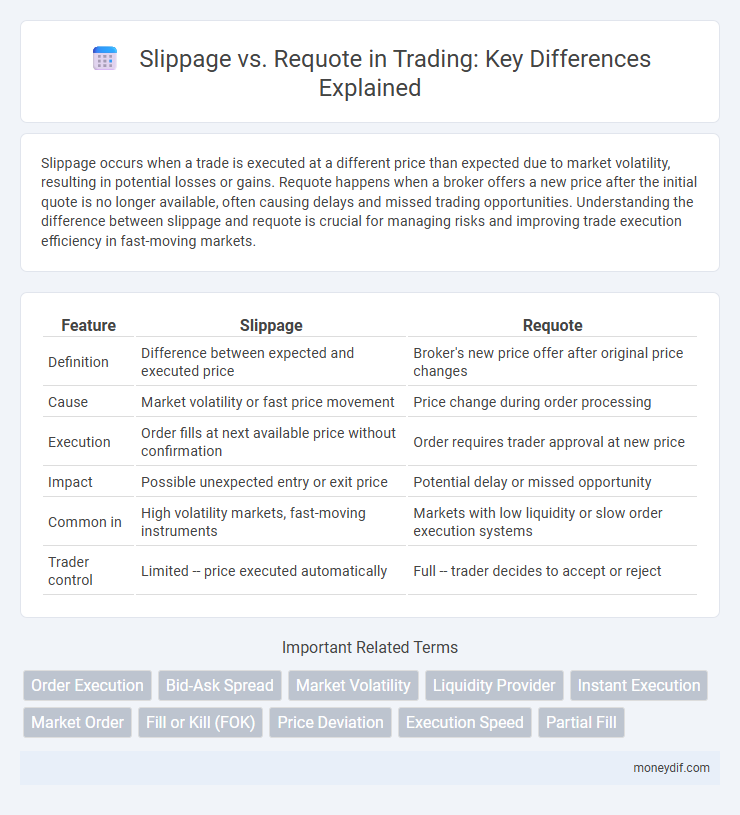

Slippage occurs when a trade is executed at a different price than expected due to market volatility, resulting in potential losses or gains. Requote happens when a broker offers a new price after the initial quote is no longer available, often causing delays and missed trading opportunities. Understanding the difference between slippage and requote is crucial for managing risks and improving trade execution efficiency in fast-moving markets.

Table of Comparison

| Feature | Slippage | Requote |

|---|---|---|

| Definition | Difference between expected and executed price | Broker's new price offer after original price changes |

| Cause | Market volatility or fast price movement | Price change during order processing |

| Execution | Order fills at next available price without confirmation | Order requires trader approval at new price |

| Impact | Possible unexpected entry or exit price | Potential delay or missed opportunity |

| Common in | High volatility markets, fast-moving instruments | Markets with low liquidity or slow order execution systems |

| Trader control | Limited -- price executed automatically | Full -- trader decides to accept or reject |

Understanding Slippage in Trading

Slippage in trading refers to the difference between the expected price of a trade and the price at which the trade is actually executed, often occurring during high volatility or low liquidity. It is crucial to differentiate slippage from requotes, where traders receive a new price quote before order execution instead of acceptance at the original price. Understanding slippage helps traders manage risk effectively, optimize order execution, and implement strategies such as limit orders to minimize unexpected costs.

What is a Requote?

A requote occurs in trading when a broker offers a new price after a client attempts to execute an order, typically due to market volatility or rapid price changes. This prevents the order from being filled at the originally requested price, often leading to delays or missed trading opportunities. Requotes impact traders by increasing uncertainty and potentially affecting trade execution efficiency and profitability.

Key Differences: Slippage vs. Requote

Slippage occurs when a trade is executed at a different price than expected due to market volatility, often during fast-moving markets or low liquidity conditions, resulting in either a better or worse price. Requote happens when a broker cannot fill the order at the requested price and offers a new price, requiring trader confirmation before execution, which can delay or alter the trade outcome. Key differences lie in slippage being an automatic price deviation during execution, while requote is an explicit renegotiation requiring trader approval.

Causes of Slippage in Financial Markets

Slippage in financial markets occurs when an order is executed at a different price than expected due to rapid price movements, low liquidity, or delays in order processing. Market volatility often causes slippage by increasing price fluctuations between the time an order is placed and executed. Additionally, insufficient liquidity can prevent trades from being filled at the desired price, leading to unexpected execution levels.

Why Do Requotes Happen?

Requotes occur when market prices change rapidly, causing a broker to offer a new price different from the trader's original request, ensuring the order fills at the updated rate. High volatility, low liquidity, and execution delays increase the likelihood of requotes, as brokers cannot guarantee the initial price during fast-moving markets. Requotes protect brokers from losses but can disrupt trading strategies reliant on precise entry points.

Impact of Slippage on Trading Strategies

Slippage occurs when a trade is executed at a price different from the expected entry or exit point, directly affecting the precision of trading strategies and potentially reducing profitability. High slippage often leads to increased trading costs, especially in volatile markets or low-liquidity assets, impacting risk management and strategy performance. Traders must incorporate slippage forecasts into algorithms to minimize unexpected losses and optimize order execution.

How Requotes Affect Trade Execution

Requotes significantly impact trade execution by delaying order confirmation and causing missed opportunities in fast-moving markets. When a requote occurs, traders receive a new price different from their original request, often resulting in execution at less favorable levels. This disruption can increase trading costs and reduce overall profitability by preventing timely order fulfillment.

Managing and Minimizing Slippage

Managing and minimizing slippage in trading involves using limit orders to set maximum acceptable prices, reducing execution delays during high volatility. Employing advanced trading platforms with fast execution speeds and reliable liquidity sources also helps prevent price discrepancies between order submission and fulfillment. Regularly monitoring market conditions and adjusting strategies accordingly enhances control over slippage and avoids costly requotes.

Tips to Avoid Requotes

To minimize requotes in trading, use limit orders instead of market orders to control execution prices precisely. Implement trading during periods of high liquidity to reduce price volatility and ensure faster order fills. Monitor broker execution speeds and choose a platform with low latency to avoid delays causing requotes.

Choosing the Right Broker: Slippage and Requote Policies

Choosing the right broker requires careful evaluation of slippage and requote policies, as these factors directly impact trading execution and cost efficiency. Brokers with transparent slippage policies and minimal requote frequency offer more reliable order fills, especially in volatile markets where price movements can be rapid. Understanding the broker's approach to handling slippage and requotes ensures traders can minimize unexpected losses and optimize trade performance.

Important Terms

Order Execution

Slippage occurs when an order is executed at a different price than expected due to market volatility, while requotes happen when a broker offers a new price after the original price becomes unavailable.

Bid-Ask Spread

Bid-ask spread directly impacts slippage by widening execution prices, increasing the likelihood of requotes during volatile market conditions.

Market Volatility

Market volatility amplifies the risk of slippage and requotes by increasing price fluctuations between order placement and execution.

Liquidity Provider

Liquidity providers reduce slippage by supplying sufficient order volume, minimizing requotes during high market volatility.

Instant Execution

Instant Execution minimizes slippage by executing trades at requested prices, reducing the need for requotes in volatile markets.

Market Order

Market orders often experience slippage, causing execution prices to deviate from expected levels, whereas requotes occur when brokers cannot fill the order at the requested price and offer a new price for confirmation.

Fill or Kill (FOK)

Fill or Kill (FOK) orders minimize slippage risk by requiring immediate full execution, avoiding requotes caused by partial fills or price changes.

Price Deviation

Price deviation between slippage and requote affects trade execution by causing unexpected costs or order delays in volatile markets.

Execution Speed

Execution speed significantly reduces slippage by minimizing the need for requotes during fast-moving market conditions.

Partial Fill

Partial fill occurs when a trade is executed at a different price due to slippage or requote, resulting in only a portion of the order being completed at the desired price.

Slippage vs Requote Infographic

moneydif.com

moneydif.com