The candlewick represents price volatility by showing the highest and lowest points reached during the trading period, while the body reflects the opening and closing prices, indicating market sentiment. A long wick with a small body suggests rejection of price levels and potential reversals, whereas a large body implies strong buying or selling pressure. Analyzing the relationship between the candlewick and body helps traders identify momentum shifts and key support or resistance zones.

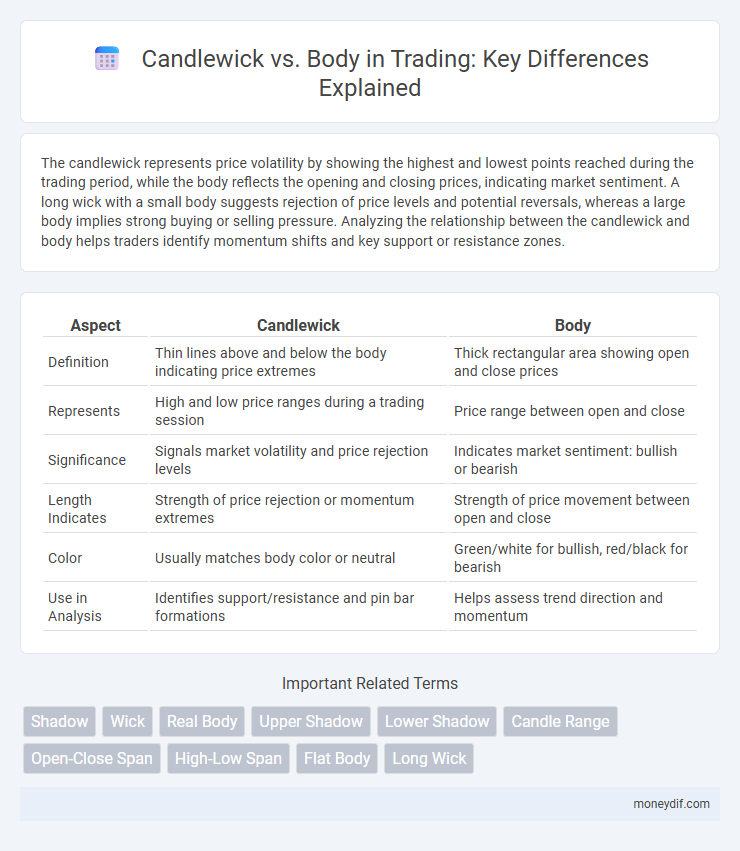

Table of Comparison

| Aspect | Candlewick | Body |

|---|---|---|

| Definition | Thin lines above and below the body indicating price extremes | Thick rectangular area showing open and close prices |

| Represents | High and low price ranges during a trading session | Price range between open and close |

| Significance | Signals market volatility and price rejection levels | Indicates market sentiment: bullish or bearish |

| Length Indicates | Strength of price rejection or momentum extremes | Strength of price movement between open and close |

| Color | Usually matches body color or neutral | Green/white for bullish, red/black for bearish |

| Use in Analysis | Identifies support/resistance and pin bar formations | Helps assess trend direction and momentum |

Understanding Candlestick Components: Wick vs Body

The candlestick body represents the price range between the opening and closing prices, indicating bullish or bearish market sentiment, while the wick (or shadow) reflects the highest and lowest prices during the trading period. A long wick suggests volatility and potential price reversals, whereas a larger body indicates strong buying or selling pressure. Understanding the relationship between the candlewick and body helps traders identify trend strength, market indecision, and potential entry or exit points in stock, forex, or cryptocurrency markets.

The Significance of Candlewick in Price Action

The candlewick, representing the high and low price extremes during a trading period, signals market volatility and investor sentiment more effectively than the body alone. Long wicks indicate strong rejection of price levels, often foreshadowing potential reversals or breakout points. Analyzing the wick length relative to the body helps traders assess momentum shifts and identify support or resistance zones more accurately.

Decoding the Candlestick Body: What It Reveals

The candlestick body represents the price range between the open and close within a specific time frame, providing crucial insight into market sentiment. A long body indicates strong buying or selling pressure, while a short body reflects consolidation or indecision. Analyzing the relationship between the body and the wick helps traders identify potential reversals, trend strength, and market momentum.

Comparing Wick and Body: Key Differences

The candlewick in trading charts represents the high and low prices during a specific period, indicating market volatility, while the body shows the opening and closing prices, reflecting the buying or selling pressure. A long wick suggests price rejection or reversal potential, whereas a large body signifies strong momentum in the direction of the trend. Understanding the distinction between wick and body helps traders interpret market sentiment and make informed decisions.

How Candlewick Length Influences Market Signals

Candlewick length significantly influences market signals by indicating volatility and potential price reversals in trading charts. A long wick suggests strong rejection of price levels, signaling potential reversals or breakouts, while a short wick indicates market indecision or consolidation. Traders analyze the wick-to-body ratio to assess momentum strength and predict subsequent market movements more accurately.

The Role of the Body Size in Trend Identification

The size of the candle body is a critical indicator in trend identification, where larger bodies signify strong buying or selling pressure, reinforcing the momentum of a trend. Smaller bodies, often accompanied by long candlewicks, indicate market indecision or potential reversals, as the price closes near its opening level. Traders analyze the proportion between the candlewick and body to assess the strength and sustainability of bullish or bearish trends in trading charts.

Wick vs Body: Spotting Market Reversals

The wick on a candlestick chart reveals market rejection levels and price extremes, signaling potential reversals when significantly longer than the body. A long wick with a small body, especially after a strong trend, often indicates investor hesitation and a possible shift in momentum. Traders use these wick-to-body ratios to identify entry or exit points, enhancing reversal prediction accuracy.

Trading Strategies Based on Wick and Body Analysis

Analyzing the candlewick length relative to the body in candlestick charts can reveal market sentiment and potential price reversals, with long wicks indicating rejection of higher or lower prices and short bodies suggesting indecision or consolidation. Traders often use wick patterns to set more precise entry and exit points by identifying key support and resistance levels, while substantial body sizes confirm momentum and trend strength. Incorporating wick and body analysis enhances risk management by highlighting potential fakeouts and validating trend continuation or reversal signals in various trading strategies.

Common Patterns: Wick and Body Interpretation

In trading, the length and position of the candlewick compared to the body reveal market sentiment and potential reversals. Long upper wicks indicate selling pressure, while long lower wicks suggest buying interest, often signaling support or resistance levels. Candle bodies reflect the strength of price movement, where large bodies denote strong momentum and small bodies indicate indecision or consolidation.

Candlewick and Body: Avoiding Common Trading Mistakes

In trading, the candlewick represents the highest and lowest prices reached during a session, revealing market volatility and potential reversals, whereas the body indicates the opening and closing prices, reflecting the overall market sentiment. Misinterpreting the candlewick as the body can lead to erroneous conclusions about price momentum and trend strength, resulting in poor trade entries or exits. Focusing on the candlewick's length and position relative to the body enhances decision-making accuracy and reduces common trading mistakes tied to misleading price action interpretations.

Important Terms

Shadow

Shadow intensity varies with Candlewick thickness, directly influencing the body's heat absorption and dispersion.

Wick

Wick thickness and material composition directly influence the burn rate and soot production of Candlewick vs Body candles, affecting overall flame stability and scent diffusion.

Real Body

Real Body provides a precise, high-quality alternative to Candlewick embroidery by offering detailed texture and durability tailored for intricate fabric embellishments.

Upper Shadow

The upper shadow of a candlestick chart represents the price range between the highest point and the candlewick's close or open, indicating selling pressure above the candle body.

Lower Shadow

The lower shadow in candlestick charts represents the price range between the lowest traded price and the candle body's lower edge, indicating buying pressure when it is long relative to the body.

Candle Range

The candle range is determined by the distance between the candlewick's highest and lowest points, reflecting price volatility beyond the body which represents the open and close prices.

Open-Close Span

The open-close span of a candlestick chart measures the difference between the candlewick and body, indicating market momentum and price volatility.

High-Low Span

High-Low Span measures the total candle length by subtracting the low price from the high price, highlighting the full price range beyond the candlewick and body in technical analysis.

Flat Body

Flat Body design enhances candlewick durability by reducing fabric puckering and maintaining smooth surface integrity.

Long Wick

Long wick candles create a larger flame and more soot compared to a traditional candlewick, affecting the candle's burn quality and body consistency.

Candlewick vs Body Infographic

moneydif.com

moneydif.com