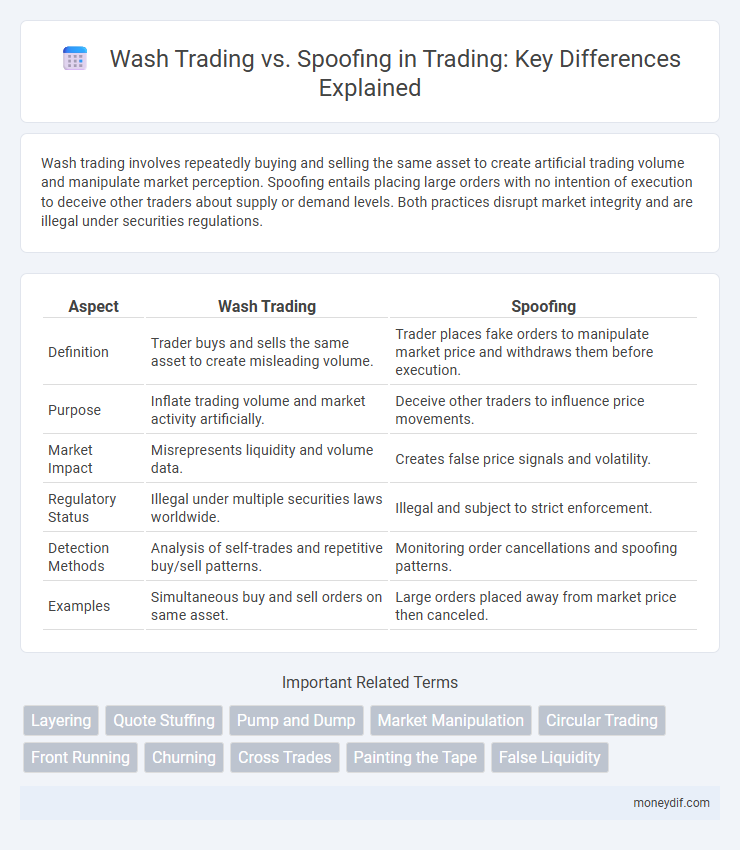

Wash trading involves repeatedly buying and selling the same asset to create artificial trading volume and manipulate market perception. Spoofing entails placing large orders with no intention of execution to deceive other traders about supply or demand levels. Both practices disrupt market integrity and are illegal under securities regulations.

Table of Comparison

| Aspect | Wash Trading | Spoofing |

|---|---|---|

| Definition | Trader buys and sells the same asset to create misleading volume. | Trader places fake orders to manipulate market price and withdraws them before execution. |

| Purpose | Inflate trading volume and market activity artificially. | Deceive other traders to influence price movements. |

| Market Impact | Misrepresents liquidity and volume data. | Creates false price signals and volatility. |

| Regulatory Status | Illegal under multiple securities laws worldwide. | Illegal and subject to strict enforcement. |

| Detection Methods | Analysis of self-trades and repetitive buy/sell patterns. | Monitoring order cancellations and spoofing patterns. |

| Examples | Simultaneous buy and sell orders on same asset. | Large orders placed away from market price then canceled. |

Understanding Wash Trading and Spoofing in Financial Markets

Wash trading involves simultaneously buying and selling the same financial instrument to create misleading market activity, artificially inflating volume and price. Spoofing entails placing fake orders with the intent to cancel before execution, manipulating other traders' perceptions of supply and demand. Both practices undermine market integrity and are illegal under securities laws due to their deceptive nature.

Defining Wash Trading: Key Characteristics and Mechanics

Wash trading involves the simultaneous buying and selling of the same asset to create misleading market activity without real change in ownership. This tactic is characterized by self-dealing transactions intended to inflate volume, manipulate prices, or generate artificial demand signals. Unlike spoofing, which places deceptive orders to influence prices before canceling them, wash trading executes matched trades to simulate genuine market participation.

What is Spoofing? Techniques and Market Impact

Spoofing is a manipulative trading technique where traders place large orders to create a false impression of demand or supply, only to cancel them before execution. Common spoofing techniques include placing and quickly withdrawing orders to mislead other market participants about the true market direction. This practice disrupts market integrity, leading to price distortions, reduced investor confidence, and regulatory scrutiny in trading markets.

Legal Perspectives: Wash Trading vs Spoofing Regulations

Wash trading involves a trader simultaneously buying and selling the same financial instrument to create misleading market activity, often violating anti-manipulation laws enforced by the SEC and CFTC. Spoofing, where traders place and quickly cancel large orders to deceive market participants, is explicitly illegal under the Dodd-Frank Act and subject to severe penalties. Regulatory agencies consistently prioritize detecting and prosecuting these manipulative practices to maintain market integrity and protect investors.

Detecting Wash Trading and Spoofing: Red Flags and Indicators

Detecting wash trading involves identifying patterns where traders simultaneously buy and sell the same asset to create misleading trading volume, often evidenced by repeated self-matching orders and abnormal trade frequency without market impact. Spoofing detection focuses on spotting large, non-bona fide orders placed to manipulate prices, with key red flags including rapid order cancellations, large order sizes significantly disproportionate to actual executed trades, and price movements triggered by these phantom orders. Monitoring abnormal order book activity, unusual trade-to-order ratios, and sudden liquidity changes are critical indicators for uncovering both wash trading and spoofing in financial markets.

The Consequences: Market Manipulation and Investor Trust

Wash trading and spoofing severely disrupt market integrity by creating false trading volumes and misleading price signals, ultimately distorting market prices. These manipulative practices undermine investor trust, leading to reduced market participation and liquidity as investors fear unfair trading conditions. Regulatory bodies impose significant penalties to deter such activities and protect the transparency and fairness essential for healthy financial markets.

Case Studies: Real-World Examples of Wash Trading and Spoofing

Case studies of wash trading reveal instances where traders create artificial volume by simultaneously buying and selling the same asset, as seen in the 2017 Bitfinex investigation involving millions of dollars in fictitious trades. Spoofing cases, such as the manipulation scheme exposed in the 2019 JP Morgan Chase lawsuit, demonstrate traders placing large orders with no intent to execute, misleading market participants to influence prices. These real-world examples highlight regulatory scrutiny and emphasize the importance of advanced surveillance technologies to detect and prevent market manipulation tactics.

Prevention Strategies: How Exchanges Combat Manipulation

Exchanges deploy advanced monitoring algorithms and real-time surveillance systems to detect patterns indicative of wash trading and spoofing, enabling swift intervention. Regulatory compliance frameworks require transparent order book reporting and strict identity verification, reducing manipulative trade opportunities. Collaborative efforts with regulatory bodies enhance data sharing and enforcement, strengthening overall market integrity against manipulation.

Impact on Market Liquidity and Price Discovery

Wash trading artificially inflates trading volumes without genuine market risk, distorting price signals and misleading investors about true liquidity. Spoofing manipulates order books by placing deceitful orders to create false demand or supply, disrupting natural price discovery and often leading to erratic price movements. Both practices undermine market integrity, deteriorate liquidity quality, and impede accurate price formation essential for efficient markets.

Future Trends: The Role of Technology in Stopping Manipulative Practices

Emerging technologies like artificial intelligence and blockchain are reshaping efforts to detect and prevent wash trading and spoofing in financial markets. Machine learning algorithms analyze trading patterns in real-time, flagging suspicious activities with higher accuracy and speed than traditional methods. Increased regulatory adoption of these technologies enhances market integrity by reducing manipulative practices in trading ecosystems.

Important Terms

Layering

Layering involves placing multiple fake buy or sell orders at different price levels to create a misleading market appearance, a tactic closely related to spoofing but distinguished by the strategic depth and volume manipulation across various order layers. Both practices aim to deceive market participants by fabricating demand or supply, often leading to artificial price movements and increased volatility in financial markets.

Quote Stuffing

Quote stuffing is a high-frequency trading tactic involving placing and canceling large volumes of orders to confuse market participants and manipulate price discovery, closely related to spoofing where fake orders mislead traders about demand or supply. Unlike wash trading, which entails buying and selling the same asset to create misleading volume, quote stuffing and spoofing disrupt market signals without executing trades, aiming to exploit milliseconds of market reaction time for profit.

Pump and Dump

Pump and dump schemes manipulate market prices by artificially inflating asset value through wash trading, where traders repeatedly buy and sell to create false volume, or spoofing, which involves placing fake orders to mislead other investors about supply and demand. Both tactics distort market transparency and can trigger rapid price surges followed by sudden crashes, harming market integrity and investor trust.

Market Manipulation

Market manipulation involves deceptive practices like wash trading and spoofing, where wash trading entails simultaneously buying and selling the same asset to create false market activity, while spoofing involves placing large orders with no intent to execute to mislead other traders. Both tactics distort market prices and liquidity, undermining market integrity and leading to regulatory penalties under securities laws such as the SEC's Rule 10b-5 and the CFTC's anti-manipulation provisions.

Circular Trading

Circular trading manipulates market prices by repeatedly buying and selling the same assets among colluding parties to create artificial volume, differing from wash trading where a trader buys and sells the same security to themselves to mislead the market. Spoofing involves placing large fake orders to deceive other traders about supply and demand, contrasting with circular trading's coordinated transactions aimed at generating misleading market activity.

Front Running

Front running involves executing trades based on advance knowledge of pending orders, contrasting with wash trading where traders create artificial volume by buying and selling the same asset to mislead the market; spoofing differs by placing fake orders to manipulate prices before canceling them. Both wash trading and spoofing are manipulative schemes that distort market integrity, whereas front running exploits privileged information for unfair profit.

Churning

Churning involves excessive buying and selling of securities by a broker to generate commissions, often misleading clients about investment performance, whereas wash trading entails creating artificial market activity by simultaneously buying and selling the same security to manipulate prices. Spoofing differs as it involves placing deceptive orders intended to cancel before execution to create false demand or supply signals, distorting market perception without actual trade fulfillment.

Cross Trades

Cross trades involve simultaneous buying and selling of the same asset between related parties, often raising concerns about market manipulation practices such as wash trading and spoofing; wash trading entails executing trades to create artificial activity without genuine risk transfer, while spoofing involves placing deceptive orders to mislead market participants. Regulatory bodies closely monitor these activities to maintain market integrity and prevent fraudulent behaviors that distort prices and liquidity.

Painting the Tape

Painting the tape is a form of market manipulation where traders execute transactions to create misleading appearances of trading activity and price movement, often associated with wash trading that involves buying and selling the same asset to fabricate volume. This practice contrasts with spoofing, which involves placing fake orders to deceive market participants about supply and demand without actual trade execution.

False Liquidity

False liquidity occurs when apparent market depth is artificially created through practices like wash trading, where traders simultaneously buy and sell the same asset to inflate volume, or spoofing, which involves placing deceptive orders to manipulate prices and canceling them before execution. Both tactics distort true market conditions, mislead participants about genuine supply and demand, and undermine price discovery efficiency.

wash trading vs spoofing Infographic

moneydif.com

moneydif.com