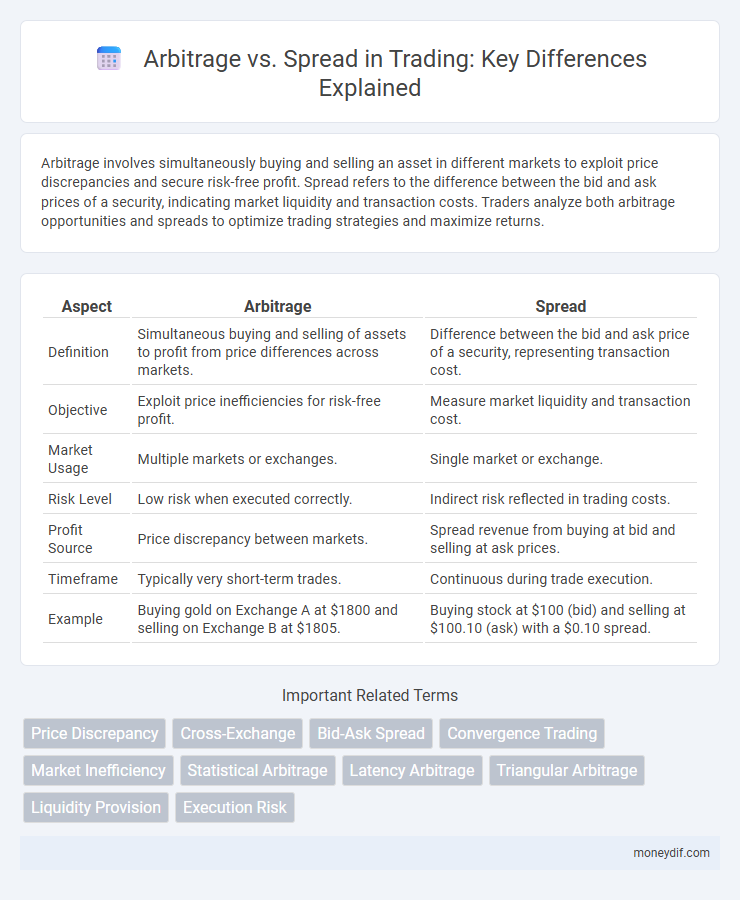

Arbitrage involves simultaneously buying and selling an asset in different markets to exploit price discrepancies and secure risk-free profit. Spread refers to the difference between the bid and ask prices of a security, indicating market liquidity and transaction costs. Traders analyze both arbitrage opportunities and spreads to optimize trading strategies and maximize returns.

Table of Comparison

| Aspect | Arbitrage | Spread |

|---|---|---|

| Definition | Simultaneous buying and selling of assets to profit from price differences across markets. | Difference between the bid and ask price of a security, representing transaction cost. |

| Objective | Exploit price inefficiencies for risk-free profit. | Measure market liquidity and transaction cost. |

| Market Usage | Multiple markets or exchanges. | Single market or exchange. |

| Risk Level | Low risk when executed correctly. | Indirect risk reflected in trading costs. |

| Profit Source | Price discrepancy between markets. | Spread revenue from buying at bid and selling at ask prices. |

| Timeframe | Typically very short-term trades. | Continuous during trade execution. |

| Example | Buying gold on Exchange A at $1800 and selling on Exchange B at $1805. | Buying stock at $100 (bid) and selling at $100.10 (ask) with a $0.10 spread. |

Overview of Arbitrage and Spread in Trading

Arbitrage in trading involves simultaneously buying and selling an asset in different markets to exploit price discrepancies for risk-free profit, often executed through high-frequency trading algorithms. Spread refers to the difference between the bid and ask prices of an asset, representing transaction costs and liquidity in the market. Understanding the dynamics of arbitrage opportunities and spread variations is crucial for traders aiming to optimize execution strategies and minimize costs.

Defining Arbitrage: Mechanics and Methods

Arbitrage involves simultaneously buying and selling an asset across different markets to profit from price discrepancies without exposure to market risk. It exploits inefficiencies by executing synchronized trades, ensuring risk-free gains by capturing price differences in equities, commodities, or currencies. Common methods include spatial arbitrage, statistical arbitrage, and triangular arbitrage, which utilize varying market structures and instruments to optimize returns.

Understanding Spread: Types and Relevance

Spread in trading refers to the difference between the bid and ask prices of a financial instrument, serving as a key indicator of market liquidity and transaction cost. Common types of spreads include the bid-ask spread, yield spread, and credit spread, each relevant to different asset classes such as equities, bonds, and derivatives. Understanding these spreads helps traders identify market efficiency, manage risk, and optimize entry and exit points in arbitrage and other trading strategies.

Key Differences Between Arbitrage and Spread

Arbitrage involves simultaneously buying and selling an asset across different markets to exploit price discrepancies and secure risk-free profits, while spread trading focuses on profiting from the price difference between two related securities or contracts within the same market. Arbitrage opportunities are typically short-lived due to market efficiency, whereas spread trading relies on the relative value changes between paired positions over time. Key differences include the risk profile, with arbitrage considered lower risk due to hedged positions, and spread trading carrying higher risk due to market volatility affecting both legs of the spread.

Practical Examples of Arbitrage Strategies

Arbitrage strategies in trading involve simultaneously buying and selling an asset across different markets to exploit price discrepancies, such as purchasing Bitcoin on one exchange at $30,000 while selling it on another at $30,050, locking in a risk-free profit. Spread trading, by contrast, focuses on profiting from the price difference between two related assets, like buying crude oil futures and selling gasoline futures when their price spread deviates from historical norms. Practical arbitrage examples include triangular arbitrage in forex markets, where traders exploit cross-currency rate mismatches, and statistical arbitrage involving quantitative models to identify short-term mispricings in equities.

Common Spread Trading Techniques

Common spread trading techniques involve simultaneously buying and selling related securities to capitalize on price differentials, such as calendar spreads, inter-commodity spreads, and intra-commodity spreads. Traders leverage these strategies to manage risk and exploit market inefficiencies without exposure to outright market direction. Arbitrage, by contrast, focuses on exploiting price discrepancies across different markets or instruments for risk-free profit, while spread trading emphasizes relative price movements within correlated assets.

Risks and Rewards: Arbitrage vs. Spread

Arbitrage involves exploiting price differences of identical assets across markets, offering low-risk profit opportunities but requiring significant capital and rapid execution to avoid losses. Spread trading entails simultaneously buying and selling related securities to profit from price differentials, exposing traders to market volatility and directional risk. While arbitrage generally offers more predictable returns due to market inefficiencies correction, spread trading carries higher reward potential but increases exposure to adverse price movements and liquidity risks.

Factors Influencing Arbitrage and Spread Opportunities

Arbitrage opportunities arise when price discrepancies exist between different markets or instruments, influenced by factors such as market liquidity, transaction costs, and timing imbalances. Spread opportunities depend on bid-ask differentials, volatility levels, and order book depth, affecting profitability and risk exposure. Efficient market conditions and rapid information flow tend to reduce both arbitrage and spread opportunities by minimizing price inefficiencies.

Regulatory Considerations for Arbitrage and Spread Trading

Regulatory considerations for arbitrage trading primarily involve strict compliance with market manipulation laws and transparency requirements to prevent unfair advantages across different markets. Spread trading faces regulatory scrutiny focused on margin requirements, position limits, and the accurate reporting of spread transactions to mitigate systemic risk. Both arbitrage and spread trading demand adherence to financial regulations such as the SEC's rules in the US or ESMA guidelines in Europe to ensure market integrity and investor protection.

Choosing Between Arbitrage and Spread: Which Suits Your Trading Style?

Arbitrage exploits price discrepancies across different markets, offering low-risk profits but requiring fast execution and significant capital. Spread trading involves capitalizing on price gaps between related assets, demanding strong analytical skills and risk tolerance for potential volatility. Traders focused on quick, risk-averse gains may prefer arbitrage, while those comfortable with directional strategies and market analysis often lean toward spread trading.

Important Terms

Price Discrepancy

Price discrepancy occurs when asset prices differ across markets, creating opportunities for arbitrage, which exploits these inefficiencies by simultaneously buying low and selling high. The spread, representing the bid-ask difference, reflects market liquidity and transaction costs influencing the profitability of arbitrage strategies.

Cross-Exchange

Cross-exchange arbitrage exploits price differences of the same asset between exchanges, while spread trading involves profiting from the bid-ask price gap within a single exchange.

Bid-Ask Spread

Arbitrage opportunities arise when the bid-ask spread exceeds transaction costs, allowing traders to exploit price discrepancies across markets for risk-free profits.

Convergence Trading

Convergence trading exploits price differentials between related assets, such as arbitrage opportunities and spread trades, to profit from the eventual alignment of their values.

Market Inefficiency

Market inefficiency arises when arbitrage opportunities exist due to discrepancies between bid-ask spreads and asset prices across different markets or instruments.

Statistical Arbitrage

Statistical arbitrage exploits pricing inefficiencies by modeling price spreads between correlated assets to generate consistent, low-risk profits.

Latency Arbitrage

Latency arbitrage exploits time delays in market data to profit from price discrepancies, differentiating from traditional arbitrage that targets price spreads across markets without relying on speed advantages.

Triangular Arbitrage

Triangular arbitrage exploits price discrepancies among three currency pairs to profit from arbitrage opportunities by simultaneously buying and selling currencies, whereas arbitrage involves risk-free profit from price differences between markets, and spread refers to the bid-ask price difference that impacts trading costs.

Liquidity Provision

Liquidity provision enhances market efficiency by enabling arbitrageurs to exploit price discrepancies between asset prices and spreads, thereby narrowing bid-ask spreads and increasing market depth. Effective arbitrage reduces pricing inefficiencies, directly impacting liquidity providers' profitability through tighter spreads and improved order execution.

Execution Risk

Execution risk in arbitrage arises from price spread fluctuations between related assets during the time lag needed to complete simultaneous transactions.

Arbitrage vs Spread Infographic

moneydif.com

moneydif.com