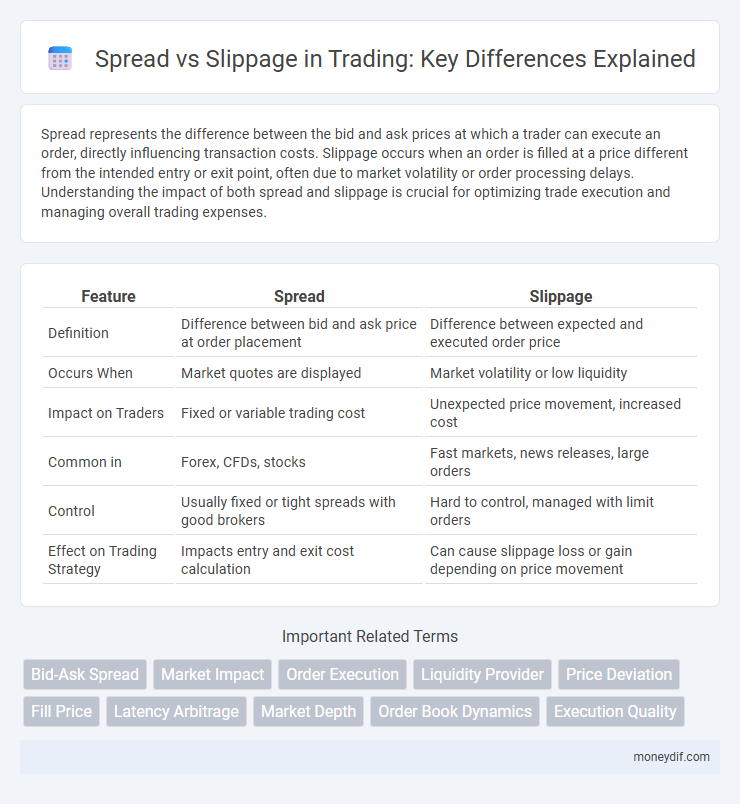

Spread represents the difference between the bid and ask prices at which a trader can execute an order, directly influencing transaction costs. Slippage occurs when an order is filled at a price different from the intended entry or exit point, often due to market volatility or order processing delays. Understanding the impact of both spread and slippage is crucial for optimizing trade execution and managing overall trading expenses.

Table of Comparison

| Feature | Spread | Slippage |

|---|---|---|

| Definition | Difference between bid and ask price at order placement | Difference between expected and executed order price |

| Occurs When | Market quotes are displayed | Market volatility or low liquidity |

| Impact on Traders | Fixed or variable trading cost | Unexpected price movement, increased cost |

| Common in | Forex, CFDs, stocks | Fast markets, news releases, large orders |

| Control | Usually fixed or tight spreads with good brokers | Hard to control, managed with limit orders |

| Effect on Trading Strategy | Impacts entry and exit cost calculation | Can cause slippage loss or gain depending on price movement |

Understanding Spread and Slippage in Trading

Spread represents the difference between the bid and ask prices, acting as an implicit cost in trading, while slippage refers to the price change experienced between order placement and execution. Traders must account for spread and slippage to accurately assess transaction costs and the true entry or exit price during volatile market conditions. Monitoring liquidity and using limit orders can help minimize slippage, whereas spreads vary with market conditions and broker policies.

Key Differences Between Spread and Slippage

Spread refers to the fixed difference between the bid and ask price set by the broker, representing the cost of entering a trade, while slippage occurs when an order is executed at a different price than expected due to market volatility or liquidity gaps. Spread is predictable and generally stable in liquid markets, whereas slippage is unpredictable and often happens during high volatility or low liquidity conditions. Understanding these distinctions helps traders manage execution costs and optimize trading strategies effectively.

How Spread Impacts Your Trading Costs

Spread directly affects trading costs by representing the difference between the bid and ask prices, which traders pay when entering or exiting a position. Wider spreads increase the cost of each trade, reducing overall profitability, especially in high-frequency or low-margin strategies. Understanding the spread is crucial for managing expenses and optimizing execution in forex, stocks, and commodities markets.

Slippage: What It Is and Why It Happens

Slippage occurs when a trade is executed at a different price than expected, often during periods of high volatility or low liquidity. This price discrepancy arises due to rapid market movements or delays in order processing, causing traders to receive less favorable prices. Understanding slippage helps traders anticipate potential costs and implement strategies like limit orders to minimize its impact.

Types of Spread: Fixed vs Variable

Fixed spreads remain constant regardless of market conditions, providing predictability and stability for traders in forex and CFD markets. Variable spreads fluctuate based on market volatility and liquidity, often widening during high-impact news events or low liquidity periods, which can increase trading costs. Understanding the differences between fixed and variable spreads helps traders optimize strategies by balancing execution certainty with potential cost efficiency in dynamic trading environments.

Factors Influencing Slippage in the Markets

Slippage in trading is influenced by market volatility, liquidity levels, and order size, causing execution prices to deviate from expected values. During high volatility or low liquidity periods, price gaps can widen, increasing the likelihood of slippage. Large orders exacerbate this effect as they may consume available liquidity at the desired price, pushing execution to less favorable levels.

Strategies to Minimize Spread and Slippage

Effective strategies to minimize spread and slippage include trading during peak market hours when liquidity is highest and spreads are narrowest. Utilizing limit orders instead of market orders helps control entry prices and reduce slippage. Employing advanced trading algorithms and monitoring economic news releases can further optimize trade execution and mitigate adverse price movements.

The Role of Liquidity in Spread and Slippage

Liquidity directly impacts both spread and slippage in trading by determining the ease of executing buy or sell orders without causing significant price changes. Higher liquidity typically results in narrower spreads due to more market participants offering competitive prices, while low liquidity can increase slippage as large orders move the market price away from the expected execution level. Traders prioritize liquid markets to minimize transaction costs and reduce the risk of adverse price movements during order execution.

Measuring the Impact of Spread and Slippage on Profitability

Spread represents the difference between the bid and ask price, directly impacting trading costs by increasing the entry and exit price gap. Slippage occurs when orders are executed at a price different from the expected, often during volatile market conditions, causing unplanned losses or reduced profits. Measuring their impact requires analyzing trade execution data to quantify cost deviations and assessing how these factors affect overall trading profitability and strategy efficiency.

Choosing the Right Broker: Spread and Slippage Considerations

Selecting the right broker requires careful evaluation of both spread and slippage to minimize trading costs and optimize execution quality. Narrow spreads reduce entry costs, while low slippage ensures trades execute close to expected prices, especially in volatile markets. Prioritize brokers with transparent pricing, high liquidity, and robust order execution technology to enhance overall trading performance.

Important Terms

Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, directly impacting trading costs and liquidity. Slippage occurs when a market order executes at a price different from the expected bid-ask spread, often caused by market volatility and order size exceeding available liquidity at the quoted prices.

Market Impact

Market impact refers to the effect that a large trade has on the asset's price, often causing the spread between bid and ask prices to widen temporarily. Slippage occurs when the execution price deviates from the expected price due to market impact and liquidity constraints during order fulfillment.

Order Execution

Order execution quality is critically influenced by the spread and slippage, where the spread represents the difference between the bid and ask prices, directly affecting transaction costs, and slippage occurs when an order is filled at a price different from the expected level due to market volatility. Tight spreads minimize initial trading costs, but high slippage can erode potential profits by causing orders to execute at less favorable prices, especially in fast-moving or illiquid markets.

Liquidity Provider

Liquidity providers enhance market efficiency by supplying assets that narrow spreads, reducing the cost of trading for market participants. Low spreads minimize the difference between bid and ask prices, while adequate liquidity mitigates slippage by ensuring orders execute closer to desired prices.

Price Deviation

Price deviation in trading refers to the difference between the expected price and the actual execution price, often caused by spread and slippage. While spread is the fixed cost represented by the bid-ask gap, slippage occurs when market volatility causes execution at a less favorable price, increasing the overall cost beyond the initial spread.

Fill Price

Fill price reflects the actual execution cost of a trade, influenced by the spread, which is the difference between the bid and ask price, and slippage, the deviation from the expected price due to market volatility or order size. Traders experience tighter spreads under normal conditions but may encounter increased slippage during high volatility or low liquidity, impacting the final fill price.

Latency Arbitrage

Latency arbitrage exploits the time delay between price updates across different trading platforms, capitalizing on spreads before slippage occurs. By executing trades faster than market adjustments, traders capture profits from temporary price discrepancies, effectively turning low spreads into immediate gains despite potential slippage risks.

Market Depth

Market depth reveals the volume of buy and sell orders at varying price levels, directly influencing the bid-ask spread and slippage experienced during trades. Tighter spreads indicate higher liquidity and lower slippage, while shallow market depth often leads to wider spreads and increased slippage risks.

Order Book Dynamics

Order book dynamics directly influence the relationship between spread and slippage, as narrower bid-ask spreads typically reduce slippage during trade execution. High-frequency changes in order placement and cancellation affect liquidity depth, causing variations in both spread and the realized slippage experienced by traders.

Execution Quality

Execution quality is critical in assessing trading performance, where tight spreads reduce initial costs but slippage reflects the real price impact during order execution. Low slippage combined with narrow spreads ensures optimal trade execution, minimizing hidden costs and maximizing returns.

spread vs slippage Infographic

moneydif.com

moneydif.com