A margin call occurs when a trader's account equity falls below the broker's required minimum margin, prompting the trader to deposit additional funds or close positions to avoid further losses. A stop out happens when the equity further drops to the broker's stop-out level, triggering automatic liquidation of open positions to prevent the account from going negative. Understanding the difference between margin call and stop out levels is crucial for effective risk management in trading.

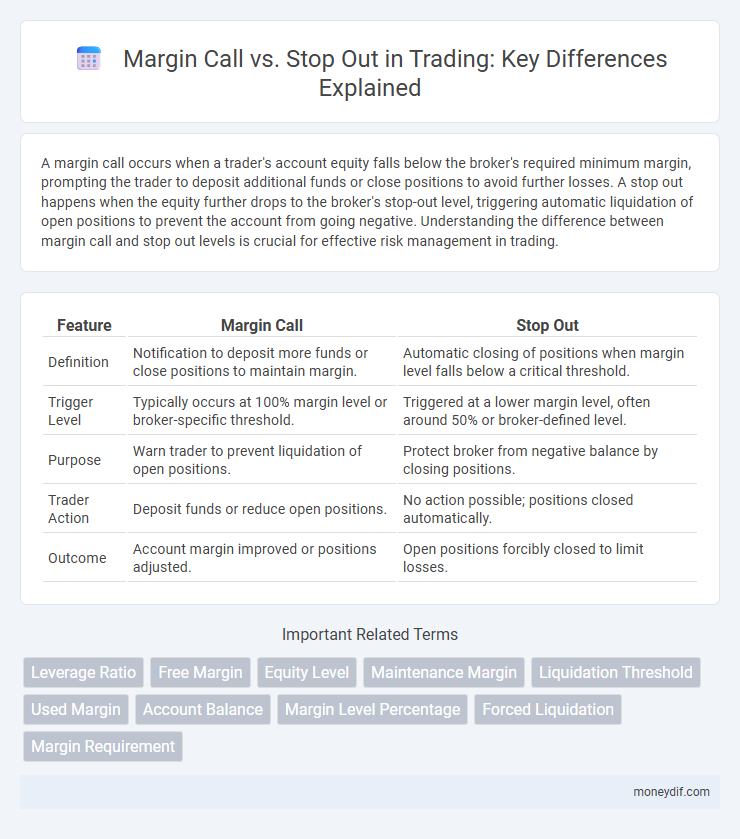

Table of Comparison

| Feature | Margin Call | Stop Out |

|---|---|---|

| Definition | Notification to deposit more funds or close positions to maintain margin. | Automatic closing of positions when margin level falls below a critical threshold. |

| Trigger Level | Typically occurs at 100% margin level or broker-specific threshold. | Triggered at a lower margin level, often around 50% or broker-defined level. |

| Purpose | Warn trader to prevent liquidation of open positions. | Protect broker from negative balance by closing positions. |

| Trader Action | Deposit funds or reduce open positions. | No action possible; positions closed automatically. |

| Outcome | Account margin improved or positions adjusted. | Open positions forcibly closed to limit losses. |

Understanding Margin Call in Trading

A margin call occurs when a trader's account equity falls below the broker's required maintenance margin, prompting the need to deposit additional funds or close positions to restore margin levels. This mechanism helps prevent further losses by ensuring that the trader maintains sufficient collateral to support open trades. Understanding how margin calls work is crucial for effective risk management and avoiding forced liquidation through stop out levels.

What Triggers a Margin Call?

A margin call is triggered when a trader's equity falls below the broker's required maintenance margin, signaling insufficient funds to cover open positions. This occurs as market fluctuations cause losses that reduce the available margin, prompting the broker to request additional capital to avoid liquidation. Failure to meet the margin call may lead to a stop out, where positions are automatically closed to prevent further losses.

Defining Stop Out: The Last Line of Defense

Stop Out is the critical threshold in trading where a broker forcibly closes a trader's positions to prevent further losses when account equity falls below the required margin level. Serving as the last line of defense, stop out protects both traders and brokers from incurring negative balances by automatically liquidating assets. Understanding stop out levels is essential for effective margin management and risk control in leveraged trading.

Margin Call vs Stop Out: Key Differences

Margin call occurs when a trader's account equity falls below the broker's required margin level, prompting a warning to deposit more funds or close positions. Stop out happens when the equity drops further, triggering automatic closure of open positions to prevent further losses. The key difference lies in margin call being a notification phase, whereas stop out enforces position liquidation to protect both trader and broker.

How Brokers Handle Margin Calls and Stop Outs

Brokers monitor client accounts closely to trigger margin calls when equity falls below the required margin, demanding additional funds to maintain positions and avoid liquidation. If the account equity continues to decline and crosses the stop out level, brokers automatically close losing trades to prevent further losses and protect both the trader and the broker. Margin calls serve as warnings, while stop outs execute forced liquidation, ensuring risk management and capital preservation in volatile markets.

Margin Level Calculations Explained

Margin Level is calculated by dividing the Equity by the Used Margin and multiplying by 100%, serving as a critical indicator of account health in trading. A Margin Call occurs when the Margin Level falls below a broker-defined threshold, prompting the trader to deposit more funds or close losing positions to prevent further losses. Stop Out happens at a lower Margin Level, automatically closing positions to protect both the trader and the broker from negative balances.

Real-World Examples of Margin Call vs Stop Out

Margin calls occur when a trader's account balance falls below the broker's required maintenance margin, prompting a request to deposit additional funds or liquidate positions, as seen during the 2008 financial crisis when many retail traders faced margin calls due to volatile stock prices. Stop out happens when the broker automatically closes part or all of the trader's positions to prevent further losses once the margin level drops below a critical threshold, exemplified by the 2020 COVID-19 market crash where rapid price swings triggered widespread stop outs. Real-world instances demonstrate that margin calls offer a last warning to add funds, while stop outs enforce automatic liquidation to protect both the trader's capital and the broker's risk exposure.

Risk Management Strategies to Avoid Margin Calls

Implementing strict risk management strategies such as setting tight stop-loss orders and maintaining adequate account equity helps prevent margin calls in trading. Monitoring leverage ratios and diversifying trading positions reduce exposure to extreme market fluctuations that trigger stop outs. Regularly adjusting margin requirements based on market volatility ensures sufficient buffer to avoid forced liquidations and preserve capital.

Best Practices for Preventing Stop Outs

Maintaining a sufficient margin level by closely monitoring account equity and avoiding excessive leverage is essential for preventing stop outs. Implementing risk management strategies, such as setting conservative stop-loss orders and regularly reviewing position sizes, helps minimize exposure to sudden market volatility. Utilizing margin alerts and automated notifications enables timely actions to replenish margin or close losing positions before reaching the stop out threshold.

Choosing the Right Leverage to Minimize Margin Risks

Choosing the right leverage is crucial to minimize margin risks, as high leverage increases the likelihood of triggering a margin call or stop out during volatile market conditions. A lower leverage ratio helps maintain sufficient free margin, reducing the chances of forced position liquidations and preserving trading capital. Effective risk management strategies include setting appropriate leverage levels aligned with account size and market volatility to prevent excessive exposure.

Important Terms

Leverage Ratio

Leverage ratio directly impacts margin call thresholds and stop out levels by determining the maximum borrowed funds relative to equity, where higher leverage increases the risk of margin calls and stop outs during volatile market conditions.

Free Margin

Free Margin represents the available funds in a trading account that can absorb losses before triggering a Margin Call, which occurs at a higher threshold than a Stop Out where positions start to be forcibly closed.

Equity Level

Equity level represents the total value of an investor's margin account, calculated as the sum of the account balance and unrealized profits or losses from open positions. When the equity level falls below the margin call threshold, traders receive a margin call warning to deposit more funds, while reaching the stop out level triggers automatic closure of positions to prevent further losses.

Maintenance Margin

Maintenance margin is the minimum equity level required to avoid a margin call, while a stop out occurs when the account equity falls below this maintenance margin, triggering automatic position liquidation.

Liquidation Threshold

The liquidation threshold marks the critical margin level where a margin call escalates to a stop out, triggering automatic asset liquidation to prevent further losses.

Used Margin

Used margin represents the amount of funds currently allocated to open positions, where reaching the margin call level signals a warning to deposit more funds while hitting the stop out level triggers automatic position liquidation to prevent further losses.

Account Balance

Account balance determines margin call thresholds and stop out levels, where falling below the required margin triggers liquidation to prevent further losses.

Margin Level Percentage

Margin Level Percentage below 100% triggers a margin call, while falling further to the broker's specified stop out level forces automatic position closure to prevent negative balance.

Forced Liquidation

Forced liquidation occurs when a trader's margin call is not met, causing the broker to automatically close positions to prevent further losses. A stop out level is the predetermined equity threshold at which this forced liquidation is triggered to protect both the trader's and broker's capital.

Margin Requirement

Margin requirement determines the minimum equity needed to maintain open positions, triggering a margin call when equity falls below this threshold and a stop out when it further declines, forcing position liquidation.

Margin Call vs Stop Out Infographic

moneydif.com

moneydif.com