Iceberg orders reveal only a small portion of the total order size to the market, allowing traders to execute large trades discreetly without significantly impacting the price. Hidden orders remain completely invisible until fully executed, providing maximum confidentiality but potentially lower priority in order matching. Understanding the differences between iceberg and hidden orders helps traders optimize execution strategies based on liquidity needs and market impact.

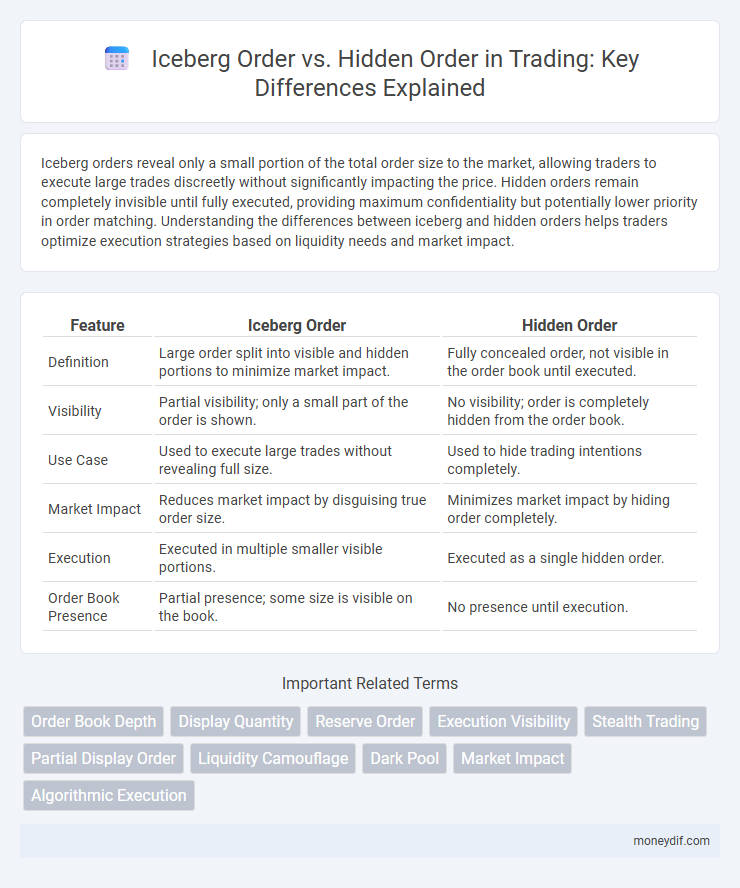

Table of Comparison

| Feature | Iceberg Order | Hidden Order |

|---|---|---|

| Definition | Large order split into visible and hidden portions to minimize market impact. | Fully concealed order, not visible in the order book until executed. |

| Visibility | Partial visibility; only a small part of the order is shown. | No visibility; order is completely hidden from the order book. |

| Use Case | Used to execute large trades without revealing full size. | Used to hide trading intentions completely. |

| Market Impact | Reduces market impact by disguising true order size. | Minimizes market impact by hiding order completely. |

| Execution | Executed in multiple smaller visible portions. | Executed as a single hidden order. |

| Order Book Presence | Partial presence; some size is visible on the book. | No presence until execution. |

Introduction to Iceberg and Hidden Orders

Iceberg orders are large trade orders divided into smaller visible portions to conceal the full size and minimize market impact, enhancing strategic execution in trading. Hidden orders remain entirely invisible on the order book, providing complete discretion to traders aiming to execute large trades without alerting the market. Both order types optimize liquidity management by balancing transparency and secrecy in market operations.

Key Differences Between Iceberg and Hidden Orders

Iceberg orders reveal only a portion of the total order size, allowing traders to execute large trades stealthily without impacting market price significantly. Hidden orders remain completely invisible on the order book until fully executed, providing maximum discretion but less control over market signaling. The primary difference lies in visibility and execution strategy: iceberg orders balance exposure and concealment, while hidden orders prioritize concealment at the cost of potential price discovery.

How Iceberg Orders Work in Trading

Iceberg orders work in trading by allowing large orders to be divided into smaller, visible portions while the bulk remains hidden from the market. These smaller displayed quantities help traders avoid significant market impact and maintain anonymity when executing substantial trades. Sophisticated trading platforms use algorithms to automatically replenish the visible portion as it gets filled, ensuring continuous partial order execution without revealing the full order size.

Mechanics of Hidden Orders Explained

Hidden orders in trading operate by concealing the entire order size from the market, allowing large traders to execute substantial trades without revealing their full intent, thus minimizing market impact. Unlike iceberg orders that display only a small portion of the total size, hidden orders keep the entire quantity invisible until executed. This mechanism enhances execution discretion and reduces information leakage, benefiting traders aiming to maintain anonymity and minimize price movement.

Advantages of Using Iceberg Orders

Iceberg orders offer significant advantages by allowing traders to execute large trades without revealing the full order size, reducing market impact and minimizing price slippage. The visible portion of the order provides liquidity while concealing the remainder, helping maintain price stability and preventing adversaries from detecting trading intentions. This strategic order execution enhances anonymity and optimizes entry and exit prices in highly liquid or volatile markets.

Benefits of Implementing Hidden Orders

Hidden orders provide traders with the advantage of maintaining anonymity by concealing the full order size, preventing market impact and minimizing price fluctuations. They enable strategic execution by allowing large orders to be broken down without signaling intent to other market participants. This discretion helps in optimizing trade outcomes and reducing information leakage in both equity and futures markets.

Risks Associated with Iceberg and Hidden Orders

Iceberg orders carry the risk of partial exposure since only a fraction of the total order is visible, potentially leading to price slippage and adverse market reactions as other traders infer hidden demand. Hidden orders, while fully concealed, may suffer from lower priority in execution compared to visible orders, increasing the chance of non-fill or delayed trades in fast-moving markets. Both order types risk triggering unfavorable price movements due to their strategic concealment, impacting trade execution efficiency and market impact.

Use Cases: When to Choose Iceberg vs Hidden Orders

Iceberg orders are ideal for institutional traders aiming to execute large buy or sell orders without revealing the full order size, minimizing market impact and price slippage. Hidden orders suit traders who want complete discretion by keeping the entire order invisible to the market, often used in illiquid markets or when traders anticipate front-running. Choosing between iceberg and hidden orders depends on the need for partial visibility versus total secrecy, balancing market impact with order execution speed.

Impact on Market Liquidity and Price Discovery

Iceberg orders offer partial transparency by revealing only a fraction of the total order size, which helps maintain market liquidity without causing significant price disruption. Hidden orders remain completely concealed, reducing the chance of price impact but potentially impairing price discovery by limiting visible supply and demand information. Both order types strategically manage liquidity exposure, with iceberg orders striking a balance between market visibility and stealth, while hidden orders prioritize minimizing market impact at the expense of transparency.

Best Practices for Executing Stealth Trades

Iceberg orders conceal large trade sizes by revealing only a small portion of the total order, minimizing market impact and price slippage, making them ideal for maintaining discretion in high-volume trades. Hidden orders remain completely invisible to the market until execution, offering maximum stealth but less control over partial fills and timing. Best practices for executing stealth trades involve balancing order visibility with execution speed, using iceberg orders for gradual market absorption and hidden orders when avoidance of market signaling is critical.

Important Terms

Order Book Depth

Order book depth reveals liquidity layers where iceberg orders show partial visible size while hidden orders remain entirely concealed, impacting market transparency and trading strategies.

Display Quantity

Display quantity in Iceberg Orders reveals only a portion of the total order size to the market, while Hidden Orders keep the entire order quantity concealed.

Reserve Order

A Reserve Order reveals only a portion of its total size to the market like an Iceberg Order, whereas a Hidden Order remains completely concealed until fully executed.

Execution Visibility

Execution visibility in trading differs between Iceberg Orders, which reveal only a portion of the total order size to the market, and Hidden Orders, which keep the entire order concealed until fully executed.

Stealth Trading

Stealth trading techniques use Iceberg Orders to reveal small portions of large trades for market impact minimization, while Hidden Orders remain completely invisible to the market until fully executed, optimizing trade secrecy.

Partial Display Order

Partial Display Order reveals only a portion of the total order size, bridging the transparency gap between Iceberg Orders, which expose limited quantity while hiding the remainder, and Hidden Orders, which conceal the entire order from the order book.

Liquidity Camouflage

Liquidity Camouflage is a trading strategy that conceals large Iceberg Orders by breaking them into smaller visible parts while Hidden Orders remain completely invisible to market participants, enhancing stealth and reducing market impact.

Dark Pool

Dark pools facilitate large trades by concealing orders from public view, allowing institutions to minimize market impact. Iceberg orders reveal only a portion of the total order size in the order book, whereas hidden orders remain entirely concealed until executed, making both strategies essential for maintaining anonymity in dark pool trading.

Market Impact

Iceberg orders minimize market impact by revealing only a small portion of the total order size to avoid price disruption, whereas hidden orders conceal the entire size but may trigger larger market impact due to sudden full-volume execution.

Algorithmic Execution

Algorithmic execution optimizes trade execution by utilizing Iceberg Orders to reveal partial order size while concealing the remainder, whereas Hidden Orders remain entirely undisclosed until executed, enhancing market impact control and minimizing price slippage.

Iceberg Order vs Hidden Order Infographic

moneydif.com

moneydif.com