A pullback refers to a temporary price decline within an overall uptrend, signaling a brief pause before the trend continues. Retracement, however, indicates a more significant reversal against the prevailing trend but does not signal a trend change. Understanding the difference between pullbacks and retracements helps traders identify optimal entry points and manage risk effectively.

Table of Comparison

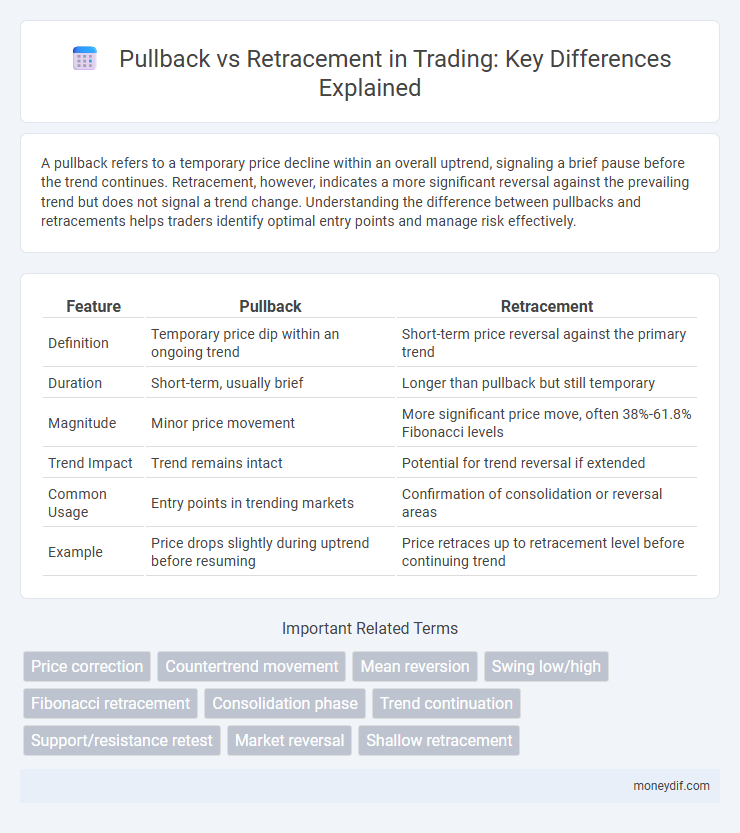

| Feature | Pullback | Retracement |

|---|---|---|

| Definition | Temporary price dip within an ongoing trend | Short-term price reversal against the primary trend |

| Duration | Short-term, usually brief | Longer than pullback but still temporary |

| Magnitude | Minor price movement | More significant price move, often 38%-61.8% Fibonacci levels |

| Trend Impact | Trend remains intact | Potential for trend reversal if extended |

| Common Usage | Entry points in trending markets | Confirmation of consolidation or reversal areas |

| Example | Price drops slightly during uptrend before resuming | Price retraces up to retracement level before continuing trend |

Pullback vs Retracement: Key Differences Explained

Pullbacks and retracements both represent temporary price movements against the prevailing trend in trading but differ in scale and context. A pullback is a short-term dip within an existing uptrend or downtrend, commonly lasting a few days to weeks, while a retracement refers to larger, more significant reversals that correct a prior trend, often analyzed using Fibonacci levels to identify support or resistance zones. Understanding these key differences helps traders discern market strength and optimize entry or exit points effectively.

Understanding Pullbacks in Trading

Pullbacks in trading refer to temporary price declines within an ongoing uptrend, allowing traders to enter positions at reduced prices. Unlike retracements, which often indicate a more significant reversal or correction, pullbacks are shorter and less severe price dips that maintain the overall bullish momentum. Recognizing pullbacks involves analyzing volume and support levels to confirm the continuation of the primary trend.

What is a Retracement?

A retracement is a temporary reversal in the price movement of a financial asset within an overall trend, often identified by a partial price pullback before the trend resumes. It typically indicates a short-term pause or correction in the market, where prices retrace a portion of the previous move without signaling a complete trend reversal. Traders use retracement levels, such as Fibonacci retracements, to identify potential entry points or support and resistance zones during these temporary reversals.

Identifying Pullbacks on Price Charts

Pullbacks on price charts represent temporary reversals in a prevailing trend, where prices move against the dominant direction before resuming it, often distinguishable by lower volume compared to trend moves. Identifying pullbacks involves analyzing support levels, trendlines, and moving averages to confirm a minor pause rather than a trend reversal. Recognizing these patterns aids traders in timing entries during uptrends or downtrends, optimizing risk-reward ratios in market positions.

Spotting Retracements During Trends

Spotting retracements during trends involves identifying temporary price reversals within a prevailing market direction, usually characterized by a minor price dip in an uptrend or a brief rally in a downtrend. Traders use technical indicators like Fibonacci retracement levels, moving averages, and volume analysis to distinguish retracements from broader trend reversals. Recognizing retracements allows traders to enter positions at better prices, improving risk management and maximizing profit potential in trending markets.

Common Causes of Pullbacks and Retracements

Pullbacks and retracements commonly occur due to profit-taking by traders, market sentiment shifts, and reaction to key technical levels such as support and resistance. Economic news releases and unexpected geopolitical events also trigger temporary price reversals within prevailing trends. Understanding these causes helps traders identify entry points and manage risk during trend continuations.

Pullback vs Retracement: Impact on Trade Entries

Pullbacks represent temporary price reversals within a strong overall trend, often providing traders with opportunities for optimal trade entries by confirming trend continuation. Retracements, on the other hand, indicate deeper price corrections that may signal potential trend reversals or consolidation, requiring traders to exercise caution before entering positions. Understanding the distinction between pullbacks and retracements helps improve trade timing and risk management by aligning entries with genuine momentum shifts.

Confirmation Tools for Pullbacks and Retracements

Confirmation tools for pullbacks and retracements include volume analysis, moving averages, and Fibonacci levels, which help traders validate the strength and potential reversal points of price corrections. Price action signals such as candlestick patterns and support-resistance zones provide visual confirmation of whether a price move is a temporary retracement or a deeper pullback. Utilizing these tools enables more accurate entry and exit decisions by distinguishing between short-term fluctuations and trend-continuing adjustments.

Trading Strategies: Pullback vs Retracement

Pullback and retracement are critical concepts in trading strategies, where a pullback refers to a temporary dip against the prevailing strong trend, while a retracement implies a deeper and more prolonged correction within a trend. Traders often use pullbacks for entry points, relying on indicators like Fibonacci levels, moving averages, or RSI to time their trades accurately. Effective differentiation between a pullback and a retracement enables traders to optimize position sizing, manage risk, and set stop-loss orders strategically during trend continuation or reversal setups.

Avoiding Common Mistakes with Pullbacks and Retracements

Misidentifying pullbacks as retracements often leads traders to enter or exit positions prematurely, causing missed profit opportunities or unnecessary losses. Distinguishing a pullback as a temporary price dip within a strong trend and a retracement as a deeper, corrective move to key Fibonacci levels enhances trade timing and risk management. Using volume analysis and trend confirmation indicators can help avoid common mistakes and improve accuracy in recognizing valid pullbacks versus retracements.

Important Terms

Price correction

Price correction refers to a temporary decline in an asset's price after a significant uptrend, typically ranging from 10% to 20%, distinguishing it from a pullback, which is a shorter, less severe price reversal within an ongoing trend. A retracement represents a minor, brief reversal in price movement, often viewed as a natural market fluctuation rather than a complete trend reversal, making it crucial for traders to differentiate between these patterns for effective entry and exit strategies.

Countertrend movement

Countertrend movement involves price action temporarily moving against the prevailing trend, often identified as pullbacks or retracements depending on duration and depth. Pullbacks are short-term reversals within a strong trend, while retracements indicate more extended corrections that can signal potential trend reversals or continuation points.

Mean reversion

Mean reversion in trading refers to the tendency of asset prices to return to their historical average after deviating significantly. Pullbacks represent short-term price declines within an overall uptrend, often seen as opportunities to buy before mean reversion pushes prices back up, while retracements indicate deeper price corrections that test support levels but still align with the ongoing trend.

Swing low/high

Swing lows and swing highs represent key turning points on a price chart, where a pullback is a temporary price movement against the prevailing trend within the swing, whereas a retracement denotes a deeper corrective movement often targeting Fibonacci levels before the trend resumes. Traders analyze the depth and duration of pullbacks and retracements relative to previous swing highs and lows to identify potential entry points and trend continuation signals.

Fibonacci retracement

Fibonacci retracement levels identify potential support and resistance zones during price pullbacks within an overall trend, helping traders distinguish between minor corrections and deeper retracements. Pullbacks are short-term pauses in price movement often bouncing off Fibonacci levels, while retracements represent more significant reversals approaching key Fibonacci ratios like 38.2%, 50%, or 61.8%.

Consolidation phase

The consolidation phase in trading represents a period of price stabilization following a trend, often characterized by sideways movement and reduced volatility. In this context, a pullback signifies a temporary reversal against the prevailing trend within this phase, while a retracement refers to a more significant price correction that tests key support or resistance levels before the trend resumes.

Trend continuation

Trend continuation often occurs after a pullback, where price temporarily reverses against the prevailing trend before resuming its direction, while a retracement represents a more substantial correction that may signal a potential trend reversal. Traders use Fibonacci levels and moving averages to differentiate between pullbacks and retracements, enabling better entry points for trend continuation strategies.

Support/resistance retest

Support and resistance retests occur when price revisits a previously broken level to confirm it as a new support or resistance, often following a pullback, which is a temporary price reversal within a prevailing trend. Retracement refers to a more significant price correction that partially reverses the previous trend, providing clearer retest zones for support and resistance levels.

Market reversal

Market reversal signals a major shift in price direction, often following a pullback, which is a temporary price movement against the prevailing trend. Retracement refers to a short-term price correction within the larger trend, and distinguishing it from a reversal is crucial for traders to avoid premature exit or entry decisions.

Shallow retracement

Shallow retracement refers to a minor price pullback within a prevailing trend, typically retracing less than 38.2% of the previous move according to Fibonacci levels, indicating a strong continuation potential. Unlike deeper pullbacks that may signal trend reversals, shallow retracements are viewed as healthy corrections that provide entry points without undermining the overall trend momentum.

pullback vs retracement Infographic

moneydif.com

moneydif.com