Delta measures the sensitivity of an option's price to changes in the underlying asset's price, indicating the expected change in option value per one-point move in the asset. Gamma indicates the rate of change of Delta itself, providing insight into the stability of Delta over price movements and helping traders anticipate how their risk exposure evolves. Understanding the interplay between Delta and Gamma is crucial for dynamic hedging strategies and managing options portfolios effectively.

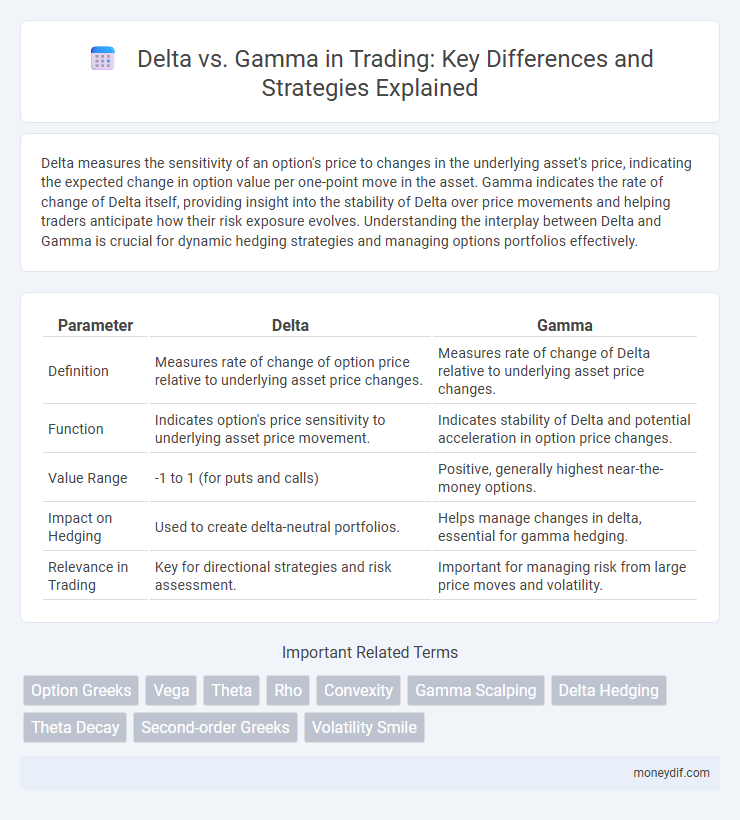

Table of Comparison

| Parameter | Delta | Gamma |

|---|---|---|

| Definition | Measures rate of change of option price relative to underlying asset price changes. | Measures rate of change of Delta relative to underlying asset price changes. |

| Function | Indicates option's price sensitivity to underlying asset price movement. | Indicates stability of Delta and potential acceleration in option price changes. |

| Value Range | -1 to 1 (for puts and calls) | Positive, generally highest near-the-money options. |

| Impact on Hedging | Used to create delta-neutral portfolios. | Helps manage changes in delta, essential for gamma hedging. |

| Relevance in Trading | Key for directional strategies and risk assessment. | Important for managing risk from large price moves and volatility. |

Understanding Delta and Gamma in Options Trading

Delta measures the sensitivity of an option's price to changes in the underlying asset's price, indicating the expected price movement per one-point change in the asset. Gamma quantifies the rate of change of Delta itself, providing insight into how Delta will shift as the underlying price fluctuates, essential for managing option position risk. Understanding both Delta and Gamma helps traders optimize hedging strategies and make informed decisions about options pricing dynamics.

Delta Explained: Measuring Price Sensitivity

Delta measures an option's price sensitivity relative to the underlying asset's price change, indicating the expected change in the option's price for a one-point move in the underlying. Traders use Delta to gauge directional risk and hedge positions effectively, with values ranging from 0 to 1 for calls and 0 to -1 for puts. Unlike Gamma, which measures the rate of change of Delta itself, Delta provides a direct indicator of price movement impact on option value.

What Is Gamma? Assessing Rate of Change in Delta

Gamma measures the rate of change in delta for an options contract, indicating how delta shifts with underlying asset price movements. High gamma values suggest delta is highly sensitive to price changes, crucial for managing option positions and risk. Traders monitor gamma to predict potential adjustments needed in hedging strategies as market conditions fluctuate.

Key Differences Between Delta and Gamma

Delta measures the sensitivity of an option's price to changes in the underlying asset's price, indicating the expected change in option value per one-point movement in the underlying. Gamma represents the rate of change of Delta itself, providing insight into the stability or acceleration of Delta as the underlying price fluctuates. Understanding the interplay between Delta and Gamma is crucial for traders managing option positions, as Delta guides directional exposure while Gamma assesses the risk of sudden Delta shifts.

The Role of Delta in Hedging Strategies

Delta measures an option's sensitivity to underlying asset price changes, serving as a critical parameter in hedging strategies by indicating the hedge ratio needed to maintain a neutral position. Traders use Delta to adjust their portfolios dynamically, offsetting risk from price fluctuations and stabilizing returns in volatile markets. Understanding Delta's behavior enables precise control over exposure, reducing potential losses and improving risk management efficiency.

How Gamma Influences Risk Management

Gamma measures the rate of change of Delta in options trading, providing critical insight into how an option's Delta shifts as the underlying asset price moves. High Gamma indicates that Delta can change rapidly, increasing the potential for significant profit or loss, which traders must closely monitor for effective risk management. By understanding Gamma, traders can better anticipate price sensitivity and adjust their hedging strategies to maintain balanced portfolios and mitigate sudden market movements.

Delta vs Gamma: Impact on Options Pricing

Delta measures the rate of change in an option's price relative to changes in the underlying asset's price, directly influencing options pricing by indicating directional exposure. Gamma represents the rate of change of Delta itself, capturing the curvature and acceleration of price movements, which affects the stability and risk profile of an option position. A higher Gamma implies greater sensitivity to price swings and increased hedging requirements, making Gamma crucial for dynamic options pricing and risk management strategies.

Practical Examples of Delta and Gamma in Action

Delta measures the rate of change in an option's price relative to the underlying asset's price, such as a call option with a delta of 0.6 increasing by $0.60 for every $1 rise in the stock. Gamma represents the rate of change of delta itself, with a high gamma indicating that the delta will adjust significantly as the underlying price moves, which is crucial for managing risk in rapidly changing markets. In practice, a trader might use delta to gauge directional exposure while monitoring gamma to understand the acceleration of delta changes, especially near expiration or at-the-money options.

Managing Delta and Gamma in Your Portfolio

Managing delta and gamma in your trading portfolio requires a balanced approach to risk exposure and responsiveness to market movements. Delta measures the sensitivity of an option's price to changes in the underlying asset, while gamma indicates the rate of change of delta, providing insight into how delta shifts with price fluctuations. Effective portfolio management involves monitoring and adjusting delta to maintain desired exposure, while gamma hedging helps minimize large swings in delta, enhancing stability and limiting potential losses during volatile market conditions.

Advanced Strategies Utilizing Delta and Gamma

Advanced trading strategies leverage Delta and Gamma to optimize portfolio risk and return profiles by dynamically adjusting option positions. Delta measures the sensitivity of an option's price to changes in the underlying asset, enabling traders to hedge directional risk, while Gamma assesses the rate of change of Delta, providing insight into price acceleration and volatility exposure. Combining Delta and Gamma management allows for sophisticated tactics such as Gamma scalping and Delta-neutral hedging, enhancing precision in capturing market movements and mitigating adverse shifts.

Important Terms

Option Greeks

Delta measures an option's price sensitivity to underlying asset changes, while Gamma quantifies the rate of Delta's change, indicating the curvature of the option's price curve.

Vega

Vega measures an option's sensitivity to volatility changes, while Delta quantifies price sensitivity to the underlying asset, and Gamma indicates the rate of change of Delta with respect to the underlying price.

Theta

Theta represents the time decay of options and impacts Delta and Gamma by reducing the option's extrinsic value as expiration approaches, thereby influencing Delta's sensitivity and Gamma's rate of change.

Rho

Rho measures the sensitivity of an option's price to interest rate changes, complementing Delta's sensitivity to underlying price movements and Gamma's rate of Delta change.

Convexity

Convexity in options trading quantifies the rate of change of Delta with respect to price movements, directly linked to Gamma as Gamma measures the Delta's sensitivity.

Gamma Scalping

Gamma scalping exploits gamma curvature to adjust delta-neutral positions dynamically, capturing profits from underlying price fluctuations while managing delta risk.

Delta Hedging

Delta hedging minimizes risk by adjusting positions based on Delta, while monitoring Gamma helps anticipate changes in Delta for more accurate portfolio management.

Theta Decay

Theta decay accelerates as Delta moves closer to zero while Gamma peaks, indicating higher time decay sensitivity in near-the-money options.

Second-order Greeks

Second-order Greeks measure the sensitivity of Delta with respect to changes in the underlying asset price and time, with Gamma representing the rate of change of Delta, indicating the convexity of an option's value relative to price movements.

Volatility Smile

Volatility smile illustrates how implied volatility varies with Delta, often showing higher Gamma sensitivity at extreme Delta values.

Delta vs Gamma Infographic

moneydif.com

moneydif.com