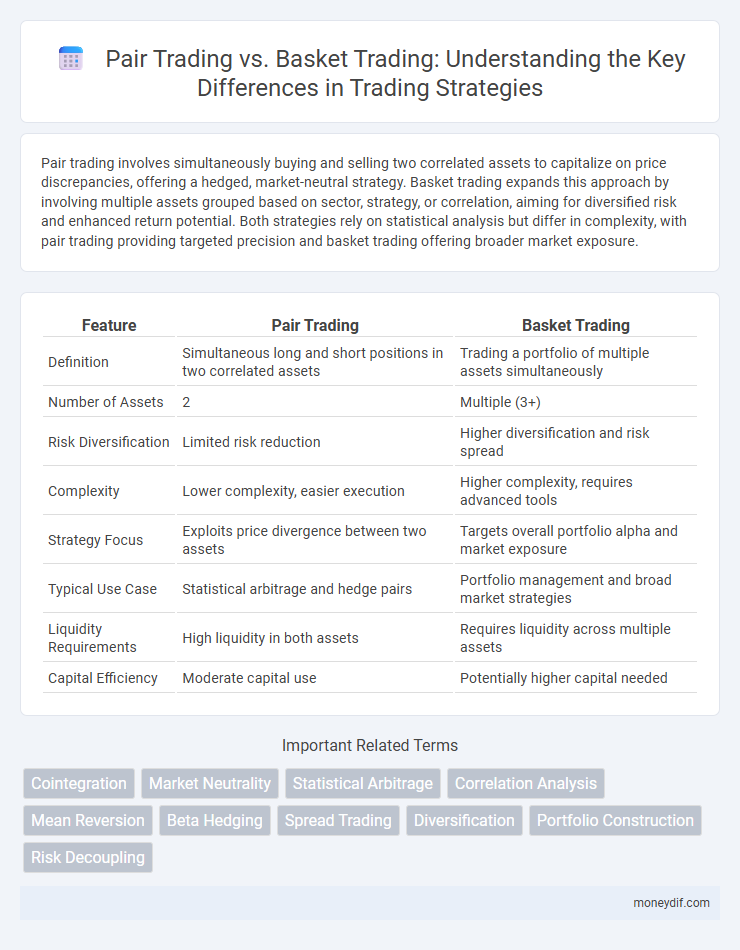

Pair trading involves simultaneously buying and selling two correlated assets to capitalize on price discrepancies, offering a hedged, market-neutral strategy. Basket trading expands this approach by involving multiple assets grouped based on sector, strategy, or correlation, aiming for diversified risk and enhanced return potential. Both strategies rely on statistical analysis but differ in complexity, with pair trading providing targeted precision and basket trading offering broader market exposure.

Table of Comparison

| Feature | Pair Trading | Basket Trading |

|---|---|---|

| Definition | Simultaneous long and short positions in two correlated assets | Trading a portfolio of multiple assets simultaneously |

| Number of Assets | 2 | Multiple (3+) |

| Risk Diversification | Limited risk reduction | Higher diversification and risk spread |

| Complexity | Lower complexity, easier execution | Higher complexity, requires advanced tools |

| Strategy Focus | Exploits price divergence between two assets | Targets overall portfolio alpha and market exposure |

| Typical Use Case | Statistical arbitrage and hedge pairs | Portfolio management and broad market strategies |

| Liquidity Requirements | High liquidity in both assets | Requires liquidity across multiple assets |

| Capital Efficiency | Moderate capital use | Potentially higher capital needed |

Introduction to Pair Trading and Basket Trading

Pair trading is a market-neutral strategy involving simultaneous buying and selling of two correlated assets to exploit price divergences and achieve profit regardless of market direction. Basket trading expands this approach by executing trades across a portfolio of multiple securities, enhancing diversification and risk management. Both strategies rely on statistical analysis and correlation to identify trading opportunities and minimize exposure to market volatility.

Core Concepts: How Pair and Basket Trading Work

Pair trading involves simultaneously buying and selling two correlated assets to exploit price discrepancies while minimizing market risk. Basket trading consists of trading a group of securities as a single entity, allowing diversification and exposure to broader market trends. Both strategies leverage statistical relationships, with pair trading focusing on relative value and basket trading on portfolio-level performance.

Key Differences Between Pair Trading and Basket Trading

Pair trading involves simultaneously buying one asset and selling another to capitalize on relative price movements, typically focusing on two correlated securities. Basket trading encompasses trading a group of multiple assets as a single portfolio, enabling diversification and exposure to broader market segments. Key differences include the number of securities involved, the complexity of risk management, and the trading strategy's focus on individual pairs versus collective asset behavior.

Advantages of Pair Trading Strategies

Pair trading strategies offer precise risk management by exploiting price divergences between two correlated assets, enhancing market-neutral positions. This approach reduces market exposure compared to basket trading, lowering systemic risk and improving profit consistency. Traders benefit from simplified execution and clearer entry and exit signals, optimizing capital efficiency in volatile markets.

Benefits of Basket Trading Approaches

Basket trading enables diversification by allowing simultaneous investment in multiple securities, reducing risk exposure compared to pair trading's reliance on two correlated assets. It enhances portfolio optimization through increased flexibility in asset selection and weighting, allowing for improved risk-adjusted returns. The approach also simplifies execution and monitoring by consolidating multiple trades into a single transaction, improving efficiency and cost-effectiveness.

Risk Management: Pair vs Basket Trading

Pair trading involves hedging risk by simultaneously buying and selling two correlated assets, reducing exposure to market fluctuations through relative value strategies. Basket trading diversifies risk by trading a group of multiple assets, spreading exposure across various securities to minimize the impact of any single asset's volatility. Effective risk management in pair trading centers on correlation stability, while basket trading emphasizes asset diversification and portfolio balance to mitigate systemic risks.

Market Conditions Favoring Each Strategy

Pair trading thrives in stable or sideways markets where correlated assets exhibit temporary divergences, allowing traders to exploit mean reversion with minimal directional risk. Basket trading performs better in trending markets or during sector rotations as it diversifies risk across multiple assets, capturing broader market movements and reducing idiosyncratic volatility. Market volatility favors basket trading due to its diversified exposure, while low volatility environments benefit pair trading's precision in capitalizing on relative value discrepancies.

Performance Metrics: Evaluating Results

Pair trading performance metrics focus on spread mean reversion, Sharpe ratio, and maximum drawdown to assess risk-adjusted returns and strategy stability. Basket trading evaluation emphasizes portfolio-level metrics such as overall return, diversification benefits measured by correlation coefficients, and value-at-risk (VaR) for multi-asset risk assessment. Comparing the two, pair trading offers precision in exploiting relative mispricings, while basket trading provides broader risk distribution and potential for enhanced cumulative returns.

Common Pitfalls and Challenges

Pair trading and basket trading both involve relative value strategies but face distinct challenges; pair trading struggles with accurately identifying cointegrated asset pairs, leading to model risk and potential losses. Basket trading requires managing higher complexity due to larger asset groups, increasing transaction costs and the difficulty of maintaining balanced exposures. Both strategies demand rigorous risk management to address market volatility and execution risks inherent in mean reversion tactics.

Choosing the Right Strategy for Your Portfolio

Pair trading involves simultaneous long and short positions in two highly correlated assets, aiming to profit from price divergences while minimizing market risk. Basket trading diversifies exposure by trading a group of correlated securities, enhancing risk distribution and portfolio stability. Selecting the right strategy depends on risk tolerance, market conditions, and the desired level of diversification to optimize portfolio performance.

Important Terms

Cointegration

Cointegration is a statistical property crucial for pair trading, as it identifies pairs of securities whose prices move together over time, enabling traders to exploit mean-reverting relationships and reduce risk. In contrast, basket trading extends this concept by applying cointegration analysis to multiple securities simultaneously, enhancing diversification and potentially improving the stability of returns in a broader portfolio.

Market Neutrality

Market neutrality aims to eliminate systematic risk by balancing long and short positions, where pair trading focuses on exploiting price discrepancies between two correlated assets, while basket trading diversifies risk across multiple securities to capture broader market inefficiencies. Pair trading offers higher precision in isolating relative value opportunities, whereas basket trading enhances diversification and reduces idiosyncratic risk through a portfolio of paired positions.

Statistical Arbitrage

Statistical arbitrage leverages quantitative models to exploit price discrepancies, with pair trading focusing on two correlated assets and basket trading involving a portfolio of multiple securities to diversify risk and enhance return potential. Pair trading provides simplicity and lower transaction costs, while basket trading captures broader market inefficiencies and reduces idiosyncratic risk through diversification.

Correlation Analysis

Correlation analysis is essential in pair trading to identify two assets with historically strong positive or negative correlations, enabling profitable mean-reversion strategies. In basket trading, correlation matrices among multiple securities optimize portfolio diversification and hedging efficiency by minimizing unsystematic risk.

Mean Reversion

Mean reversion strategies leverage the tendency of asset prices to return to their historical averages, making pair trading effective by exploiting price divergences between two correlated securities for profit. Basket trading expands on this concept by monitoring and trading a group of correlated assets, allowing for diversified risk and opportunities to capitalize on mean reversion across multiple securities simultaneously.

Beta Hedging

Beta hedging in pair trading involves neutralizing market risk by offsetting the beta exposure of two correlated assets, typically a long position and a short position in a closely related pair. In contrast, basket trading applies beta hedging across a diversified portfolio of multiple assets, aiming to minimize systematic risk while capturing relative value opportunities within a broader market segment.

Spread Trading

Spread trading involves simultaneously buying and selling related securities to capitalize on price differentials, with pair trading focusing on two correlated assets to exploit relative value changes, while basket trading expands this concept by managing positions across a group of securities to diversify risk and capture broader market trends. Pair trading typically offers tighter control and lower capital requirements, whereas basket trading leverages diversification to reduce idiosyncratic risk and enhance returns through multiple asset correlations.

Diversification

Diversification in pair trading involves simultaneously taking opposite positions in two correlated assets to hedge risk, while basket trading diversifies risk by managing a portfolio of multiple securities to capture broader market trends. Basket trading offers enhanced risk distribution and reduced exposure to idiosyncratic asset fluctuations compared to the more focused approach of pair trading.

Portfolio Construction

Portfolio construction in pair trading focuses on creating market-neutral positions by selecting two highly correlated assets to exploit relative price movements, minimizing systematic risk. In contrast, basket trading involves assembling a diversified group of multiple securities to capture broader market trends and diversify idiosyncratic risks, enhancing overall portfolio stability.

Risk Decoupling

Risk decoupling in pair trading involves isolating market-neutral positions by trading two correlated assets to exploit pricing inefficiencies while minimizing systematic risk exposure. In contrast, basket trading diversifies risk across multiple securities, enabling broader exposure but often with less precision in isolating specific asset risks compared to pair trading.

Pair Trading vs Basket Trading Infographic

moneydif.com

moneydif.com