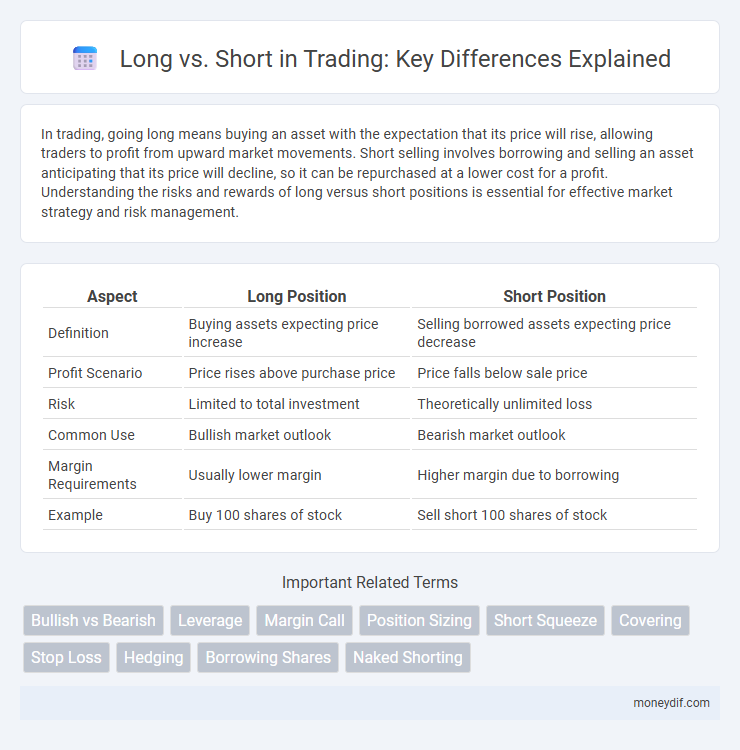

In trading, going long means buying an asset with the expectation that its price will rise, allowing traders to profit from upward market movements. Short selling involves borrowing and selling an asset anticipating that its price will decline, so it can be repurchased at a lower cost for a profit. Understanding the risks and rewards of long versus short positions is essential for effective market strategy and risk management.

Table of Comparison

| Aspect | Long Position | Short Position |

|---|---|---|

| Definition | Buying assets expecting price increase | Selling borrowed assets expecting price decrease |

| Profit Scenario | Price rises above purchase price | Price falls below sale price |

| Risk | Limited to total investment | Theoretically unlimited loss |

| Common Use | Bullish market outlook | Bearish market outlook |

| Margin Requirements | Usually lower margin | Higher margin due to borrowing |

| Example | Buy 100 shares of stock | Sell short 100 shares of stock |

Understanding Long and Short Positions in Trading

Long positions involve buying an asset to profit from its anticipated price increase, while short positions entail selling an asset borrowed from a broker, aiming to buy it back at a lower price for profit. Traders utilize long strategies when bullish on market trends, whereas short strategies capitalize on expected price declines. Mastering the dynamics of long and short positions enhances risk management and maximizes trading opportunities.

Key Differences Between Long and Short Strategies

Long trading strategies involve buying assets with the expectation that their price will increase over time, allowing traders to profit from upward market movements. Short trading strategies, on the other hand, entail selling borrowed assets anticipating a price decline, aiming to repurchase them at a lower price to gain profits. Key differences include risk exposure, with longs benefiting from sustained growth while shorts face potentially unlimited losses if prices rise, and market conditions, where longs thrive in bullish trends and shorts perform better in bearish environments.

When to Go Long: Market Scenarios and Signals

Going long is optimal during bullish market trends characterized by consistent upward price momentum and strong economic indicators such as rising GDP and low unemployment rates. Technical signals like higher highs and higher lows, coupled with increased volume, often confirm entry points for long positions. Investors also consider positive earnings reports and favorable monetary policies as key drivers to initiate long trades.

When to Go Short: Identifying Bearish Opportunities

Going short is ideal during bearish market trends characterized by declining stock prices, weak earnings reports, or negative economic indicators such as rising unemployment rates and decreasing GDP. Technical analysis signals like lower highs, breaking support levels, and bearish chart patterns help identify opportune moments to enter short positions. Traders capitalize on anticipated price drops by borrowing shares to sell high and later buy back at lower prices, maximizing profit potential in downtrending markets.

Risk Management for Long and Short Trades

Long trades expose investors to risks such as market downturns and prolonged price declines, emphasizing the importance of stop-loss orders and position sizing to limit losses. Short trades carry the risk of unlimited losses due to potential price surges, requiring strict risk management strategies like setting tight stop losses and monitoring margin requirements. Effective risk management in both long and short positions ensures capital preservation and minimizes adverse impacts from market volatility.

Profit Potential: Long Trades vs. Short Trades

Long trades offer unlimited profit potential as asset prices can rise indefinitely, allowing traders to capitalize on upward market momentum. Short trades provide profit opportunities during market downturns but are limited by the asset price floor at zero, capping maximum gains. Understanding the risk-reward dynamics of long versus short positions is essential for optimizing trading strategies and maximizing profit potential.

Common Mistakes in Long and Short Trading

Common mistakes in long trading include holding losing positions too long due to hope bias and ignoring stop-loss orders, which can lead to significant capital erosion. In short trading, errors often stem from underestimating short squeeze risks and failing to monitor margin requirements, resulting in forced liquidations. Both strategies suffer from poor risk management and emotional decision-making, impacting overall trading performance.

Tools and Indicators for Long vs. Short Decisions

Tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands provide critical signals for identifying long or short trading opportunities. Traders use volume analysis and MACD crossovers to confirm entry points and potential trend reversals, enhancing decision accuracy. Price action patterns combined with sentiment indicators ensure precise timing for long or short positions in volatile markets.

Psychological Factors in Long and Short Trading

Long trading often involves a mindset of optimism and confidence, where traders anticipate upward price movements and may experience emotional attachment to holding positions. Short trading requires heightened vigilance and stress management due to the inherent risks of betting against market trends, leading to increased anxiety and the need for disciplined exit strategies. Psychological factors such as fear of missing out (FOMO) in longs and fear of unlimited losses in shorts critically influence decision-making and risk tolerance in both trading styles.

Choosing the Right Strategy: Long, Short, or Both?

Choosing the right trading strategy depends on market conditions and individual risk tolerance, with long positions benefiting from upward trends and short positions profiting from downward moves. Combining long and short strategies through hedging or pairs trading can balance risk and enhance portfolio diversification. Successful traders analyze technical indicators, market sentiment, and fundamental data to determine optimal entry and exit points for both long and short positions.

Important Terms

Bullish vs Bearish

Bullish investors typically take long positions expecting asset prices to rise, while bearish investors often take short positions anticipating price declines.

Leverage

Leverage amplifies potential gains and losses in both long and short positions by increasing exposure to underlying assets beyond the invested capital.

Margin Call

Margin call occurs when a trader's account value falls below the required maintenance margin, forcing them to deposit more funds or liquidate positions, commonly affecting both long and short positions.

Position Sizing

Effective position sizing differs between long and short trades, requiring risk management adjustments based on market volatility and directional bias for optimal portfolio performance.

Short Squeeze

A short squeeze occurs when heavily shorted stocks experience rapid price increases, forcing short sellers to buy shares to cover positions, which intensifies upward momentum against long traders.

Covering

Long positions involve buying assets expecting price increases, while short positions entail selling borrowed assets anticipating price declines.

Stop Loss

Setting precise stop loss orders protects trading positions by limiting potential losses in both long and short market scenarios.

Hedging

Hedging strategies involve taking long and short positions simultaneously to mitigate potential losses in volatile markets.

Borrowing Shares

Borrowing shares enables short selling by allowing investors to sell borrowed stock with the expectation of buying back at a lower price, contrasting with long positions where investors purchase shares to benefit from price appreciation.

Naked Shorting

Naked shorting involves selling shares without borrowing them first, increasing market risk compared to traditional long positions or borrowed short sales.

Long vs Short Infographic

moneydif.com

moneydif.com