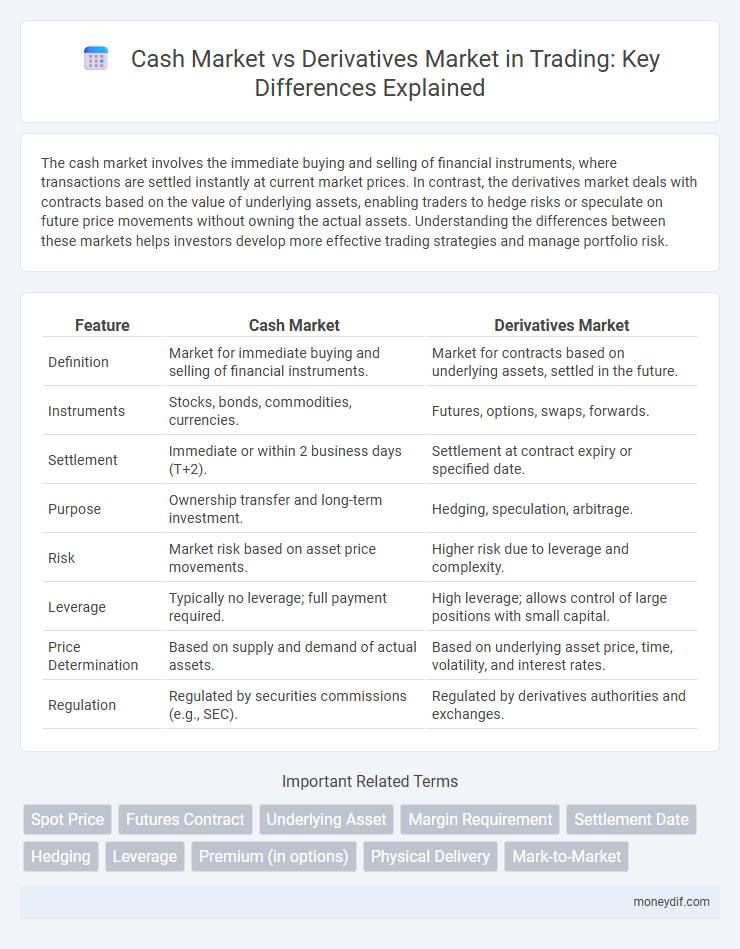

The cash market involves the immediate buying and selling of financial instruments, where transactions are settled instantly at current market prices. In contrast, the derivatives market deals with contracts based on the value of underlying assets, enabling traders to hedge risks or speculate on future price movements without owning the actual assets. Understanding the differences between these markets helps investors develop more effective trading strategies and manage portfolio risk.

Table of Comparison

| Feature | Cash Market | Derivatives Market |

|---|---|---|

| Definition | Market for immediate buying and selling of financial instruments. | Market for contracts based on underlying assets, settled in the future. |

| Instruments | Stocks, bonds, commodities, currencies. | Futures, options, swaps, forwards. |

| Settlement | Immediate or within 2 business days (T+2). | Settlement at contract expiry or specified date. |

| Purpose | Ownership transfer and long-term investment. | Hedging, speculation, arbitrage. |

| Risk | Market risk based on asset price movements. | Higher risk due to leverage and complexity. |

| Leverage | Typically no leverage; full payment required. | High leverage; allows control of large positions with small capital. |

| Price Determination | Based on supply and demand of actual assets. | Based on underlying asset price, time, volatility, and interest rates. |

| Regulation | Regulated by securities commissions (e.g., SEC). | Regulated by derivatives authorities and exchanges. |

Understanding the Cash Market: Fundamentals and Features

The cash market, also known as the spot market, involves the immediate buying and selling of financial instruments such as stocks, currencies, and commodities, with transactions settled 'on the spot' or within a short time frame. Key features include ownership transfer at the time of the transaction and price determination based on current supply and demand dynamics. Understanding liquidity, price transparency, and the role of market participants in the cash market is essential for grasping its fundamental operation within the broader financial ecosystem.

What is the Derivatives Market? Key Concepts Explained

The derivatives market involves financial contracts whose value derives from underlying assets such as stocks, bonds, commodities, currencies, or market indexes. Key concepts include futures, options, swaps, and forwards, which enable investors to hedge risk, speculate on price movements, and leverage positions. This market plays a crucial role in price discovery and risk management by providing liquidity and enabling transfer of risk between participants.

Primary Differences Between Cash and Derivatives Markets

The Cash Market involves the immediate buying and selling of financial instruments such as stocks and commodities, with transactions settled "on the spot." The Derivatives Market trades contracts like futures and options, which derive their value from underlying assets but allow for leverage, speculation, and hedging without immediate asset exchange. Price discovery, settlement timing, and risk exposure fundamentally differentiate the cash market from the derivatives market in trading dynamics.

Instruments Traded: Stocks vs. Futures and Options

The Cash Market primarily involves the trading of stocks, where investors buy and sell shares of companies for immediate delivery and ownership transfer. In contrast, the Derivatives Market deals with futures and options contracts, enabling traders to speculate or hedge based on the underlying asset's price movements without owning the asset itself. Stocks represent direct equity ownership, while futures and options provide leveraged exposure with defined expiration dates and varying risk profiles.

Settlement Process: Spot Settlement vs. Future Settlement

The cash market features spot settlement where transactions are settled immediately or within a short period, typically two business days, ensuring rapid transfer of assets and funds. In contrast, the derivatives market involves future settlement, with contracts executed on predetermined dates, allowing traders to hedge or speculate on price movements without immediate exchange of the underlying asset. Settlement in derivatives often includes margin requirements and mark-to-market processes to manage risk over the contract duration.

Risk and Leverage: Cash Market Stability vs. Derivatives Speculation

The cash market offers stable price discovery and lower risk since trades involve actual asset ownership, reducing exposure to market volatility. In contrast, the derivatives market provides high leverage, amplifying potential gains but significantly increasing the risk of substantial losses. Traders in derivatives must manage margin requirements and price fluctuations carefully to avoid rapid liquidation events.

Participant Profiles: Who Trades in Each Market?

Institutional investors, individual traders, and companies actively participate in the cash market to buy and sell actual securities like stocks and bonds, seeking direct ownership and immediate settlement. Derivatives markets attract hedgers, speculators, and arbitrageurs who trade contracts such as futures, options, and swaps to manage risk, leverage positions, or exploit price discrepancies without owning the underlying assets. Market makers and financial intermediaries play crucial roles in both markets, providing liquidity and facilitating efficient price discovery.

Liquidity Comparison: Cash Market vs. Derivatives Market

The derivatives market typically offers higher liquidity than the cash market due to standardized contracts and the presence of various expiration dates, attracting a broader range of traders and hedgers. Cash markets involve the direct buying and selling of underlying assets, which can result in lower liquidity especially for less-traded instruments or smaller exchanges. Enhanced liquidity in derivatives markets allows for tighter bid-ask spreads and quicker entry and exit, benefiting both speculative and risk management strategies.

Regulatory Framework and Compliance for Both Markets

The regulatory framework for the cash market focuses on transparency, investor protection, and real-time settlement processes under entities like the SEC and FINRA, ensuring immediate ownership transfer of securities. The derivatives market is governed by stricter regulations from bodies such as the CFTC and NFA, emphasizing risk management, margin requirements, and reporting to mitigate systemic risk associated with leverage and speculation. Both markets require rigorous compliance with anti-fraud provisions and market conduct rules but differ in their oversight intensity due to the inherent risks and complexities of derivative instruments.

Choosing the Right Market: Factors for Traders and Investors

Traders and investors should evaluate risk tolerance, investment horizon, and capital requirements when choosing between the cash market and derivatives market. The cash market offers direct ownership of assets and is suitable for long-term investors seeking stability and dividends. In contrast, the derivatives market provides leverage and hedging opportunities, appealing to traders aiming for short-term gains or mitigating price volatility risks.

Important Terms

Spot Price

Spot price reflects the current cash market value of an asset, while derivatives markets derive their prices from the expected future spot price of that asset.

Futures Contract

Futures contracts enable investors to hedge or speculate by locking in prices in the derivatives market based on the underlying assets traded in the cash market.

Underlying Asset

The underlying asset in the cash market represents the actual financial instrument traded, while in the derivatives market it serves as the reference asset from which contract values are derived and settled.

Margin Requirement

Margin requirement in the derivatives market is typically higher and acts as a risk control mechanism, whereas the cash market usually requires full payment upfront, reflecting immediate ownership of the underlying assets.

Settlement Date

The settlement date in the cash market typically occurs two business days after the trade (T+2), whereas in the derivatives market, settlement dates vary based on contract specifications and can be monthly, quarterly, or at expiration.

Hedging

Hedging in the cash market involves buying or selling underlying assets to mitigate price risk, while in the derivatives market, it entails using financial instruments like futures and options contracts to lock in prices or hedge against adverse price movements. Derivatives provide more flexibility and leverage in managing risk compared to direct transactions in the cash market.

Leverage

Leverage in the derivatives market allows traders to control larger positions with a smaller amount of capital compared to the cash market, significantly amplifying potential gains and risks. While the cash market involves direct ownership of securities, the derivatives market uses contracts like futures and options to speculate or hedge without owning the underlying asset.

Premium (in options)

Premium in options represents the price paid for the right to buy or sell an underlying asset, reflecting factors like volatility and time value, making it a key differentiator from the outright price movements observed in the cash market compared to the leveraged exposure in the derivatives market.

Physical Delivery

Physical delivery in the cash market involves the actual exchange of the underlying asset, while in the derivatives market, it refers to the settlement process where the underlying asset is delivered upon contract expiration.

Mark-to-Market

Mark-to-Market accurately reflects daily gains and losses by valuing positions at current market prices in both Cash Market and Derivatives Market, ensuring transparent financial reporting and risk management.

Cash Market vs Derivatives Market Infographic

moneydif.com

moneydif.com