Front running involves a trader executing orders based on advance knowledge of pending large trades to gain an unfair advantage, while spoofing entails placing fake orders to manipulate market prices and deceive other participants. Both practices distort market integrity by creating false signals and undermining fair price discovery. Regulatory bodies enforce strict penalties to deter such manipulative trading behaviors and protect investors.

Table of Comparison

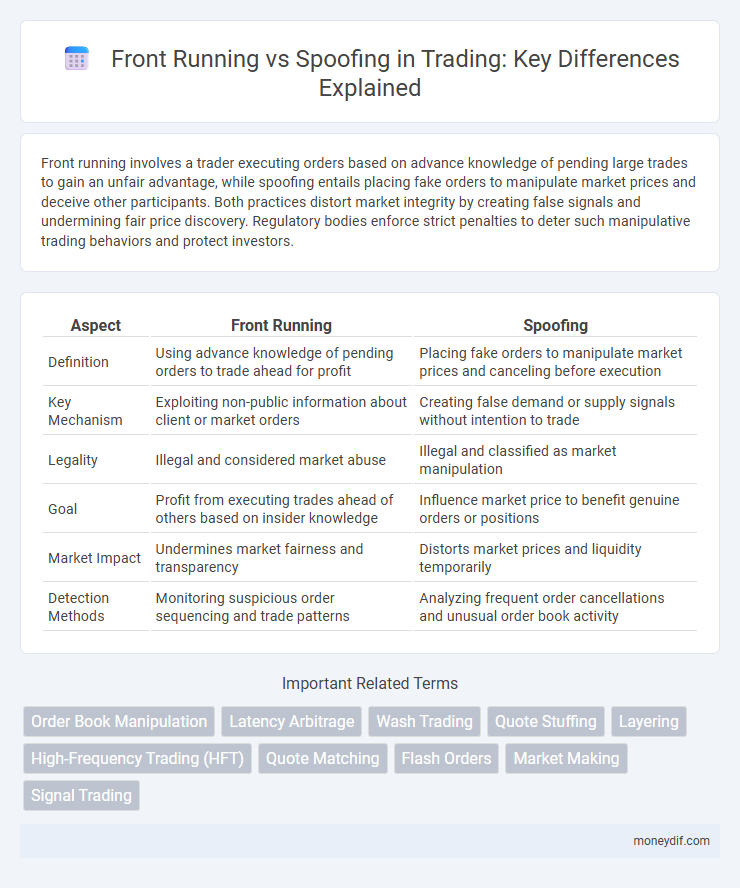

| Aspect | Front Running | Spoofing |

|---|---|---|

| Definition | Using advance knowledge of pending orders to trade ahead for profit | Placing fake orders to manipulate market prices and canceling before execution |

| Key Mechanism | Exploiting non-public information about client or market orders | Creating false demand or supply signals without intention to trade |

| Legality | Illegal and considered market abuse | Illegal and classified as market manipulation |

| Goal | Profit from executing trades ahead of others based on insider knowledge | Influence market price to benefit genuine orders or positions |

| Market Impact | Undermines market fairness and transparency | Distorts market prices and liquidity temporarily |

| Detection Methods | Monitoring suspicious order sequencing and trade patterns | Analyzing frequent order cancellations and unusual order book activity |

Understanding Front Running and Spoofing in Trading

Front running involves a trader exploiting advance knowledge of pending orders to execute trades ahead of others, gaining an unfair advantage by anticipating market moves. Spoofing entails placing large, deceptive orders to manipulate market perception and influence prices without the intention of executing those orders. Both practices distort market transparency, violate trading regulations, and undermine fair market conditions.

Key Differences Between Front Running and Spoofing

Front running involves a trader exploiting advance knowledge of pending orders to execute trades for personal gain, whereas spoofing entails placing deceptive orders to manipulate market prices without intent to execute them. Front running targets specific trades based on confidential information, while spoofing aims to create artificial demand or supply to influence other traders' decisions. Regulatory authorities classify front running as insider trading and spoofing as market manipulation, both carrying severe penalties but differing in execution and intent.

How Front Running Works in Financial Markets

Front running in financial markets occurs when a trader or broker executes orders on a security for their own account ahead of a client's large pending order, leveraging insider knowledge to profit from the anticipated price movement. This practice exploits the non-public information about upcoming trades to buy or sell shares before the client's order impacts market prices. Unlike spoofing, which involves placing deceptive orders to manipulate prices, front running directly uses privileged information to gain unfair advantage, leading to regulatory scrutiny and penalties.

The Mechanics of Spoofing in Trading

Spoofing in trading involves placing large orders with the intent to cancel before execution, creating a false impression of market demand or supply. Traders use this tactic to manipulate prices by triggering other market participants to react to the deceptive order flow, often causing price movements favorable to the spoofer's actual position. Regulatory authorities like the SEC and CFTC actively monitor order book patterns and employ advanced algorithms to detect and penalize spoofing practices in electronic and high-frequency trading environments.

Legal Implications of Front Running vs. Spoofing

Front running and spoofing both carry significant legal risks under financial market regulations, with front running classified as a form of insider trading involving the exploitation of non-public information for profit. Spoofing violates market manipulation laws by placing and quickly canceling orders to create false demand or supply, misleading other traders. Regulatory bodies such as the SEC and CFTC impose heavy fines, sanctions, and criminal charges on individuals and firms engaged in either practice to maintain market integrity.

Detecting and Preventing Front Running

Detecting front running requires real-time monitoring of order flow and trade timestamps to identify suspicious patterns where traders execute orders ahead of large pending transactions. Advanced algorithms analyze market data, comparing order book changes and trade executions to highlight potential front running activities. Preventing front running involves implementing strict regulatory measures, enhancing transparency through audit trails, and deploying machine learning models that flag anomalous behaviors for further investigation.

Common Indicators of Spoofing Activities

Common indicators of spoofing activities include large, non-bona fide orders placed significantly away from the current market price to create false demand or supply signals, rapid order cancellations before execution, and repetitive patterns of order placement and withdrawal. Traders may observe sudden spikes in order book depth, unusually high order-to-trade ratios, and an increase in canceled orders compared to executed trades. Regulatory bodies monitor these anomalies using advanced surveillance algorithms designed to detect manipulative trading behaviors that distort market integrity.

Regulatory Measures Against Market Manipulation

Regulatory measures against market manipulation, including front running and spoofing, involve stringent surveillance systems and enforceable penalties designed by agencies such as the SEC and CFTC. These regulations mandate transparency in order execution and impose hefty fines or criminal charges on traders engaging in deceptive practices to distort market prices. Enhanced real-time monitoring and advanced algorithmic detection tools are critical for identifying suspicious trading patterns and maintaining market integrity.

Impact of Front Running and Spoofing on Market Integrity

Front running and spoofing both severely undermine market integrity by distorting price discovery and eroding investor confidence. Front running uses non-public order information to gain an unfair advantage, leading to unfair price movements and reduced market fairness. Spoofing manipulates market sentiment by placing deceptive orders, creating artificial demand or supply that misleads genuine traders and destabilizes market transparency.

Best Practices for Traders to Avoid Unintentional Violations

Traders should implement robust order monitoring systems to detect unusual patterns that may resemble front running or spoofing to avoid unintentional violations. Strict adherence to transparency in order entry, maintaining clear separation between proprietary trading and client orders, and continuous education on regulatory updates minimize the risk of inadvertent market manipulation. Utilizing advanced analytics and compliance tools ensures real-time identification and correction of potentially manipulative behaviors.

Important Terms

Order Book Manipulation

Order book manipulation involves deceptive practices like front running and spoofing to gain unfair trading advantages by influencing market perception and order flow. Front running exploits non-public knowledge of impending orders to trade ahead, while spoofing places false orders to create misleading market signals and withdraws them before execution.

Latency Arbitrage

Latency arbitrage exploits speed advantages in financial markets by executing trades milliseconds before others, often associated with front-running where traders capitalize on pending orders to gain profit. Unlike spoofing, which involves placing and canceling fake orders to manipulate prices, latency arbitrage focuses on technological superiority to access and act on market data faster, creating unfair advantages in high-frequency trading environments.

Wash Trading

Wash trading involves repeatedly buying and selling the same asset to create misleading market activity, distinct from front running where traders exploit non-public order information, and spoofing, which entails placing fake orders to manipulate prices before cancelation. These manipulative practices disrupt market integrity by creating false demand, misleading market participants, and compromising fair price discovery.

Quote Stuffing

Quote stuffing involves rapidly placing and canceling large volumes of orders to create market confusion, enabling front running algorithms to exploit delayed price information. Unlike spoofing, which manipulates market perception by placing deceptive orders without intent to execute, quote stuffing primarily targets system latency to gain unfair trading advantages.

Layering

Layering in financial markets involves placing multiple buy or sell orders at different price levels to create a false impression of market demand or supply, often used to manipulate prices through spoofing tactics. Front running exploits this by executing trades based on anticipations of these deceptive orders, profiting from subsequent price movements before the genuine orders are executed.

High-Frequency Trading (HFT)

High-Frequency Trading (HFT) employs advanced algorithms to execute large volumes of trades in milliseconds, often exploiting market inefficiencies such as front running, where traders anticipate and act on incoming orders ahead of others. Spoofing involves placing deceptive orders to manipulate prices and create false market signals, a practice strictly prohibited due to its potential to distort fair market conditions and undermine investor confidence.

Quote Matching

Quote matching is a technique used to identify front running by detecting trades executed just before large client orders at matching or better prices, whereas spoofing involves placing deceptive quotes with no intention of execution to manipulate market perception. Analysis of order book patterns and timing precision is critical to distinguish between legitimate quote matching and manipulative spoofing behaviors.

Flash Orders

Flash orders enable high-frequency traders to access market data milliseconds before the public, creating opportunities for front running by anticipating large trades and executing ahead of them. Unlike spoofing, which involves placing fake orders to manipulate prices, flash orders exploit speed advantages without deceptive intent, raising regulatory concerns about market fairness and transparency.

Market Making

Market making involves providing liquidity by continuously quoting buy and sell prices, helping to stabilize market prices and facilitate trades. Unlike spoofing, which is a deceptive practice involving placing large orders with no intention of execution to manipulate prices, market making operates transparently, while front running illegally exploits advanced knowledge of pending orders to gain unfair trading advantages.

Signal Trading

Signal trading involves using real-time market data to anticipate price movements, but distinguishing it from front running--the illegal practice of trading on advance non-public information--is crucial. Unlike spoofing, which manipulates market prices through deceptive order placements, signal trading leverages transparent signals without creating false market impressions.

front running vs spoofing Infographic

moneydif.com

moneydif.com