Tick size represents the smallest possible price movement in trading an asset, varying by market and instrument, while a pip is a standardized unit typically used in forex trading to measure price changes. Understanding the difference between tick size and pip is crucial for traders when calculating profit, loss, and setting stop-loss orders. Accurate knowledge of tick size and pip values facilitates precise risk management and effective trade execution across different asset classes.

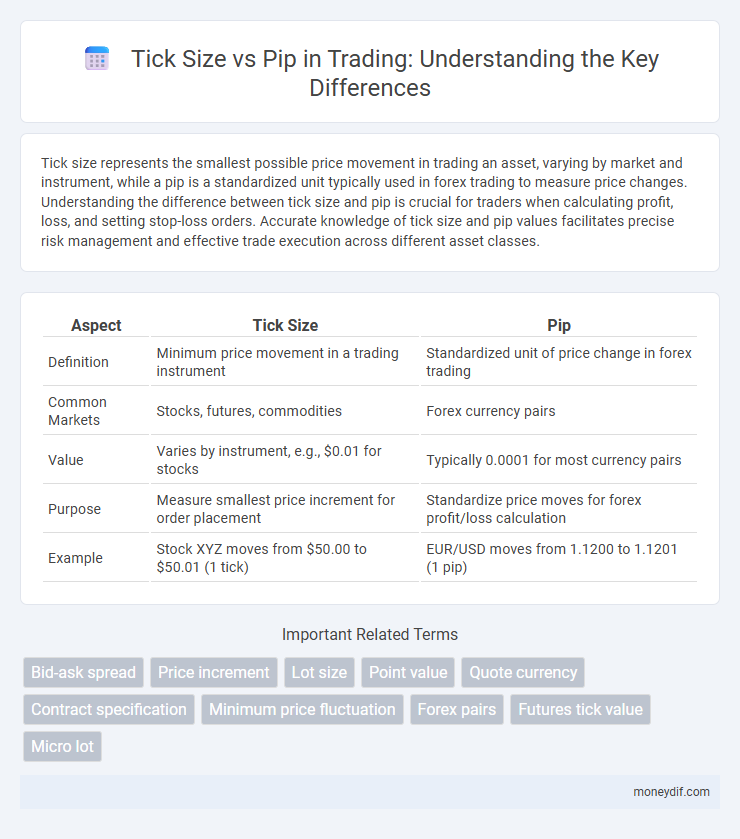

Table of Comparison

| Aspect | Tick Size | Pip |

|---|---|---|

| Definition | Minimum price movement in a trading instrument | Standardized unit of price change in forex trading |

| Common Markets | Stocks, futures, commodities | Forex currency pairs |

| Value | Varies by instrument, e.g., $0.01 for stocks | Typically 0.0001 for most currency pairs |

| Purpose | Measure smallest price increment for order placement | Standardize price moves for forex profit/loss calculation |

| Example | Stock XYZ moves from $50.00 to $50.01 (1 tick) | EUR/USD moves from 1.1200 to 1.1201 (1 pip) |

Understanding Tick Size in Trading

Tick size in trading refers to the minimum price movement of a trading instrument, differing across markets and assets, while a pip specifically denotes the standard incremental movement in forex currency pairs, typically 0.0001 for most majors. Understanding tick size is essential for traders to accurately assess price changes, calculate potential profits or losses, and manage risk effectively in various trading environments. Precise knowledge of tick size enables better execution strategies and enhances decision-making by clarifying the smallest possible fluctuations in asset prices.

What is a Pip? A Complete Overview

A pip, short for "percentage in point," represents the smallest price movement in forex trading, typically the fourth decimal place in currency pairs like EUR/USD. Unlike tick size, which varies by market and is the minimum price increment for stocks or futures, a pip standardizes price changes across global forex markets, facilitating clear profit and loss calculations. Understanding pip value is essential for effective risk management and position sizing in currency trading strategies.

Key Differences Between Tick Size and Pip

Tick size represents the minimum price movement a trading instrument can make, usually defined by the exchange, while a pip is a standardized unit measuring price change in forex markets, typically 0.0001 for most currency pairs. Tick size varies between assets and markets, impacting the spread and liquidity, whereas pips provide a consistent framework for traders to calculate profits, losses, and risk management in currency trading. Understanding these key differences allows traders to accurately interpret price movements and optimize their trading strategies across various financial instruments.

How Tick Size Impacts Market Prices

Tick size determines the smallest price increment at which a financial instrument can trade, directly influencing bid-ask spreads and liquidity in markets such as forex and futures. A smaller tick size allows for tighter spreads, enhancing price efficiency and reducing transaction costs for traders. Conversely, larger tick sizes can increase price volatility by limiting price granularity, affecting market depth and trader execution strategies.

The Role of Pip in Forex Trading

The role of a pip in forex trading is crucial as it represents the smallest price movement a currency pair can make, typically 0.0001 for most major pairs. Unlike tick size, which varies depending on the market or instrument, the pip standardizes measurement, making it easier for traders to calculate profits and losses accurately. Understanding pip values is essential for effective risk management and developing precise trading strategies in the forex market.

Tick Size Across Different Asset Classes

Tick size, the minimum price movement of a trading instrument, varies significantly across asset classes, impacting liquidity and volatility measures. In equities, tick sizes are typically fixed by exchanges, such as 0.01 USD in U.S. stocks, while forex markets use pips, standardized as 0.0001 for major currency pairs. Understanding these variations allows traders to optimize order placement strategies and risk management across diverse markets.

Calculating Profits and Losses: Tick Size vs. Pip

Tick size represents the minimum price movement in futures trading, usually defined by the exchange, while a pip is the smallest price change in forex, often equivalent to 0.0001 for major currency pairs. Calculating profits and losses depends on the tick size multiplied by the tick value in futures, whereas in forex, pip value varies based on currency pair and trade size, directly impacting the monetary gain or loss. Understanding the difference ensures precise risk management and accurate profit/loss calculations across different trading markets.

How Tick Size and Pip Affect Trading Strategies

Tick size, the minimum price movement of a trading instrument, directly influences order placement and risk management in trading strategies. Pip, representing the smallest price change in forex pairs, is crucial for calculating profit, loss, and setting stop-loss or take-profit levels. Understanding the relationship between tick size and pip enables traders to optimize entry points, manage volatility, and improve the precision of algorithmic trading systems.

Regulatory Influence on Tick Size and Pip

Regulatory bodies like the Commodity Futures Trading Commission (CFTC) and the European Securities and Markets Authority (ESMA) set specific rules on tick size to ensure market fairness and transparency, directly impacting liquidity and trading costs. Pip size, while primarily defined by the currency pair's decimal precision, is indirectly influenced by regulations that mandate minimum price increments for different asset classes. These regulatory frameworks help standardize market practices, reducing price manipulation risks and enhancing investor confidence across forex and futures markets.

Which is More Important for Traders: Tick Size or Pip?

Tick size defines the minimum price movement of a trading instrument, crucial for assets like stocks and futures, while pip represents the smallest price change in forex pairs, typically 0.0001 for major currencies. Traders prioritize tick size in markets with discrete price increments affecting order execution and liquidity, whereas pips are vital for forex trading to measure profit, loss, and volatility accurately. Understanding both concepts enhances trading precision, but relevance depends on the specific market and instrument being traded.

Important Terms

Bid-ask spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, directly influenced by tick size, which is the smallest possible price movement in a trading instrument. In forex markets, the pip serves as a standardized unit for measuring price changes, while the tick size determines the minimum increment of the bid-ask spread, impacting liquidity and trading costs.

Price increment

Price increment in trading is determined by tick size, the minimum price movement of a financial instrument, which directly influences the value of a pip, the standardized unit of price change in forex markets. Smaller tick sizes allow for finer price adjustments, enhancing precision in pip calculations and affecting trading strategies and risk management.

Lot size

Lot size represents the standardized quantity of a financial instrument traded, directly influencing trade volume and risk exposure in forex markets. Tick size denotes the smallest possible price movement of an asset, while pip measures the smallest price change in currency pairs, with lot size determining the total monetary impact of each pip movement.

Point value

Point value quantifies the monetary worth of a one-point price movement in a trading instrument and is directly influenced by tick size, which represents the smallest possible price increment; pip, commonly used in forex, denotes a standardized unit of price change typically equivalent to 0.0001 for most currency pairs. Understanding the relationship between tick size and pip is essential for accurately calculating point value, managing risk, and optimizing trade execution strategies.

Quote currency

Quote currency represents the second currency in a forex pair, determining the value of one unit of the base currency; tick size is the smallest price movement possible in the quote currency, while a pip typically equals a standardized unit like 0.0001 of the quote currency. Understanding the difference is crucial for precise trading strategies and risk management, as tick size impacts order execution precision and pips quantify profit or loss in forex trading.

Contract specification

Contract specifications define the tick size as the smallest permissible price movement of a trading instrument, directly impacting precision and transaction costs in forex markets. In contrast, a pip represents a standardized unit measuring price changes, typically equating to 0.0001 for most currency pairs, and serves as a basis for calculating profit, loss, and spread relative to the tick size.

Minimum price fluctuation

Minimum price fluctuation, defined as the smallest possible change in a trading instrument's price, is commonly determined by the tick size in markets like stocks or futures, while in forex trading, this minimum unit is referred to as a pip. Tick size varies by asset and exchange, directly influencing spread and liquidity, whereas pip values standardize price movements in currency pairs, typically representing 0.0001 for most major forex pairs, enabling precise risk management and trade execution.

Forex pairs

Forex pairs' tick size represents the smallest possible price movement in the trading platform, often corresponding to a fraction of a pip, which equals 0.0001 for most currency pairs like EUR/USD. Understanding the difference between tick size and pip value helps traders accurately calculate profit, loss, and risk in forex trading strategies.

Futures tick value

Futures tick value represents the monetary worth of a single tick movement, calculated by multiplying the tick size by the contract's pip value; tick size is the minimum price fluctuation allowed on a futures contract, while a pip measures the smallest price increment in forex or related markets. Understanding the relationship between tick size and pip is crucial for traders to accurately assess potential profit or loss from price changes in futures trading.

Micro lot

A micro lot in forex trading represents 1,000 units of the base currency, with the tick size indicating the smallest possible price movement, often smaller than a pip which equals 0.0001 for most currency pairs; understanding the distinction between tick size and pip is essential for precise trade calculations and risk management. Traders use this differentiation to calculate profit, loss, and margin requirements accurately when trading micro lots, especially in pairs with varying decimal places such as the Japanese yen pairs where a pip equals 0.01.

tick size vs pip Infographic

moneydif.com

moneydif.com