Front-running in trading involves executing orders based on prior knowledge of upcoming large trades to gain an advantage, often exploiting information asymmetry. Back-running, on the other hand, occurs when traders place orders immediately after a large trade to capitalize on the resulting market movement, benefiting from momentum shifts. Both strategies highlight different approaches to timing trades relative to large market orders, impacting liquidity and price discovery.

Table of Comparison

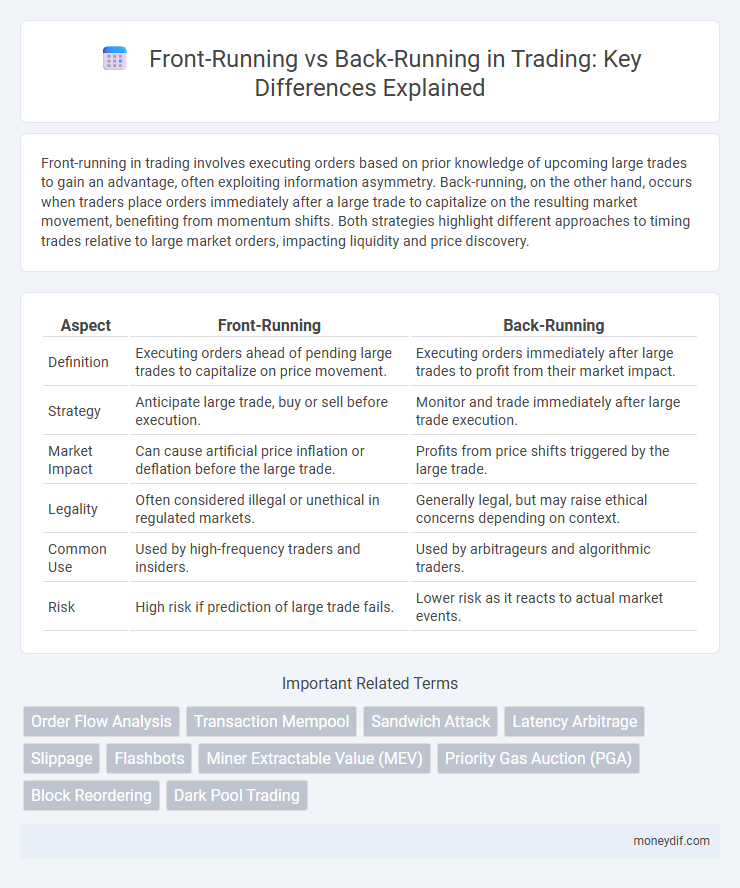

| Aspect | Front-Running | Back-Running |

|---|---|---|

| Definition | Executing orders ahead of pending large trades to capitalize on price movement. | Executing orders immediately after large trades to profit from their market impact. |

| Strategy | Anticipate large trade, buy or sell before execution. | Monitor and trade immediately after large trade execution. |

| Market Impact | Can cause artificial price inflation or deflation before the large trade. | Profits from price shifts triggered by the large trade. |

| Legality | Often considered illegal or unethical in regulated markets. | Generally legal, but may raise ethical concerns depending on context. |

| Common Use | Used by high-frequency traders and insiders. | Used by arbitrageurs and algorithmic traders. |

| Risk | High risk if prediction of large trade fails. | Lower risk as it reacts to actual market events. |

Understanding Front-Running in Trading

Front-running in trading occurs when a trader or broker executes orders on a security for their own account ahead of a pending client order, leveraging advance knowledge to gain an unfair advantage. This practice exploits non-public information about upcoming trades to profit from price movements before the market reacts, undermining market integrity and eroding investor trust. Regulatory bodies like the SEC strictly prohibit front-running due to its manipulative nature and detrimental impact on market fairness.

What is Back-Running and How Does It Work?

Back-running in trading involves executing a buy or sell order immediately after a large, impactful transaction to capitalize on the resulting price movement. This strategy leverages the knowledge of a preceding trade that has already influenced the market price, allowing traders to profit from the momentum created. By monitoring order flow and market depth, back-runners anticipate the price direction following significant trades to optimize their entry and exit points.

Key Differences Between Front-Running and Back-Running

Front-running involves executing orders based on advance knowledge of upcoming trades to capitalize on anticipated market movements, while back-running occurs by placing trades immediately after large orders to benefit from the resulting price changes. Front-running typically relies on privileged information or high-speed access, making it prone to regulatory scrutiny, whereas back-running exploits natural market momentum without prior insider knowledge. The primary distinction lies in timing relative to the target trade and the ethical implications tied to information asymmetry and market fairness.

Legal Implications of Front-Running and Back-Running

Front-running involves executing trades based on non-public information about pending orders, often violating securities laws and subject to severe regulatory penalties including fines and imprisonment. Back-running, while less frequently prosecuted, can also breach legal boundaries if it exploits privileged information or manipulates market prices, leading to investigations by bodies such as the SEC or CFTC. Both practices undermine market integrity, prompting stringent enforcement to protect investors and ensure fair trading environments.

Impact of Front-Running on Market Integrity

Front-running distorts market integrity by exploiting non-public order information to execute trades ahead of others, leading to unfair price advantages and reduced market transparency. This practice undermines investor confidence as it creates an uneven playing field, discouraging participation from retail and institutional investors alike. The resulting market inefficiencies can increase volatility and degrade overall liquidity, harming the fairness and efficiency of financial markets.

How Back-Running Influences Market Movements

Back-running exploits the information from recent transactions to execute trades immediately after, influencing market prices by amplifying short-term momentum and creating artificial demand or supply. This practice can lead to increased volatility and distorted price signals, undermining the market's efficiency and fairness. Traders employing back-running strategies often capitalize on predictable patterns, potentially disadvantaging uninformed participants and impacting overall liquidity.

Strategies to Detect and Prevent Front-Running

Effective strategies to detect and prevent front-running in trading rely on advanced monitoring systems analyzing order flow patterns and transaction timestamps for suspicious activity. Implementing real-time surveillance algorithms combined with robust compliance rules helps identify unauthorized pre-emptive trades executed before large orders impact the market. Regulatory frameworks, such as MiFID II and SEC Rule 10b-5, mandate transparency and strict enforcement to deter front-running practices and protect market integrity.

Back-Running: Risks and Ethical Considerations

Back-running in trading involves executing orders immediately after a large trade to capitalize on the expected price movement, posing significant risks such as market manipulation accusations and regulatory penalties. This practice raises ethical concerns related to fairness, as it can undermine market integrity by exploiting non-public information or the order flow of others. Traders engaging in back-running may face reputational damage and legal consequences, highlighting the need for compliance with trading regulations and transparent market conduct.

Front-Running Case Studies in Financial Markets

Front-running in financial markets occurs when traders place orders based on prior knowledge of upcoming large transactions, exploiting this information to gain unfair profits before the market reacts. Case studies such as the 2008 SEC investigation into hedge funds reveal how front-running can distort market prices and undermine investor confidence. Regulatory frameworks continuously evolve to detect and penalize front-running, emphasizing the need for enhanced surveillance technologies in trading platforms to protect market integrity.

The Future of Trading: Mitigating Front-Running and Back-Running

Mitigating front-running and back-running in trading relies heavily on advanced algorithms and blockchain transparency to ensure fair market practices. Decentralized finance (DeFi) platforms employ measures such as transaction ordering protocols and time-weighted average price (TWAP) execution to reduce the risks associated with these predatory trading tactics. Enhanced regulatory frameworks combined with real-time monitoring tools are shaping the future of trading by promoting market integrity and protecting investors from exploitative behaviors.

Important Terms

Order Flow Analysis

Order Flow Analysis examines the sequence of buy and sell orders to predict short-term price movements, enabling traders to identify potential front-running opportunities where orders are executed ahead of large trades. Back-running leverages the insight gained from order flow to place trades immediately after significant orders, capitalizing on anticipated price changes caused by those trades.

Transaction Mempool

The transaction mempool temporarily holds pending Ethereum transactions, enabling front-running bots to identify and manipulate transaction orders for profit by prioritizing their own trades before others, while back-running bots capitalize on confirmed transactions by placing follow-up trades immediately after to gain advantage. Efficient mempool monitoring and transaction sequencing prevent exploitative front-running and back-running strategies, enhancing blockchain fairness and transaction integrity.

Sandwich Attack

A Sandwich Attack in blockchain exploits front-running and back-running by placing one transaction before (front-running) and another after (back-running) a victim's trade to manipulate token prices and extract profit. This attack leverages transaction ordering within blocks to profit from slippage induced by the victim's trade, significantly impacting decentralized exchange users.

Latency Arbitrage

Latency arbitrage exploits milliseconds-long delays in market data transmission to execute trades faster than competitors, often resulting in front-running where traders anticipate orders before they're fully processed. Back-running involves executing trades immediately after large orders, capitalizing on predictable price movements caused by the initial transaction to gain profit.

Slippage

Slippage refers to the difference between the expected price of a trade and the actual execution price, often exacerbated by front-running, where attackers place orders ahead of a large transaction to profit from the price impact. Back-running occurs when traders place orders immediately after a large trade to capitalize on the resultant price movement, both front-running and back-running strategies exploit slippage to gain arbitrage opportunities in financial markets.

Flashbots

Flashbots is a research and development organization focused on mitigating front-running and back-running attacks in decentralized finance by enabling transparent and fair transaction ordering through MEV (Miner Extractable Value) auctions. Its tools allow miners and traders to coordinate transaction execution, reducing harmful front-running while enabling profitable back-running strategies that improve market efficiency.

Miner Extractable Value (MEV)

Miner Extractable Value (MEV) quantifies the profit miners can capture by reordering, including front-running or back-running, transactions within a blockchain block. Front-running involves placing a transaction ahead of a target transaction to capitalize on anticipated price movements, while back-running executes immediately after to exploit the target's market impact.

Priority Gas Auction (PGA)

Priority Gas Auction (PGA) optimizes transaction ordering by allowing users to bid for preferential placement in blockchain blocks, effectively mitigating front-running attacks where adversaries exploit transaction sequencing for profit. By prioritizing higher gas bids, PGA also controls back-running, reducing the risk of delayed transactions being exploited after the initial execution.

Block Reordering

Block reordering manipulates the sequence of transactions within a blockchain block, enabling front-running by placing a trade before a target transaction or back-running by executing a trade immediately after it. This practice exploits transaction ordering to gain unfair profit advantages in decentralized finance (DeFi) protocols and negatively impacts transaction fairness and market integrity.

Dark Pool Trading

Dark pool trading enables large institutional investors to execute sizable orders away from public exchanges, reducing market impact and information leakage; front-running involves exploiting advance knowledge of these trades for profit, whereas back-running capitalizes on price movements after the order execution. Understanding the interplay between dark pools and front-running versus back-running strategies is crucial for maintaining market fairness and regulatory compliance.

front-running vs back-running Infographic

moneydif.com

moneydif.com