Order book analysis provides a snapshot of current buy and sell orders, revealing market depth and potential support or resistance levels. Tape reading complements this by tracking real-time transaction flow, offering insights into the aggressiveness of buyers and sellers. Combining both techniques enables traders to anticipate short-term price movements with greater accuracy.

Table of Comparison

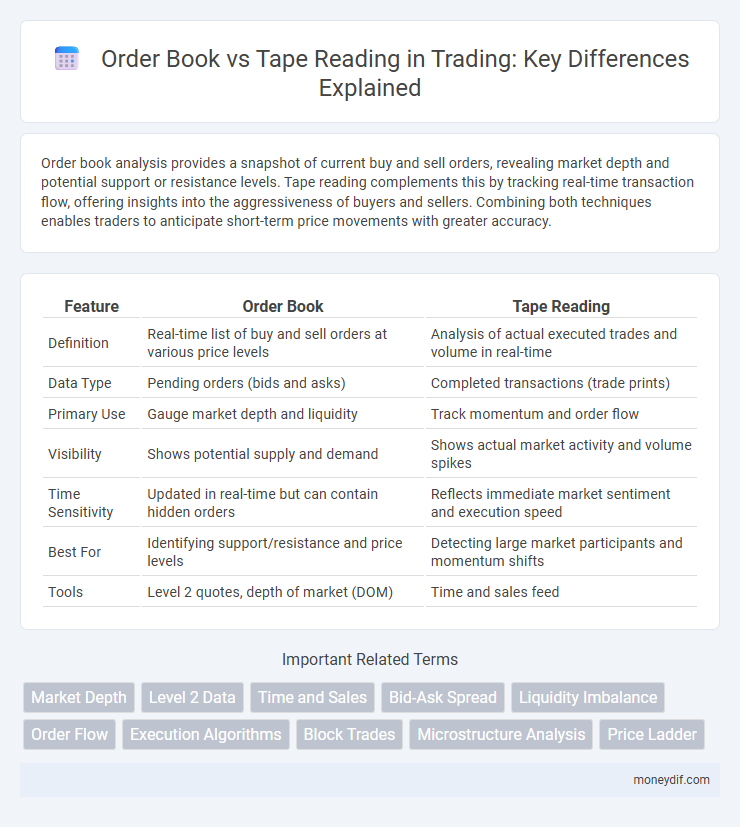

| Feature | Order Book | Tape Reading |

|---|---|---|

| Definition | Real-time list of buy and sell orders at various price levels | Analysis of actual executed trades and volume in real-time |

| Data Type | Pending orders (bids and asks) | Completed transactions (trade prints) |

| Primary Use | Gauge market depth and liquidity | Track momentum and order flow |

| Visibility | Shows potential supply and demand | Shows actual market activity and volume spikes |

| Time Sensitivity | Updated in real-time but can contain hidden orders | Reflects immediate market sentiment and execution speed |

| Best For | Identifying support/resistance and price levels | Detecting large market participants and momentum shifts |

| Tools | Level 2 quotes, depth of market (DOM) | Time and sales feed |

Understanding the Order Book: Key Concepts

The order book displays real-time buy and sell orders, showing price levels and order sizes that help traders gauge market depth and liquidity. Understanding bid and ask prices, order imbalances, and support or resistance zones within the order book provides critical insights into potential price movements. Tape reading complements this by analyzing transaction prints to confirm order book signals and detect market sentiment shifts.

What Is Tape Reading in Trading?

Tape reading in trading refers to the real-time analysis of price and volume data from the ticker tape or trading tape to gauge market sentiment and potential price movements. Traders interpret the flow of buy and sell orders, trade sizes, and transaction speeds to identify trends and momentum before placing trades. Unlike the order book, which shows pending orders, tape reading focuses on executed trades to reveal actual market activity and liquidity changes.

Core Differences Between Order Book and Tape Reading

The order book displays real-time limit orders at various price levels, revealing market depth and liquidity while showing potential support and resistance zones. Tape reading captures the actual flow of executed trades, providing insight into market momentum, volume spikes, and trader sentiment. Together, order book data emphasizes supply and demand structure, whereas tape reading reflects immediate market activity and order execution dynamics.

Advantages of Order Book Analysis

Order book analysis offers real-time visibility into market depth and liquidity, allowing traders to identify key support and resistance levels through the aggregation of buy and sell orders. This transparency helps in anticipating price movements by revealing the intentions of large market participants and potential order imbalances. Compared to tape reading, order book analysis provides a clearer, structured view of supply and demand dynamics, enabling more informed decision-making in fast-moving trading environments.

Benefits of Tape Reading for Traders

Tape reading provides traders with real-time insights into market sentiment by analyzing the flow of trade orders and transaction volumes. It enables precise identification of momentum shifts and large institutional trades that are often hidden within the order book. This granular visibility enhances decision-making speed, allowing traders to capitalize on short-term price movements and improve trade accuracy.

Order Book vs Tape Reading: Which Is More Effective?

Order book analysis provides a detailed view of market depth by displaying bid and ask prices with corresponding volumes, enabling traders to identify supply and demand levels and potential price movements. Tape reading, on the other hand, offers real-time insights into actual transaction flow, revealing market sentiment through trade prints and speed of execution. Effectiveness depends on trading style: order book excels in gauging liquidity and large orders for swing or intraday trading, while tape reading benefits scalpers and day traders seeking immediate confirmation of momentum and order flow.

Combining Order Book and Tape Reading Strategies

Combining order book analysis with tape reading enhances real-time market transparency by providing comprehensive insights into supply and demand dynamics as well as actual transaction flow. Traders leveraging the order book can identify pending buy and sell orders to gauge potential price levels, while tape reading reveals market sentiment through time and sales data, capturing executed trades and volume spikes. Integrating both strategies allows for more precise entry and exit points, improving timing and reducing risk in volatile markets.

Common Mistakes in Order Book and Tape Reading

Common mistakes in order book and tape reading include misinterpreting large order sizes as guaranteed trades rather than potential market manipulation or iceberg orders. Traders often overlook the context of order flow, failing to distinguish between genuine buying pressure and spoofing or layering tactics. Ignoring time and sales patterns while focusing solely on static order book data can lead to inaccurate trade decisions and increased risk exposure.

Best Tools for Order Book and Tape Reading Analysis

The best tools for order book and tape reading analysis include advanced trading platforms like Bookmap, which provides real-time depth of market visualization, and Sierra Chart, known for customizable order flow indicators. Market indicators such as Time & Sales data, along with footprint charts, enhance tape reading by revealing actual trade volume and price levels, offering traders precise insights into market liquidity and momentum. Integrating Level II quotes with these tools allows for comprehensive analysis of buyer and seller activity, improving decision-making in short-term trading strategies.

Order Book and Tape Reading in Today’s Markets

Order book provides a real-time visual representation of market depth by displaying bids and asks, enabling traders to gauge supply and demand levels effectively. Tape reading complements this by offering a continuous stream of time-stamped trade prints, revealing the actual transactions and helping identify market sentiment and momentum. Together, these tools enhance decision-making in today's fast-paced markets by providing both predictive order flow information and confirmed trade activity.

Important Terms

Market Depth

Market depth reveals the quantity of buy and sell orders at various price levels within the order book, providing insights into supply and demand dynamics. Tape reading complements this by analyzing real-time transaction data to detect order flow and market momentum, helping traders interpret the actual execution against the visible liquidity.

Level 2 Data

Level 2 data provides detailed insight into the order book by displaying the best bid and ask prices along with the depth of market liquidity at multiple price levels, allowing traders to gauge supply and demand dynamics more precisely. Tape reading complements this by showing the actual time and sales data of executed trades, helping traders confirm order flow and market momentum for more informed decision-making.

Time and Sales

Time and Sales provides a real-time record of executed trades, including price, volume, and time, which complements the order book's display of pending buy and sell orders by confirming actual market transactions. Tape reading enhances trade decision-making by analyzing Time and Sales data to identify market momentum and potential price reversals beyond the static order book depth.

Bid-Ask Spread

The Bid-Ask Spread reflects the difference between the highest price buyers are willing to pay and the lowest price sellers are asking, serving as a critical metric within the order book that displays real-time buy and sell orders at various price levels. Tape reading complements this by analyzing the time and sales data to detect shifts in market sentiment and liquidity, providing insight into the speed and volume of transactions that impact the spread's fluctuations.

Liquidity Imbalance

Liquidity imbalance occurs when buy and sell orders in the order book show significant disparity, causing price inefficiencies detectable through tape reading; this imbalance signals potential market moves as large orders consume available liquidity, influencing short-term price trends and volatility. Traders utilize real-time data from order book depth and time and sales (tape) to gauge supply-demand imbalance, optimizing entry and exit points by anticipating price reactions to liquidity gaps.

Order Flow

Order flow analysis integrates real-time data from the order book and tape reading to provide traders with deeper insights into market liquidity and price momentum. By examining bid-ask imbalances in the order book alongside actual transaction prints on the tape, traders can anticipate short-term price movements and identify institutional buying or selling pressure.

Execution Algorithms

Execution algorithms leverage real-time order book data to optimize trade placement, balancing order flow and liquidity with price impact. Tape reading complements this by analyzing time-stamped trade prints to detect hidden market momentum and inform precise algorithmic adjustments.

Block Trades

Block trades significantly impact the order book by causing large volume shifts that may not be immediately visible in the tape reading, which reflects real-time transaction data. Analyzing block trades alongside order book depth helps traders identify large market participants' intentions and potential price movements before they are fully reflected in the tape.

Microstructure Analysis

Microstructure analysis examines the intricate dynamics between order book depth and time and sales data (tape reading) to identify supply and demand imbalances, price discovery, and liquidity flow at a granular level. Combining order book imbalance metrics with sequential trade prints enhances the ability to detect short-term market sentiment shifts and predict price movements with higher precision.

Price Ladder

Price Ladder visually represents the order book by displaying bid and ask prices alongside corresponding order quantities, enabling traders to gauge market depth and liquidity levels. Tape reading complements this by analyzing the time and sales data, providing real-time insights into executed trades and momentum shifts, which enhances decision-making in active trading environments.

order book vs tape reading Infographic

moneydif.com

moneydif.com