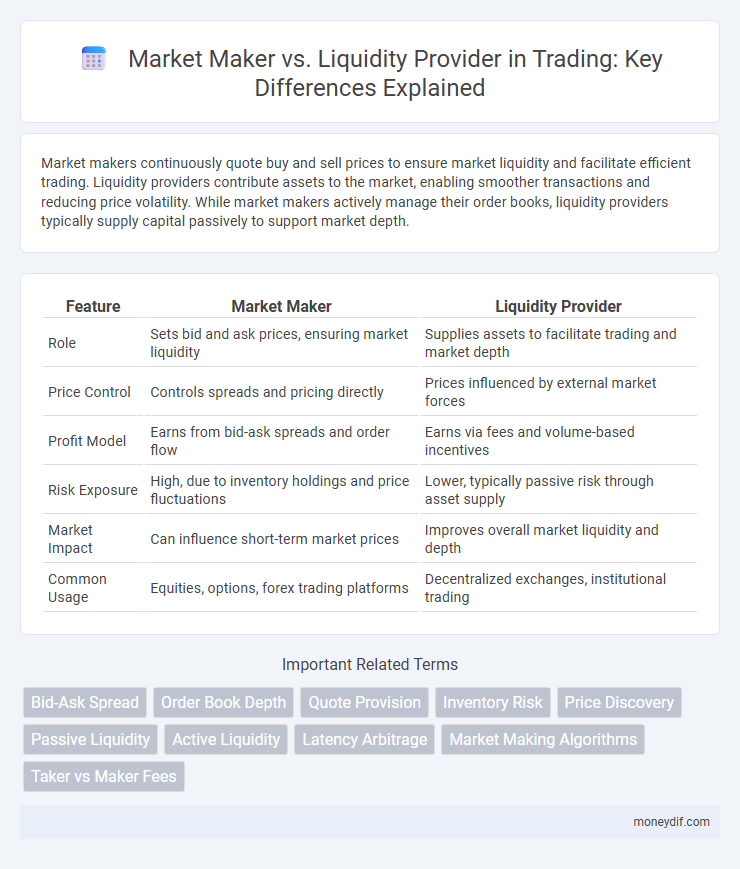

Market makers continuously quote buy and sell prices to ensure market liquidity and facilitate efficient trading. Liquidity providers contribute assets to the market, enabling smoother transactions and reducing price volatility. While market makers actively manage their order books, liquidity providers typically supply capital passively to support market depth.

Table of Comparison

| Feature | Market Maker | Liquidity Provider |

|---|---|---|

| Role | Sets bid and ask prices, ensuring market liquidity | Supplies assets to facilitate trading and market depth |

| Price Control | Controls spreads and pricing directly | Prices influenced by external market forces |

| Profit Model | Earns from bid-ask spreads and order flow | Earns via fees and volume-based incentives |

| Risk Exposure | High, due to inventory holdings and price fluctuations | Lower, typically passive risk through asset supply |

| Market Impact | Can influence short-term market prices | Improves overall market liquidity and depth |

| Common Usage | Equities, options, forex trading platforms | Decentralized exchanges, institutional trading |

Introduction to Market Makers and Liquidity Providers

Market makers and liquidity providers play crucial roles in financial markets by facilitating smooth trading and reducing spreads. Market makers continuously quote buy and sell prices for specific assets, ensuring market liquidity and tight bid-ask spreads. Liquidity providers, often institutional traders or algorithms, supply assets to the market without necessarily quoting prices, enhancing market depth and stability.

Core Functions: Market Makers vs Liquidity Providers

Market makers continuously quote buy and sell prices to facilitate trading, ensuring market liquidity and reducing bid-ask spreads through active order book management. Liquidity providers contribute assets to the market, enabling smoother execution of large trades without significantly impacting price, often by pooling resources in liquidity pools for decentralized finance platforms. Both entities play crucial roles in stabilizing market volatility but differ in operational methods and market impact.

How Market Makers Operate in Financial Markets

Market makers operate by continuously quoting both buy and sell prices for financial instruments, ensuring liquidity and reducing bid-ask spreads in the market. They hold inventories of securities to fulfill orders promptly, absorbing imbalances between supply and demand while managing inventory risk. Their activities stabilize price fluctuations and enhance market efficiency by facilitating smoother transactions for traders and investors.

Role of Liquidity Providers in Trading Ecosystems

Liquidity providers play a crucial role in trading ecosystems by supplying the necessary capital that enables continuous bid and ask prices, ensuring market efficiency and minimizing price volatility. Unlike market makers, who often take on risk by actively quoting buy and sell prices, liquidity providers primarily facilitate seamless order execution by bridging gaps between buyers and sellers. Their participation enhances market depth and transparency, contributing to tighter spreads and improved overall trading conditions.

Key Differences: Market Makers and Liquidity Providers

Market makers actively quote both buy and sell prices to facilitate trading and profit from the bid-ask spread, while liquidity providers supply assets to ensure market depth and reduce price volatility without necessarily aiming for direct profit from spreads. Market makers typically operate on centralized exchanges with obligations to maintain continuous quotes, whereas liquidity providers include decentralized entities or institutional traders adding volume across various platforms. Understanding these distinctions clarifies roles in enhancing market efficiency, price stability, and trade execution quality.

Impact on Market Liquidity and Price Stability

Market makers enhance market liquidity by continuously quoting buy and sell prices, narrowing spreads and facilitating smoother price discovery. Liquidity providers contribute by supplying large volumes of assets, ensuring depth and resilience in the order book, which reduces volatility. Both play critical roles in maintaining price stability and efficient market functioning, especially during high trading volumes or volatility spikes.

Risks and Challenges in Market Making and Liquidity Provision

Market makers face significant risks including inventory risk, where price fluctuations can lead to substantial losses, and adverse selection risk from informed traders exploiting their quotes. Liquidity providers encounter challenges such as managing execution risk and the impact of volatile market conditions that can reduce order fill rates and increase slippage. Both roles require sophisticated risk management strategies and technological infrastructure to maintain profitability and market stability.

Profit Models and Revenue Streams Explained

Market makers generate profits primarily through the bid-ask spread by continuously quoting buy and sell prices, earning the difference when trades occur. Liquidity providers often earn revenue from rebates or incentives offered by exchanges for supplying volume and enhancing market liquidity. Both entities leverage high-frequency trading strategies and inventory management to optimize their profit margins within volatile market environments.

Regulatory Considerations for Market Makers and Liquidity Providers

Regulatory frameworks for market makers and liquidity providers emphasize transparency, fair pricing, and risk management to protect market integrity and investor interests. Market makers often face stricter capital requirements and reporting obligations to ensure continuous market support and limit systemic risks. Liquidity providers must comply with anti-manipulation rules and disclosure standards to promote efficient and equitable trading environments.

Choosing Between Market Makers and Liquidity Providers for Your Trading Strategy

Selecting between market makers and liquidity providers depends on your trading strategy's needs for price stability and order execution speed. Market makers ensure tighter spreads and consistent quoting, benefiting high-frequency traders with frequent trades and short-term strategies. Liquidity providers offer deeper pools and better fill rates, which suit institutional traders seeking large order executions with minimal market impact.

Important Terms

Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask), serving as a key indicator of market liquidity. Market makers narrow this spread by continuously providing buy and sell quotes, while liquidity providers enhance market depth by supplying large volumes of assets, both crucial for efficient price discovery and reduced transaction costs.

Order Book Depth

Order book depth reflects the volume and price levels of buy and sell orders, crucial for market makers who strategically place multiple limit orders to stabilize prices and capture bid-ask spreads. Liquidity providers enhance this depth by continuously submitting substantial orders, ensuring smoother transactions and reduced market volatility.

Quote Provision

A quote provision defines the obligation of a market maker to continuously display buy and sell prices within a specific spread, enhancing market transparency and liquidity. In contrast, a liquidity provider supplies large volumes of assets to the market without necessarily adhering to firm quotes, focusing on depth and reducing price volatility.

Inventory Risk

Inventory risk for market makers arises from holding large positions that can incur losses due to adverse price movements, while liquidity providers mitigate this risk by balancing supply and demand with diversified order flows. Effective inventory management tools and real-time market data enable both entities to minimize exposure and optimize trading strategies.

Price Discovery

Price discovery is the process where market makers influence bid-ask spreads by quoting buy and sell prices, facilitating efficient trade execution. Liquidity providers enhance market depth by supplying continuous order flow, stabilizing prices and reducing volatility during price discovery.

Passive Liquidity

Passive liquidity refers to the buy and sell orders placed by liquidity providers that rest on the order book without immediately executing, allowing market makers to profit from the bid-ask spread by matching these orders with incoming market orders. Market makers actively manage risk by adjusting prices in response to market conditions, while liquidity providers contribute passive liquidity by supplying depth and stability to the market through limit orders.

Active Liquidity

Active liquidity involves market makers who continuously quote buy and sell prices to facilitate trading and enhance market efficiency, contrasting with liquidity providers who may supply liquidity passively by placing orders without constant price adjustment. Market makers actively manage risk and inventory to maintain price stability, while liquidity providers contribute to market depth primarily through existing order placements.

Latency Arbitrage

Latency arbitrage exploits minute time delays between market makers and liquidity providers to execute trades faster, capitalizing on price discrepancies before they update. Market makers face risks as latency arbitrageurs may trade on stale quotes, impacting their ability to provide accurate liquidity and maintain stable spreads.

Market Making Algorithms

Market making algorithms continuously place buy and sell orders to profit from the bid-ask spread, functioning as automated market makers that ensure market liquidity. Unlike traditional liquidity providers who passively supply capital, these algorithms dynamically adjust quotes based on real-time market data and volatility to manage inventory risk and optimize trading efficiency.

Taker vs Maker Fees

Taker fees apply to traders who remove liquidity from the order book by executing market orders, while maker fees reward liquidity providers who add limit orders that increase market depth. Market makers, acting as liquidity providers, benefit from lower or rebate fees to incentivize maintaining continuous order flow and tighter spreads.

market maker vs liquidity provider Infographic

moneydif.com

moneydif.com