A margin call occurs when a trader's account equity falls below the maintenance margin, requiring them to deposit additional funds or close positions to avoid further losses. Liquidation happens if the trader fails to meet the margin call, forcing the broker to automatically close positions to prevent negative balances. Understanding the difference between margin call and liquidation is crucial for managing risk and protecting trading capital.

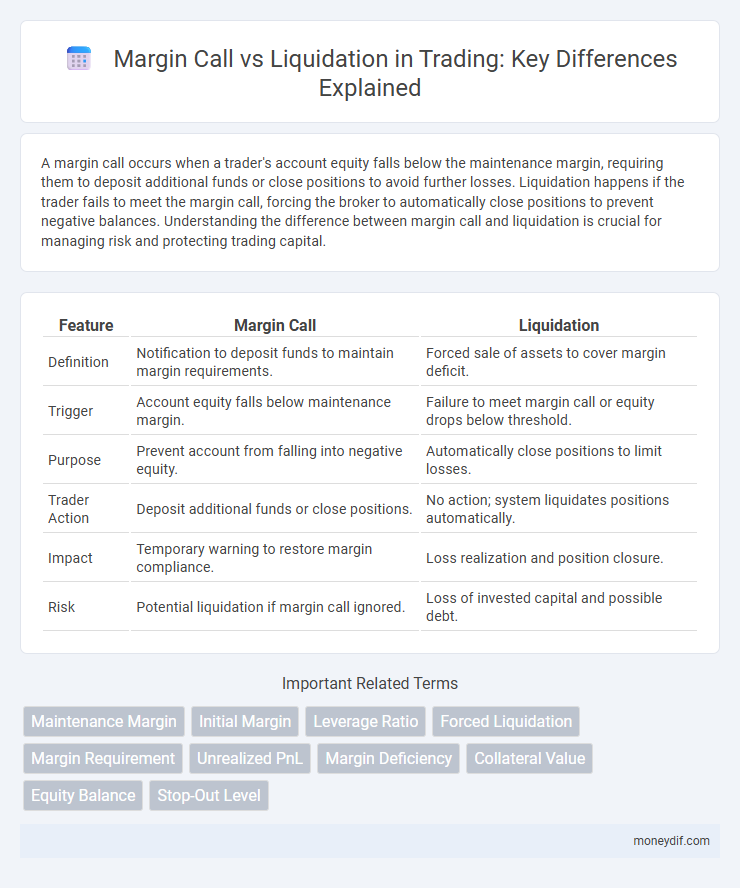

Table of Comparison

| Feature | Margin Call | Liquidation |

|---|---|---|

| Definition | Notification to deposit funds to maintain margin requirements. | Forced sale of assets to cover margin deficit. |

| Trigger | Account equity falls below maintenance margin. | Failure to meet margin call or equity drops below threshold. |

| Purpose | Prevent account from falling into negative equity. | Automatically close positions to limit losses. |

| Trader Action | Deposit additional funds or close positions. | No action; system liquidates positions automatically. |

| Impact | Temporary warning to restore margin compliance. | Loss realization and position closure. |

| Risk | Potential liquidation if margin call ignored. | Loss of invested capital and possible debt. |

Understanding Margin Calls in Trading

Margin calls occur when a trader's account equity falls below the broker's required maintenance margin, prompting the trader to deposit additional funds or close positions to avoid forced liquidation. Liquidation happens when the margin call is not met, resulting in the broker automatically closing positions to prevent further losses. Understanding margin calls is critical for managing risk and maintaining sufficient capital to sustain leveraged trading positions.

What is Liquidation in Financial Markets?

Liquidation in financial markets refers to the forced closing of a trader's position when their margin account falls below the maintenance margin requirement, ensuring losses do not exceed the available equity. This process occurs automatically to protect brokers from incurring further risks due to insufficient funds. Understanding liquidation is crucial for traders to manage risk and avoid total account depletion during volatile market conditions.

Key Differences Between Margin Call and Liquidation

Margin calls occur when an investor's account value falls below the broker's required maintenance margin, prompting a request to deposit additional funds to cover potential losses. Liquidation happens when the investor fails to meet the margin call, causing the broker to automatically sell assets to recover the borrowed funds and prevent further losses. The key difference lies in margin call being a warning with an opportunity to restore margin, while liquidation is the forced sale of assets to close positions.

Causes of Margin Calls and Liquidations

Margin calls occur when an investor's account equity falls below the broker's required maintenance margin due to unfavorable market movements or excessive leverage. Liquidation takes place when the broker forcibly closes positions to prevent further losses after a margin call is not met or the account equity continues to decline. Understanding margin requirements, market volatility, and proper risk management strategies is crucial to avoid triggering margin calls and subsequent liquidations.

How Margin Requirements Affect Trading Positions

Margin requirements determine the minimum amount of equity needed to maintain a trading position, influencing the risk of margin calls and liquidation. When a trader's account equity falls below the maintenance margin, a margin call is triggered, requiring additional funds to prevent forced liquidation. Failure to meet a margin call results in liquidation, where brokerage firms close positions to protect against further losses and preserve capital.

Steps to Avoid a Margin Call

Maintaining a sufficient account balance and closely monitoring your leverage ratio are essential steps to avoid a margin call in trading. Implementing stop-loss orders and regularly reviewing your positions can help manage risk and prevent liquidation. Staying informed about market volatility and adjusting your margin accordingly minimizes the chances of forced liquidation due to insufficient margin.

The Liquidation Process: What Traders Need to Know

The liquidation process occurs when a trader's margin level falls below the maintenance margin requirement, triggering an automatic closure of positions to prevent further losses. Understanding this process is crucial because once liquidation starts, traders lose control over their positions and may incur significant losses beyond their initial investment. To avoid liquidation, traders must monitor their margin ratios closely and maintain sufficient capital in their accounts.

Impact of Volatility on Margin Calls and Liquidation

Market volatility significantly increases the frequency and severity of margin calls, as rapid price fluctuations reduce account equity and trigger broker demands for additional collateral. High volatility can accelerate liquidation processes when traders fail to meet margin requirements promptly, leading to forced asset sales at unfavorable prices. Understanding volatility's impact on margin maintenance is crucial for risk management and avoiding substantial losses in leveraged trading.

Risk Management Strategies to Prevent Forced Liquidation

Implementing strict stop-loss orders and maintaining sufficient account equity are essential risk management strategies to prevent forced liquidation during margin calls. Traders should regularly monitor leverage ratios and market volatility to adjust margin levels proactively. Utilizing alerts and automated risk controls minimizes exposure and protects capital from sudden adverse price movements.

Margin Call vs Liquidation: Which is More Dangerous for Traders?

Margin call signals a trader to add funds or close positions to maintain required margin, preventing forced liquidation. Liquidation occurs when the broker automatically closes positions due to insufficient margin, often resulting in realized losses. Liquidation is more dangerous as it eliminates control over trades and can incur substantial financial damage, whereas margin calls offer a chance to mitigate risks.

Important Terms

Maintenance Margin

Maintenance margin represents the minimum equity an investor must maintain in a margin account to avoid a margin call, which occurs when the account value falls below this threshold. Failure to meet a margin call can lead to liquidation, where the broker sells assets to restore the account margin above the maintenance requirement.

Initial Margin

Initial Margin represents the minimum collateral required to open a leveraged position, ensuring sufficient funds to cover potential losses before triggering a margin call. If the account equity falls below this threshold, a margin call demands additional funds to avoid forced liquidation, where the position is closed to prevent further losses.

Leverage Ratio

Leverage ratio measures the proportion of borrowed funds to equity, directly impacting the risk of margin calls and liquidation events in trading accounts. A higher leverage ratio increases the likelihood of margin calls due to small market fluctuations, while maintaining adequate equity levels helps prevent forced liquidation by meeting minimum margin requirements.

Forced Liquidation

Forced liquidation occurs when a trader's margin account falls below the maintenance margin requirement, triggering a margin call that demands additional funds to avoid liquidation. Failure to meet the margin call results in the broker automatically closing positions to limit losses and protect the account from going negative.

Margin Requirement

Margin requirement is the minimum amount of equity an investor must maintain in a margin account to avoid a margin call, which occurs when the account's equity falls below this threshold. Failure to meet the margin call can lead to forced liquidation of securities to cover losses and restore the required margin level.

Unrealized PnL

Unrealized PnL represents the floating profit or loss on open positions that directly impacts margin levels, influencing the risk of a margin call when equity falls below the required maintenance margin. If unrealized losses continue to deplete margin and trigger a margin call that is not met, the broker may proceed with forced liquidation to prevent further losses.

Margin Deficiency

Margin deficiency occurs when an investor's account equity falls below the required maintenance margin, triggering a margin call that demands additional funds to restore the minimum balance. Failure to meet the margin call often results in forced liquidation of securities to cover the shortfall and prevent further losses.

Collateral Value

Collateral value is the assessed worth of assets pledged to secure a loan, directly influencing margin call thresholds by determining when additional funds must be deposited to maintain required equity. Insufficient collateral value triggers liquidation, where assets are sold off to cover the loan and prevent further loss.

Equity Balance

Equity balance represents the total value of funds in a trading account, serving as a critical metric to prevent margin calls, which occur when equity falls below the required maintenance margin. Maintaining a sufficient equity balance helps avoid liquidation, where positions are forcibly closed to cover losses and protect the broker from credit risk.

Stop-Out Level

The Stop-Out Level is a critical threshold in trading platforms where a trader's equity falls below a specified percentage of the required margin, triggering automatic position liquidation to prevent further losses. Unlike a margin call that alerts traders to deposit additional funds to maintain open positions, reaching the Stop-Out Level results in the forced closure of trades to protect both the trader and broker from negative balances.

margin call vs liquidation Infographic

moneydif.com

moneydif.com