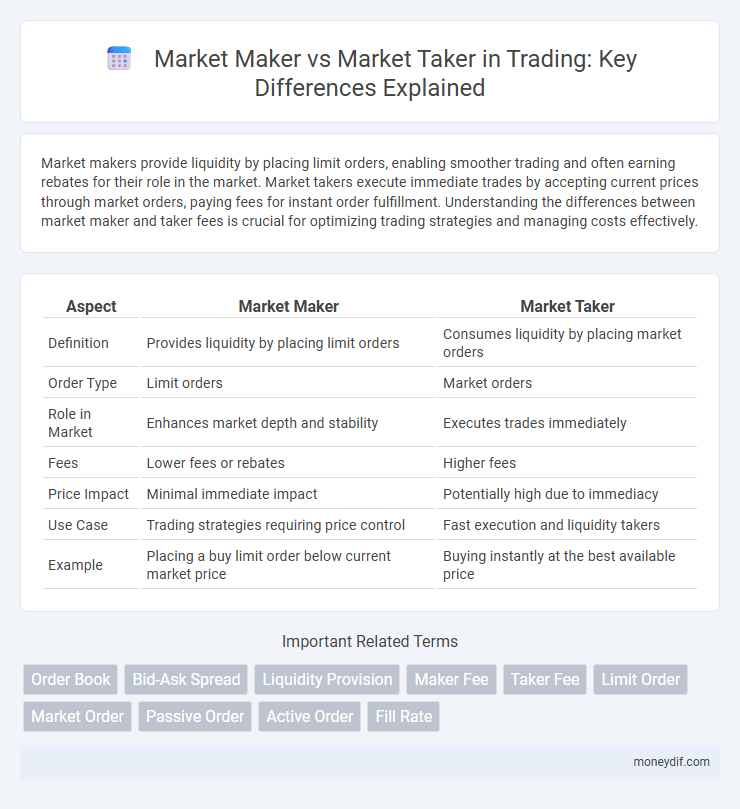

Market makers provide liquidity by placing limit orders, enabling smoother trading and often earning rebates for their role in the market. Market takers execute immediate trades by accepting current prices through market orders, paying fees for instant order fulfillment. Understanding the differences between market maker and taker fees is crucial for optimizing trading strategies and managing costs effectively.

Table of Comparison

| Aspect | Market Maker | Market Taker |

|---|---|---|

| Definition | Provides liquidity by placing limit orders | Consumes liquidity by placing market orders |

| Order Type | Limit orders | Market orders |

| Role in Market | Enhances market depth and stability | Executes trades immediately |

| Fees | Lower fees or rebates | Higher fees |

| Price Impact | Minimal immediate impact | Potentially high due to immediacy |

| Use Case | Trading strategies requiring price control | Fast execution and liquidity takers |

| Example | Placing a buy limit order below current market price | Buying instantly at the best available price |

Understanding Market Makers and Takers

Market makers provide liquidity by continuously offering buy and sell orders at specified prices, facilitating smoother and more efficient trading environments. Market takers accept these orders, executing trades at the quoted prices, which impacts market price discovery and transaction speed. Understanding the roles of market makers and takers is essential for grasping market dynamics, order book behavior, and trading cost implications.

Role of Market Makers in Trading

Market makers provide liquidity to financial markets by continuously quoting buy and sell prices, enabling smoother and more efficient trading. They facilitate price discovery and reduce spreads, ensuring that traders can execute orders promptly without significant price impact. By assuming inventory risk, market makers enhance overall market stability and increase transaction volumes.

Role of Market Takers in Trading

Market takers play a crucial role in trading by accepting existing bids or offers in the order book, ensuring liquidity and market fluidity. They execute trades immediately at predetermined prices, driving price discovery and enabling efficient market functioning. High-frequency traders and retail investors often act as market takers to capitalize on available market conditions and respond quickly to price movements.

Key Differences Between Makers and Takers

Market makers provide liquidity by placing limit orders, setting bid and ask prices on the order book, while takers remove liquidity by executing market orders against existing bids or asks. Makers typically benefit from lower trading fees as they contribute to market depth, whereas takers incur higher fees for immediate order execution. The fundamental difference lies in makers adding liquidity and setting prices, whereas takers consume liquidity and accept prices.

Maker and Taker Fee Structures

Market makers provide liquidity by placing limit orders, often benefiting from lower or even negative maker fees as exchanges incentivize their role in stabilizing price fluctuations. Takers remove liquidity by executing market orders, generally facing higher taker fees that compensate for the immediate liquidity consumption. Fee structures vary across platforms, but the differential pricing between maker and taker fees is central to encouraging balanced market participation and depth.

Liquidity Impact: Makers vs Takers

Market makers enhance liquidity by placing limit orders that add depth to the order book, facilitating smoother price discovery and reducing spreads. Conversely, market takers consume liquidity by executing immediate market orders, which can increase volatility and cause rapid price movements. The balance between makers and takers is crucial in maintaining an efficient and stable trading environment.

Trading Strategies for Makers and Takers

Market makers utilize limit orders to provide liquidity by setting bid and ask prices, aiming to profit from the bid-ask spread while managing inventory risk through careful position balancing. Market takers execute market orders to quickly enter or exit positions, focusing on capturing immediate price movements and often employing momentum or news-based trading strategies. Both roles require tailored risk management and order execution tactics to optimize trading performance in volatile markets.

Advantages of Being a Market Maker

Market makers provide liquidity by continuously offering buy and sell prices, enabling smoother and faster trade executions while often receiving lower fees or rebates from exchanges. Their role reduces bid-ask spreads, benefiting overall market efficiency and stability. This position allows market makers to capitalize on the spread difference, generating consistent profits even in volatile markets.

Advantages of Being a Market Taker

Market takers benefit from immediate order execution by accepting existing prices on the order book, ensuring faster transaction completion. They play a crucial role in providing liquidity to the market by filling existing orders, which can lead to better price discovery. Market takers often face relatively straightforward trading strategies without the need to predict market movements, allowing for efficient and timely trades.

Choosing the Right Approach: Maker or Taker?

Choosing the right approach between market maker and taker depends on trading goals and market conditions. Market makers provide liquidity by placing limit orders, often benefiting from tighter spreads and potential rebates, while takers execute market orders that guarantee immediate execution but typically incur higher fees. Evaluating factors like fee structure, order execution speed, and market volatility helps traders optimize their strategy for cost efficiency and trade effectiveness.

Important Terms

Order Book

Market makers provide liquidity by placing limit orders on the order book, while market takers consume liquidity by executing market orders against those existing bids and offers.

Bid-Ask Spread

The bid-ask spread represents the price difference set by market makers who provide liquidity, while market takers accept this spread to execute immediate trades.

Liquidity Provision

Market makers enhance market liquidity by continuously placing buy and sell orders, while takers consume liquidity by executing trades against existing orders.

Maker Fee

Maker fees are typically lower than taker fees because makers provide liquidity by placing limit orders, while takers remove liquidity by executing market orders.

Taker Fee

Taker fees are typically higher than market maker fees because takers remove liquidity from the order book by matching existing orders, while market makers add liquidity by placing new limit orders.

Limit Order

A limit order sets a specific price to buy or sell an asset, allowing market makers to provide liquidity by matching these orders, while market takers accept existing prices to execute trades immediately.

Market Order

Market orders execute instantly by matching taker demand with market maker liquidity at the best available price, ensuring rapid trade fulfillment in financial markets.

Passive Order

Passive orders provide liquidity by placing limit orders that market makers use to add volume to order books, while takers execute market orders that consume available liquidity instantly.

Active Order

Active orders contribute liquidity as market makers by providing limit orders that improve market depth, while market takers remove liquidity by executing market orders against existing bids or asks.

Fill Rate

Market makers typically achieve higher fill rates than takers by providing liquidity and executing trades from the order book rather than consuming it.

Market Maker vs Taker Infographic

moneydif.com

moneydif.com