Hedging involves reducing risk exposure by taking offsetting positions to protect against market volatility, while speculating aims to profit from price fluctuations by taking on higher risk. Traders use hedging to safeguard assets or investments, ensuring more predictable outcomes, whereas speculators actively seek to capitalize on market movements for potential gains. Understanding the distinction between these strategies helps in managing portfolio risk effectively and aligning trading approaches with financial goals.

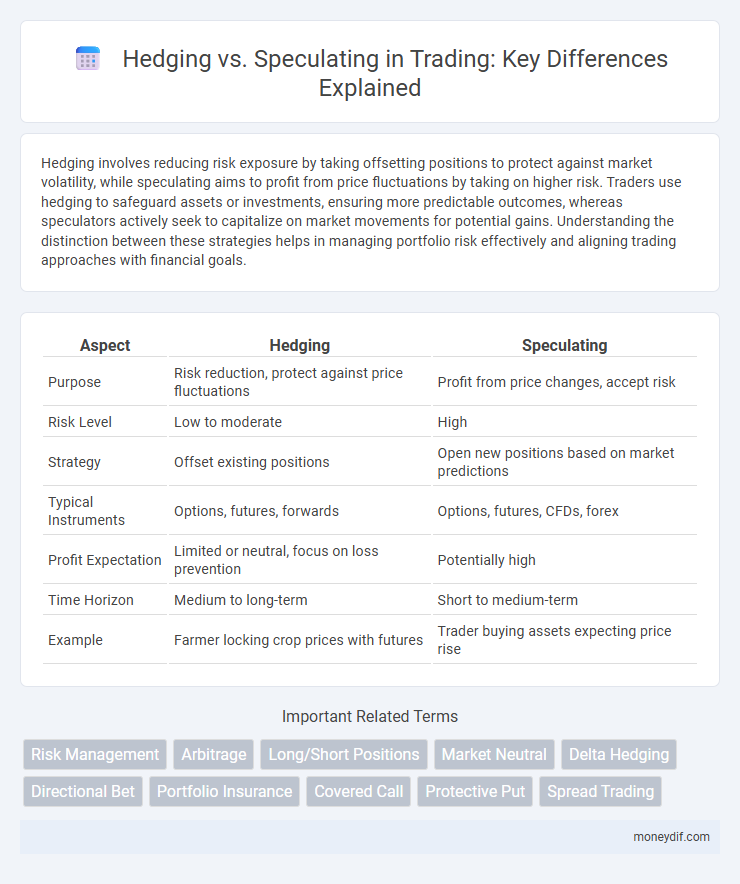

Table of Comparison

| Aspect | Hedging | Speculating |

|---|---|---|

| Purpose | Risk reduction, protect against price fluctuations | Profit from price changes, accept risk |

| Risk Level | Low to moderate | High |

| Strategy | Offset existing positions | Open new positions based on market predictions |

| Typical Instruments | Options, futures, forwards | Options, futures, CFDs, forex |

| Profit Expectation | Limited or neutral, focus on loss prevention | Potentially high |

| Time Horizon | Medium to long-term | Short to medium-term |

| Example | Farmer locking crop prices with futures | Trader buying assets expecting price rise |

Understanding the Core Differences Between Hedging and Speculating

Hedging involves reducing risk exposure by entering offsetting positions to protect assets from adverse price movements, while speculating aims to profit from predicting market fluctuations by taking on higher risks. Hedgers prioritize capital preservation and stability, using strategies like futures contracts or options to mitigate potential losses. Speculators accept market volatility and uncertainty, leveraging tools such as leveraged positions and derivatives to maximize returns based on market forecasts.

The Primary Objectives: Risk Management vs Profit Maximization

Hedging aims to minimize financial risk by protecting investments against adverse price movements, primarily focusing on risk management to preserve capital. Speculating involves taking calculated risks to achieve profit maximization by leveraging market volatility and price fluctuations. Traders use hedging strategies such as options, futures, and swaps, while speculators engage in directional bets and high-risk positions for potential gains.

Common Instruments Used for Hedging and Speculating

Futures contracts, options, and swaps are common instruments utilized in both hedging and speculating within trading markets. Hedgers primarily use these derivatives to manage risk by locking in prices or rates, reducing exposure to market volatility. Speculators employ the same tools to capitalize on price movements, aiming for profit through market predictions rather than risk mitigation.

Typical Participants: Who Hedges and Who Speculates?

Hedging is primarily employed by businesses, financial institutions, and investors seeking to mitigate risk from price fluctuations in commodities, currencies, or securities. Speculators, on the other hand, are traders and hedge funds aiming to profit from market volatility by taking on risk through derivative contracts or leveraged positions. Commercial producers, importers, and exporters typically hedge, whereas individual traders and proprietary desks are the main speculators in financial markets.

Risk Profiles: Exposure and Potential Gains/Losses

Hedging in trading involves reducing exposure to adverse price movements by taking offsetting positions, thereby limiting potential losses but also capping gains. Speculating carries a higher risk profile, as traders aim to profit from price fluctuations with no protective measures, exposing themselves to unlimited potential gains or losses. Understanding these risk profiles is crucial for aligning trading strategies with investment goals and risk tolerance.

Impact on Market Liquidity and Volatility

Hedging stabilizes market liquidity by enabling participants to offset risk, reducing price fluctuations and contributing to lower volatility. Speculating, driven by profit motives, increases trading volume and market liquidity but often amplifies price swings, leading to heightened volatility. The balance between hedging and speculating shapes overall market dynamics, influencing risk distribution and price stability.

Real-World Examples: Hedging vs Speculative Strategies

Hedging strategies, such as airline companies purchasing fuel futures contracts, help mitigate price volatility and protect profit margins by locking in costs. In contrast, speculative strategies involve traders buying or selling assets like cryptocurrencies or oil futures to profit from anticipated price movements without owning the underlying asset. Real-world examples include farmers using commodity futures to safeguard crop prices versus hedge fund managers executing high-risk trades aiming for substantial returns.

Regulatory Perspectives on Hedging and Speculation

Regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) impose distinct compliance requirements on hedging and speculation to mitigate market risks and protect investors. Hedging practices are often granted exemptions or favorable treatments under regulations like the Dodd-Frank Act because they aim to reduce exposure to price volatility. Conversely, speculation is closely monitored to prevent market manipulation, requiring stringent reporting and capital adequacy standards to ensure market integrity.

Pros and Cons: Evaluating Hedging and Speculating Approaches

Hedging minimizes risk by using financial instruments like options and futures to protect against market volatility but often limits potential profits due to cost and reduced exposure. Speculating aims for high returns by taking on greater risk, leveraging market movements without protection, which can lead to significant losses if predictions are inaccurate. Evaluating these strategies depends on risk tolerance, market knowledge, and investment goals, as hedging offers stability while speculating pursues aggressive growth.

Choosing the Right Strategy: When to Hedge and When to Speculate

Hedging is best suited for traders seeking to minimize risk and protect existing positions from market volatility, often using instruments like options, futures, or swaps to lock in prices or limit potential losses. Speculating involves taking on higher risk by making directional bets on asset price movements, aiming for significant profits through market timing and momentum analysis. Choosing the right strategy depends on the trader's risk tolerance, investment goals, market conditions, and the time horizon for the position.

Important Terms

Risk Management

Effective risk management leverages hedging strategies to minimize exposure to price fluctuations while speculating involves taking calculated risks to profit from market volatility.

Arbitrage

Arbitrage exploits price discrepancies in different markets for risk-free profit, while hedging aims to reduce potential losses by offsetting exposure and speculating involves taking on risk to achieve higher returns.

Long/Short Positions

Long and short positions serve distinct roles in hedging and speculating, where long positions involve buying assets to benefit from price increases, while short positions entail selling borrowed assets to profit from price declines. Hedgers use these strategies to mitigate risk by offsetting potential losses in underlying assets, whereas speculators accept higher risk to capitalize on anticipated market movements for profit.

Market Neutral

Market neutral strategies prioritize hedging to minimize risk by offsetting positions rather than speculating on market direction, aiming to generate consistent returns regardless of market movements.

Delta Hedging

Delta hedging minimizes risk exposure by dynamically adjusting options positions to maintain a neutral delta, distinguishing it from speculating where traders assume directional market risk.

Directional Bet

Directional bets involve making investment choices based on the anticipated movement of asset prices, often associated with higher risk and potential reward. Hedging focuses on minimizing risk by offsetting potential losses in existing positions, while speculating aims to profit from price fluctuations without an underlying position to protect.

Portfolio Insurance

Portfolio insurance utilizes dynamic hedging strategies to protect investment portfolios from significant losses by simulating a put option, reducing downside risk without outright selling assets. Unlike speculating, which seeks to profit from market movements, portfolio insurance focuses on capital preservation through risk management techniques.

Covered Call

A covered call strategy involves holding a stock while selling call options on the same stock to generate income, serving as a hedging technique to limit downside risk rather than purely speculating on price movements.

Protective Put

A protective put strategy involves purchasing put options to hedge against potential losses in an underlying asset, distinguishing it from speculative trading by prioritizing risk management over profit-seeking.

Spread Trading

Spread trading involves simultaneously buying and selling correlated assets to hedge risk and capitalize on price differentials, distinguishing itself from speculating which relies on predicting market direction for profit.

Hedging vs Speculating Infographic

moneydif.com

moneydif.com