Volatility smile and volatility skew are patterns observed in implied volatility across different option strike prices. A volatility smile shows higher implied volatility for deep in-the-money and out-of-the-money options, forming a U-shaped curve, while volatility skew reflects a consistent increase or decrease in implied volatility, often due to market sentiment or demand imbalance. Understanding the differences between these patterns helps traders make better decisions on pricing, risk management, and strategy formulation.

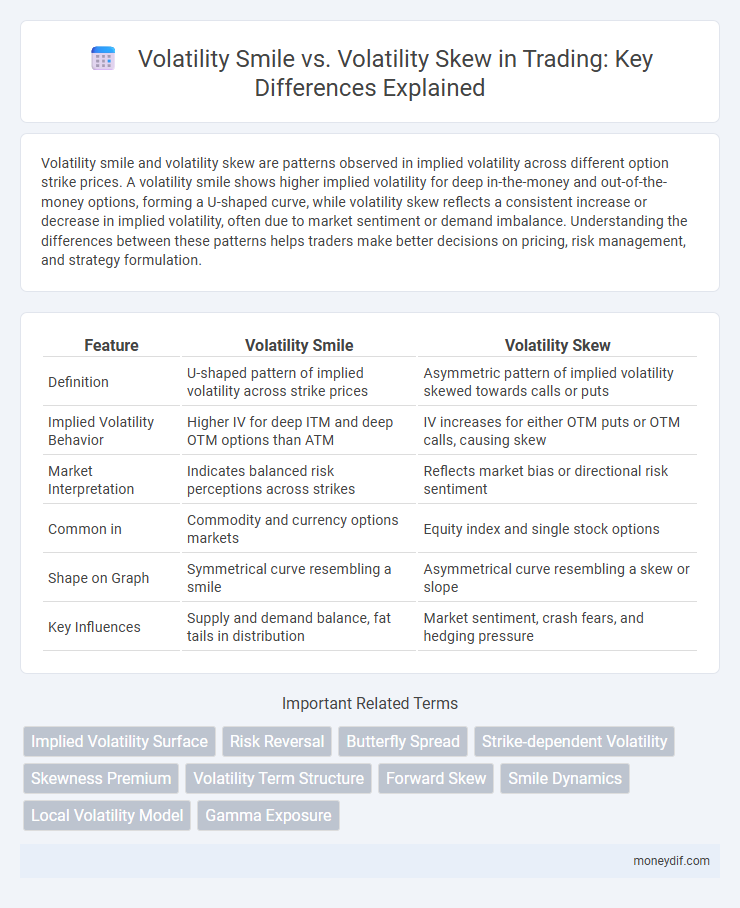

Table of Comparison

| Feature | Volatility Smile | Volatility Skew |

|---|---|---|

| Definition | U-shaped pattern of implied volatility across strike prices | Asymmetric pattern of implied volatility skewed towards calls or puts |

| Implied Volatility Behavior | Higher IV for deep ITM and deep OTM options than ATM | IV increases for either OTM puts or OTM calls, causing skew |

| Market Interpretation | Indicates balanced risk perceptions across strikes | Reflects market bias or directional risk sentiment |

| Common in | Commodity and currency options markets | Equity index and single stock options |

| Shape on Graph | Symmetrical curve resembling a smile | Asymmetrical curve resembling a skew or slope |

| Key Influences | Supply and demand balance, fat tails in distribution | Market sentiment, crash fears, and hedging pressure |

Understanding Volatility Smile and Volatility Skew

Volatility smile and volatility skew represent patterns in implied volatility across option strike prices, reflecting market sentiment and perceived risk. A volatility smile occurs when implied volatility is higher for both in-the-money and out-of-the-money options compared to at-the-money options, forming a U-shaped curve. Volatility skew, on the other hand, shows asymmetry where implied volatility varies more significantly in one direction of strike prices, often indicating bearish or bullish market biases.

Key Differences Between Volatility Smile and Skew

Volatility smile refers to the pattern where implied volatility is higher for deep in-the-money and out-of-the-money options compared to at-the-money options, forming a U-shaped curve on a graph. Volatility skew, on the other hand, describes the asymmetry where implied volatility differs across strike prices, often showing higher implied volatility for either out-of-the-money puts or calls, reflecting market sentiment and risk perceptions. The key difference lies in the shape: the smile exhibits symmetry in volatilities around the at-the-money strike, while the skew shows a directional bias favoring one tail of the distribution.

Causes of Volatility Smile in Options Markets

Volatility smile arises in options markets primarily due to the market's anticipation of extreme price movements, reflecting higher implied volatility for deep in-the-money and deep out-of-the-money options compared to at-the-money options. This pattern is driven by factors such as demand for protective puts, differences in supply and demand dynamics, and the presence of jump risk or fat tails in asset price distributions. Unlike volatility skew, which often stems from asymmetrical market sentiment or directional bias, the volatility smile signifies symmetric concerns over large deviations in underlying asset prices.

Factors Driving Volatility Skew

Volatility skew arises from market factors such as supply and demand imbalances, investor sentiment, and the perceived risk of underlying assets, influencing options pricing asymmetrically across strike prices. Unlike the symmetrical volatility smile, skew reflects a market's expectation of directional risk, often driven by events like earnings announcements or economic data releases that increase downside risk. Implied volatility variations result from hedging demand, liquidity constraints, and differing risk premiums across strike prices, making skew a critical tool for traders assessing market sentiment and tail risk.

Interpreting Smile and Skew in Pricing Models

Volatility smile and volatility skew both reflect implied volatility variations across strike prices, crucial in options pricing models for accurate risk assessment. A volatility smile exhibits symmetrical implied volatility around the at-the-money strike, suggesting equal market expectations of price moves in either direction, influencing models like Black-Scholes. In contrast, volatility skew shows asymmetry, typically with higher implied volatility in out-of-the-money puts or calls, signaling market biases or risks that pricing models must incorporate to improve option valuation and hedging strategies.

Implications for Options Trading Strategies

Volatility smile and volatility skew reflect patterns in implied volatility across options strike prices, influencing trading strategies by highlighting market sentiment and risk perceptions. Traders use volatility smile, which shows higher implied volatility for deep in-the-money and out-of-the-money options, to identify potential price reversals or extreme market movements. Volatility skew, often indicating higher implied volatility for out-of-the-money puts, signals downside risk and guides hedging strategies such as protective puts or collar spreads in options trading.

Historical Examples of Smile and Skew Patterns

Historical examples of volatility smile patterns often emerge in options markets following major events like the 1987 stock market crash, where implied volatility exhibited a pronounced U-shape around the at-the-money strike. Volatility skew patterns became prominent during the 2008 financial crisis, reflecting increased demand for out-of-the-money put options that caused a distinct downward slope in implied volatility. These patterns highlight how market stress and investor sentiment shape option pricing dynamics across various strike prices.

Risk Management Using Volatility Smile vs. Skew

Volatility smile and volatility skew provide critical insights for risk management in options trading by revealing how implied volatility varies across strike prices and maturities. Traders use the volatility smile to identify symmetric risk patterns around the at-the-money strike, aiding in balanced hedging strategies, while volatility skew highlights asymmetric risks that reflect market sentiment and directional biases. Integrating both volatility smile and skew analyses allows for more precise option pricing, improved hedging accuracy, and enhanced mitigation of tail-risk exposure in dynamic trading environments.

Impact on Implied Volatility Surface

Volatility smile and volatility skew both significantly impact the implied volatility surface by altering the distribution of implied volatilities across strikes and maturities. A volatility smile typically represents higher implied volatilities for deep in-the-money and out-of-the-money options, creating a symmetric curvature, whereas volatility skew indicates an asymmetric distribution often driven by market sentiment or risk aversion, with higher implied volatilities on either puts or calls. These patterns affect option pricing models by influencing the shape and dynamics of the implied volatility surface, crucial for accurate risk management and derivative pricing strategies.

Choosing Between Smile and Skew in Market Analysis

In market analysis, choosing between volatility smile and volatility skew depends on the underlying asset's price behavior and market conditions; volatility smile often reflects symmetric risk perception around the at-the-money strike, while volatility skew indicates asymmetric risk preferences driven by demand for puts or calls. Traders leverage volatility skew to gauge directional bias and tail risk, whereas volatility smile offers insights into overall uncertainty and implied kurtosis. Accurate interpretation of these patterns enhances option pricing models and strategic hedging decisions.

Important Terms

Implied Volatility Surface

The Implied Volatility Surface represents the variation of implied volatility across different strike prices and maturities, capturing patterns like the volatility smile and volatility skew which reflect market expectations of asset price movements and risk asymmetry. The volatility smile displays symmetric implied volatility curves around at-the-money options, while the volatility skew shows asymmetric curves where out-of-the-money puts often exhibit higher implied volatility than calls, indicating market sentiment and demand for protective hedging.

Risk Reversal

Risk reversal measures the difference between implied volatilities of out-of-the-money call and put options, capturing market sentiment on directional risk and contributing to the shape of the volatility skew. This dynamic interaction explains how the volatility smile can be asymmetric, reflecting traders' preferences and hedging demands across different strike prices.

Butterfly Spread

A Butterfly Spread strategy exploits differences in implied volatility across strike prices, often capitalizing on the volatility smile, where volatility is higher for far out-of-the-money and in-the-money options. This contrasts with the volatility skew, which reflects directional bias in implied volatility, typically showing higher volatility for out-of-the-money puts or calls, influencing the pricing and profitability of Butterfly Spreads.

Strike-dependent Volatility

Strike-dependent volatility captures the variation of implied volatility across different option strike prices, highlighting patterns such as the volatility smile and volatility skew that reflect market perceptions of risk and demand asymmetry. The volatility smile shows symmetric curvature in implied volatility around the at-the-money strike, while the volatility skew exhibits a monotonic slope, often signaling market biases toward downside or upside risk.

Skewness Premium

Skewness premium reflects the compensation investors demand for bearing asymmetric risk, often observed in options markets where volatility smile represents symmetric implied volatility variations across strike prices, while volatility skew captures directional bias with higher implied volatility for out-of-the-money puts than calls. This premium quantifies the cost difference embedded in options pricing models due to the market's expectation of negative skewness or fat tails in asset return distributions.

Volatility Term Structure

Volatility term structure illustrates how implied volatility varies across different option maturities, reflecting market expectations of future volatility changes, while volatility smile and volatility skew depict the implied volatility patterns across strike prices for a single maturity. The volatility smile shows symmetrical implied volatility for in-the-money and out-of-the-money options, whereas the volatility skew demonstrates an asymmetric pattern, often driven by market sentiment or underlying asset risk profiles.

Forward Skew

Forward skew refers to the pattern where implied volatility varies for options with different expiration dates, often showing higher volatility in the forward or longer-dated options compared to near-term ones, contrasting with the classic volatility smile that displays symmetric volatility around the current strike price. This phenomenon highlights market expectations of future price movement asymmetry and differs from the volatility skew, which describes the variation of implied volatility across strike prices for options with the same expiration date.

Smile Dynamics

Smile Dynamics describes the way implied volatility changes in response to shifts in the underlying asset price, capturing the evolving shape of the volatility smile over time. Volatility skew refers to the asymmetric pattern where implied volatilities vary with strike prices, often showing higher volatilities for out-of-the-money puts than calls, reflecting market sentiment and demand imbalances.

Local Volatility Model

The Local Volatility Model dynamically adjusts the volatility input based on both the asset price and time to better capture the volatility smile observed in option markets, where implied volatility varies symmetrically around the strike price. Unlike the volatility skew, which reflects asymmetry typically caused by market sentiment or jump risk, the Local Volatility Model provides a deterministic framework that explains the entire volatility surface through a state-dependent diffusion process.

Gamma Exposure

Gamma exposure quantifies how an option's delta changes with the underlying asset price, playing a crucial role in shaping the volatility smile by indicating sensitivity to large price movements. Volatility skew reflects the asymmetric distribution of implied volatilities across strike prices, influenced by market perceptions of risk and directional bias, with gamma exposure affecting the dynamic hedging demands that drive these skew patterns.

volatility smile vs volatility skew Infographic

moneydif.com

moneydif.com