Futures contracts are standardized agreements traded on exchanges, offering high liquidity and daily settlement through margin calls, which reduces counterparty risk. Forwards are customized contracts negotiated privately between parties, creating flexibility but exposing participants to higher default risk due to lack of regulation and daily settlements. Traders choose futures for transparency and ease of exit, while forwards suit those needing tailored terms and specific delivery schedules.

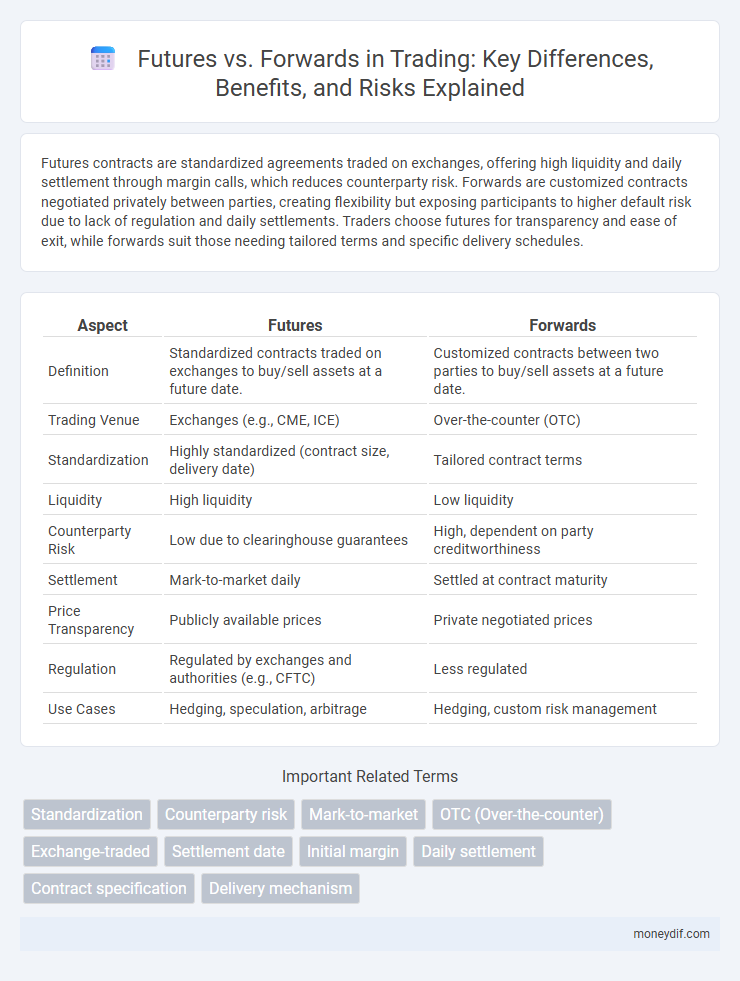

Table of Comparison

| Aspect | Futures | Forwards |

|---|---|---|

| Definition | Standardized contracts traded on exchanges to buy/sell assets at a future date. | Customized contracts between two parties to buy/sell assets at a future date. |

| Trading Venue | Exchanges (e.g., CME, ICE) | Over-the-counter (OTC) |

| Standardization | Highly standardized (contract size, delivery date) | Tailored contract terms |

| Liquidity | High liquidity | Low liquidity |

| Counterparty Risk | Low due to clearinghouse guarantees | High, dependent on party creditworthiness |

| Settlement | Mark-to-market daily | Settled at contract maturity |

| Price Transparency | Publicly available prices | Private negotiated prices |

| Regulation | Regulated by exchanges and authorities (e.g., CFTC) | Less regulated |

| Use Cases | Hedging, speculation, arbitrage | Hedging, custom risk management |

Understanding Futures and Forwards: Key Differences

Futures contracts are standardized agreements traded on regulated exchanges, offering high liquidity and daily settlement through marking-to-market, while forwards are customizable private agreements between two parties with settlement at contract maturity. Futures reduce counterparty risk due to exchange clearinghouses, whereas forwards carry higher default risk as they lack centralized clearing. The choice between futures and forwards depends on the need for customization, risk tolerance, and regulatory environment in trading strategies.

Contract Structure: Standardization vs Customization

Futures contracts are standardized agreements traded on exchanges with fixed contract sizes, expiration dates, and settlement procedures, ensuring liquidity and transparency. Forwards offer customizable terms negotiated directly between parties, allowing flexibility in contract size, delivery dates, and settlement methods to suit specific hedging or investment needs. The standardization of futures enhances market efficiency, while the customization of forwards provides tailored risk management solutions.

Participants: Who Trades Futures and Forwards?

Futures contracts are primarily traded by institutional investors, hedge funds, and retail traders seeking standardized, regulated market exposure with daily settlement and margin requirements. Forwards are commonly used by corporations, banks, and producers aiming for customized agreements to hedge specific risks or secure future prices in over-the-counter (OTC) markets. Market participants choose futures or forwards based on their need for liquidity, counterparty risk management, and contract customization.

Exchange Trading vs Over-the-Counter (OTC) Markets

Futures contracts are standardized agreements traded on regulated exchanges, ensuring high liquidity, transparent pricing, and daily settlement through clearinghouses, which minimize counterparty risk. Forwards are customized contracts negotiated over-the-counter (OTC), allowing tailored terms but exposing parties to higher counterparty risk due to lack of centralized clearing and regulatory oversight. Exchange-traded futures offer greater market efficiency and risk management compared to the flexible but riskier OTC forwards market.

Margin Requirements and Settlement Procedures

Futures contracts require daily margin deposits and are marked-to-market, ensuring gains and losses are settled each trading day through clearinghouses, minimizing counterparty risk. Forwards, however, typically have no margin requirements and settle only at contract maturity, exposing both parties to higher counterparty risk due to the absence of daily settlement. The standardized nature of futures facilitates liquidity and reduces credit risk compared to the customizable, privately negotiated forwards.

Risk Management: Counterparty and Default Risks

Futures contracts minimize counterparty risk through centralized clearinghouses that guarantee trade performance, whereas forwards expose parties to higher default risk due to their OTC nature and lack of intermediaries. Margin requirements and daily mark-to-market mechanisms in futures further reduce default probability by ensuring timely collateral adjustments. In contrast, forwards require thorough credit assessment and monitoring, increasing risk management complexity for counterparties.

Flexibility and Liquidity: Which is Better?

Futures contracts offer greater flexibility and liquidity due to their standardized terms and active exchanges, enabling easy entry and exit for traders. Forwards are customized agreements with less liquidity, often traded over-the-counter, limiting flexibility and making them better suited for hedgers seeking tailored risk management. The superior liquidity and flexibility of futures contracts make them more appealing for speculative trading and dynamic portfolio adjustments.

Pricing Mechanisms and Mark-to-Market Concepts

Futures contracts use standardized pricing based on continuous mark-to-market settlements, reflecting daily changes in market value and minimizing credit risk through margin requirements. Forward contracts feature customized pricing determined at initiation, with settlement occurring only at contract maturity, exposing parties to counterparty risk and potential valuation uncertainty. The mark-to-market mechanism in futures ensures real-time risk management, whereas forwards rely on credit evaluations and collateral agreements to manage default risk.

Applications in Hedging and Speculation

Futures contracts are widely used in hedging to lock in prices for commodities and financial instruments, providing price certainty and reducing risk exposure. Forwards offer customized terms, making them suitable for tailored hedging strategies but carry counterparty risk due to their over-the-counter nature. Speculators leverage futures for high liquidity and standardized contracts, enabling quick entry and exit, while forwards appeal less to speculators due to limited marketability.

Pros and Cons of Futures vs Forwards

Futures contracts offer standardized terms and are traded on regulated exchanges, providing high liquidity and reduced counterparty risk through daily mark-to-market settlements. Forwards are customizable private agreements that allow flexibility in contract specifications but carry higher counterparty risk due to lack of centralized clearing and liquidity. While futures benefit from price transparency and lower credit risk, forwards can be tailored for specific hedging needs despite potential exposure to default risk and less ease of trading.

Important Terms

Standardization

Standardization in futures contracts involves predefined terms such as contract size, expiration dates, and settlement procedures, whereas forwards are customizable agreements tailored to the specific needs of the contracting parties.

Counterparty risk

Counterparty risk is higher in forwards due to their over-the-counter nature, whereas futures reduce this risk through centralized clearinghouses and margin requirements.

Mark-to-market

Mark-to-market ensures daily settlement of gains and losses in futures contracts, while forwards are typically settled at contract maturity without daily price adjustments.

OTC (Over-the-counter)

Over-the-counter (OTC) markets facilitate customized futures and forwards contracts that differ from standardized exchange-traded futures by allowing tailored terms and counterparty negotiation.

Exchange-traded

Exchange-traded futures contracts offer standardized terms and higher liquidity compared to over-the-counter forwards, which provide customizable terms but carry greater counterparty risk.

Settlement date

The settlement date for futures contracts is standardized and occurs on a specified daily or monthly schedule, while forward contracts have a customizable settlement date agreed upon by both parties at contract initiation.

Initial margin

Initial margin for futures contracts is a standardized upfront deposit ensuring contract performance, while forwards typically require no initial margin but expose parties to higher counterparty risk.

Daily settlement

Daily settlement in futures involves marking positions to market each trading day, ensuring immediate profit or loss realization, whereas forwards settle only at contract maturity, leading to higher counterparty risk.

Contract specification

Futures contracts are standardized and traded on exchanges with daily settlement, while forwards are customizable, privately negotiated agreements settled at maturity.

Delivery mechanism

Futures contracts utilize standardized delivery mechanisms through centralized exchanges ensuring daily settlement and reduced counterparty risk, whereas forwards involve customized delivery terms directly negotiated between parties, resulting in higher counterparty risk and flexible settlement.

Futures vs Forwards Infographic

moneydif.com

moneydif.com