Slippage occurs when a trade is executed at a different price than expected, often during volatile market conditions, while spread refers to the difference between the bid and ask price of a financial instrument. Managing slippage is crucial for traders aiming to minimize unexpected costs, whereas understanding the spread helps in assessing the initial cost of entering a trade. Both factors significantly impact overall trade execution quality and profitability in fast-moving markets.

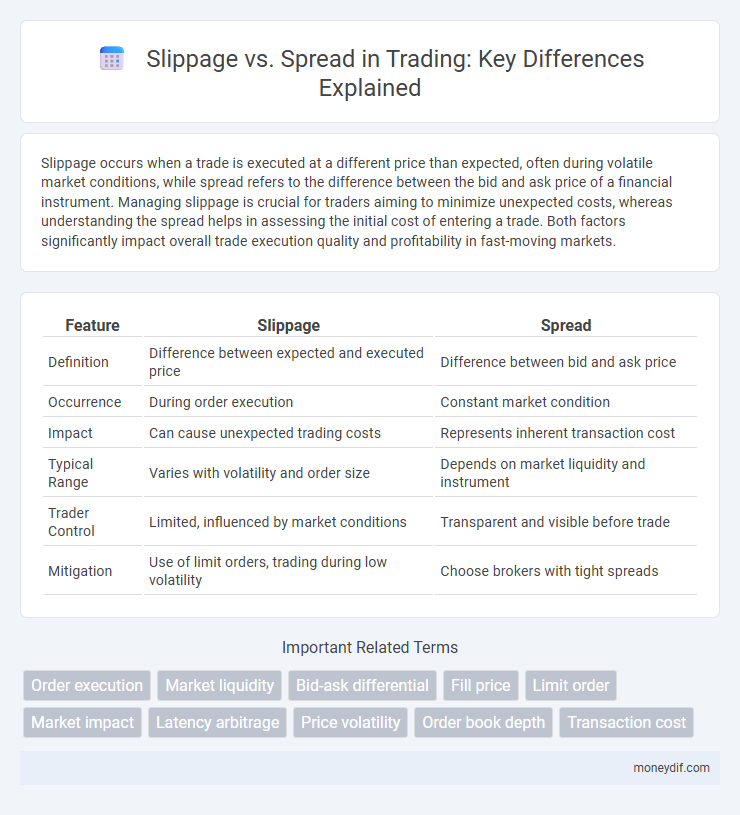

Table of Comparison

| Feature | Slippage | Spread |

|---|---|---|

| Definition | Difference between expected and executed price | Difference between bid and ask price |

| Occurrence | During order execution | Constant market condition |

| Impact | Can cause unexpected trading costs | Represents inherent transaction cost |

| Typical Range | Varies with volatility and order size | Depends on market liquidity and instrument |

| Trader Control | Limited, influenced by market conditions | Transparent and visible before trade |

| Mitigation | Use of limit orders, trading during low volatility | Choose brokers with tight spreads |

Understanding Slippage and Spread in Trading

Slippage occurs when a trade is executed at a different price than expected, often due to market volatility or low liquidity, impacting the final trade cost beyond the initial spread. The spread represents the difference between the bid and ask prices, serving as a cost benchmark and liquidity indicator for traders. Understanding the distinction between slippage and spread helps traders manage execution risks and optimize entry and exit strategies in dynamic markets.

Key Differences Between Slippage and Spread

Slippage refers to the difference between the expected price of a trade and the actual execution price, often occurring during high volatility or low liquidity. Spread is the fixed difference between the bid and ask prices set by brokers, representing the cost to enter a trade. Key differences include that slippage is unpredictable and happens during order execution, while spread is a constant, transparent cost embedded in the market quote.

How Slippage Affects Trade Execution

Slippage occurs when a trade is executed at a price different from the expected entry or exit point, often due to market volatility or low liquidity, leading to less favorable trade outcomes. Unlike the spread, which is the fixed difference between the bid and ask prices, slippage represents an unpredictable cost that traders cannot control. High slippage can significantly impact trade execution by increasing transaction costs and reducing overall profitability, especially in fast-moving markets.

The Role of Spread in Trading Costs

The spread represents the difference between the bid and ask prices and is a primary component of trading costs, directly impacting profitability. Tighter spreads reduce the cost of entering and exiting positions, especially in high-frequency or scalping strategies. While slippage occurs during order execution due to market volatility, the spread consistently affects every trade by defining the initial cost baseline for traders.

Factors Influencing Slippage and Spread

Slippage occurs when the execution price deviates from the expected price due to market volatility and order size, while the spread represents the difference between bid and ask prices influenced by liquidity and market conditions. High volatility, low liquidity, and large order volumes increase slippage risk, whereas tighter spreads are typically found in highly liquid markets with frequent trading activity. Understanding the relationship between order execution speed, market depth, and volatility is crucial for minimizing trading costs related to slippage and spread.

Slippage vs Spread: Impact on Trading Strategies

Slippage and spread are critical factors influencing trading strategies and overall execution quality. While spread represents the difference between bid and ask prices at order initiation, slippage refers to the deviation between expected and actual execution prices, often caused by market volatility or liquidity gaps. Traders must account for slippage to optimize entry and exit points, as excessive slippage can erode profits and distort risk management, making it a key consideration beyond the fixed cost implied by spreads.

Managing Slippage and Spread in Volatile Markets

Managing slippage and spread in volatile markets requires traders to employ precise order types such as limit and stop orders to control execution prices effectively. Monitoring real-time market liquidity and volatility indicators allows for strategic trade timing, reducing the risk of unexpected price deviations. Leveraging advanced trading platforms with customizable slippage tolerance settings further enhances order execution accuracy amidst rapid market fluctuations.

Reducing Trading Losses from Slippage and Spread

Minimizing trading losses requires understanding the differences between slippage and spread, where slippage refers to the price difference executed from the expected order price, and spread is the gap between bid and ask prices. Effective strategies include using limit orders to control entry and exit points, thereby reducing the impact of wide spreads and unexpected slippage during volatile market conditions. Monitoring market liquidity and avoiding trading during low-volume periods can also significantly reduce slippage-related losses.

Broker Types: Their Effect on Slippage and Spread

Broker types significantly impact slippage and spread, with market makers often providing fixed spreads but potentially higher slippage during volatile markets. ECN brokers offer variable spreads that can be tighter but may experience increased slippage due to direct market access and order execution speed. Understanding these differences helps traders select brokers aligned with their strategy to minimize trading costs and improve execution quality.

Best Practices to Minimize Slippage and Spread

Traders can minimize slippage and spread by using limit orders instead of market orders, which ensures execution at desired price levels and reduces unexpected costs. Choosing brokers with low spreads and high liquidity pools improves trade execution efficiency, especially during volatile market conditions. Monitoring trading times to avoid periods of low liquidity, such as major news releases or off-market hours, further decreases the risk of slippage and wider spreads.

Important Terms

Order execution

Order execution efficiency is critical in trading, as slippage occurs when the actual execution price deviates from the expected price due to market volatility, often leading to higher transaction costs compared to the bid-ask spread, which represents the standard cost of entering and exiting trades. Minimizing slippage involves selecting brokers with fast execution speeds and stable liquidity to reduce the gap between the executed price and the quoted spread.

Market liquidity

Market liquidity significantly influences slippage and spread, where higher liquidity typically results in narrower spreads and reduced slippage during trade execution. Traders benefit from liquid markets as tighter bid-ask spreads minimize transaction costs, while sufficient depth limits price impact, preventing large deviations between expected and actual trade prices.

Bid-ask differential

The bid-ask differential directly influences slippage, as wider spreads increase the cost of executing trades beyond expected prices. Traders experience higher slippage when market orders execute at prices less favorable than the bid-ask spread, especially in volatile or low-liquidity conditions.

Fill price

Fill price reflects the actual execution cost of a trade, which can deviate from the quoted price due to slippage and spread variations. Slippage occurs when market volatility causes the fill price to be less favorable than expected, while the spread represents the gap between bid and ask prices, influencing the baseline execution cost.

Limit order

A limit order ensures execution at a specified price or better, minimizing slippage compared to market orders which can be affected by the bid-ask spread. By setting a maximum purchase price or minimum sale price, traders avoid adverse price movements caused by high volatility and wide spreads, thereby enhancing trade precision and cost efficiency.

Market impact

Market impact directly affects trading costs by causing slippage, which refers to the difference between the expected transaction price and the actual executed price. Spread represents the bid-ask price gap, while slippage quantifies price changes resulting from order size and market liquidity, highlighting the importance of minimizing market impact for optimal trading execution.

Latency arbitrage

Latency arbitrage exploits the speed difference in trade execution to capitalize on price discrepancies between bid-ask spreads before slippage impacts order fulfillment. This strategy thrives when market participants experience higher slippage compared to the narrow spreads latency arbitrageurs leverage for profit.

Price volatility

Price volatility directly impacts the magnitude of slippage during trade execution, as rapid market fluctuations cause order prices to deviate from expected levels. Tight bid-ask spreads mitigate slippage risk by reducing the cost difference between trade entry and exit, improving overall trade efficiency.

Order book depth

Order book depth directly influences slippage by determining how much volume can be traded at the current bid-ask spread before price moves unfavorably, with deeper order books minimizing slippage by absorbing larger trades without affecting the spread. Low order book depth increases the spread and slippage risk, as limited liquidity causes prices to shift more sharply when executing sizable orders.

Transaction cost

Transaction cost in trading encompasses both slippage and spread, where slippage refers to the difference between the expected price of a trade and the actual executed price, often occurring during high volatility or low liquidity. The spread represents the gap between the bid and ask prices, and together, these factors directly impact overall trading expenses and profitability.

slippage vs spread Infographic

moneydif.com

moneydif.com