Bullish engulfing patterns signal potential upward price reversals when a small bearish candle is followed by a larger bullish candle that completely covers it, indicating strong buying pressure. Bearish engulfing patterns suggest possible downward reversals as a small bullish candle is overtaken by a larger bearish candle, reflecting increased selling momentum. Traders use these reversal patterns to identify entry and exit points, combining them with volume analysis and other technical indicators for higher accuracy.

Table of Comparison

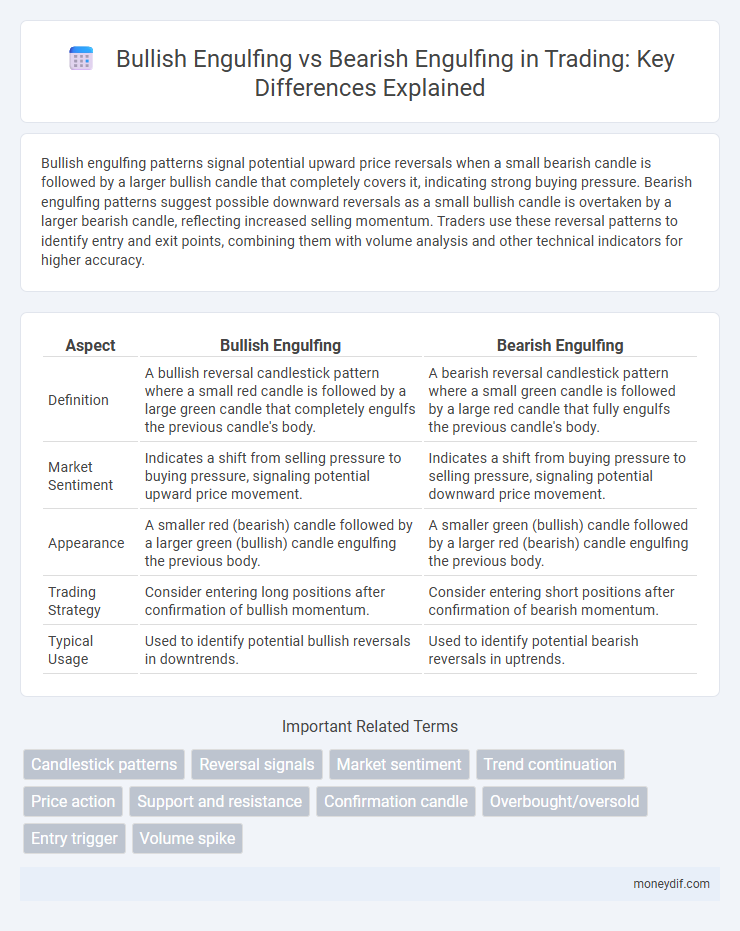

| Aspect | Bullish Engulfing | Bearish Engulfing |

|---|---|---|

| Definition | A bullish reversal candlestick pattern where a small red candle is followed by a large green candle that completely engulfs the previous candle's body. | A bearish reversal candlestick pattern where a small green candle is followed by a large red candle that fully engulfs the previous candle's body. |

| Market Sentiment | Indicates a shift from selling pressure to buying pressure, signaling potential upward price movement. | Indicates a shift from buying pressure to selling pressure, signaling potential downward price movement. |

| Appearance | A smaller red (bearish) candle followed by a larger green (bullish) candle engulfing the previous body. | A smaller green (bullish) candle followed by a larger red (bearish) candle engulfing the previous body. |

| Trading Strategy | Consider entering long positions after confirmation of bullish momentum. | Consider entering short positions after confirmation of bearish momentum. |

| Typical Usage | Used to identify potential bullish reversals in downtrends. | Used to identify potential bearish reversals in uptrends. |

Understanding Candlestick Patterns: Bullish vs Bearish Engulfing

Bullish engulfing patterns occur when a smaller red candlestick is followed by a larger green candlestick that completely covers the previous day's body, signaling potential upward momentum and buying pressure in trading charts. Bearish engulfing patterns appear when a smaller green candlestick is succeeded by a larger red candlestick that fully engulfs it, indicating increased selling pressure and possible trend reversal downward. Recognizing these candlestick patterns helps traders identify shifts in market sentiment and make informed decisions about entering or exiting positions.

Key Differences: Bullish Engulfing and Bearish Engulfing Patterns

Bullish engulfing patterns occur when a small red candlestick is followed by a larger green candlestick that completely engulfs the previous day's body, signaling potential upward price reversal. Bearish engulfing patterns feature a small green candlestick followed by a larger red candlestick enveloping the prior body, indicating possible downward trend reversal. Key differences include the market sentiment they reflect--bullish engulfing suggests buying pressure, while bearish engulfing indicates selling pressure--and their position in the overall price trend.

Psychological Implications Behind Engulfing Patterns

Bullish engulfing patterns reflect growing trader confidence as buyers overpower sellers, signaling potential trend reversals due to increased demand and optimism. Bearish engulfing patterns indicate rising fear and selling pressure, as sellers dominate buyers, often leading to further price declines and risk aversion. These patterns reveal shifts in market sentiment, guiding traders in anticipating momentum changes based on trader psychology.

How to Identify Bullish Engulfing in Trading Charts

A bullish engulfing pattern is identified on trading charts when a smaller red candlestick is immediately followed by a larger green candlestick that completely engulfs the previous candle's body, signaling a potential trend reversal from bearish to bullish. Traders look for this pattern at the bottom of a downtrend as confirmation of increasing buying momentum and a potential buying opportunity. Volume spikes during the formation of the bullish engulfing pattern further validate the strength of the reversal signal.

Spotting Bearish Engulfing for Bearish Market Signals

Spotting a bearish engulfing pattern involves identifying a large red candlestick that completely engulfs the previous smaller green candlestick, signaling potential market reversal from bullish to bearish. This pattern indicates strong selling pressure and typically appears at market tops, suggesting a shift in momentum toward bearish trends. Traders often use bearish engulfing signals to anticipate downward price movements and adjust their trading strategies accordingly in spot markets.

Market Conditions Favoring Engulfing Patterns

Bullish engulfing patterns typically emerge in oversold market conditions and signal potential trend reversals to the upside, frequently indicating buyer dominance and increased buying pressure. Bearish engulfing patterns often form in overbought environments, reflecting a shift to selling momentum and suggesting a near-term price decline. Identifying these market conditions enhances the reliability and predictive power of engulfing candlestick patterns in technical analysis.

Interpreting Volume with Bullish and Bearish Engulfing

Interpreting volume during bullish and bearish engulfing patterns is crucial for confirming price reversals in trading. High volume accompanying a bullish engulfing pattern indicates strong buying interest, signaling a potential upward trend reversal, while high volume in a bearish engulfing pattern reflects significant selling pressure, confirming a possible downward trend continuation. Low volume during these patterns may suggest weak momentum and increase the risk of false signals, making volume analysis essential for effective technical trading strategies.

Entry and Exit Strategies Using Engulfing Patterns

Bullish engulfing patterns signal potential upward reversals, suggesting entry points near the close of the engulfing candle, with stop-loss orders placed below its low to minimize risk. Bearish engulfing patterns indicate possible downward reversals, recommending short entries or exits on long positions at the candle's close, with stops set above the high of the engulfing candle. Traders often confirm these signals with volume analysis and other indicators to optimize timing for entry and exit decisions.

Common Mistakes When Trading Engulfing Patterns

Traders often mistake bullish engulfing patterns as guaranteed buy signals without considering volume confirmation or overall market context, leading to poor entry points. Conversely, bearish engulfing signals can be misread during market consolidations, causing premature selling. Ignoring these nuances reduces the reliability of engulfing patterns in forecasting price reversals.

Enhancing Engulfing Pattern Signals with Technical Indicators

Bullish engulfing and bearish engulfing patterns gain predictive accuracy when combined with technical indicators such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and volume analysis. High RSI values above 70 during a bearish engulfing pattern confirm overbought conditions, increasing the likelihood of a trend reversal, while low RSI below 30 during bullish engulfing signals oversold conditions supporting upward momentum. MACD crossovers aligned with engulfing patterns further validate trend shifts, and volume spikes during these patterns enhance signal reliability for market entry and exit points.

Important Terms

Candlestick patterns

Bullish engulfing patterns occur when a smaller red candle is followed by a larger green candle that completely engulfs the previous candle's body, signaling potential upward price reversal and strong buying momentum. In contrast, bearish engulfing patterns feature a smaller green candle followed by a larger red candle engulfing the prior candle's body, indicating potential downward price reversal and increased selling pressure.

Reversal signals

Bullish engulfing signals a potential reversal from a downtrend to an uptrend as a larger bullish candle fully engulfs the previous smaller bearish candle, indicating strong buying momentum. Conversely, bearish engulfing suggests a possible reversal from an uptrend to a downtrend when a larger bearish candle completely covers the prior smaller bullish candle, signaling increased selling pressure.

Market sentiment

Bullish engulfing patterns indicate a potential reversal to upward momentum as buyers overpower sellers, signaling increased market confidence and possible price gains. Bearish engulfing patterns reflect a shift to downward pressure, where sellers dominate buyers, often signaling waning investor confidence and potential price declines.

Trend continuation

Bullish engulfing patterns signal potential trend continuation by indicating strong buying momentum that can lead to price increases, whereas bearish engulfing patterns suggest a reversal or weakening of the current trend due to increased selling pressure. Traders use these candlestick patterns to confirm trend strength and make decisions on entry or exit points based on the dominance of buyers or sellers.

Price action

Bullish engulfing patterns occur when a smaller bearish candle is followed by a larger bullish candle, indicating potential upward momentum and buyer dominance. Conversely, bearish engulfing patterns form when a smaller bullish candle is overtaken by a larger bearish candle, signaling possible downward pressure and seller control in price action analysis.

Support and resistance

Support and resistance levels play a crucial role in confirming bullish and bearish engulfing patterns, with bullish engulfing often signaling a strong reversal at support zones and bearish engulfing indicating potential reversals near resistance levels. Traders rely on these patterns combined with key price levels to anticipate market direction and ensure higher probability of trend continuation or reversal.

Confirmation candle

A Confirmation candle validates the pattern indicated by bullish engulfing or bearish engulfing formations by closing decisively above the high of the bullish engulfing candle or below the low of the bearish engulfing candle, signaling strong market momentum in the anticipated direction. Traders rely on this candle to confirm trend reversals or continuations, enhancing the reliability of entry points in technical analysis.

Overbought/oversold

Overbought and oversold conditions, indicated by technical tools like the RSI, often precede bullish engulfing and bearish engulfing candlestick patterns, signaling potential market reversals. A bullish engulfing pattern tends to emerge in oversold markets, suggesting a strong buying momentum, while a bearish engulfing pattern commonly appears in overbought markets, indicating impending selling pressure.

Entry trigger

A bullish engulfing pattern signals a potential entry trigger as it indicates strong buying pressure with the second candle fully engulfing the first, suggesting a reversal to an uptrend. Conversely, a bearish engulfing pattern serves as an entry trigger for short positions, reflecting a shift to selling dominance where the second candle completely engulfs the previous bullish candle, often leading to a downtrend.

Volume spike

Volume spikes during a bullish engulfing pattern signal strong buying pressure as the larger green candle fully engulfs the previous red candle, indicating potential trend reversal to upside momentum. In contrast, volume surge accompanying a bearish engulfing pattern reflects heightened selling activity where a larger red candle overtakes a prior green candle, suggesting increased bearish sentiment and possible downtrend continuation.

bullish engulfing vs bearish engulfing Infographic

moneydif.com

moneydif.com