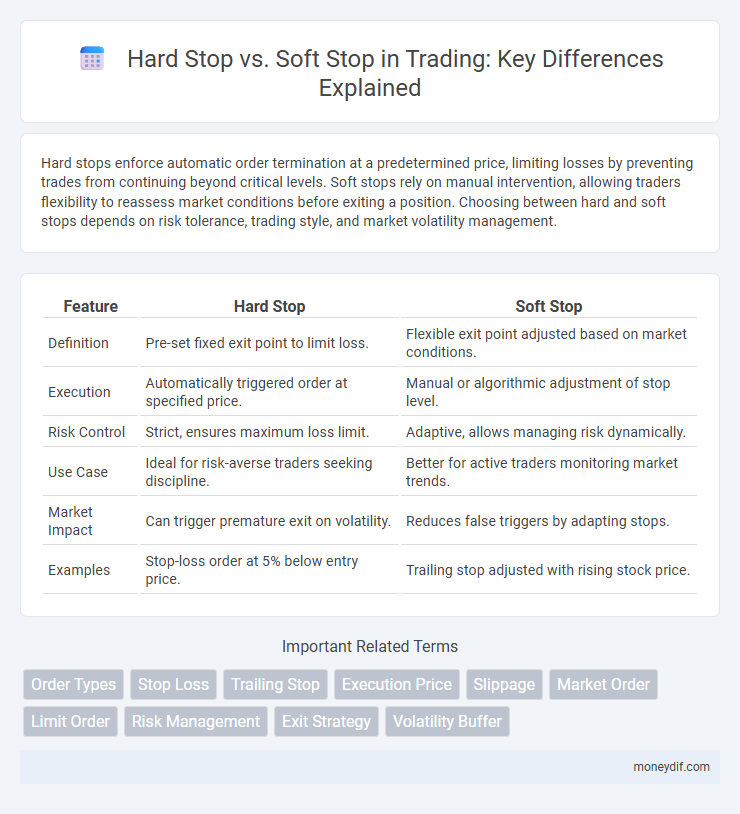

Hard stops enforce automatic order termination at a predetermined price, limiting losses by preventing trades from continuing beyond critical levels. Soft stops rely on manual intervention, allowing traders flexibility to reassess market conditions before exiting a position. Choosing between hard and soft stops depends on risk tolerance, trading style, and market volatility management.

Table of Comparison

| Feature | Hard Stop | Soft Stop |

|---|---|---|

| Definition | Pre-set fixed exit point to limit loss. | Flexible exit point adjusted based on market conditions. |

| Execution | Automatically triggered order at specified price. | Manual or algorithmic adjustment of stop level. |

| Risk Control | Strict, ensures maximum loss limit. | Adaptive, allows managing risk dynamically. |

| Use Case | Ideal for risk-averse traders seeking discipline. | Better for active traders monitoring market trends. |

| Market Impact | Can trigger premature exit on volatility. | Reduces false triggers by adapting stops. |

| Examples | Stop-loss order at 5% below entry price. | Trailing stop adjusted with rising stock price. |

Understanding Hard Stops and Soft Stops in Trading

Hard stops in trading are strict, predetermined exit points set to limit losses by automatically closing a position once a specific price level is reached. Soft stops, alternatively, function as flexible exit strategies allowing traders to reevaluate market conditions before executing an order, often used to optimize profit or minimize losses. Mastering the distinction between hard stops and soft stops enhances risk management and trade execution efficiency in volatile markets.

Key Differences Between Hard Stops and Soft Stops

Hard stops execute automatic, non-negotiable trade exits at predetermined price levels to limit losses or secure profits, ensuring strict risk management without manual intervention. Soft stops rely on discretionary exit strategies, allowing traders to adjust or delay exits based on market conditions or new information, providing flexibility but increasing subjective decision-making. The key differences lie in execution rigidity, with hard stops offering enforced discipline and soft stops allowing adaptive control over trade management.

Advantages of Using Hard Stops

Hard stops provide traders with a clear, non-negotiable exit point, effectively limiting potential losses and preserving capital in volatile markets. By enforcing disciplined risk management, hard stops prevent emotional decision-making and help maintain a consistent trading strategy. This precise control over downside risk enhances overall portfolio stability and improves long-term trading performance.

Benefits of Soft Stop Strategies

Soft stop strategies in trading offer enhanced flexibility by allowing traders to adjust exit points dynamically based on market conditions and volatility, reducing premature position closures. These strategies help optimize profit potential and minimize losses through adaptive risk management, unlike rigid hard stops which might trigger on temporary price fluctuations. Implementing soft stops encourages more informed decision-making and better alignment with overall trading goals.

Risks Associated with Hard Stops

Hard stops impose automatic exit points that may trigger during temporary volatility, potentially causing premature liquidation and missed recovery opportunities. The rigid nature of hard stops increases exposure to slippage and market gaps, exacerbating losses under fast-moving conditions. Traders relying solely on hard stops risk undermining long-term strategy stability by reacting to short-term price fluctuations rather than fundamental trends.

Potential Pitfalls of Soft Stops

Soft stops in trading often expose positions to increased risk since they rely on mental execution rather than automatic order triggers, leading to delayed reactions during volatile market conditions. This delay can result in larger-than-expected losses, especially when rapid price movements occur beyond the intended exit points. Traders may also face emotional challenges, as hesitation or fear can prevent timely order placement, undermining disciplined risk management strategies.

When to Use Hard Stops vs Soft Stops

Hard stops are essential when limiting maximum loss is critical, especially in highly volatile markets or when trading large positions with tight risk management rules. Soft stops are better suited for less aggressive strategies, allowing traders to adjust stop levels based on evolving market conditions and technical indicators. Use hard stops for automated, rule-based exits and soft stops when flexibility and market context guide decision-making in trading.

Impact on Trading Psychology

Hard stops create clear boundaries that help traders manage risk by enforcing discipline and preventing emotional decision-making during market fluctuations. Soft stops offer flexibility, allowing traders to adjust exit points based on market conditions, but they can increase the risk of hesitation and emotional bias. The psychological impact of hard stops fosters consistency and confidence, while soft stops may lead to second-guessing and increased stress.

How to Set Effective Stop-Loss Orders

Setting an effective stop-loss order involves choosing between a hard stop and a soft stop based on market volatility and personal risk tolerance. A hard stop fixes the exit price rigidly, ensuring strict loss limits, while a soft stop adapts dynamically using trailing stops or technical indicators to protect profits as the price moves favorably. Traders optimize stop-loss placement by analyzing support and resistance levels, average true range (ATR), and recent price action to balance risk and potential reward accurately.

Best Practices for Combining Hard and Soft Stops

Combining hard stops and soft stops enhances risk management by setting a fixed exit point while allowing flexibility for market fluctuations through alerts. Best practices include placing hard stops at critical support or resistance levels to limit losses, and using soft stops to monitor price action and adjust risk dynamically. Implementing both ensures disciplined trading while adapting to real-time market trends effectively.

Important Terms

Order Types

Hard Stop orders execute immediately at the specified stop price, providing strict risk management by enforcing a fixed exit point. Soft Stop orders trigger a conditional alert or sell signal when the stop price is reached, offering flexibility but less certainty in trade execution compared to Hard Stop orders.

Stop Loss

Stop Loss orders minimize trading risks by automatically selling assets at set prices to prevent large losses, with Hard Stops enforcing strict exit points and Soft Stops allowing more flexible, conditional triggers based on market volatility. Traders choose between Hard Stop orders for precise risk control and Soft Stop methods for adaptive risk management to optimize portfolio protection in varying market conditions.

Trailing Stop

Trailing Stop dynamically adjusts the stop-loss level based on market price movements, locking in profits while allowing flexibility, unlike a Hard Stop which remains fixed and may trigger prematurely. Soft Stops incorporate volatility measures, reducing the risk of being stopped out by minor price fluctuations compared to rigid Hard Stops.

Execution Price

Execution price in trading refers to the actual price at which a buy or sell order is fulfilled, directly impacting profitability and risk management. Hard stops trigger immediate market orders at a fixed price to limit losses, often resulting in slippage from the expected execution price, while soft stops use alerts or conditional orders that allow more flexibility but may delay execution, affecting the final trade price.

Slippage

Slippage occurs when the execution price of a trade deviates from the expected price, commonly seen in volatile markets or with hard stop orders that trigger market executions. Soft stops, using limit orders, help reduce slippage by setting precise exit prices, though they may not guarantee execution if the price moves rapidly beyond the limit.

Market Order

A market order executes immediately at the current best available price, ensuring rapid trade completion, while a hard stop triggers an automatic exit at a predetermined price to limit losses, reflecting strict stop-loss discipline. Soft stops involve manual or conditional exits with more flexibility, allowing traders to adjust based on market conditions instead of enforcing rigid price points like hard stops.

Limit Order

A Limit Order ensures a trade is executed at a specified price or better, providing precise entry or exit points compared to Hard Stop orders, which trigger market orders at exact stop prices risking slippage. Soft Stops, often trailing stops, adjust dynamically with price movement, offering flexibility but potentially less certainty than fixed Limit Orders in volatile markets.

Risk Management

Risk management differentiates between hard stops, which are fixed exit points that automatically close a position to limit losses, and soft stops, which are flexible thresholds allowing discretionary adjustments based on market conditions. Implementing hard stops protects against significant downside risk, while soft stops provide adaptability to evolving price action, enhancing overall trade risk control.

Exit Strategy

A hard stop exit strategy enforces a strict, non-negotiable deadline or limit for exiting a position to minimize losses or lock in profits, while a soft stop exit strategy allows some flexibility, adjusting based on market conditions or updated analysis. Traders often prefer hard stops for risk management discipline and soft stops for adaptive decision-making in volatile markets.

Volatility Buffer

The volatility buffer is a risk management tool designed to absorb price fluctuations, enabling traders to set a hard stop that strictly limits losses or a soft stop that allows flexibility by adjusting exit points based on market volatility. Utilizing a volatility buffer helps optimize stop-loss levels by accounting for standard deviation measures and average true range (ATR), reducing premature exits while maintaining effective downside protection.

Hard Stop vs Soft Stop Infographic

moneydif.com

moneydif.com