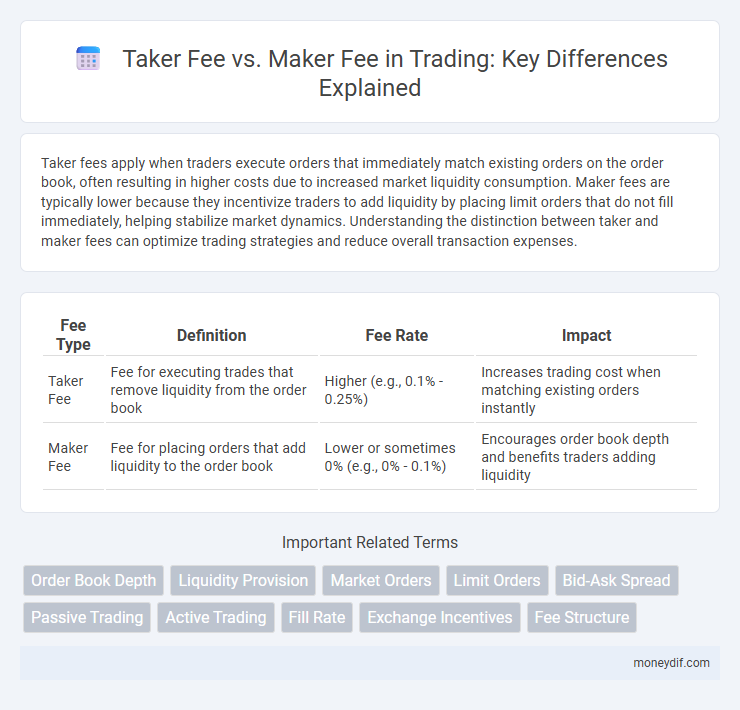

Taker fees apply when traders execute orders that immediately match existing orders on the order book, often resulting in higher costs due to increased market liquidity consumption. Maker fees are typically lower because they incentivize traders to add liquidity by placing limit orders that do not fill immediately, helping stabilize market dynamics. Understanding the distinction between taker and maker fees can optimize trading strategies and reduce overall transaction expenses.

Table of Comparison

| Fee Type | Definition | Fee Rate | Impact |

|---|---|---|---|

| Taker Fee | Fee for executing trades that remove liquidity from the order book | Higher (e.g., 0.1% - 0.25%) | Increases trading cost when matching existing orders instantly |

| Maker Fee | Fee for placing orders that add liquidity to the order book | Lower or sometimes 0% (e.g., 0% - 0.1%) | Encourages order book depth and benefits traders adding liquidity |

Understanding Taker Fees and Maker Fees in Trading

Taker fees apply when a trader fills an existing order from the order book, removing liquidity, while maker fees are charged when placing limit orders that add liquidity. Taker fees typically incur higher charges compared to maker fees, incentivizing traders to provide liquidity to the market. Understanding the distinction helps optimize trading costs on cryptocurrency and stock exchanges, improving overall strategy efficiency.

The Role of Liquidity: Makers vs Takers

Liquidity plays a crucial role in trading by distinguishing makers and takers based on their contribution to the market's order book. Makers add liquidity by placing limit orders that provide available shares or contracts, often benefiting from lower or zero maker fees as incentive. Takers consume liquidity by executing market orders against existing limit orders, typically incurring higher taker fees because their trades reduce available market depth.

How Taker Fees and Maker Fees Impact Your Trading Costs

Taker fees and maker fees directly influence overall trading costs by determining the charges applied based on order types. Taker fees are typically higher as they apply to market orders that execute immediately, reducing liquidity on the exchange. Maker fees are lower because they incentivize placing limit orders that add liquidity, ultimately affecting profitability and trading strategy efficiency.

Comparing Fee Structures Across Top Crypto Exchanges

Taker fees generally cost more than maker fees on most major crypto exchanges like Binance, Coinbase Pro, and Kraken, reflecting the higher demand for liquidity consumption. Maker fees often incentivize traders to provide liquidity by placing limit orders, with Binance offering as low as 0.015% compared to its 0.04% taker fee, while Coinbase Pro charges up to 0.50% for takers and as low as 0.00% for makers. Comparing fee structures reveals that active traders can significantly reduce costs by using maker orders, especially on platforms with tiered fee models based on 30-day trading volume.

Which Traders Benefit More From Maker Fees?

Traders who provide liquidity by placing limit orders benefit more from maker fees since these fees are typically lower or even offer rebates compared to taker fees. Market makers enhance order book depth and reduce spreads, enabling cost-efficient trading strategies like scalping and arbitrage. High-frequency traders and those executing large volume trades gain significant savings by being categorized as makers rather than takers.

Why Taker Fees are Higher: The Exchange Perspective

Taker fees are higher because they remove liquidity from the order book, increasing market volatility and operational risk for exchanges. Exchanges rely on maker orders to provide depth and stability, so they incentivize liquidity provision with lower fees. These fee structures balance order flow, ensuring efficient markets and minimizing transaction latency.

Strategies to Minimize Trading Fees

Optimizing trading strategies to minimize taker fees involves placing limit orders to become a market maker, thereby paying lower maker fees compared to taker fees applied on market orders. Employing algorithms that strategically time order placements can increase the likelihood of filling orders as makers, which reduces overall trading costs. Utilizing exchanges with tiered fee structures based on monthly trading volume further decreases taker fees and maximizes fee rebates for high-frequency traders.

Maker-Taker Models: Pros and Cons

Maker-taker models distinguish fees based on order types, where makers add liquidity with limit orders and takers remove liquidity via market orders. Maker fees are typically lower or even negative to incentivize providing liquidity, enhancing market depth and reducing spreads, while taker fees are higher to reflect the immediate execution cost. However, this model can encourage order book manipulation and increased costs for aggressive traders, potentially impacting market fairness and price stability.

Real-World Scenarios: Calculating Taker and Maker Fees

Taker fees apply when trades execute immediately against existing orders, typical in high-frequency trading where liquidity is consumed, often ranging from 0.05% to 0.1% per trade on major exchanges like Binance and Coinbase Pro. Maker fees are charged when placing limit orders that add liquidity to the order book, usually lower at 0.01%-0.05%, benefiting traders who provide market depth and reduce overall transaction costs. Calculating these fees in real-world scenarios requires understanding order types, trade volume, and exchange fee schedules to optimize costs and improve trading strategy profitability.

Choosing the Right Exchange Based on Fee Types

Selecting the right cryptocurrency exchange depends heavily on understanding taker fees versus maker fees, where taker fees are charged for orders that immediately match existing orders, while maker fees apply to orders that add liquidity to the market. Traders seeking cost efficiency should analyze their trading style: high-frequency or market orders may result in higher taker fees, whereas placing limit orders that create liquidity often benefits from lower maker fees. Evaluating exchanges with competitive maker fees for liquidity providers or balanced fee structures tailored to specific trading strategies optimizes overall transaction costs and trading profitability.

Important Terms

Order Book Depth

Order book depth directly impacts the taker fee since deeper liquidity allows takers to execute large trades without significant price slippage, often resulting in higher fees due to immediate order fulfillment. Maker fees are usually lower or incentivized as providing liquidity by adding orders to the order book increases market depth and benefits overall trading efficiency.

Liquidity Provision

Liquidity provision incentivizes market makers by offering lower maker fees compared to higher taker fees, encouraging order book depth and reducing bid-ask spreads. This fee structure optimizes trading efficiency and market stability by rewarding participants who add liquidity rather than removing it.

Market Orders

Market orders execute immediately at the best available price, incurring taker fees since they remove liquidity from the order book. Maker fees apply to limit orders that add liquidity, often resulting in lower fees as they provide market depth without immediate execution.

Limit Orders

Limit orders add liquidity to the market by sitting on the order book until matched, qualifying for lower maker fees that incentivize this passive trading behavior. Market takers who execute against existing orders remove liquidity instantly and incur higher taker fees reflecting the cost of immediate execution.

Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is asking (ask), directly impacting trading costs for takers and makers. Taker fees are typically higher as takers execute trades immediately against the existing order book, consuming liquidity and effectively paying the spread, while maker fees are lower or even negative to incentivize liquidity provision by placing limit orders within the spread.

Passive Trading

Passive trading typically involves placing limit orders that add liquidity to the market, resulting in lower maker fees compared to the higher taker fees charged when orders immediately execute against existing liquidity. Traders who use passive strategies benefit from reduced transaction costs due to these discounted maker fees, which incentivize market depth and price stability.

Active Trading

Active trading involves frequent buying and selling of financial instruments where taker fees are charged for market orders that remove liquidity, while maker fees apply to limit orders that add liquidity to the order book. Traders optimizing cost efficiency often prefer maker fees due to their lower rates compared to taker fees, enhancing profitability in high-frequency trading strategies.

Fill Rate

Fill rate directly impacts trading costs, as taker fees generally incur higher charges compared to maker fees due to immediate order execution, encouraging traders to prefer limit orders for cost efficiency. Optimizing order placement to leverage lower maker fees can improve fill rates while minimizing overall trading expenses on cryptocurrency exchanges.

Exchange Incentives

Exchange incentives often differentiate between taker fees and maker fees to encourage liquidity and trading volume, typically offering lower or zero maker fees for market makers who add liquidity. Taker fees, charged to traders who remove liquidity by placing market orders, are generally higher to balance incentives and optimize exchange profitability.

Fee Structure

Maker fees are typically lower than taker fees because makers add liquidity to the market by placing limit orders, while takers remove liquidity by executing market orders. Exchanges incentivize makers with reduced fees to encourage more order book depth and smoother trading experiences.

taker fee vs maker fee Infographic

moneydif.com

moneydif.com