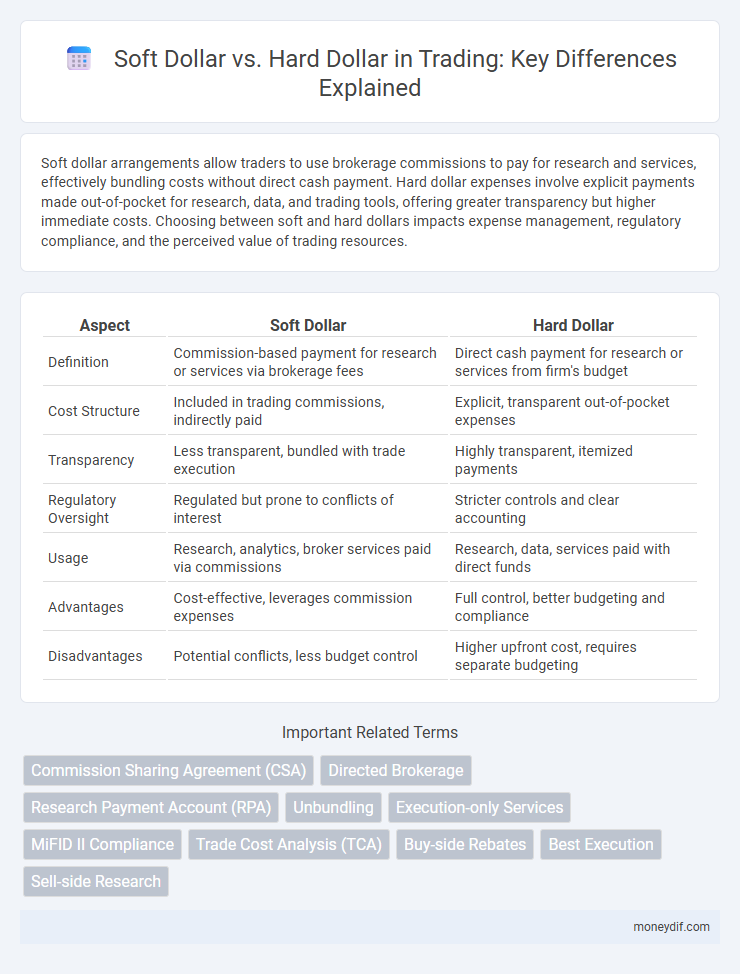

Soft dollar arrangements allow traders to use brokerage commissions to pay for research and services, effectively bundling costs without direct cash payment. Hard dollar expenses involve explicit payments made out-of-pocket for research, data, and trading tools, offering greater transparency but higher immediate costs. Choosing between soft and hard dollars impacts expense management, regulatory compliance, and the perceived value of trading resources.

Table of Comparison

| Aspect | Soft Dollar | Hard Dollar |

|---|---|---|

| Definition | Commission-based payment for research or services via brokerage fees | Direct cash payment for research or services from firm's budget |

| Cost Structure | Included in trading commissions, indirectly paid | Explicit, transparent out-of-pocket expenses |

| Transparency | Less transparent, bundled with trade execution | Highly transparent, itemized payments |

| Regulatory Oversight | Regulated but prone to conflicts of interest | Stricter controls and clear accounting |

| Usage | Research, analytics, broker services paid via commissions | Research, data, services paid with direct funds |

| Advantages | Cost-effective, leverages commission expenses | Full control, better budgeting and compliance |

| Disadvantages | Potential conflicts, less budget control | Higher upfront cost, requires separate budgeting |

Understanding Soft Dollar and Hard Dollar in Trading

Soft dollar arrangements in trading involve using brokerage commissions to pay for research and services, allowing traders to obtain valuable market insights without direct cash payments. In contrast, hard dollar expenses are explicit cash payments made by traders for research, data, or analytics, providing greater transparency in cost allocation. Understanding the distinction between soft dollar and hard dollar practices is crucial for compliance with regulatory requirements and optimizing overall trading costs.

Key Differences Between Soft Dollar and Hard Dollar Arrangements

Soft dollar arrangements involve brokers providing research or services funded indirectly through commissions generated by client trades, whereas hard dollar arrangements require direct payment for these services by the investment firm. Soft dollar benefits are embedded within trading costs and might affect transaction transparency, while hard dollar payments are explicit, fostering clearer expense tracking. Firms must carefully evaluate compliance, cost-effectiveness, and regulatory implications when choosing between soft dollar and hard dollar models.

Benefits of Soft Dollar Transactions for Traders

Soft dollar transactions enable traders to access valuable research and analytical tools without immediate cash outflow, enhancing informed decision-making and portfolio management. By leveraging brokerage commissions to cover these costs, traders can reduce direct expenses and reinvest savings into additional trades or asset diversification. This approach also fosters stronger broker relationships, potentially resulting in better trade execution and exclusive market insights.

Drawbacks and Risks of Soft Dollar Practices

Soft dollar practices can create conflicts of interest by incentivizing brokers to direct trades to firms offering non-transparent benefits rather than the best execution or lowest cost, potentially harming investors. The lack of clear regulatory oversight increases the risk of misallocation of client assets toward expensive or unnecessary services, reducing portfolio returns. These practices may also lead to diminished accountability and transparency, making it difficult for asset managers to justify expenses and comply with fiduciary duties.

Hard Dollar Payments: Transparency and Cost Control

Hard dollar payments in trading involve explicit, out-of-pocket expenses paid directly for research or services, ensuring greater transparency in cost allocation compared to soft dollars. This approach allows firms to accurately track and control expenditures, fostering clearer budgeting and regulatory compliance. Transparency in hard dollar payments reduces conflicts of interest by separating research costs from commission transactions, enhancing accountability in trading practices.

Regulatory Considerations for Soft and Hard Dollar Usage

Regulatory considerations for soft dollar usage emphasize transparency and compliance with fiduciary duties under frameworks like MiFID II and SEC Rule 28(e), requiring disclosure of how brokerage commissions fund research and services. Hard dollar arrangements face stringent scrutiny to ensure explicit payments directly correlate to the value of services received, minimizing conflicts of interest and promoting investor protection. Both models demand rigorous documentation and adherence to anti-fraud provisions to align with evolving global regulatory standards.

Impact on Portfolio Performance: Soft vs Hard Dollar

Soft dollar arrangements can enhance portfolio performance by allowing access to research and brokerage services without direct cash payments, potentially reducing explicit costs and improving trade execution quality. Hard dollar payments offer transparent and direct costs, which enable clearer budgeting and cost control but may limit access to certain value-added services that contribute to informed investment decisions. The choice between soft and hard dollar payment methods significantly affects cost efficiency, resource allocation, and ultimately the net returns of an investment portfolio.

Compliance Requirements in Soft Dollar Arrangements

Compliance requirements in soft dollar arrangements mandate strict adherence to fiduciary standards, ensuring that services or research acquired through brokers directly benefit clients rather than the firm. Regulatory frameworks, such as SEC Rule 28(e), provide safe harbor protections but require detailed documentation and transparency about the nature and value of the soft dollar services received. Firms must implement robust monitoring systems and maintain thorough records to demonstrate that soft dollar expenditures align with client interests and avoid conflicts of interest.

Best Practices for Managing Trading Costs

Effective management of trading costs requires a clear understanding of soft dollar and hard dollar expenses, where soft dollars involve brokerage-commission-funded research and hard dollars represent direct payments. Best practices include rigorous monitoring of soft dollar arrangements to ensure compliance with fiduciary duties and transparency with clients, alongside detailed tracking of hard dollar costs to evaluate the true economic impact on portfolio performance. Employing advanced analytics and regular trade cost analysis helps in optimizing the balance between research benefits and execution expenses, ultimately enhancing overall investment returns.

Future Trends in Soft Dollar and Hard Dollar Strategies

Future trends in soft dollar and hard dollar strategies indicate increasing regulatory scrutiny and a shift toward greater transparency in brokerage commissions. Asset managers are leveraging advanced technology and data analytics to optimize soft dollar arrangements, ensuring compliance while extracting maximum value from research and execution services. Hard dollar strategies are becoming more prevalent as firms prioritize explicit cost management and direct payment models to enhance fiduciary accountability and operational efficiency.

Important Terms

Commission Sharing Agreement (CSA)

A Commission Sharing Agreement (CSA) allows investment managers to allocate brokerage commissions between research and execution, optimizing the use of soft dollars for research purchases while preserving hard dollars for direct transaction costs.

Directed Brokerage

Directed brokerage allows investment managers to allocate client trades to specific brokers often using soft dollars for research services, contrasting with hard dollar payments that involve direct cash commissions for execution and services.

Research Payment Account (RPA)

A Research Payment Account (RPA) enables asset managers to fund research using soft dollars, which are commission-based payments, contrasting with hard dollars that are direct payments from the manager's own funds.

Unbundling

Unbundling separates investment research costs paid via soft dollars from direct transaction expenses covered by hard dollars, enhancing transparency and cost-efficiency in asset management.

Execution-only Services

Execution-only services involve using hard dollar payments, avoiding the complexity and potential conflicts of soft dollar arrangements in trading and investment management.

MiFID II Compliance

MiFID II compliance mandates strict transparency and unbundling of payments for investment services, differentiating soft dollar arrangements--where commissions are used to pay for research and services--from hard dollar payments made directly in cash. Firms must ensure that soft dollar benefits do not create conflicts of interest and all research costs are explicitly disclosed and charged separately under regulatory requirements.

Trade Cost Analysis (TCA)

Trade Cost Analysis (TCA) evaluates transaction expenses by comparing Soft Dollar arrangements, where brokerage services are paid through commission allocations, against Hard Dollar payments, involving direct monetary fees for trade execution.

Buy-side Rebates

Buy-side rebates optimize trading costs by leveraging soft dollar arrangements for research services, whereas hard dollar payments involve direct, transparent cash expenses.

Best Execution

Best Execution mandates brokers to prioritize obtaining the most favorable terms for client orders, balancing costs and execution quality. Soft dollar arrangements use commission rebates to pay for research or services without direct charges, while hard dollar payments involve explicit cash fees, influencing the assessment of trade expenses and transparency.

Sell-side Research

Sell-side research involves detailed financial analysis and investment recommendations provided by brokerage firms to assist institutional investors, typically funded through soft dollar arrangements where commissions from client trades cover research costs. Hard dollar payments, in contrast, require direct cash payments for research services, affecting budgeting decisions and potentially influencing the objectivity and accessibility of sell-side research.

Soft Dollar vs Hard Dollar Infographic

moneydif.com

moneydif.com