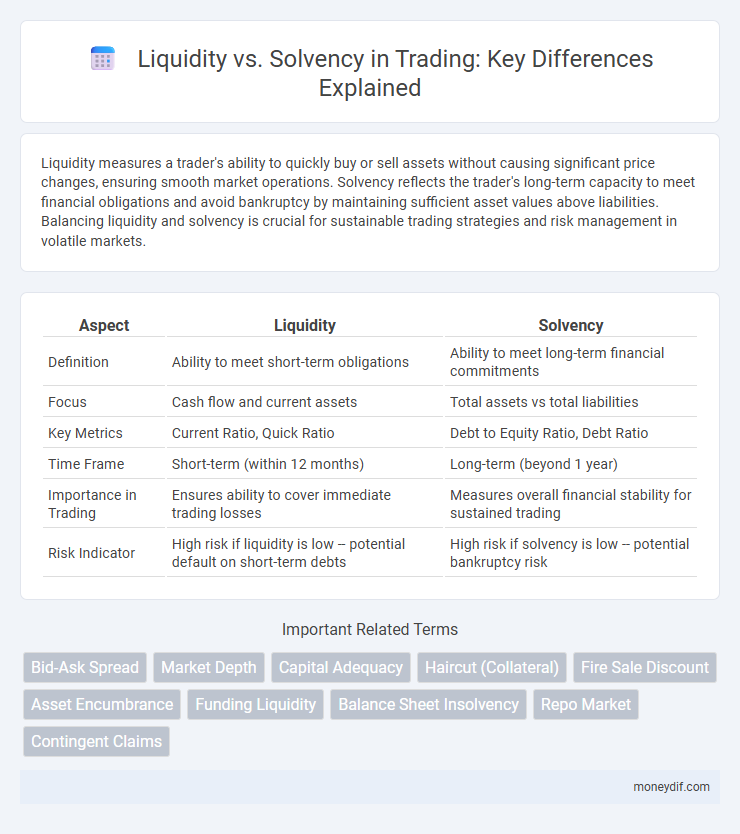

Liquidity measures a trader's ability to quickly buy or sell assets without causing significant price changes, ensuring smooth market operations. Solvency reflects the trader's long-term capacity to meet financial obligations and avoid bankruptcy by maintaining sufficient asset values above liabilities. Balancing liquidity and solvency is crucial for sustainable trading strategies and risk management in volatile markets.

Table of Comparison

| Aspect | Liquidity | Solvency |

|---|---|---|

| Definition | Ability to meet short-term obligations | Ability to meet long-term financial commitments |

| Focus | Cash flow and current assets | Total assets vs total liabilities |

| Key Metrics | Current Ratio, Quick Ratio | Debt to Equity Ratio, Debt Ratio |

| Time Frame | Short-term (within 12 months) | Long-term (beyond 1 year) |

| Importance in Trading | Ensures ability to cover immediate trading losses | Measures overall financial stability for sustained trading |

| Risk Indicator | High risk if liquidity is low -- potential default on short-term debts | High risk if solvency is low -- potential bankruptcy risk |

Understanding Liquidity in Trading

Liquidity in trading refers to the ease with which assets can be quickly bought or sold in the market without causing significant price fluctuations. High liquidity ensures traders can enter or exit positions efficiently, minimizing slippage and transaction costs. Understanding liquidity is crucial for managing risk and executing trades effectively in volatile markets.

Defining Solvency in Financial Markets

Solvency in financial markets refers to a trader's or institution's ability to meet long-term debt obligations and sustain operations without defaulting. It is measured by analyzing balance sheet metrics such as the debt-to-equity ratio, current assets versus total liabilities, and net worth. Maintaining solvency ensures long-term market viability and reduces the risk of bankruptcy during periods of financial stress.

Key Differences Between Liquidity and Solvency

Liquidity measures a trader's ability to quickly convert assets into cash to meet short-term obligations, emphasizing immediate financial flexibility. Solvency evaluates the overall financial health by comparing total assets to total liabilities, indicating long-term sustainability and risk of bankruptcy. Key differences lie in the time frame assessed and the nature of financial stability, with liquidity focusing on short-term cash flow and solvency addressing long-term debt coverage.

The Importance of Liquidity for Traders

Liquidity is crucial for traders as it ensures the ability to quickly buy or sell assets without causing significant price fluctuations, maintaining market stability. High liquidity reduces transaction costs and slippage, enabling traders to execute orders efficiently and capitalize on market opportunities. Solvency indicates long-term financial health, but liquidity directly impacts a trader's capacity to manage risk and meet margin calls in volatile markets.

The Role of Solvency in Long-Term Trading Success

Solvency ensures a trader's ability to meet long-term financial obligations, providing stability beyond immediate liquidity needs. Maintaining solvency reduces the risk of forced asset sales during market downturns, preserving capital for future trading opportunities. Strong solvency ratios enable sustainable growth and resilience in volatile trading environments.

Liquidity Risks: Causes and Consequences

Liquidity risks in trading arise primarily from sudden market volatility, reduced market depth, or unexpected large transactions that hinder the ability to execute trades at desired prices. Insufficient liquidity can lead to widened bid-ask spreads, price slippage, and increased transaction costs, eroding profit margins. Persistent liquidity shortfalls may force traders to liquidate positions at unfavorable prices, exacerbating losses and potentially triggering solvency issues.

Solvency Challenges and Their Market Impact

Solvency challenges arise when a trading firm's liabilities exceed its assets, leading to potential default risks and reduced market confidence. These solvency issues can trigger forced asset liquidations, resulting in increased volatility and disrupted market liquidity. Persistent solvency problems may escalate systemic risk, affecting not only individual traders but also broader financial market stability.

Assessing Liquidity vs Solvency in Trading Strategies

Assessing liquidity versus solvency in trading strategies involves analyzing short-term asset availability to cover immediate liabilities and evaluating long-term financial stability to sustain operations during market volatility. High liquidity ensures traders can execute transactions swiftly without significant price impact, while strong solvency indicates the capacity to meet long-term debt obligations, reducing bankruptcy risk. Effective trading strategies balance liquidity management with solvency assessment to optimize risk mitigation and capitalize on market opportunities.

Liquidity and Solvency Indicators to Monitor

Monitoring liquidity indicators such as the current ratio and quick ratio provides critical insights into a company's ability to meet short-term obligations, reflecting its operational efficiency and financial health in trading environments. Solvency indicators like the debt-to-equity ratio and interest coverage ratio assess long-term financial stability, guiding investors on the firm's capacity to sustain operations and grow amidst market fluctuations. Regular analysis of these liquidity and solvency metrics enables traders to make informed decisions, balancing risk and opportunity in dynamic markets.

Best Practices for Balancing Liquidity and Solvency

Maintaining an optimal balance between liquidity and solvency is crucial for sustainable trading operations, ensuring that traders can meet short-term obligations without compromising long-term financial health. Best practices include regularly monitoring cash flow metrics, maintaining sufficient liquid assets, and strategically managing debt levels to avoid insolvency risks. Employing robust risk management tools and stress-testing financial positions helps traders adapt to market volatility while preserving capital adequacy.

Important Terms

Bid-Ask Spread

The bid-ask spread narrows with higher liquidity, reflecting easier asset turnover, while solvency impacts the ability to meet long-term obligations but does not directly influence the bid-ask spread.

Market Depth

Market depth directly impacts liquidity by showing the volume of available buy and sell orders, which influences a company's ability to meet short-term liabilities and maintain solvency.

Capital Adequacy

Capital adequacy measures a bank's ability to absorb losses and supports both liquidity, ensuring short-term asset availability, and solvency, maintaining long-term financial stability.

Haircut (Collateral)

Understanding haircut on collateral is crucial for managing liquidity as it determines the asset's loan-to-value ratio, directly impacting solvency by mitigating credit risk exposure.

Fire Sale Discount

A fire sale discount occurs when assets are sold quickly at reduced prices to improve liquidity, often risking long-term solvency by undervaluing the firm's total asset base.

Asset Encumbrance

Asset encumbrance reduces available collateral, directly impacting liquidity by restricting asset use while increasing solvency risk through limited creditor protection.

Funding Liquidity

Funding liquidity directly impacts a firm's ability to meet short-term obligations, distinguishing it from solvency, which measures long-term financial stability and asset-liability balance.

Balance Sheet Insolvency

Balance sheet insolvency occurs when a company's total liabilities exceed its total assets, indicating a lack of solvency despite potentially having short-term liquidity.

Repo Market

The repo market provides short-term liquidity by allowing institutions to sell securities with an agreement to repurchase, helping maintain solvency through efficient cash flow management.

Contingent Claims

Contingent claims analysis assesses liquidity risk by evaluating the probability of default and insolvency costs under various financial stress scenarios.

Liquidity vs Solvency Infographic

moneydif.com

moneydif.com