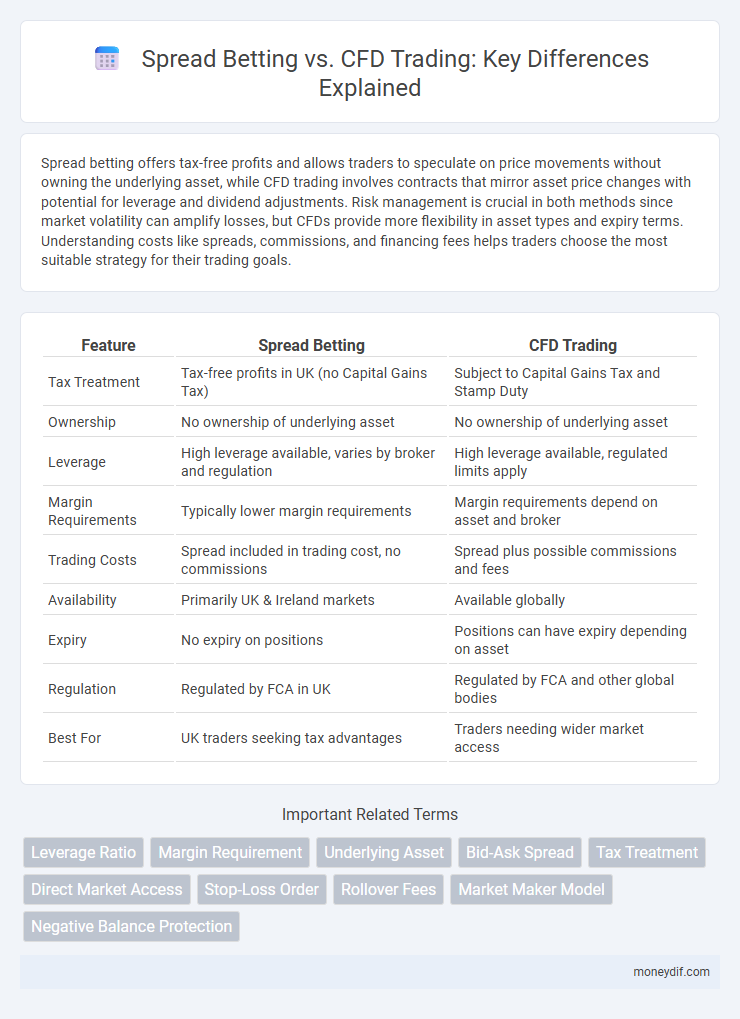

Spread betting offers tax-free profits and allows traders to speculate on price movements without owning the underlying asset, while CFD trading involves contracts that mirror asset price changes with potential for leverage and dividend adjustments. Risk management is crucial in both methods since market volatility can amplify losses, but CFDs provide more flexibility in asset types and expiry terms. Understanding costs like spreads, commissions, and financing fees helps traders choose the most suitable strategy for their trading goals.

Table of Comparison

| Feature | Spread Betting | CFD Trading |

|---|---|---|

| Tax Treatment | Tax-free profits in UK (no Capital Gains Tax) | Subject to Capital Gains Tax and Stamp Duty |

| Ownership | No ownership of underlying asset | No ownership of underlying asset |

| Leverage | High leverage available, varies by broker and regulation | High leverage available, regulated limits apply |

| Margin Requirements | Typically lower margin requirements | Margin requirements depend on asset and broker |

| Trading Costs | Spread included in trading cost, no commissions | Spread plus possible commissions and fees |

| Availability | Primarily UK & Ireland markets | Available globally |

| Expiry | No expiry on positions | Positions can have expiry depending on asset |

| Regulation | Regulated by FCA in UK | Regulated by FCA and other global bodies |

| Best For | UK traders seeking tax advantages | Traders needing wider market access |

Introduction to Spread Betting and CFD Trading

Spread betting and CFD trading are popular methods for speculating on financial markets without owning the underlying assets. Spread betting involves wagering on the price movement of assets with profits or losses based on the accuracy of the prediction, often benefiting from tax advantages in certain jurisdictions. CFDs, or Contracts for Difference, enable traders to gain exposure to price movements of stocks, indices, commodities, and forex, offering flexibility with leverage and the ability to go long or short.

Key Differences Between Spread Betting and CFDs

Spread betting allows traders to speculate on price movements without owning the underlying asset, often benefiting from tax-free profits in some jurisdictions. In contrast, CFD trading involves entering contracts to exchange the difference in asset price, with traders liable for capital gains tax but able to access a wider range of markets and leverage options. Key differences include tax treatment, regulatory frameworks, and flexibility in trading hours, impacting margin requirements and risk exposure for investors.

How Spread Betting Works

Spread betting involves speculating on the price movement of financial instruments without owning the underlying asset, allowing traders to profit from rising or falling markets. The stake is placed per point movement within a quoted spread, with profits or losses determined by the difference between the opening and closing prices. This method offers tax-free benefits in certain jurisdictions, making it a popular choice for leveraged trading in markets like forex, indices, and commodities.

How CFD Trading Works

CFD trading involves speculating on price movements of financial assets without owning the underlying security, leveraging margin to amplify potential returns and risks. Traders enter contracts reflecting the difference between opening and closing prices, allowing profit from both rising and falling markets. This flexibility makes CFDs a popular tool for hedging and short-term speculation in forex, stocks, commodities, and indices.

Tax Implications: Spread Betting vs CFD Trading

Spread betting profits are typically tax-free in the UK as they are classified as gambling winnings, whereas CFD trading gains are subject to Capital Gains Tax. Traders using CFDs must report their profits and may offset losses against gains to reduce tax liabilities. Understanding the differing tax treatments between spread betting and CFD trading is essential for effective financial planning and compliance.

Leverage and Margin Comparison

Spread betting offers tax-free leverage with lower margin requirements, typically around 5-10%, allowing traders to control larger positions with less capital. CFD trading also provides leverage but usually requires slightly higher margins, often starting at 10%, which can increase exposure but also risk. Both instruments amplify potential gains and losses, making margin management crucial for effective risk control.

Costs and Fees in Spread Betting and CFDs

Spread betting typically involves no commission fees, with costs embedded in the wider spreads, making it cost-effective for short-term traders. CFD trading often includes commission fees on shares and overnight financing charges on leveraged positions, which can increase overall trading expenses. Understanding the fee structure in both spread betting and CFDs is crucial for managing trading costs and optimizing profitability.

Risk Management Strategies

Spread betting offers tax-free trading benefits but involves overnight financing costs that can escalate risk exposure; implementing tight stop-loss orders and position size limits is essential for risk control. CFD trading allows for leveraged positions with margin requirements that can amplify both gains and losses, making it critical to use guaranteed stops and hedge strategies to manage downside risk effectively. Both instruments require continuous monitoring of market volatility and disciplined adherence to risk-reward ratios to prevent excessive capital erosion.

Regulatory Considerations and Legal Status

Spread betting is regulated primarily in the UK and Ireland, where it enjoys tax-free status on profits due to its classification as gambling rather than financial trading. CFD trading is more widely regulated across global markets, including the US, with firms required to adhere to stringent financial regulations and investor protection rules. Legal status varies significantly, with CFD trading often restricted or banned in certain countries, while spread betting remains limited to jurisdictions where gambling laws permit its operation.

Which Is Better: Spread Betting or CFD Trading?

Spread betting offers tax-free profits in the UK and allows flexible stake sizes, making it ideal for short-term traders seeking leveraged exposure without ownership of underlying assets. CFD trading provides broader market access and the ability to hold positions overnight with varying margin requirements, appealing to investors aiming for long-term strategies and portfolio diversification. Choosing between spread betting and CFDs depends on individual risk tolerance, tax considerations, and preferred market exposure.

Important Terms

Leverage Ratio

The Leverage Ratio in spread betting typically allows traders to control larger positions with a smaller margin compared to CFD trading, enhancing potential gains but also increasing risk exposure. Spread betting often provides tax advantages and greater flexibility, while CFDs offer direct ownership of underlying assets and more diverse market access, influencing the choice of leverage based on trading strategy and risk tolerance.

Margin Requirement

Margin requirements in spread betting are typically lower than in CFD trading, allowing traders to control larger positions with less capital. This difference stems from spread betting's tax advantages and regulatory framework, whereas CFDs often require higher margin levels due to increased risk management protocols.

Underlying Asset

Underlying assets in spread betting and CFD trading include stocks, indices, commodities, and forex, serving as the core instruments whose price movements determine profit or loss. While both trading methods rely on the same underlying markets, spread betting offers tax advantages in some regions, whereas CFDs provide greater flexibility in stop-loss orders and leverage options.

Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, directly impacting trading costs in both spread betting and CFD trading. Spread betting typically features variable spreads influenced by market volatility, while CFD trading may offer tighter spreads but include additional commissions, affecting overall profitability.

Tax Treatment

Spread betting profits are typically tax-free in the UK as they are classified as gambling gains, whereas CFD trading profits are subject to Capital Gains Tax and Stamp Duty. Traders should consider the differing tax implications and reporting requirements when choosing between spread betting and CFD trading.

Direct Market Access

Direct Market Access (DMA) enables traders to execute spread betting and CFD trading orders directly on financial exchanges, reducing execution time and enhancing market transparency. DMA offers tighter spreads and lower latency compared to traditional trading platforms, making it ideal for professional traders seeking efficient access to equity, forex, and commodity markets.

Stop-Loss Order

Stop-loss orders in spread betting allow traders to limit losses by automatically closing positions when a specified price level is reached, similar to CFDs where stop-loss functionality is crucial for risk management. Both instruments use stop-loss orders to protect capital, but spread betting's tax-free status combined with leverage can amplify the importance of precise stop-loss settings compared to CFD trading.

Rollover Fees

Rollover fees in spread betting and CFD trading refer to the overnight interest charged or credited when positions are held open beyond a trading day, with CFD trading often applying separate interest rates for long and short positions based on underlying asset financing costs. Spread betting rollover fees can vary depending on the broker and asset class, typically calculated as a percentage of the notional position size, impacting overall profitability especially in prolonged trades.

Market Maker Model

The Market Maker model in Spread Betting involves the provider setting bid-ask spreads and taking the opposite side of client trades, often resulting in fixed spreads and potential conflicts of interest. In contrast, CFD Trading with Market Makers also features dealer-based pricing but may offer variable spreads and deeper liquidity pools, impacting trade execution and pricing transparency.

Negative Balance Protection

Negative Balance Protection ensures traders do not lose more than their account balance during highly volatile market conditions, a feature commonly offered in CFD trading platforms but less prevalent in spread betting. While spread betting traditionally exposes traders to potential negative balances due to leveraged positions, brokers increasingly integrate negative balance protection to limit exposure and promote safer trading environments.

Spread Betting vs CFD Trading Infographic

moneydif.com

moneydif.com