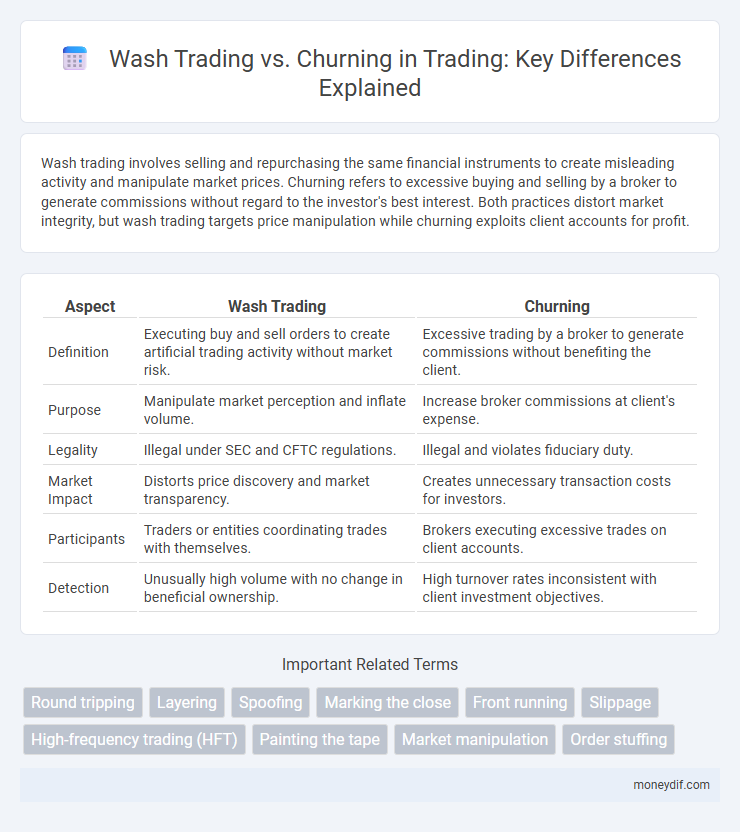

Wash trading involves selling and repurchasing the same financial instruments to create misleading activity and manipulate market prices. Churning refers to excessive buying and selling by a broker to generate commissions without regard to the investor's best interest. Both practices distort market integrity, but wash trading targets price manipulation while churning exploits client accounts for profit.

Table of Comparison

| Aspect | Wash Trading | Churning |

|---|---|---|

| Definition | Executing buy and sell orders to create artificial trading activity without market risk. | Excessive trading by a broker to generate commissions without benefiting the client. |

| Purpose | Manipulate market perception and inflate volume. | Increase broker commissions at client's expense. |

| Legality | Illegal under SEC and CFTC regulations. | Illegal and violates fiduciary duty. |

| Market Impact | Distorts price discovery and market transparency. | Creates unnecessary transaction costs for investors. |

| Participants | Traders or entities coordinating trades with themselves. | Brokers executing excessive trades on client accounts. |

| Detection | Unusually high volume with no change in beneficial ownership. | High turnover rates inconsistent with client investment objectives. |

Understanding Wash Trading and Churning

Wash trading involves repeatedly buying and selling the same asset to create misleading market activity, often to manipulate prices or generate tax benefits. Churning refers to excessive trading by a broker within a client's account primarily to generate commissions, without regard for the client's investment goals. Distinguishing between these practices is crucial for regulatory compliance and protecting investor interests in financial markets.

Key Differences Between Wash Trading and Churning

Wash trading involves buying and selling the same financial instrument to create misleading market activity, often through the same trader or coordinated entities, while churning refers to excessive trading by a broker primarily to generate commissions rather than to benefit the client. Wash trading is typically used to manipulate market prices or volumes, whereas churning is a violation of fiduciary duty, harming client interests. The key difference lies in the intent: wash trading aims at market deception, whereas churning focuses on profiting from unnecessary transactions.

Legal Implications of Wash Trading vs Churning

Wash trading involves creating artificial market activity by simultaneously buying and selling the same asset to mislead market participants, which is illegal under securities laws and subject to severe penalties including fines and imprisonment. Churning refers to excessive trading by brokers in a client's account primarily to generate commissions, constituting a breach of fiduciary duty and also leading to regulatory sanctions and civil liabilities. Both practices undermine market integrity but are prosecuted differently, with wash trading often addressed under anti-manipulation statutes and churning under fiduciary misconduct regulations.

How Wash Trading and Churning Affect Markets

Wash trading creates artificial market activity by simultaneously buying and selling the same asset, misleading investors about true demand and liquidity. Churning involves excessive trading by brokers to generate commissions, which inflates trading volume without adding real value to the market. Both practices distort price signals, reduce market efficiency, and erode investor trust, leading to increased volatility and potential regulatory scrutiny.

Identifying Signs of Wash Trading

Wash trading involves executing buy and sell orders for the same asset to create misleading market activity, often identified by unusually high trade volumes without genuine market interest. Key signs include repetitive trading patterns with the same counterparties, rapid order cancellations, and trades executed at prices significantly different from the market value. Monitoring these indicators helps regulators and traders detect fraudulent behavior that can distort market prices and liquidity.

Recognizing Patterns of Churning

Churning in trading is identified by excessive buying and selling of securities within a short period, primarily to generate commissions rather than benefiting the investor. Patterns of churning include frequent, rapid transactions that do not align with the investor's financial objectives and often result in high trading volumes without meaningful changes in portfolio positions. Monitoring irregular trading activity, such as disproportionate turnover rates and unnatural trade frequency, helps distinguish churning from legitimate market operations like wash trading.

Regulatory Response to Wash Trading and Churning

Regulators have intensified scrutiny on wash trading and churning due to their impact on market integrity and investor protection. The U.S. Securities and Exchange Commission (SEC) enforces strict rules under the Securities Exchange Act of 1934 to detect and penalize these manipulative practices, leveraging advanced surveillance technologies and algorithmic trade monitoring. Enhanced regulatory frameworks globally emphasize transparent reporting and impose severe penalties to deter wash trading and churning in equity and cryptocurrency markets.

Impact on Retail and Institutional Investors

Wash trading artificially inflates market volume, misleading retail investors into perceiving higher liquidity and price stability, which can result in poor investment decisions and increased trading costs. Churning, often perpetrated by brokers, generates excessive commissions and erodes returns, disproportionately affecting retail investors who lack the sophistication to detect such practices. Institutional investors face distorted market signals from both wash trading and churning, complicating portfolio management and risk assessment strategies.

Preventing Wash Trading and Churning in Trading Platforms

Effective prevention of wash trading and churning in trading platforms involves implementing advanced transaction monitoring systems that detect patterns indicative of self-dealing and excessive trading. Regulatory compliance is strengthened by deploying machine learning algorithms to analyze trade sequences and flag suspicious activity in real time. Enhanced transparency through detailed audit trails and mandatory trade disclosures further deters manipulative behaviors, protecting market integrity and investor interests.

Case Studies: Wash Trading vs Churning in Real Markets

Case studies in real markets reveal wash trading as artificially created trades where investors simultaneously buy and sell the same asset to inflate volume, often detected in cryptocurrency exchanges like Binance and Bitfinex. Churning, conversely, involves brokers excessively trading client accounts to generate commissions, prominently exposed in traditional equity markets through lawsuits against firms like Merrill Lynch. Analyzing these cases highlights regulatory challenges in distinguishing market manipulation forms and enforcing compliance across diverse trading platforms.

Important Terms

Round tripping

Round tripping involves selling and repurchasing the same asset to create misleading trading volume, often linked to wash trading where identical securities are traded to simulate market activity. Unlike churning, which entails excessive trading by brokers primarily to generate commissions, round tripping and wash trading focus on artificially inflating transaction levels to deceive market participants.

Layering

Layering involves placing deceptive buy or sell orders to create a false impression of market demand, often linked to wash trading schemes where traders repeatedly buy and sell the same asset to manipulate prices. Churning differs as it refers to excessive trading by brokers to generate commissions, without necessarily intending to manipulate market prices.

Spoofing

Spoofing involves placing fake orders to manipulate market prices, often preceding wash trading, where assets are bought and sold simultaneously to create misleading volume. Churning differs by focusing on excessive trading within a single account to generate commissions without genuine market impact.

Marking the close

Marking the close involves executing trades at the end of a trading session to manipulate a security's closing price, a practice closely tied to wash trading, where transactions create artificial volume without genuine market risk. Churning differs as it entails excessive trading by brokers to generate commissions, not necessarily aiming to influence closing prices but impacting market integrity through inflated trade activity.

Front running

Front running involves executing orders based on advance knowledge of pending trades, often exploiting market impact to gain profit, whereas wash trading and churning are manipulative practices focused on artificially inflating trading volume; wash trading entails buying and selling the same asset to create misleading activity, and churning involves excessive trading within an account to generate commissions without benefit to the investor. Both wash trading and churning distort market integrity, but front running directly leverages confidential information for unfair advantage.

Slippage

Slippage refers to the difference between the expected price of a trade and the actual price at which it is executed, often exacerbated by wash trading that artificially inflates volume without genuine market impact, whereas churning involves excessive trading by a broker within a client's account to generate commissions, which can also contribute to price distortions but primarily affects client costs rather than market price efficiency. Both practices undermine market integrity, but slippage caused by wash trading directly affects price execution, while churning primarily harms investor returns through unnecessary transaction fees.

High-frequency trading (HFT)

High-frequency trading (HFT) involves executing large volumes of orders at extremely fast speeds, often using sophisticated algorithms to capitalize on small price discrepancies. Wash trading, an illegal practice where traders simultaneously buy and sell the same assets to create misleading market activity, and churning, excessive trading by brokers to generate commissions, can both distort HFT strategies and undermine market integrity.

Painting the tape

Painting the tape involves executing transactions to create misleading activity or artificial price levels, often linked to wash trading where the same entity buys and sells securities to simulate genuine market interest. Unlike churning, which entails excessive trading to generate commissions, painting the tape focuses on manipulating market perception through repeated trades without genuine economic risk.

Market manipulation

Market manipulation encompasses practices like wash trading and churning, which distort genuine market dynamics and mislead investors. Wash trading involves simultaneously buying and selling the same asset to create artificial volume, while churning refers to excessive trading by brokers to generate commissions, both undermining market integrity and liquidity.

Order stuffing

Order stuffing involves placing a large number of fake orders to create misleading market activity, often used to manipulate prices. This practice differs from wash trading, which entails buying and selling the same asset to create artificial volume, and churning, which refers to excessive trading by brokers primarily to generate commissions.

wash trading vs churning Infographic

moneydif.com

moneydif.com