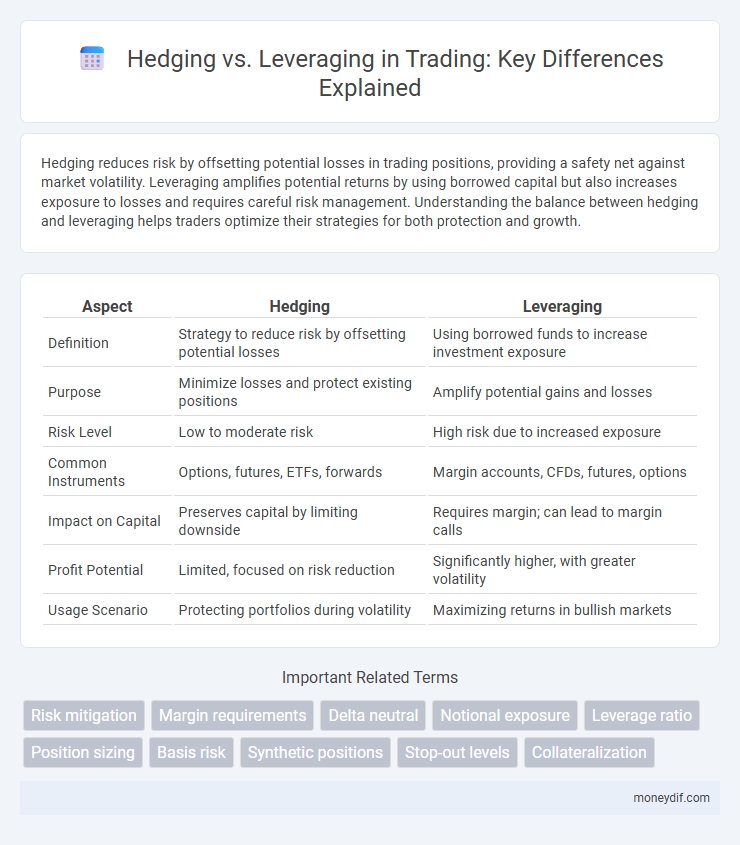

| Aspect | Hedging | Leveraging |

|---|---|---|

| Definition | Strategy to reduce risk by offsetting potential losses | Using borrowed funds to increase investment exposure |

| Purpose | Minimize losses and protect existing positions | Amplify potential gains and losses |

| Risk Level | Low to moderate risk | High risk due to increased exposure |

| Common Instruments | Options, futures, ETFs, forwards | Margin accounts, CFDs, futures, options |

| Impact on Capital | Preserves capital by limiting downside | Requires margin; can lead to margin calls |

| Profit Potential | Limited, focused on risk reduction | Significantly higher, with greater volatility |

| Usage Scenario | Protecting portfolios during volatility | Maximizing returns in bullish markets |

Understanding Hedging and Leveraging in Trading

Hedging in trading involves using financial instruments or strategies to reduce the risk of adverse price movements in assets, often through options, futures, or inverse ETFs. Leveraging amplifies potential returns by borrowing capital to increase the size of a position, but it also heightens the risk of significant losses. Effective trading strategies balance hedging to protect investments and leveraging to maximize gains, ensuring risk management aligns with market exposure.

Core Principles: Risk Management vs. Profit Maximization

Hedging in trading is centered on risk management, employing strategies like options and futures to protect investments from adverse market movements. Leveraging focuses on profit maximization by using borrowed capital to increase exposure and potential returns, though it amplifies both gains and losses. Understanding the core principles of hedging and leveraging enables traders to balance risk and reward effectively within their portfolios.

Key Differences Between Hedging and Leveraging

Hedging involves reducing risk by taking an offsetting position in related securities, aiming to protect investments from adverse market movements. Leveraging uses borrowed funds to amplify potential returns, thereby increasing both risk and reward exposure in trading activities. Key differences lie in their objectives: hedging prioritizes minimizing losses, while leveraging focuses on maximizing gains through increased capital deployment.

When to Use Hedging Strategies in Trading

Hedging strategies in trading are most effective during periods of high market volatility or economic uncertainty, as they help mitigate potential losses by offsetting risk exposure. Traders often use hedging to protect portfolio value when holding assets vulnerable to adverse price movements, such as commodities, currencies, or stocks in fluctuating markets. Employing hedging techniques like options, futures, or inverse ETFs can safeguard investments without sacrificing long-term growth opportunities.

Leveraging Techniques for Enhanced Returns

Leveraging techniques in trading involve using borrowed capital to increase the potential return on investment, allowing traders to control larger positions with a smaller initial outlay. Common leveraging tools include margin trading, options, and futures contracts, which amplify both gains and risks in volatile markets. Effective leverage management requires precise risk assessment and stop-loss strategies to maximize returns while minimizing potential losses.

Common Instruments Used for Hedging and Leveraging

Common instruments used for hedging include options, futures contracts, and forward contracts, which help traders mitigate market risks by locking in prices or providing downside protection. Leveraging often involves margin trading, contracts for difference (CFDs), and options to amplify exposure and potential returns with borrowed capital. Both strategies utilize derivatives, but hedging prioritizes risk reduction while leveraging focuses on increasing market exposure.

Pros and Cons: Hedging vs. Leveraging

Hedging minimizes risk by offsetting potential losses through protective positions, offering stability during market volatility but often limiting profit potential and incurring additional costs. Leveraging amplifies exposure to market movements, enabling higher returns from smaller capital but significantly increasing the risk of substantial losses and margin calls. Traders must balance the safety of hedging against the aggressive profit opportunities of leveraging to align with their risk tolerance and trading objectives.

Impact of Market Volatility on Hedging and Leveraging

Market volatility significantly influences the effectiveness of hedging and leveraging strategies, as rapid price fluctuations can increase the cost of hedging while amplifying both potential gains and losses in leveraged positions. Hedging minimizes downside risk by using derivatives like options or futures to offset market movements, but extreme volatility can widen spreads and reduce hedge efficiency. Leveraging magnifies exposure to market swings, making volatile conditions riskier by increasing the chance of margin calls and substantial financial loss.

Real-World Examples: Hedging vs. Leveraging in Action

Hedging in trading involves using options or futures contracts to minimize potential losses, such as airlines purchasing fuel futures to lock in prices and reduce exposure to rising costs. Leveraging amplifies potential returns by borrowing capital, commonly seen in forex trading where traders control large currency positions with smaller amounts of margin. Real-world cases include institutional investors employing hedge strategies to protect portfolios during market downturns, while retail traders leverage positions to maximize short-term gains, each carrying distinct risk profiles.

Best Practices for Balancing Hedging and Leveraging

Balancing hedging and leveraging requires maintaining a diversified portfolio to minimize risk while maximizing potential returns, with hedge ratios typically set between 20% to 50% depending on market volatility. Traders should employ stop-loss orders and position sizing strategies to limit downside exposure when leveraging, ensuring that leverage levels do not exceed 2:1 in volatile markets to avoid margin calls. Utilizing real-time risk analytics and stress testing helps optimize the interplay between hedging instruments like options or futures and leveraged positions for sustainable trading performance.

Important Terms

Risk mitigation

Risk mitigation strategies include hedging, which involves using financial instruments like options and futures to offset potential losses, and leveraging, which amplifies exposure by borrowing capital to increase investment size; hedging reduces risk while leveraging can both magnify gains and exacerbate losses. Effective risk management balances hedging techniques to protect assets and controlled leveraging to optimize returns without excessive risk exposure.

Margin requirements

Margin requirements dictate the minimum capital investors must hold to open and maintain positions, playing a critical role in both hedging and leveraging strategies; in hedging, margins ensure sufficient collateral to offset potential losses, while in leveraging, they amplify exposure to assets, increasing both potential returns and risks. Regulatory bodies set margin thresholds to balance market stability and investor protection, with varying levels depending on the asset class, liquidity, and volatility involved in these financial tactics.

Delta neutral

Delta neutral strategies aim to hedge portfolio risk by balancing long and short positions to maintain a net delta close to zero, minimizing exposure to price movements in the underlying asset. This approach contrasts with leveraging, which amplifies potential returns and risks by using borrowed capital or derivatives to increase market exposure.

Notional exposure

Notional exposure represents the total value of a position in derivatives or financial contracts, serving as a benchmark for assessing risk in hedging and leveraging activities. Effective hedging strategies use notional exposure to compensate for potential losses, while leveraging amplifies returns by increasing exposure beyond actual capital through borrowed funds.

Leverage ratio

The leverage ratio measures the proportion of a company's debt relative to its equity, playing a crucial role in assessing financial risk in both hedging and leveraging strategies. Effective hedging minimizes potential losses by balancing asset exposure, while leveraging amplifies returns by increasing debt, making the leverage ratio a key metric for risk management and capital efficiency.

Position sizing

Position sizing directly impacts risk management by determining the number of units or contracts to take in a trade, balancing potential gains against exposure. In hedging, smaller position sizes limit downside risk and protect existing assets, while leveraging involves larger position sizes to amplify returns, increasing both profit potential and risk.

Basis risk

Basis risk arises when the price of a hedging instrument does not move perfectly in sync with the underlying asset, leading to imperfect risk mitigation and potential unexpected losses. Leveraging amplifies exposure to basis risk by increasing the size of positions, thereby magnifying both gains and losses related to mismatches between hedge and asset price movements.

Synthetic positions

Synthetic positions replicate the payoff of an asset using options or derivatives, allowing traders to hedge risk by mimicking ownership without holding the actual asset, while simultaneously enabling leverage through controlled exposure to price movements. These strategies optimize portfolio risk management by balancing potential gains and losses without requiring full upfront capital investment associated with the underlying asset.

Stop-out levels

Stop-out levels represent the critical margin threshold at which a broker automatically closes losing positions to prevent further losses, directly impacting both hedging and leveraging strategies. Managing stop-out levels effectively is essential for traders using high leverage, as it determines the risk tolerance and capital preservation while hedging against market volatility.

Collateralization

Collateralization involves pledging assets to secure a loan or position, reducing counterparty risk in hedging strategies by ensuring coverage against adverse price movements. In leveraging, collateralization enables borrowing additional capital to amplify investment exposure, increasing potential returns while also elevating default risk.

hedging vs leveraging Infographic

moneydif.com

moneydif.com