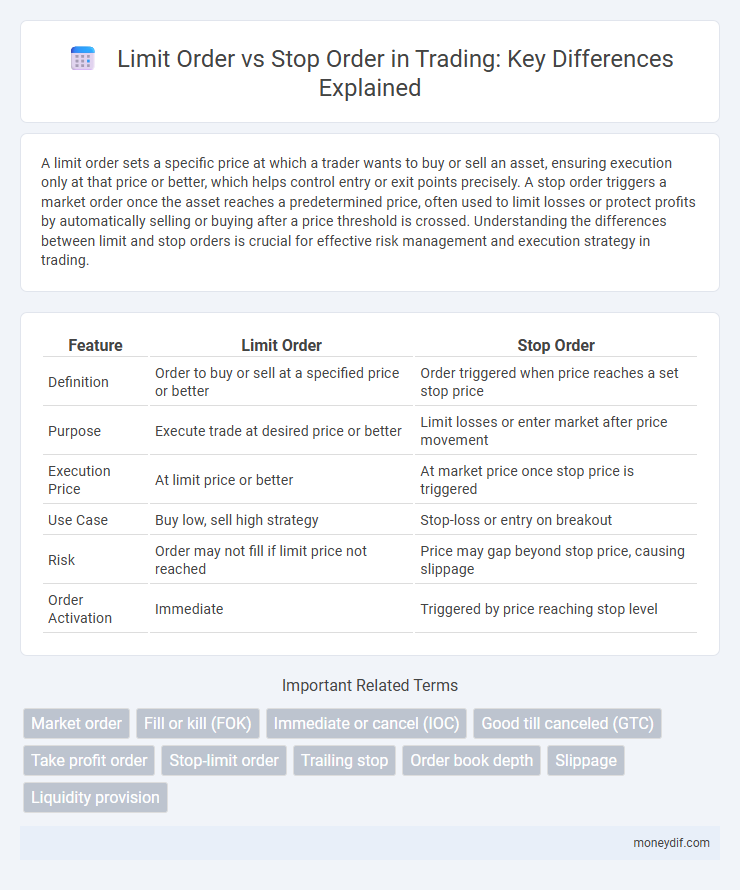

A limit order sets a specific price at which a trader wants to buy or sell an asset, ensuring execution only at that price or better, which helps control entry or exit points precisely. A stop order triggers a market order once the asset reaches a predetermined price, often used to limit losses or protect profits by automatically selling or buying after a price threshold is crossed. Understanding the differences between limit and stop orders is crucial for effective risk management and execution strategy in trading.

Table of Comparison

| Feature | Limit Order | Stop Order |

|---|---|---|

| Definition | Order to buy or sell at a specified price or better | Order triggered when price reaches a set stop price |

| Purpose | Execute trade at desired price or better | Limit losses or enter market after price movement |

| Execution Price | At limit price or better | At market price once stop price is triggered |

| Use Case | Buy low, sell high strategy | Stop-loss or entry on breakout |

| Risk | Order may not fill if limit price not reached | Price may gap beyond stop price, causing slippage |

| Order Activation | Immediate | Triggered by price reaching stop level |

Limit Order vs Stop Order: Key Differences

Limit orders specify the exact price at which a trader wants to buy or sell an asset, ensuring the order executes only at the designated price or better. Stop orders become market orders once a predetermined price, known as the stop price, is reached, aiming to limit losses or capture profits during market movements. The key difference lies in execution certainty: limit orders guarantee price but not execution, while stop orders guarantee execution but not price.

How Limit Orders Work in Trading

Limit orders in trading specify the exact price at which a trader wants to buy or sell an asset, ensuring execution only at the designated price or better. This type of order provides price control and helps manage risk by preventing trades at unfavorable prices during market volatility. Traders use limit orders to optimize entry and exit points, especially in highly liquid markets like stocks, forex, and cryptocurrencies.

How Stop Orders Function in the Market

Stop orders activate a market order once a specified price, known as the stop price, is reached, triggering immediate execution. This mechanism helps traders limit losses or enter positions in trending markets by automatically buying or selling when the market moves against their predefined threshold. Unlike limit orders that execute at a set price or better, stop orders ensure execution but may experience slippage in volatile markets.

Pros and Cons of Limit Orders

Limit orders provide traders control over the execution price by setting a specific entry or exit point, which helps avoid unfavorable market prices and slippage. They offer price certainty but carry the risk of non-execution if the market price never reaches the limit level, potentially missing trading opportunities. Limit orders are ideal in volatile markets where precise price targeting is essential, but may result in delayed trades during rapidly moving conditions.

Advantages and Disadvantages of Stop Orders

Stop orders allow traders to automate the selling or buying of assets once a specified price is reached, helping to limit losses and lock in profits. However, stop orders can trigger at unfavorable prices during volatile market conditions due to slippage, potentially causing unexpected losses. Unlike limit orders, stop orders do not guarantee execution at the exact stop price, which can be a significant disadvantage in fast-moving markets.

When to Use a Limit Order

Use a limit order when you want to buy or sell a security at a specific price or better, ensuring you don't overpay or undersell. Limit orders are ideal in volatile markets where price control is crucial, preventing execution at unfavorable prices. This type of order provides price certainty but does not guarantee execution, unlike stop orders which trigger market orders once the stop price is reached.

When to Place a Stop Order

Place a stop order when aiming to limit losses or protect profits by triggering a market or limit order once a specified price level is reached. This is particularly useful in volatile markets where prices can rapidly move against your position. Unlike limit orders that execute at a predetermined price or better, stop orders activate only after the stop price is hit, enabling disciplined exit strategies.

Limit and Stop Orders: Impact on Trading Strategy

Limit orders allow traders to specify the exact price at which they want to buy or sell an asset, enabling precise entry and exit points that minimize slippage and maximize profit potential. Stop orders trigger market orders once a predefined price is reached, providing a mechanism for risk management by automatically limiting losses or locking in gains. Integrating limit and stop orders into trading strategies enhances control over trade execution, supports disciplined decision-making, and improves overall portfolio performance.

Risk Management: Choosing Between Limit and Stop Orders

Limit orders help traders control entry and exit prices by setting precise levels, reducing slippage and managing risk effectively. Stop orders trigger market orders once a specific price is reached, offering protection against significant losses but carrying the risk of price gaps. Selecting between limit and stop orders depends on balancing execution certainty with price control to optimize risk management strategies.

Common Mistakes with Limit and Stop Orders

Common mistakes with limit and stop orders include setting limit prices too far from the current market price, which can result in missed trading opportunities or unexecuted orders. Traders often place stop orders without accounting for market volatility, leading to premature triggers and unexpected losses during price fluctuations. Failing to regularly review and adjust these orders in fast-moving markets increases the risk of execution at unfavorable prices or missing strategic entry and exit points.

Important Terms

Market order

A market order executes immediately at the best available price, offering speed but less price control compared to limit orders, which set a specific price to buy or sell, ensuring price certainty but no guarantee of execution. Stop orders activate a market order once a specified price is reached, serving as a risk management tool to limit losses or protect profits by triggering automatic trades.

Fill or kill (FOK)

Fill or Kill (FOK) is a type of limit order that must be executed immediately in its entirety or canceled, ensuring no partial fills, unlike stop orders which trigger a market order once a specified price is reached. FOK orders optimize precise entry or exit points in volatile markets, while stop orders primarily serve as risk management tools by activating trades after price movements.

Immediate or cancel (IOC)

An Immediate or Cancel (IOC) order requires that all or part of the order is executed immediately at the specified limit price or better, with any unfilled portion being canceled, contrasting with stop orders that activate a market or limit order only after the trigger price is reached. Unlike stop orders designed to initiate trades based on price movement, IOC limit orders prioritize immediate execution within price constraints without waiting for specific price triggers.

Good till canceled (GTC)

Good Till Canceled (GTC) orders remain active until executed or manually canceled, allowing limit orders to set a specific price ceiling or floor for buying or selling assets. In contrast, GTC stop orders trigger a market order only after reaching a predetermined stop price, providing a mechanism for automated exit or entry strategies.

Take profit order

A take profit order is a type of limit order designed to automatically sell a security when it reaches a specified price, securing gains by closing the position at a target profit level. Unlike stop orders, which trigger a market order once a stop price is hit and may result in slippage, take profit limit orders execute only at the set price or better, ensuring precise profit capture without unexpected execution prices.

Stop-limit order

A stop-limit order combines features of stop orders and limit orders by triggering a limit order once a specified stop price is reached, allowing traders to control the execution price within a predefined range. Unlike a limit order that is placed directly with a set price and executed immediately at that price or better, and a stop order that becomes a market order once triggered, the stop-limit order provides more precise control over trade execution to avoid slippage while managing risk.

Trailing stop

A trailing stop dynamically adjusts the stop price based on the asset's price movement, helping lock in profits while limiting losses. Unlike a limit order, which sets a specific execution price, a trailing stop functions as a stop order that activates only when the price moves unfavorably by a set amount, triggering a market or limit order.

Order book depth

Order book depth reflects the volume and price levels of limit orders available, indicating market liquidity and potential price support or resistance. Stop orders do not appear in the order book until triggered, as they convert to market or limit orders once specific price points are reached.

Slippage

Slippage occurs when the execution price of a trade deviates from the expected price, often seen in market orders but can impact stop orders due to price gaps or volatility before activation. Limit orders help prevent slippage by setting a maximum or minimum price, ensuring execution only at the specified price or better, though they may result in missed trades if the market doesn't reach the limit.

Liquidity provision

Liquidity provision is enhanced by limit orders as they rest on the order book, offering immediate opportunities for traders to buy or sell at specified prices, thereby narrowing bid-ask spreads and stabilizing markets. In contrast, stop orders activate only when certain price levels are breached, typically absorbing liquidity by converting into market orders, which can lead to increased volatility and less predictable liquidity dynamics.

limit order vs stop order Infographic

moneydif.com

moneydif.com