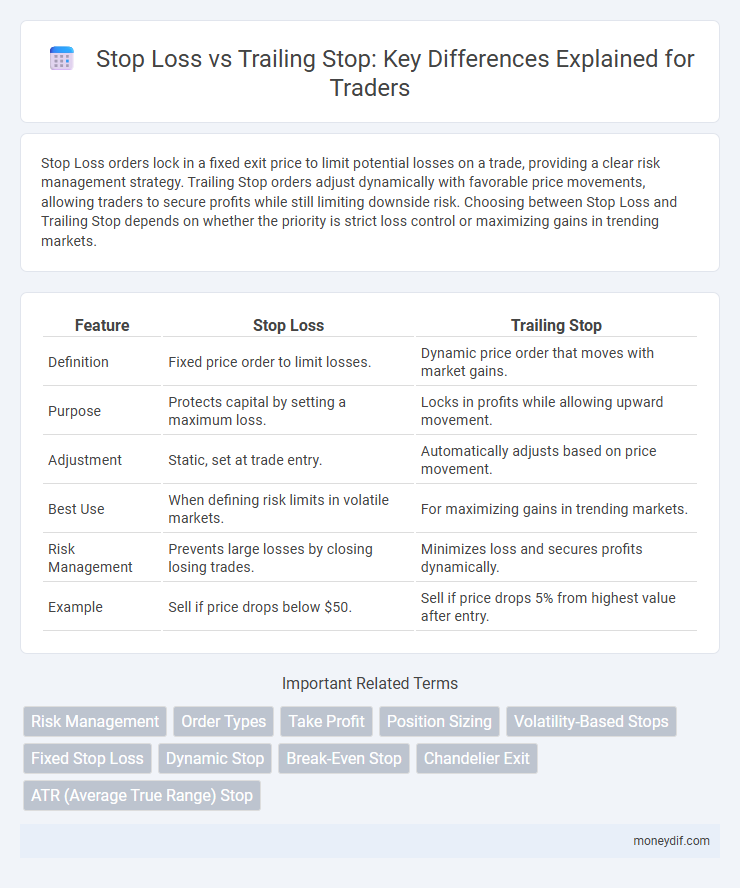

Stop Loss orders lock in a fixed exit price to limit potential losses on a trade, providing a clear risk management strategy. Trailing Stop orders adjust dynamically with favorable price movements, allowing traders to secure profits while still limiting downside risk. Choosing between Stop Loss and Trailing Stop depends on whether the priority is strict loss control or maximizing gains in trending markets.

Table of Comparison

| Feature | Stop Loss | Trailing Stop |

|---|---|---|

| Definition | Fixed price order to limit losses. | Dynamic price order that moves with market gains. |

| Purpose | Protects capital by setting a maximum loss. | Locks in profits while allowing upward movement. |

| Adjustment | Static, set at trade entry. | Automatically adjusts based on price movement. |

| Best Use | When defining risk limits in volatile markets. | For maximizing gains in trending markets. |

| Risk Management | Prevents large losses by closing losing trades. | Minimizes loss and secures profits dynamically. |

| Example | Sell if price drops below $50. | Sell if price drops 5% from highest value after entry. |

Understanding Stop Loss and Trailing Stop

Stop Loss is a predetermined price level which limits an investor's loss by automatically closing a position when the market moves against them. Trailing Stop adjusts dynamically with favorable price movements, locking in profits while still offering downside protection by following the price at a fixed percentage or amount. Understanding the fundamental differences between Stop Loss and Trailing Stop helps traders manage risk and optimize profit-taking strategies effectively.

Key Differences Between Stop Loss and Trailing Stop

Stop Loss is a fixed order placed to sell a security once it reaches a predetermined price, limiting potential losses by exiting the trade at a specific level. Trailing Stop adjusts dynamically with the asset's price movement, allowing profits to run while protecting gains by following the market price at a set distance. The main difference lies in Stop Loss providing a static exit point versus Trailing Stop offering a flexible, adaptive exit strategy that locks in profits as prices move favorably.

Advantages of Using Stop Loss Orders

Stop loss orders provide traders with a precise exit strategy by automatically closing positions at a predetermined price, effectively limiting potential losses in volatile markets. This risk management tool ensures discipline by preventing emotional decision-making during sudden market downturns. Stop loss orders offer greater predictability and protection, making them essential for maintaining capital and controlling downside risk in trading portfolios.

Benefits of Trailing Stop Orders

Trailing stop orders dynamically adjust the stop price as the market price moves in a favorable direction, helping traders lock in profits while limiting losses. This flexibility allows for maximizing gains during strong trends without manually updating orders. Compared to fixed stop loss orders, trailing stops provide adaptive risk management that aligns closely with market volatility and price momentum.

How to Set Effective Stop Loss Levels

Setting effective stop loss levels requires analyzing recent price volatility and identifying key support or resistance zones to minimize losses while allowing market fluctuations. Traders often use Average True Range (ATR) to position stop losses beyond normal market noise, ensuring they are neither too tight nor too loose. Incorporating trailing stops based on percentage thresholds or moving averages can dynamically adjust exit points, optimizing trade protection as the price moves favorably.

Strategies for Implementing Trailing Stops

Trailing stops dynamically adjust the stop loss price as the market price moves favorably, locking in profits while limiting downside risk. Effective strategies for implementing trailing stops include setting a fixed percentage or dollar amount below the current market price to allow flexibility during volatility. Traders often combine trailing stops with technical indicators like moving averages or support levels to optimize exit points and maximize gains.

Stop Loss vs Trailing Stop: Which Is Better for You?

Choosing between stop loss and trailing stop depends on your trading strategy and risk tolerance. Stop loss provides a fixed exit point to limit losses, ideal for conservative traders seeking strict risk control, while trailing stop adjusts dynamically with price movements, allowing profits to run during favorable trends. Assessing market volatility and personal risk management preferences helps determine which method aligns best with your trading goals.

Common Mistakes with Stop Loss and Trailing Stop

Many traders mistakenly place stop loss orders too close to the entry price, resulting in premature exits during normal market fluctuations. Failing to adjust trailing stops to reflect changing volatility can cause missed opportunities for maximizing profits or protecting gains. Ignoring market conditions and not using stop loss and trailing stop in conjunction often leads to suboptimal risk management and increased losses.

Best Practices for Risk Management in Trading

Implementing stop loss orders ensures fixed risk limits by automatically closing positions at predetermined price points, effectively minimizing potential losses. Trailing stops adjust dynamically with favorable price movements, locking in profits while still capping downside risk. Combining both strategies enhances risk management by allowing traders to protect gains and limit losses in volatile markets.

Real-Life Examples: Stop Loss and Trailing Stop in Action

A trader holding shares of Apple Inc. sets a stop loss at $140 to limit potential losses if the price drops from $150, while using a trailing stop at 5% below the current price to lock in profits as the stock climbs to $160. This approach allowed the trader to exit automatically at $152 if the price reversed, capturing gains without constant monitoring. Real-life examples like this demonstrate how stop loss prevents large losses, whereas trailing stops maximize profit by adjusting dynamically with favorable price movements.

Important Terms

Risk Management

Implementing stop loss orders limits potential losses at a fixed price point, while trailing stops dynamically adjust to secure profits by following market movements.

Order Types

Stop Loss orders trigger a market sale once a predetermined price is reached, limiting losses by exiting positions at a fixed point. Trailing Stop orders dynamically adjust the stop price based on asset price movements, locking in profits while allowing for upside potential.

Take Profit

Take Profit sets a fixed exit point for maximum gain, Stop Loss limits losses at a predetermined price, while Trailing Stop dynamically adjusts to lock in profits as the market moves favorably.

Position Sizing

Position sizing adjusts the number of shares or contracts based on the stop loss distance or trailing stop to optimize risk management and maximize returns.

Volatility-Based Stops

Volatility-based stops adjust stop loss levels dynamically according to market volatility, providing more adaptive risk management compared to fixed trailing stops.

Fixed Stop Loss

A fixed stop loss sets a predetermined exit price to limit losses, while a trailing stop dynamically adjusts to lock in profits as market prices move favorably.

Dynamic Stop

Dynamic Stop adjusts the Stop Loss level continuously based on price movements, unlike a fixed Stop Loss which remains static, while a Trailing Stop moves the exit point in a preset increment to lock in profits as the market price moves favorably.

Break-Even Stop

Break-Even Stop shifts the stop loss to the entry price once a trade moves favorably, minimizing risk compared to fixed stop loss and dynamically protecting profits unlike trailing stop.

Chandelier Exit

Chandelier Exit is a dynamic trailing stop loss technique that adjusts the stop level based on the highest high minus a multiple of the Average True Range (ATR), effectively optimizing exit points to limit losses and protect profits.

ATR (Average True Range) Stop

ATR Stop uses market volatility measured by the Average True Range to dynamically set Stop Loss and Trailing Stop levels, enhancing risk management by adjusting exit points based on price fluctuations.

Stop Loss vs Trailing Stop Infographic

moneydif.com

moneydif.com