A wash sale occurs when an investor sells a security at a loss and repurchases a substantially identical security within 30 days, disallowing the loss for tax deduction purposes. In contrast, a round trip in trading refers to the act of buying and selling the same security or asset within a short time frame, often to generate commissions or manipulate trading volumes. Understanding the difference between wash sales and round trips is crucial for compliance with tax regulations and avoiding potential penalties in trading strategies.

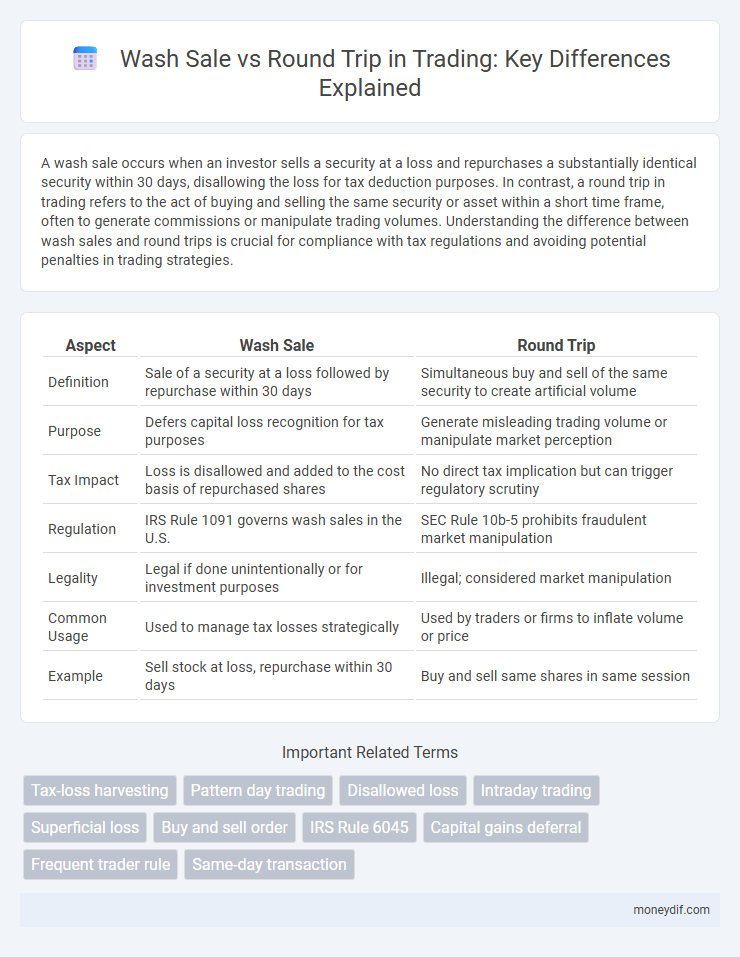

Table of Comparison

| Aspect | Wash Sale | Round Trip |

|---|---|---|

| Definition | Sale of a security at a loss followed by repurchase within 30 days | Simultaneous buy and sell of the same security to create artificial volume |

| Purpose | Defers capital loss recognition for tax purposes | Generate misleading trading volume or manipulate market perception |

| Tax Impact | Loss is disallowed and added to the cost basis of repurchased shares | No direct tax implication but can trigger regulatory scrutiny |

| Regulation | IRS Rule 1091 governs wash sales in the U.S. | SEC Rule 10b-5 prohibits fraudulent market manipulation |

| Legality | Legal if done unintentionally or for investment purposes | Illegal; considered market manipulation |

| Common Usage | Used to manage tax losses strategically | Used by traders or firms to inflate volume or price |

| Example | Sell stock at loss, repurchase within 30 days | Buy and sell same shares in same session |

Understanding Wash Sales in Trading

Wash sales occur when an investor sells a security at a loss and repurchases the same or substantially identical security within 30 days before or after the sale, disallowing the loss for tax purposes. Round trip trades, involving simultaneous buy and sell transactions, differ as they may be used to inflate trading volume or manipulate market perception rather than trigger tax-loss rules. Understanding the distinction between wash sales and round trip transactions is critical for compliance with IRS regulations and effective tax planning in trading activities.

What Constitutes a Round Trip Trade?

A round trip trade occurs when an investor buys and then sells the same security or an equivalent within a short time frame, effectively completing a full cycle of position entry and exit. This type of trade is often scrutinized for its implications on tax reporting and transaction costs, differing from wash sales which specifically involve losses on a security sold and repurchased within 30 days. Understanding the distinction is critical for traders aiming to optimize tax strategies and comply with regulatory guidelines.

Key Differences: Wash Sale vs Round Trip

A wash sale occurs when a trader sells a security at a loss and repurchases a substantially identical security within 30 days, triggering tax disallowance of the loss. A round trip involves the buying and selling of the same asset or security within a short period, often for generating commissions or manipulating market activity, without tax implications like wash sales. Key differences include tax treatment, intent, and regulatory focus, with wash sales primarily scrutinized for tax loss harvesting, while round trips are monitored for market manipulation risks.

Tax Implications of Wash Sales

Wash sales trigger the disallowance of tax deductions on losses if the same or substantially identical security is repurchased within 30 days before or after the sale, causing deferral of loss recognition. In contrast, round trip trades generally involve buying and selling the same security without the same strict tax disallowance rules, but may raise questions about substance and intent with the IRS. Investors must carefully track wash sale rules to avoid unexpected tax liabilities and ensure accurate cost basis adjustments.

Round Trip Trades: Regulatory Considerations

Round trip trades involve buying and selling the same security within a short timeframe, and regulatory bodies closely monitor these transactions to prevent market manipulation and ensure transparency. Unlike wash sales, which primarily affect tax loss harvesting by disallowing losses on repurchased securities within 30 days, round trip trades can trigger scrutiny under rules related to market abuse and trading compliance. Traders must document these trades carefully to avoid violations of SEC regulations and potential penalties.

Common Strategies Involving Wash Sales

Common strategies involving wash sales often include selling a security at a loss to realize a tax benefit and quickly repurchasing the same or substantially identical stock to maintain market position. Traders may execute these transactions within the 30-day period before or after the sale, which triggers the wash sale rule disallowing the loss deduction for tax purposes. Understanding the distinction between wash sales and round trip trades is crucial, as round trip trades involve buying and selling the same security in quick succession for profit, without tax loss considerations.

Risks Associated with Round Trip Trading

Round trip trading involves executing offsetting buy and sell transactions that can artificially inflate trading volume and manipulate market perception, posing significant regulatory and financial risks. This practice may attract scrutiny from the SEC due to its potential to distort true market activity, leading to penalties or suspensions. Traders engaging in round trips also face increased transaction costs and potential tax complications, which can erode overall profitability.

How to Avoid Wash Sale Violations

To avoid wash sale violations, traders must refrain from repurchasing the same or substantially identical securities within 30 days before or after selling them at a loss. Maintaining detailed transaction records and using tax software can help monitor holding periods and identify potential wash sales. Employing tax-loss harvesting strategies and staggering trades across different accounts or securities reduces the risk of triggering wash sale rules.

Reporting Requirements: Wash Sale and Round Trip

Wash sale reporting requires investors to identify and disclose transactions where a security is sold at a loss and repurchased within 30 days, triggering adjustments to the cost basis to prevent tax loss harvesting. Round trip transactions mandate detailed reporting of buy and sell orders executed in a short span to detect potential market manipulation or wash trading schemes. Accurate reporting of both wash sales and round trips is critical for regulatory compliance and maintaining transparent trading records.

Best Practices for Traders to Stay Compliant

Traders should meticulously track trade dates and securities to differentiate wash sales--disallowed losses on repurchases within 30 days--from round trips, which involve buying and selling the same security but do not trigger wash sale rules. Employing robust tax software and maintaining detailed transaction logs can prevent inadvertent wash sales, ensuring accurate tax reporting and compliance with IRS regulations. Consulting with tax professionals and adhering to SEC guidelines helps traders implement best practices, minimizing audit risks and optimizing tax outcomes.

Important Terms

Tax-loss harvesting

Tax-loss harvesting enables investors to offset capital gains by selling securities at a loss; however, wash sale rules prohibit claiming a loss if a substantially identical security is repurchased within 30 days before or after the sale. Round trip transactions involve selling and rebuying the same security within this period, triggering the wash sale rule and disallowing the tax deduction.

Pattern day trading

Pattern day trading involves executing four or more day trades within five business days, triggering strict regulatory requirements and increased margin rules under FINRA. Wash sale rules disallow claiming a loss for tax purposes if a substantially identical security is repurchased within 30 days, whereas round trip trades refer to the complete buying and selling cycle, potentially impacting both tax treatment and pattern day trader status.

Disallowed loss

Disallowed loss occurs in wash sales when a security is sold at a loss and repurchased within 30 days, preventing the immediate tax deduction of the loss; round-trip transactions involve selling and repurchasing the same or substantially identical securities, often to realize tax benefits, but can trigger wash sale rules that disallow losses. Understanding IRS wash sale regulations is critical for investors to avoid disallowed losses while managing round-trip trades for tax optimization.

Intraday trading

Intraday trading involves executing buy and sell orders within the same trading day, which does not trigger wash sale rules since no positions are held overnight, avoiding disallowed loss recognition. Round trip transactions, where a trader enters and exits the same security within a short period, are common in intraday trading but must be monitored carefully to prevent violating brokerage policies or incurring excessive transaction costs.

Superficial loss

Superficial loss occurs when a security sold at a loss is repurchased within 30 days, triggering wash sale rules that defer the recognition of the loss for tax purposes, whereas round trip refers to buying and selling the same asset or security in a brief period, which may not necessarily trigger superficial loss but can impact transaction costs and market timing strategies. Properly distinguishing between wash sale-induced superficial loss and round trip transactions is crucial for accurate capital loss reporting and tax compliance.

Buy and sell order

Buy and sell orders executed within a short timeframe can trigger wash sale rules, disallowing the deduction of losses for tax purposes if the same or substantially identical security is repurchased within 30 days. A round trip involves completing a buy and sell transaction consecutively, often raising scrutiny for wash sale violations when the securities are identical or substantially similar.

IRS Rule 6045

IRS Rule 6045 requires brokers to report detailed information on securities sales, including dates and prices, enabling enforcement of wash sale rules that disallow losses on repurchases of substantially identical securities within 30 days. Round trip transactions involve selling and repurchasing the same security within a short period, triggering wash sale disallowance and necessitating adjusted cost basis reporting under Rule 6045.

Capital gains deferral

Capital gains deferral strategies involving wash sales require recognition of the loss disallowed when substantially identical securities are repurchased within 30 days, preventing immediate tax benefits but enabling potential cost basis adjustments for future gains. Round trip transactions can create artificial gains or losses without economic substance, often scrutinized by tax authorities, thus proper understanding and compliance are critical to ensure legitimate capital gains deferral.

Frequent trader rule

The Frequent Trader Rule requires investors to monitor consecutive trades closely to avoid triggering wash sale losses, particularly when securities are sold at a loss and repurchased within 30 days, which can defer the recognition of the loss for tax purposes. Round trip trades, involving the simultaneous buying and selling of the same security, may also complicate tax reporting under this rule by potentially reclassifying losses or gains based on trade timing and sequence.

Same-day transaction

Same-day transactions that involve selling and repurchasing the same security can trigger wash sale rules, where losses are disallowed if a substantially identical stock is bought within 30 days, impacting tax deductions. Round trip trades, consisting of a buy and sell of the same security on the same day, may not necessarily cause wash sales but require careful tracking to avoid misclassification and ensure accurate tax reporting.

wash sale vs round trip Infographic

moneydif.com

moneydif.com